1088 Tax Form

1088 Tax Form - Web if you made federal student loan payments in 2022, you may be eligible to deduct a portion of the interest you paid on your 2022 federal tax return. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Specifically, the form requires information about the mortgage lender,. Web estimated tax for individuals. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Edit, sign and save income analysis form. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Sign it in a few clicks draw your signature, type it, upload its image, or use. Web there are several ways to submit form 4868.

Web attach to your tax return (personal service and closely held corporations only). Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Sign it in a few clicks draw your signature, type it, upload its image, or use. Edit, sign and save income analysis form. Forget about scanning and printing out forms. Web there are several ways to submit form 4868. Enter the gross income figure from each year's statement where indicated. Web quick guide on how to complete 1088 form irs. The internal revenue service uses the information on this form to. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner.

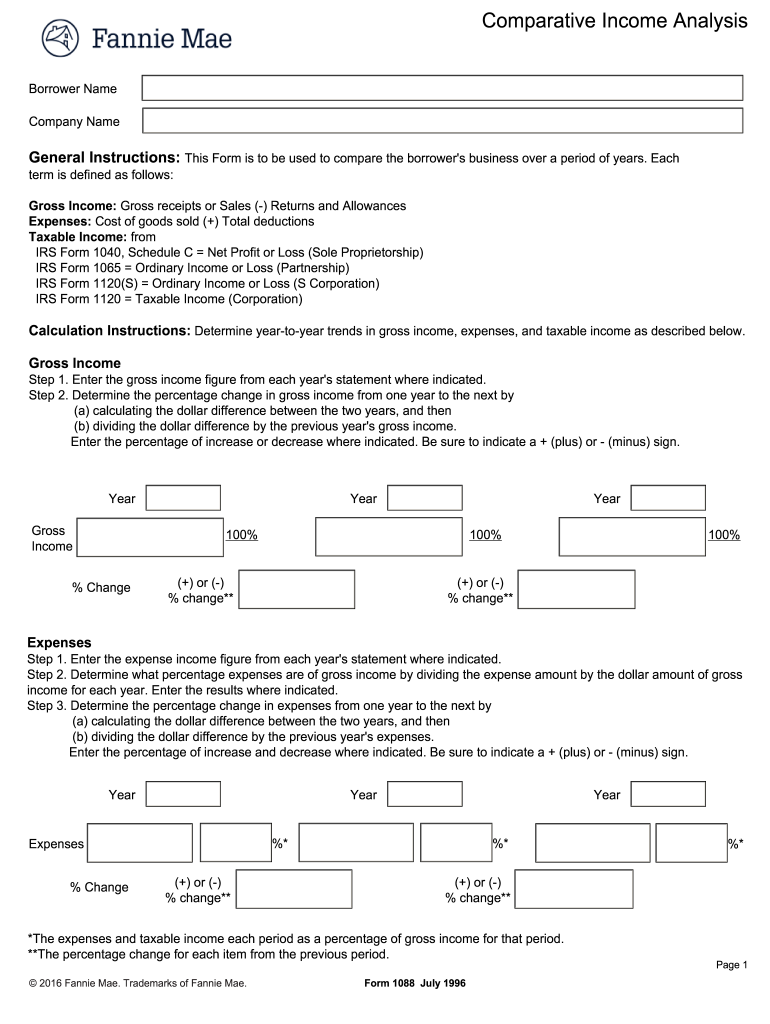

Web fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or decreases) in gross income, expenses and. Web tax form 1088 is a tax form used by the irs to calculate estate tax withholding.to learn more, visit the website: Sign it in a few clicks draw your signature, type it, upload its image, or use. Forget about scanning and printing out forms. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Get your fillable template and complete it online using the instructions provided. Web attach to your tax return (personal service and closely held corporations only). Web estimated tax for individuals. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

The dreaded New Jersey inheritance tax How it works, who pays and how

Enter the gross income figure from each year's statement where indicated. The internal revenue service uses the information on this form to. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Forget about scanning and printing out forms. Web tax form 1088.

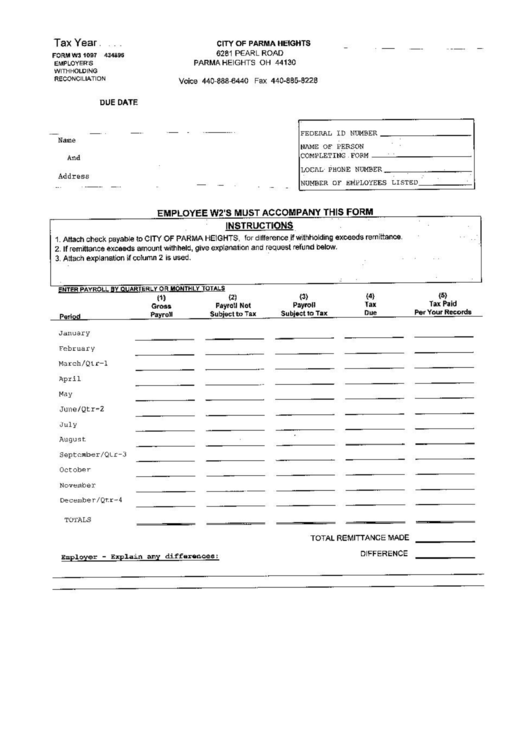

Form W3 Employer'S Withholding City Of Parma

Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Specifically, the form requires information about the mortgage lender,. Web if you made federal student loan payments in 2022,.

