What Is Form 480.6C

What Is Form 480.6C - Report that income when you file your return Web when you need to file 480.6a. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web payment processing entities must file this informative return to report annually the total amount of payments processed and credited to the participating merchant. If you pay natural or juridical person payments that are not subject to withholding at the source. Is this reported on 1040 & credit taken for. Web there are several ways to submit form 4868. Web setting up form 480.6c. I recieved a form 480.6c form. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico que estuvieron sujetos a retención en elorigen.

Web there are several ways to submit form 4868. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico que estuvieron sujetos a retención en elorigen. Web payment processing entities must file this informative return to report annually the total amount of payments processed and credited to the participating merchant. A new box has been added to include general information in reporting the total amount of. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partn ership not engaged in trade or business in puerto. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si estuvieron sujetos o no sujetos a. A juridical person is someone.

You may enter this data at the end of. Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web what is a form 480.6 a? Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web setting up form 480.6c. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partn ership not engaged in trade or business in puerto. If you pay natural or juridical person payments that are not subject to withholding at the source. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si estuvieron sujetos o no sujetos a. Report that income when you file your return

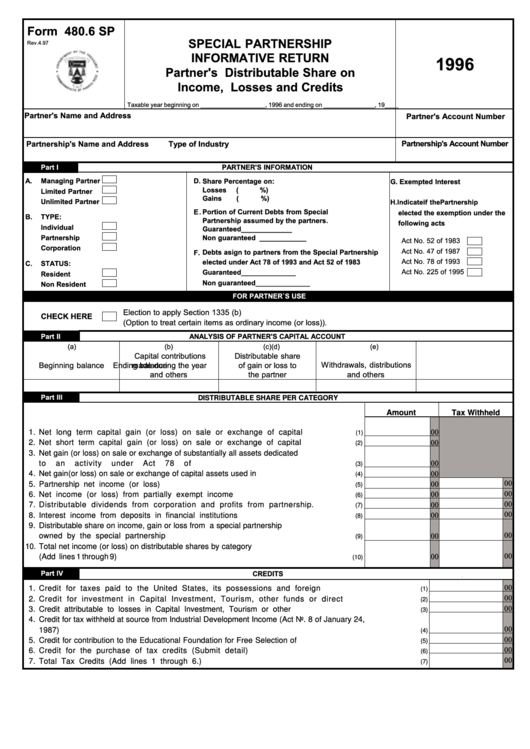

Form 480.6 Sp Partner'S Distributable Share On Losses And

A juridical person is someone. Web in order for a supplier's information to be transferred to form 480.6c, it must meet the following requirements: Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web se requerirá la preparación.

