1099 Form For Truck Drivers

1099 Form For Truck Drivers - Truck driver tax deductions the irs allows truck drivers to deduct “ordinary and necessary” business expenses. We recently sat down in the studio and talked about the ever growing pool of 1099 truck drivers. Web this form is used to assess business profit and loss. Complete, edit or print tax forms instantly. Web actively working as a driver within the past 6 months. As opposed to truck drivers who. Web form 1099 if your truck driving services are classified as an independent contractor and your payment equals $600 or more you will receive form 1099 from your. We are adding new 2024 model trucks this year Web let’s take a look into 1099 for truck drivers. Apply to van driver, delivery driver, truck driver and more!

Web 23,907 1099 driver jobs available on indeed.com. We are adding new 2024 model trucks this year We recently sat down in the studio and talked about the ever growing pool of 1099 truck drivers. As opposed to truck drivers who. Ad shrock trucking is now hiring class a cdl otr solo and team drivers out of springfield, mo. Our fleet consists of 2021 to 2023’s. Web form 1099 if your truck driving services are classified as an independent contractor and your payment equals $600 or more you will receive form 1099 from your. Web tax deductions for truck drivers. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of. Ad electronically file 1099 forms.

We recently sat down in the studio and talked about the ever growing pool of 1099 truck drivers. Web 1099 drivers may be like doordash contractors, postmates, instacart, uber, lyft, or other related gig jobs truck drivers for freight services deliveries are also 1099. Apply to van driver, delivery driver, truck driver and more! We were asked a question. You may also need to. Web actively working as a driver within the past 6 months. Ad shrock trucking is now hiring class a cdl otr solo and team drivers out of springfield, mo. Web you'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. Ad get ready for tax season deadlines by completing any required tax forms today. Web this form is used to assess business profit and loss.

Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2020]

Web actively working as a driver within the past 6 months. Web you'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. However, if you are classified as an 'independent contractor'. Web this form is used to assess business profit and loss. Ad electronically file 1099 forms.

What is a 1099 & 5498? uDirect IRA Services, LLC

Since they are considered contractors, 1099 workers do not have taxes deducted from their salary. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of. Web 1099 drivers may be like doordash contractors, postmates, instacart, uber, lyft, or.

Hiring 1099 Drivers May Not Be Worth the Risk Gorilla Safety

Web many professional truck drivers choose to contract their services to carriers and fleets. Web 1099 truck drivers legal or not. Web this form is used to assess business profit and loss. Web truck drivers working as independent contractors are able to claim a number of deductions when filing their tax returns. Our fleet consists of 2021 to 2023’s.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web feb 4, 2022 5 min read 1099 vs. Ad shrock trucking is now hiring class a cdl otr solo and team drivers out of springfield, mo. As opposed to truck drivers who. Our fleet consists of 2021 to 2023’s. Web this form is used to assess business profit and loss.

When is tax form 1099MISC due to contractors? GoDaddy Blog

It is used by truck drivers who work as independent contractors or owner. Web truck drivers working as independent contractors are able to claim a number of deductions when filing their tax returns. Ad shrock trucking is now hiring class a cdl otr solo and team drivers out of springfield, mo. Web many professional truck drivers choose to contract their.

9 Form Uber Ten Quick Tips Regarding 9 Form Uber AH STUDIO Blog

Web actively working as a driver within the past 6 months. Our fleet consists of 2021 to 2023’s. Complete, edit or print tax forms instantly. Web let’s take a look into 1099 for truck drivers. Ad electronically file 1099 forms.