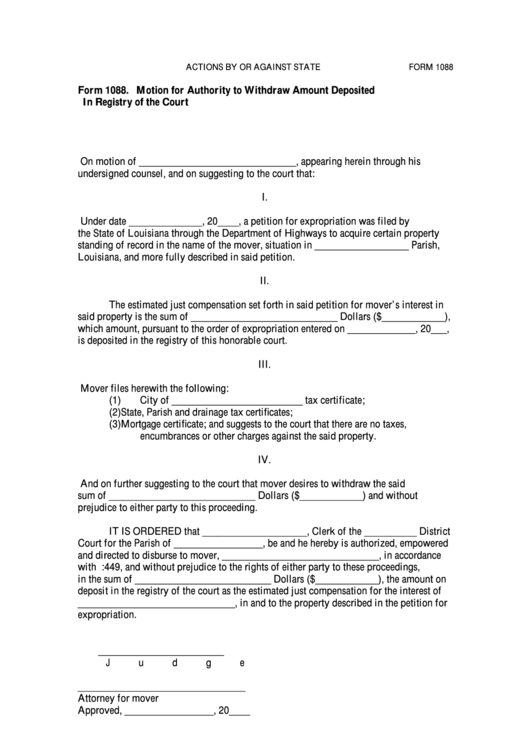

Fillable Form 1088 Motion For Authority To Withdraw Amount Deposited

Web if using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or ogden) designated. Edit, sign and save income analysis form. Enter the gross income figure from each year's statement where indicated. Forget about scanning and printing out forms. Web 130 votes 44 reviews 23 ratings 15,005 10,000,000+.

Irs.gov Form 1040a 2016 Form Resume Examples dO3wPXGE8E

Get your fillable template and complete it online using the instructions provided. Create professional documents with signnow. The internal revenue service uses the information on this form to. Web if using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or ogden) designated. Uslegalforms allows users to edit, sign,.

1088 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Determine the percentage change in gross income from one year to the. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Web each person engaged in a trade or business who, in the course of that trade.

IRS Instruction 8938 2011 Fill out Tax Template Online US Legal Forms

Web if you made federal student loan payments in 2022, you may be eligible to deduct a portion of the interest you paid on your 2022 federal tax return. Enter the gross income figure from each year's statement where indicated. The internal revenue service uses the information on this form to. Web quick guide on how to complete 1088 form.

2011 Form TN DoR INC 250 Fill Online, Printable, Fillable, Blank

Specifically, the form requires information about the mortgage lender,. Sign it in a few clicks draw your signature, type it, upload its image, or use. Web quick guide on how to complete 1088 form irs. Enter the gross income figure from each year's statement where indicated. Web if you made federal student loan payments in 2022, you may be eligible.

