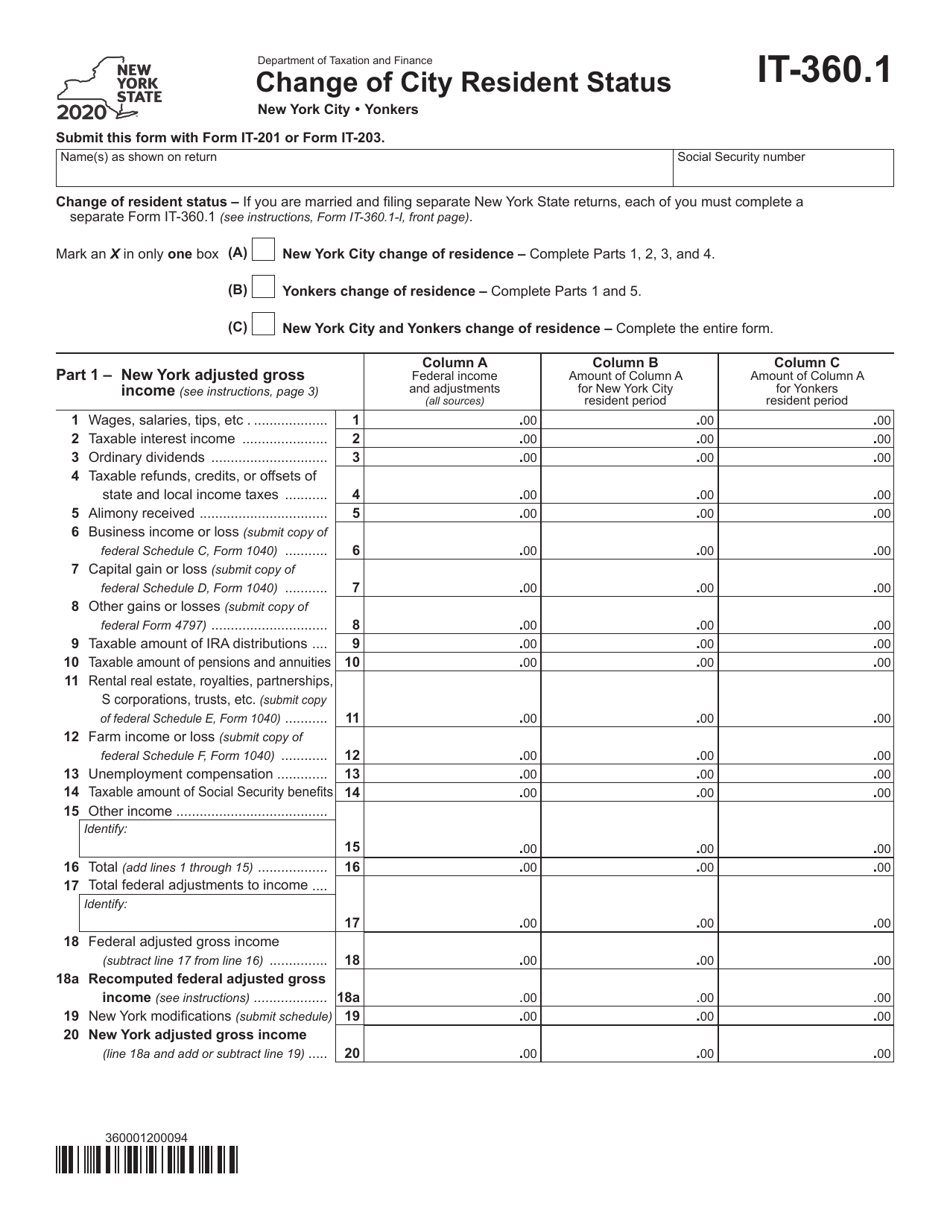

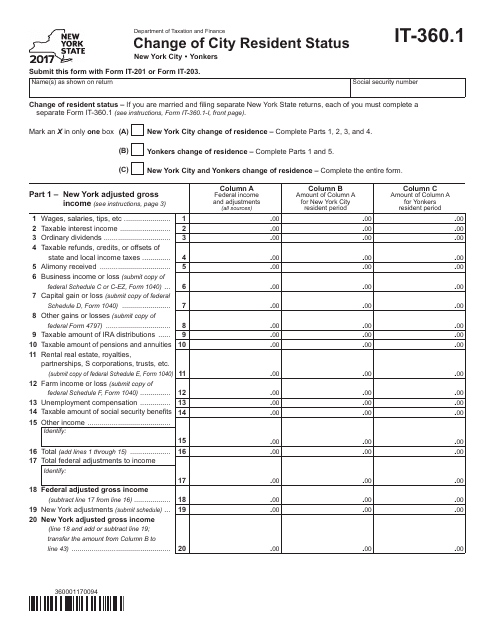

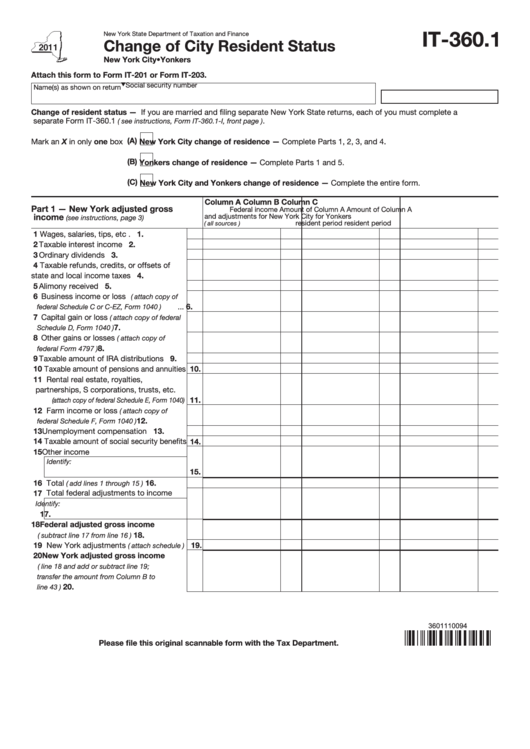

Form It 360.1

Form It 360.1 - This form is for income earned in tax year 2022, with tax. Individuals in new york are required to file a separate individual tax extension form on or before the. Web new york state individual tax extension filing instructions. Get your online template and fill it in using progressive features. Web — form it‑360.1, change of city resident status. If the period of limitations is. Enjoy smart fillable fields and interactivity. Web 54 votes how to fill out and sign ny city resident online? Web if you are referring to the it 360.1 form, then you must show your total itemized deductions in column a, and then the amounts that only apply to the time that.

Web if you are referring to the it 360.1 form, then you must show your total itemized deductions in column a, and then the amounts that only apply to the time that. Get your online template and fill it in using progressive features. If the period of limitations is. Web 54 votes how to fill out and sign ny city resident online? This form is for income earned in tax year 2022, with tax. Enjoy smart fillable fields and interactivity. Individuals in new york are required to file a separate individual tax extension form on or before the. Web new york state individual tax extension filing instructions. Web — form it‑360.1, change of city resident status.

Web 54 votes how to fill out and sign ny city resident online? Enjoy smart fillable fields and interactivity. If the period of limitations is. This form is for income earned in tax year 2022, with tax. Web if you are referring to the it 360.1 form, then you must show your total itemized deductions in column a, and then the amounts