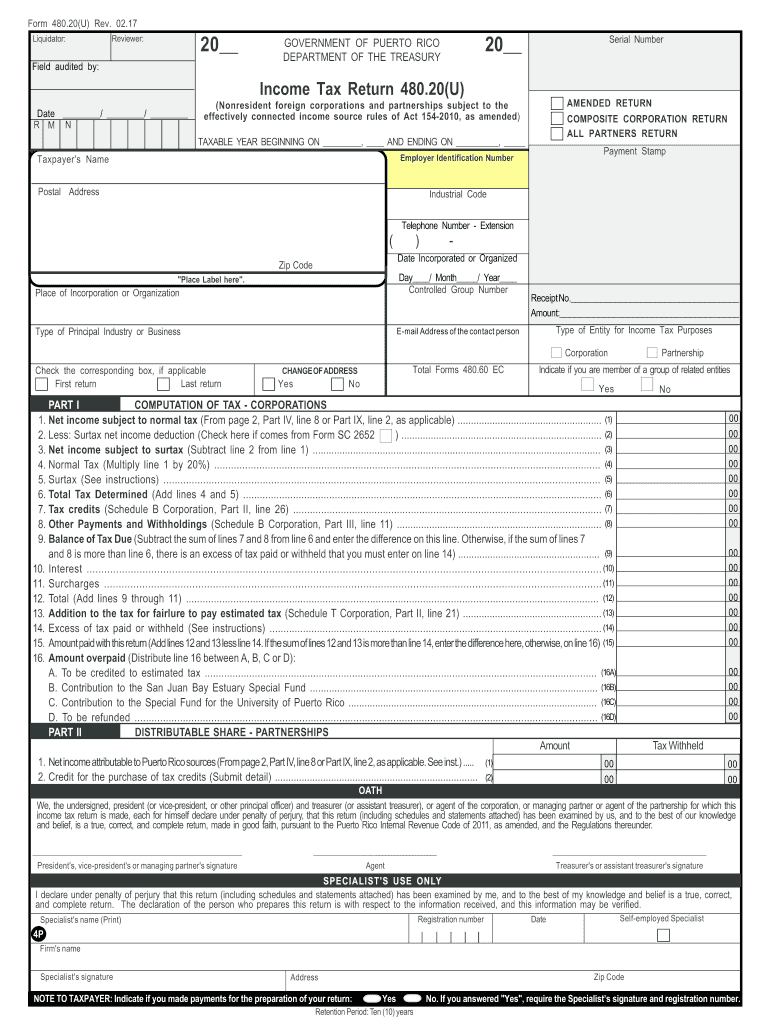

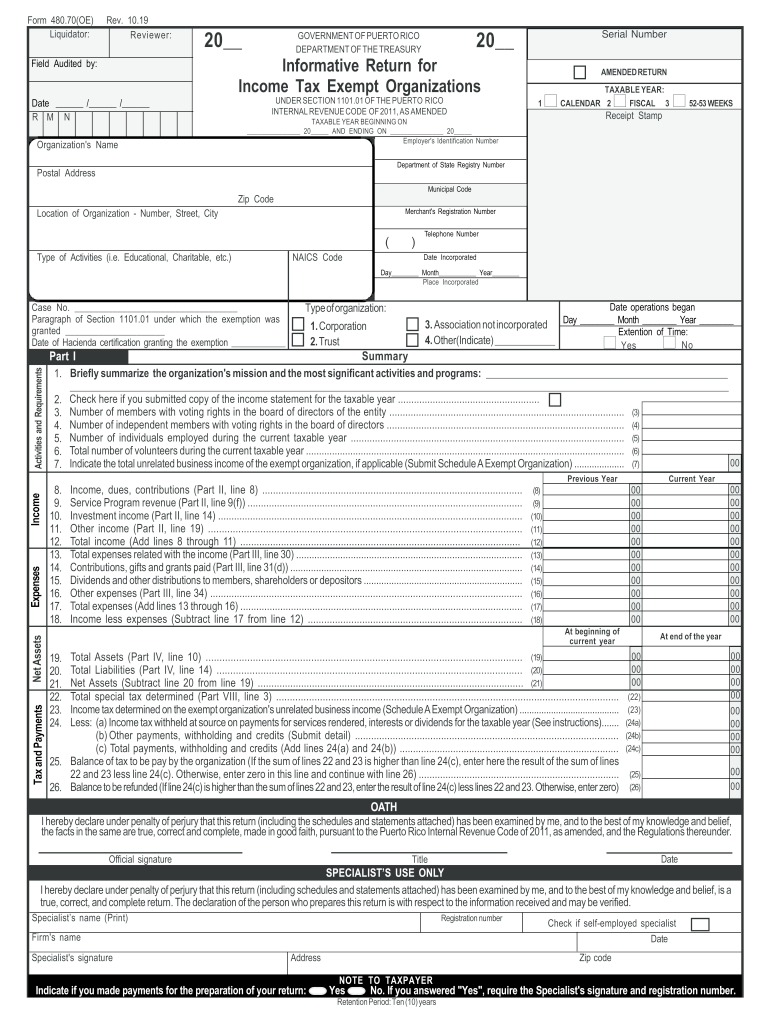

puerto rico form 480 20 instructions 2018 Fill out & sign online DocHub

Web when you need to file 480.6a. Web there are several ways to submit form 4868. Web i recieved inheritance income from sales of my mothers home in puerto rico for 44k and paid taxes of 6500. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Web series 480.6a reports.