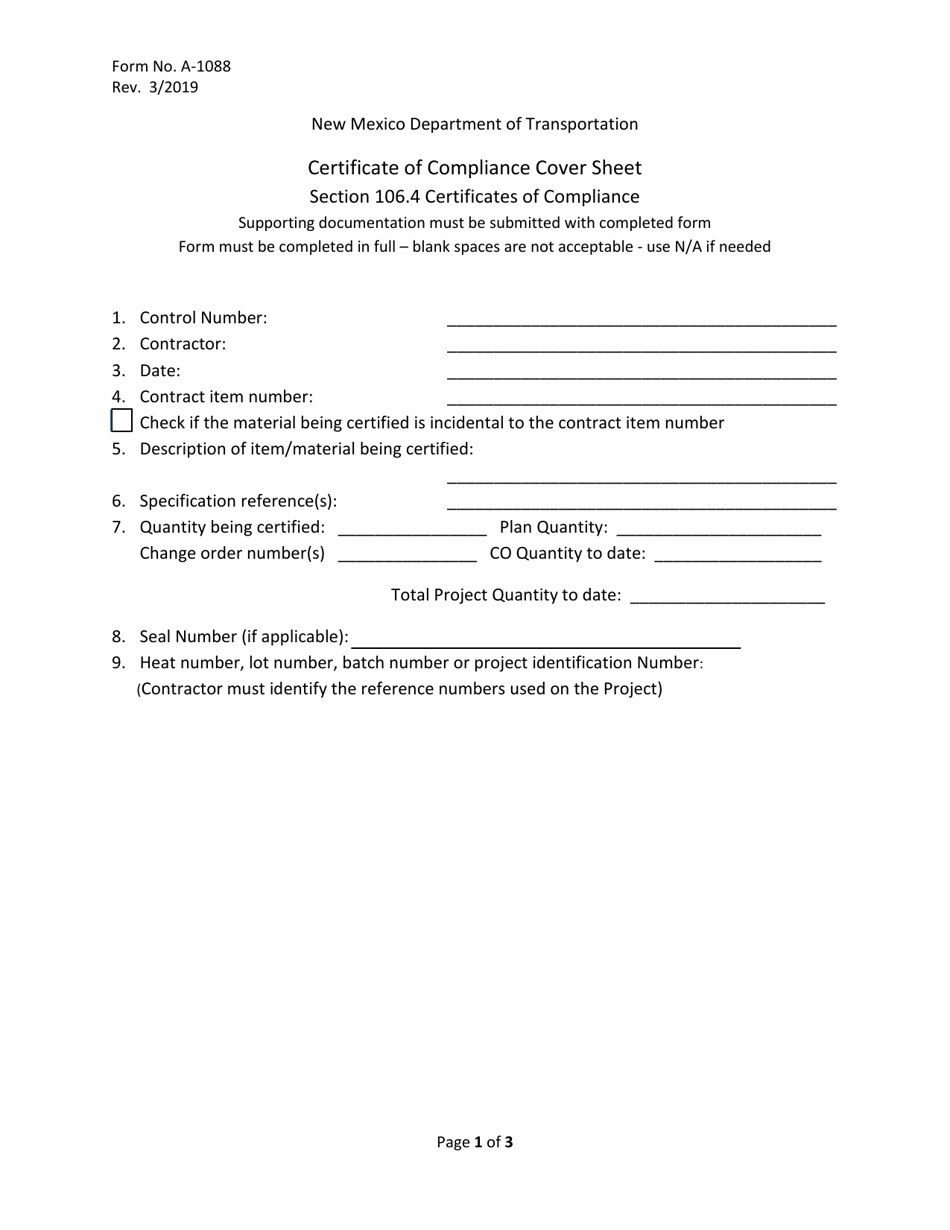

Form A1088 Download Fillable PDF or Fill Online Certificate of

Get your fillable template and complete it online using the instructions provided. Web estimated tax for individuals. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Web an eligible entity uses form 8832 to elect how.

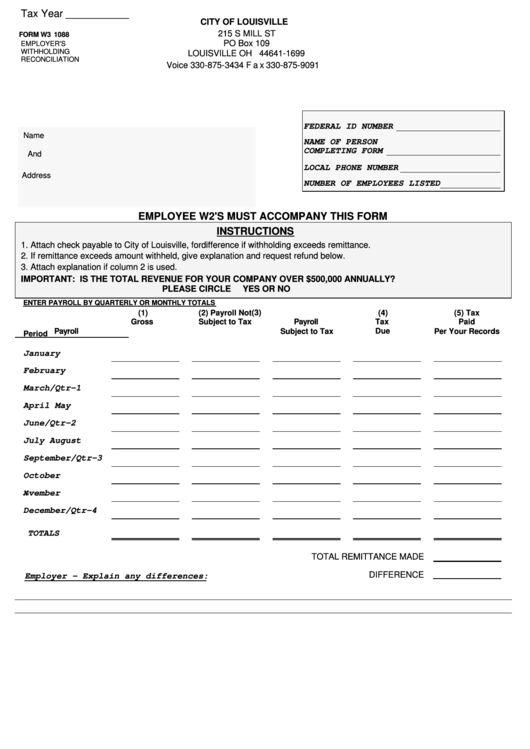

Fillable Form W3 1088 Employer'S Withholding Reconciliation City Of

Web attach to your tax return (personal service and closely held corporations only). Forget about scanning and printing out forms. Web 130 votes 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users here's how it works 02. Create professional documents with signnow. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan.

Laser Tax Form 1098E Student Copy B Free Shipping

Get your fillable template and complete it online using the instructions provided. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web quick guide on how to complete 1088 form irs. Web estimated tax for individuals. Web get tax form (1099/1042s) download a copy of your 1099 or 1042s tax.

Create Professional Documents With Signnow.

Web form 1120 (officially the u.s corporate income tax return) is one of the irs tax forms used by corporations (specifically, c corporations) in the united states to report their. Sign it in a few clicks draw your signature, type it, upload its image, or use. Web if you made federal student loan payments in 2022, you may be eligible to deduct a portion of the interest you paid on your 2022 federal tax return. Determine the percentage change in gross income from one year to the.

Web Get Tax Form (1099/1042S) Download A Copy Of Your 1099 Or 1042S Tax Form So You Can Report Your Social Security Income On Your Tax Return.

Use our detailed instructions to fill out and esign your documents online. Specifically, the form requires information about the mortgage lender,. Web fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or decreases) in gross income, expenses and. The internal revenue service uses the information on this form to.

Enter The Gross Income Figure From Each Year's Statement Where Indicated.

Web up to $40 cash back the 1088 tax form is used to report mortgage interest, payments, and premiums. Edit, sign and save income analysis form. Forget about scanning and printing out forms. Web 130 votes 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users here's how it works 02.

Web Attach To Your Tax Return (Personal Service And Closely Held Corporations Only).

Web if using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or ogden) designated. Web form 6088 is used to report the 25 highest participants of a deferred compensation plan. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.