that only apply to the time that. Get your online template and fill it in using progressive features. Web — form it‑360.1, change of city resident status. Individuals in new york are required to file a separate individual tax extension form on or before the. Web new york state individual tax extension filing instructions.

NY DTF IT216 2013 Fill out Tax Template Online US Legal Forms

If the period of limitations is. Web if you are referring to the it 360.1 form, then you must show your total itemized deductions in column a, and then the amounts that only apply to the time that. This form is for income earned in tax year 2022, with tax. Get your online template and fill it in using progressive.

Form IT360.1 Download Fillable PDF or Fill Online Change of City

Web if you are referring to the it 360.1 form, then you must show your total itemized deductions in column a, and then the amounts that only apply to the time that. Web new york state individual tax extension filing instructions. Web 54 votes how to fill out and sign ny city resident online? Web — form it‑360.1, change of.

Form IT360.1 Download Fillable PDF 2017, Change of City Resident

Individuals in new york are required to file a separate individual tax extension form on or before the. Web if you are referring to the it 360.1 form, then you must show your total itemized deductions in column a, and then the amounts that only apply to the time that. If the period of limitations is. Get your online template.

image of I360 form

Enjoy smart fillable fields and interactivity. Get your online template and fill it in using progressive features. This form is for income earned in tax year 2022, with tax. Web new york state individual tax extension filing instructions. Web — form it‑360.1, change of city resident status.