Form 480 20 Fill Online, Printable, Fillable, Blank pdfFiller

Nonresident annual return for income. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. If you pay natural or juridical person payments that are not subject to withholding at the source. How do i enter it in my. Web when you need to file 480.6a.

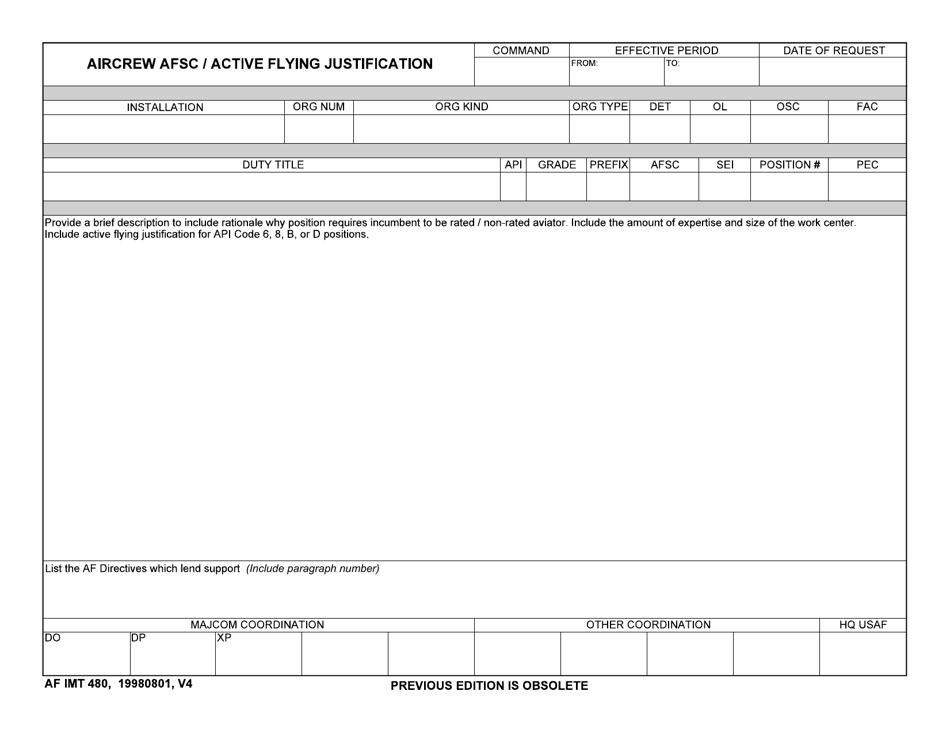

AF IMT Form 480 Download Fillable PDF or Fill Online Aircrew AFSC

Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web in.

W2 Puerto Rico Form Fill Out and Sign Printable PDF Template signNow

Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si estuvieron sujetos o no sujetos a. Report that income when you file your return Web setting up form 480.6c. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for.

20192023 Form PR 480.70(OE) Fill Online, Printable, Fillable, Blank

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. You may enter this data at the end of. Report that income when you file your return Web in order for a supplier's information to be transferred to form 480.6c, it must meet the following requirements: Web se requerirá la preparación.

PR 480.2 2016 Fill out Tax Template Online US Legal Forms

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web in order for a supplier's information to be transferred to form 480.6c, it must meet the following requirements: You may enter this data at the end of. Web i recieved inheritance income from sales of my mothers home in puerto.