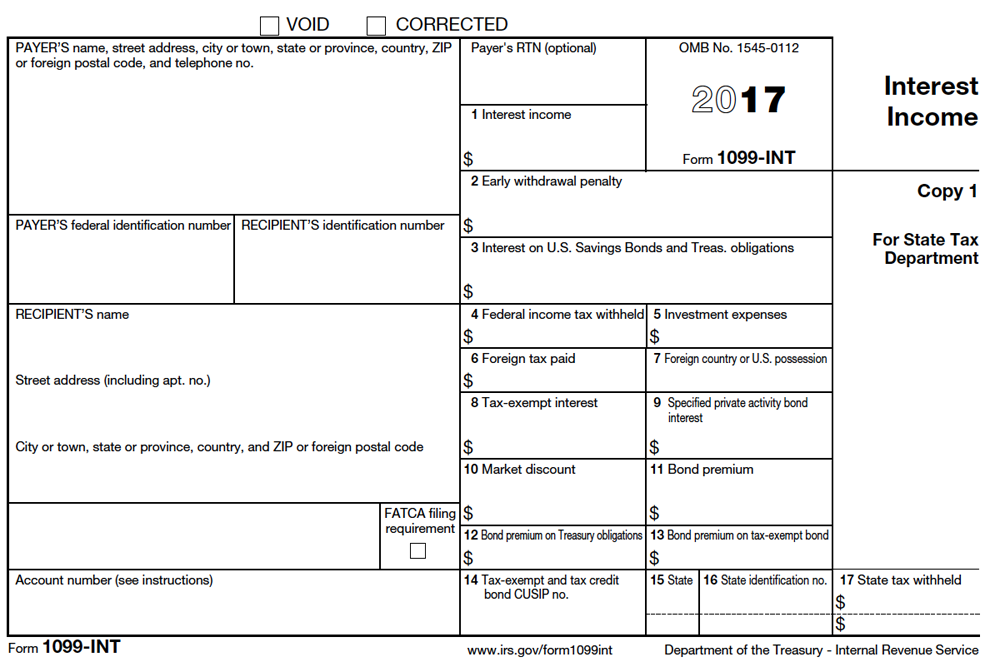

Tax Information Regarding Forms 1099R and 1099INT That We Send

Web 23,907 1099 driver jobs available on indeed.com. The entire gross sum would be. Ad shrock trucking is now hiring class a cdl otr solo and team drivers out of springfield, mo. Since they are considered contractors, 1099 workers do not have taxes deducted from their salary. You may also need to.

How To Fill Out A 1099 Misc Form For Employee Armando Friend's Template

Truck driver tax deductions the irs allows truck drivers to deduct “ordinary and necessary” business expenses. Since they are considered contractors, 1099 workers do not have taxes deducted from their salary. However, if you are classified as an 'independent contractor'. Web 1099 drivers may be like doordash contractors, postmates, instacart, uber, lyft, or other related gig jobs truck drivers for.