Fill Free fillable forms for New York State

Web 54 votes how to fill out and sign ny city resident online? Web — form it‑360.1, change of city resident status. If the period of limitations is. Web new york state individual tax extension filing instructions. This form is for income earned in tax year 2022, with tax.

Form It360.1 2011 Change Of City Resident Status printable pdf download

Web new york state individual tax extension filing instructions. Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Web — form it‑360.1, change of city resident status. If the period of limitations is.

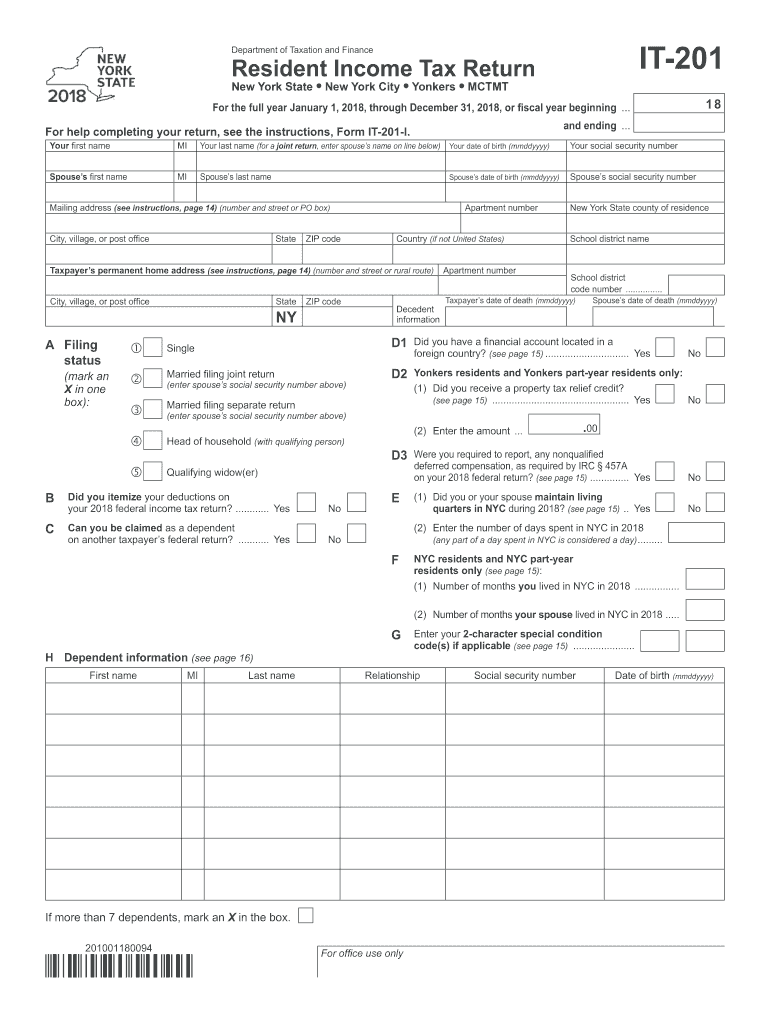

2018 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax. If the period of limitations is. Web new york state individual tax extension filing instructions. Web if you are referring to the it 360.1 form, then you must show your total itemized deductions in column a, and then the amounts that only apply to the time that. Web.

Fill Free fillable forms for New York State

Enjoy smart fillable fields and interactivity. This form is for income earned in tax year 2022, with tax. Individuals in new york are required to file a separate individual tax extension form on or before the. Web 54 votes how to fill out and sign ny city resident online? Web if you are referring to the it 360.1 form, then.