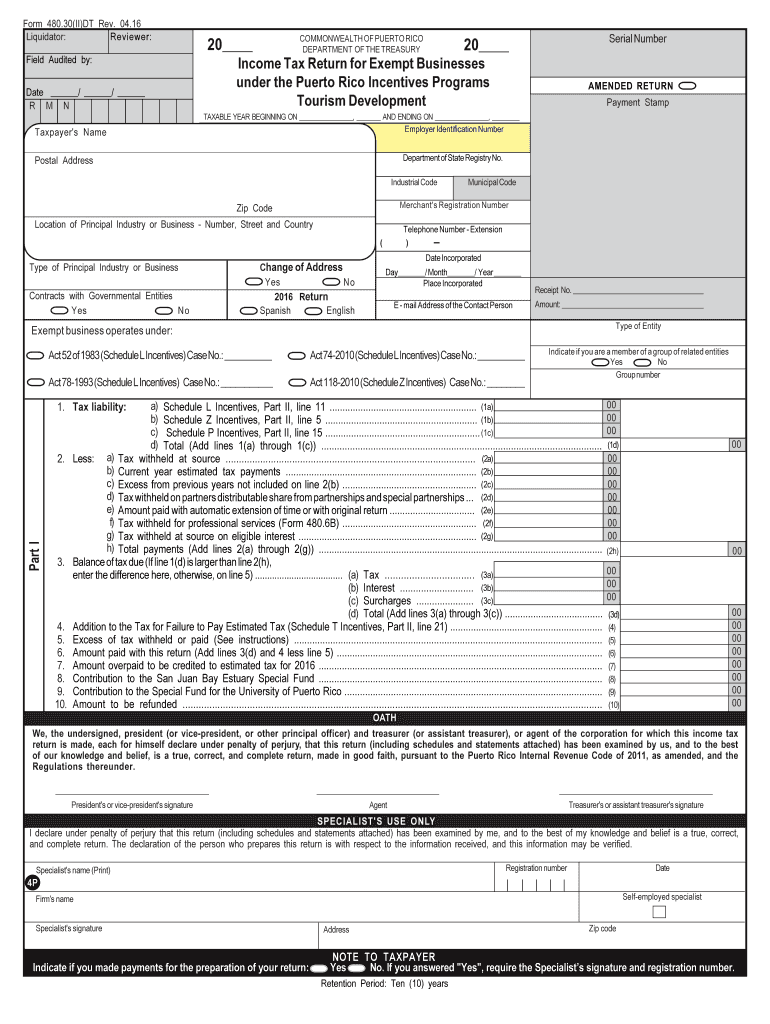

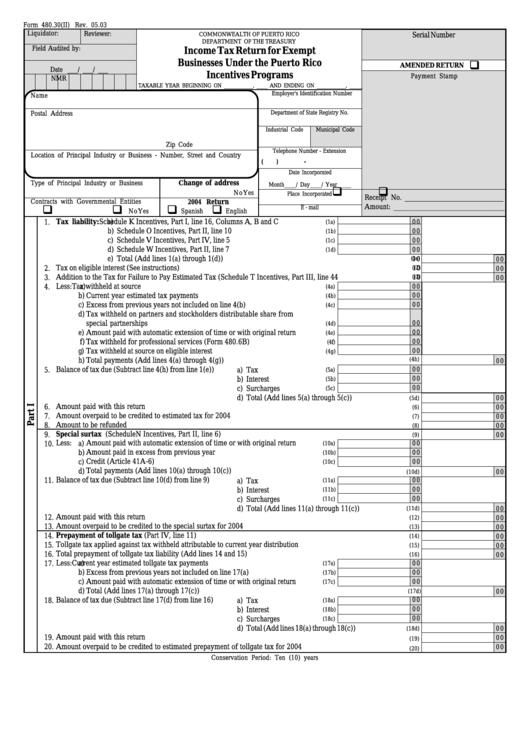

Form 480.30(Ii) Tax Return For Exempt Businesses Under The

Nonresident annual return for income. Web in order for a supplier's information to be transferred to form 480.6c, it must meet the following requirements: Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partn ership not engaged in trade or business in puerto. Web se requerirá la preparación de un.