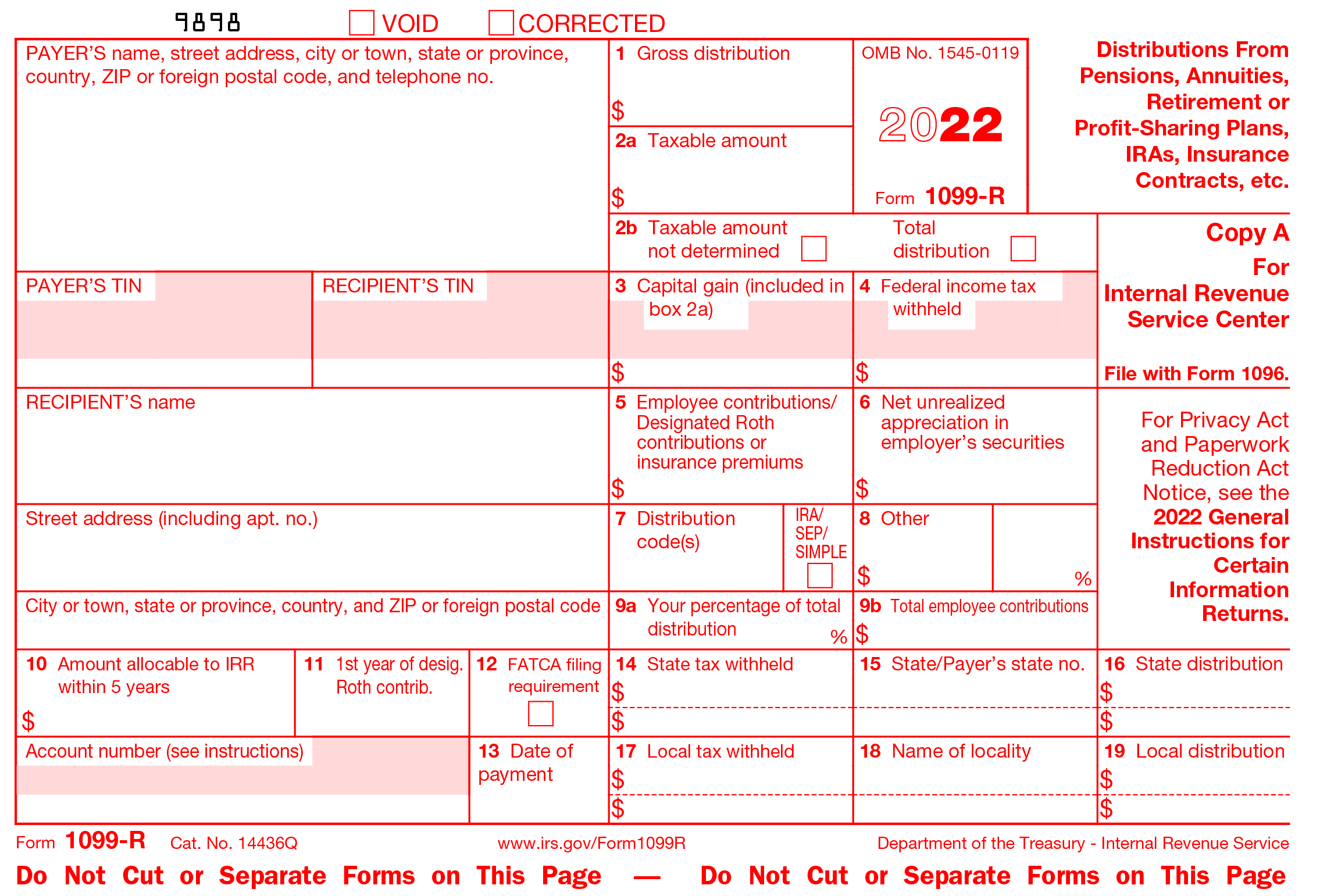

Efile 2022 Form 1099R Report the Distributions from Pensions

Web 1099 truck drivers legal or not. Web 23,907 1099 driver jobs available on indeed.com. Ad electronically file 1099 forms. We were asked a question. Web 1099 drivers may be like doordash contractors, postmates, instacart, uber, lyft, or other related gig jobs truck drivers for freight services deliveries are also 1099.

Fast Answers About 1099 Forms for Independent Workers

Web this form is used to assess business profit and loss. You may also need to. However, if you are classified as an 'independent contractor'. Apply to van driver, delivery driver, truck driver and more! Since they are considered contractors, 1099 workers do not have taxes deducted from their salary.

Web Many Professional Truck Drivers Choose To Contract Their Services To Carriers And Fleets.

Web let’s take a look into 1099 for truck drivers. Web 23,907 1099 driver jobs available on indeed.com. Our fleet consists of 2021 to 2023’s. As opposed to truck drivers who.

Web Feb 4, 2022 5 Min Read 1099 Vs.

Ad electronically file 1099 forms. Complete, edit or print tax forms instantly. Web actively working as a driver within the past 6 months. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of.

Web Tax Deductions For Truck Drivers.

Web form 1099 if your truck driving services are classified as an independent contractor and your payment equals $600 or more you will receive form 1099 from your. Web this form is used to assess business profit and loss. Ad get ready for tax season deadlines by completing any required tax forms today. The entire gross sum would be.

It Is Used By Truck Drivers Who Work As Independent Contractors Or Owner.

We recently sat down in the studio and talked about the ever growing pool of 1099 truck drivers. Web truck drivers working as independent contractors are able to claim a number of deductions when filing their tax returns. Web 1099 drivers may be like doordash contractors, postmates, instacart, uber, lyft, or other related gig jobs truck drivers for freight services deliveries are also 1099. Since they are considered contractors, 1099 workers do not have taxes deducted from their salary.

![Ultimate Tax Guide for Uber & Lyft Drivers [Updated for 2020]](https://i0.wp.com/therideshareguy.com/wp-content/uploads/2019/01/7f581fca-dac6-422f-9c38-471384c398f1_example20of20uber201099misc.jpg?ssl=1)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)