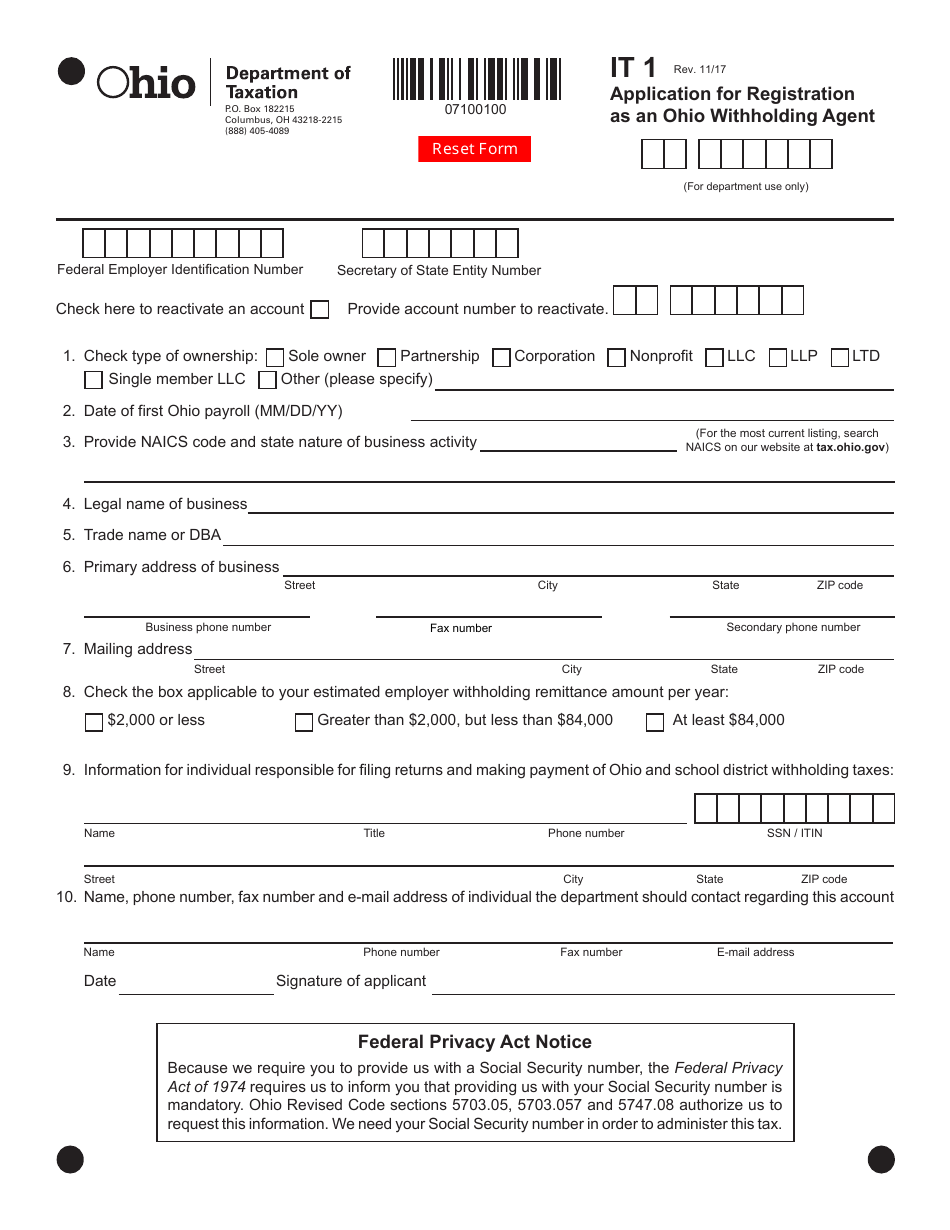

Form IT1 Download Fillable PDF or Fill Online Application for

Web 54 votes how to fill out and sign ny city resident online? Web new york state individual tax extension filing instructions. Web if you are referring to the it 360.1 form, then you must show your total itemized deductions in column a, and then the amounts that only apply to the time that. Get your online template and fill.

Washington State Vehicle Sales Tax Exemption VEHICLE UOI

Web 54 votes how to fill out and sign ny city resident online? Web — form it‑360.1, change of city resident status. Get your online template and fill it in using progressive features. Web new york state individual tax extension filing instructions. If the period of limitations is.

Web New York State Individual Tax Extension Filing Instructions.

Web — form it‑360.1, change of city resident status. Enjoy smart fillable fields and interactivity. Web 54 votes how to fill out and sign ny city resident online? Get your online template and fill it in using progressive features.

Individuals In New York Are Required To File A Separate Individual Tax Extension Form On Or Before The.

This form is for income earned in tax year 2022, with tax. If the period of limitations is. Web if you are referring to the it 360.1 form, then you must show your total itemized deductions in column a, and then the amounts that only apply to the time that.