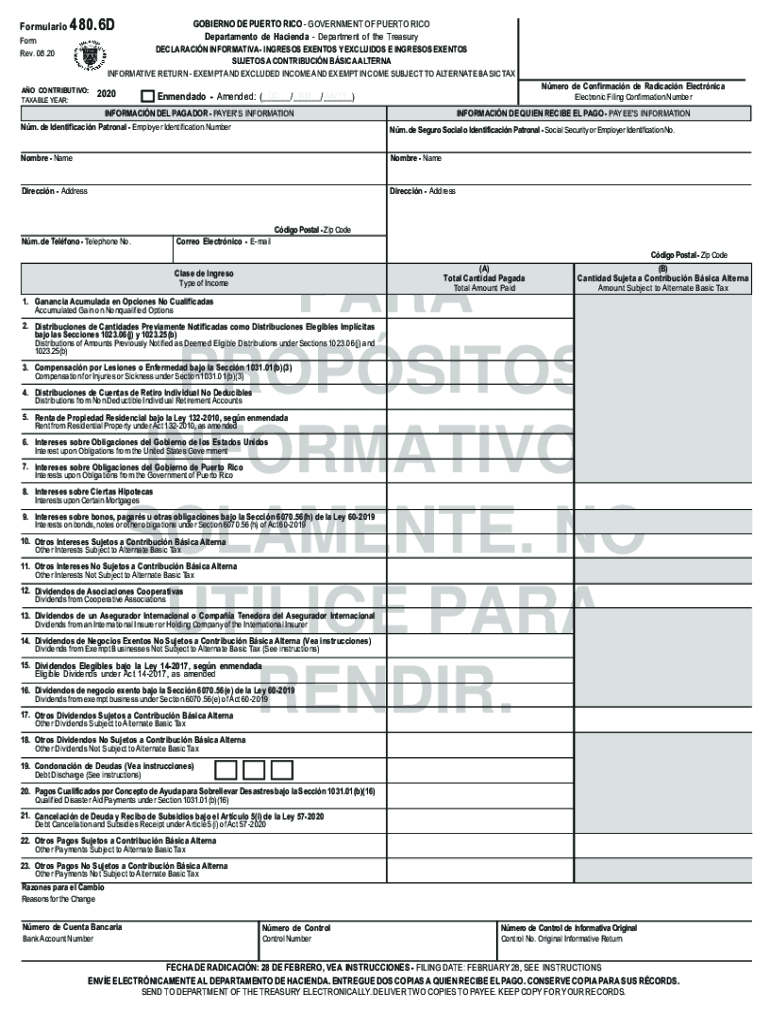

Form 480 6D Fill Out and Sign Printable PDF Template signNow

Web what is a form 480.6 a? Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. A new box has been added to include general information in reporting the.

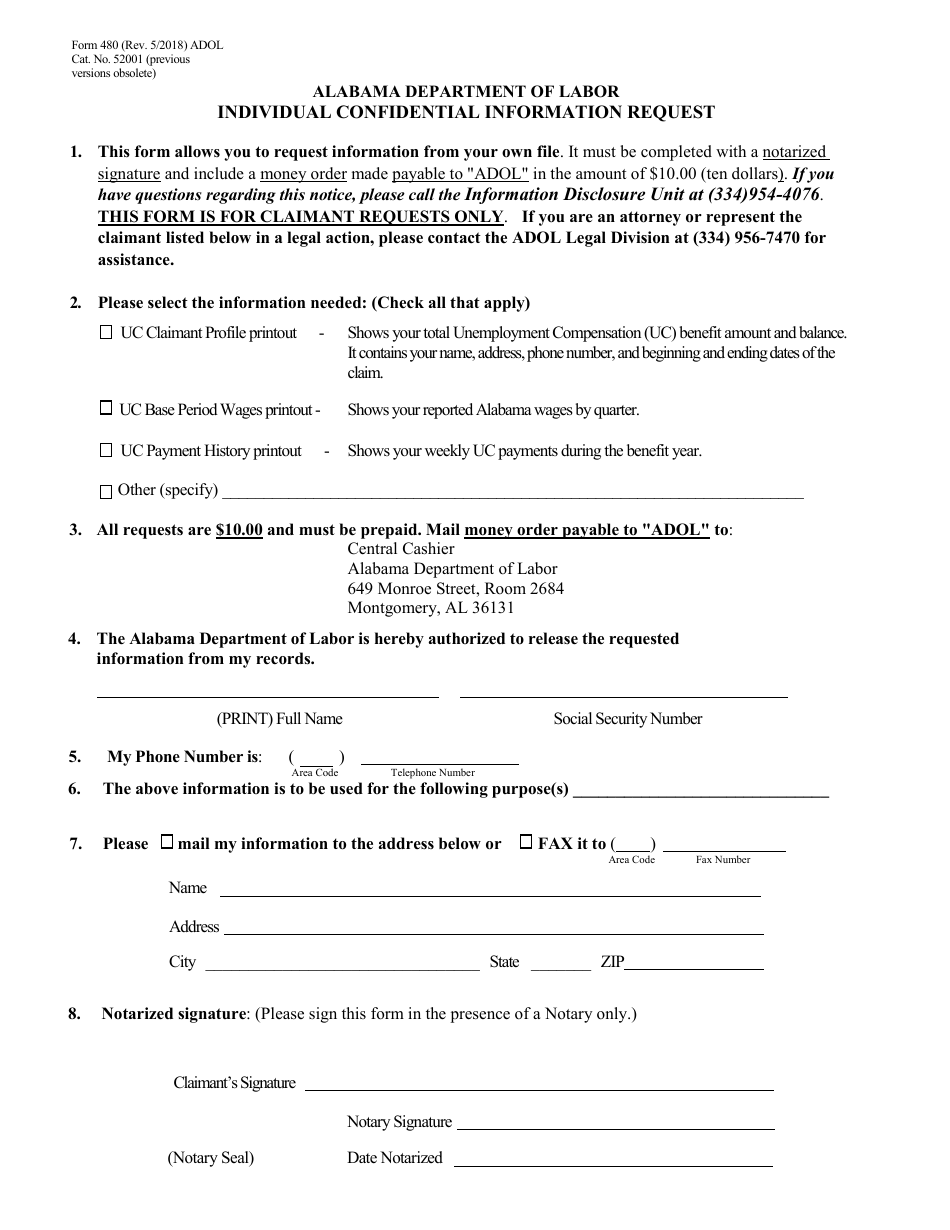

Form 480 Download Fillable PDF or Fill Online Individual Confidential

Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico que estuvieron sujetos a retención en elorigen. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web se requerirá la.

Web Puerto Rico Form 480.6C For Dividends And Taxes Withheld Within An Ira Dividends Earned In Traditional Iras Are Not Taxed When They Are Paid Or Reinvested,.

Is this reported on 1040 & credit taken for. Web what is a form 480.6 a? Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. I recieved a form 480.6c form.

Web Se Requerirá La Preparación De Un Formulario 480.6C Para Informar Todos Los Pagos Hechos A Personas No Residentes De Puerto Rico, Tanto Si Estuvieron Sujetos O No Sujetos A.

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. You may enter this data at the end of. A juridical person is someone. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a.

Web There Are Several Ways To Submit Form 4868.

How do i enter it in my. A new box has been added to include general information in reporting the total amount of. Web when you need to file 480.6a. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident.

Nonresident Annual Return For Income.

If you pay natural or juridical person payments that are not subject to withholding at the source. Web payment processing entities must file this informative return to report annually the total amount of payments processed and credited to the participating merchant. Web in order for a supplier's information to be transferred to form 480.6c, it must meet the following requirements: Web setting up form 480.6c.