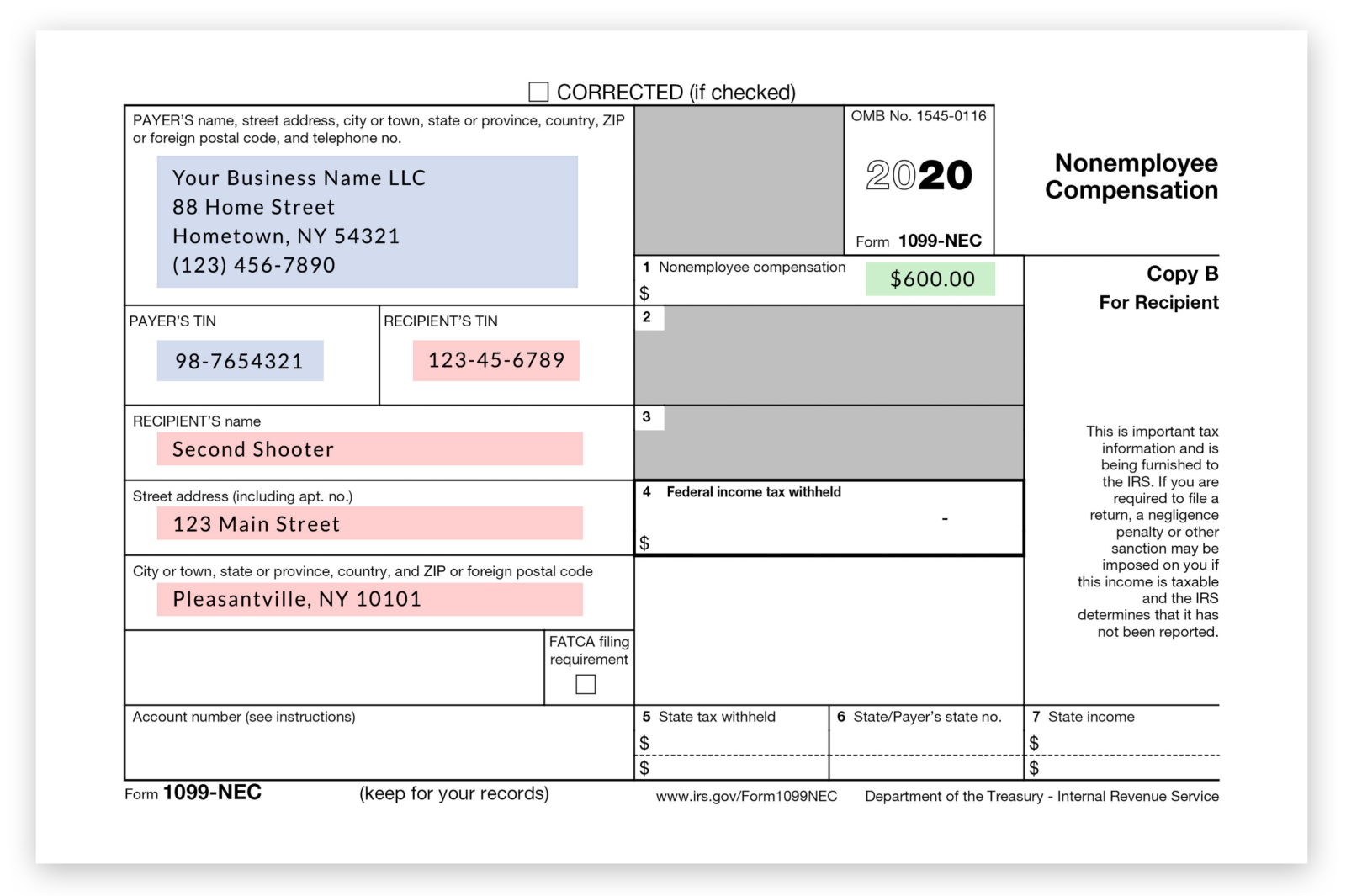

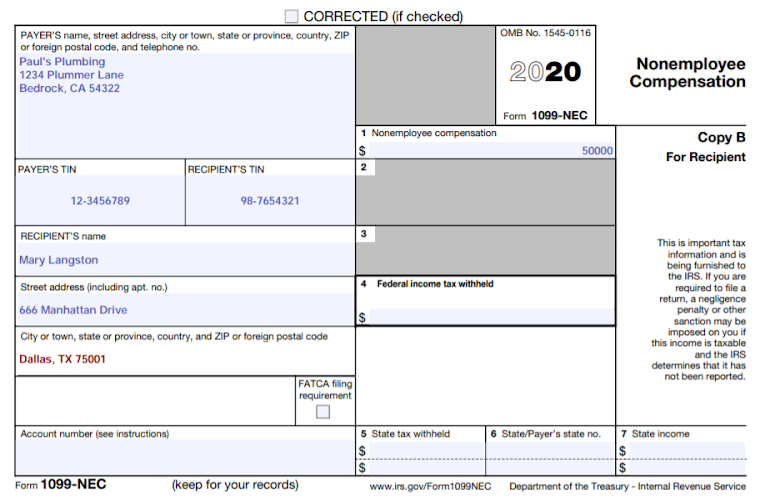

1099 Nec Form Sample

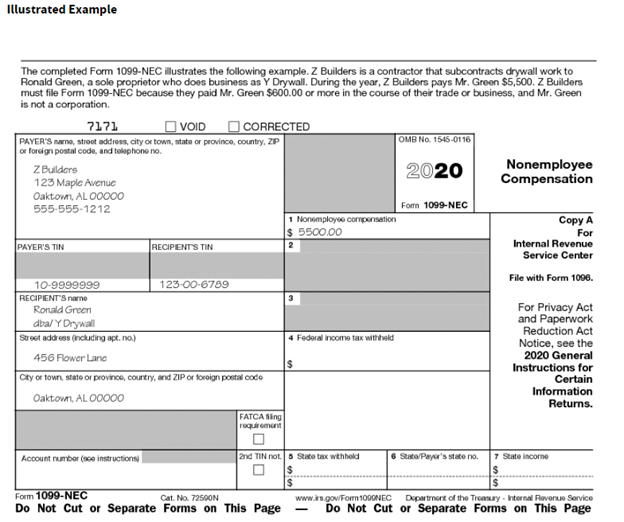

1099 Nec Form Sample - Shows nonemployee compensation and/or nonqualified deferred box 4. There are also boxes for federal income tax and state income tax withheld, which may be required for taxpayers subject to backup withholding. Department of the treasury, u.s. 10 understanding 1099 form samples. If you are in the trade or business of catching fish, certain payments if you did not give your tin to the payer. And on box 4, enter the federal tax withheld if any. Businesses use it to report nonemployee compensation as well as direct sales of $5,000 or more of consumer products. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. Report wages, tips, and other compensation paid to an. Submit the copy to the irs by the due date.

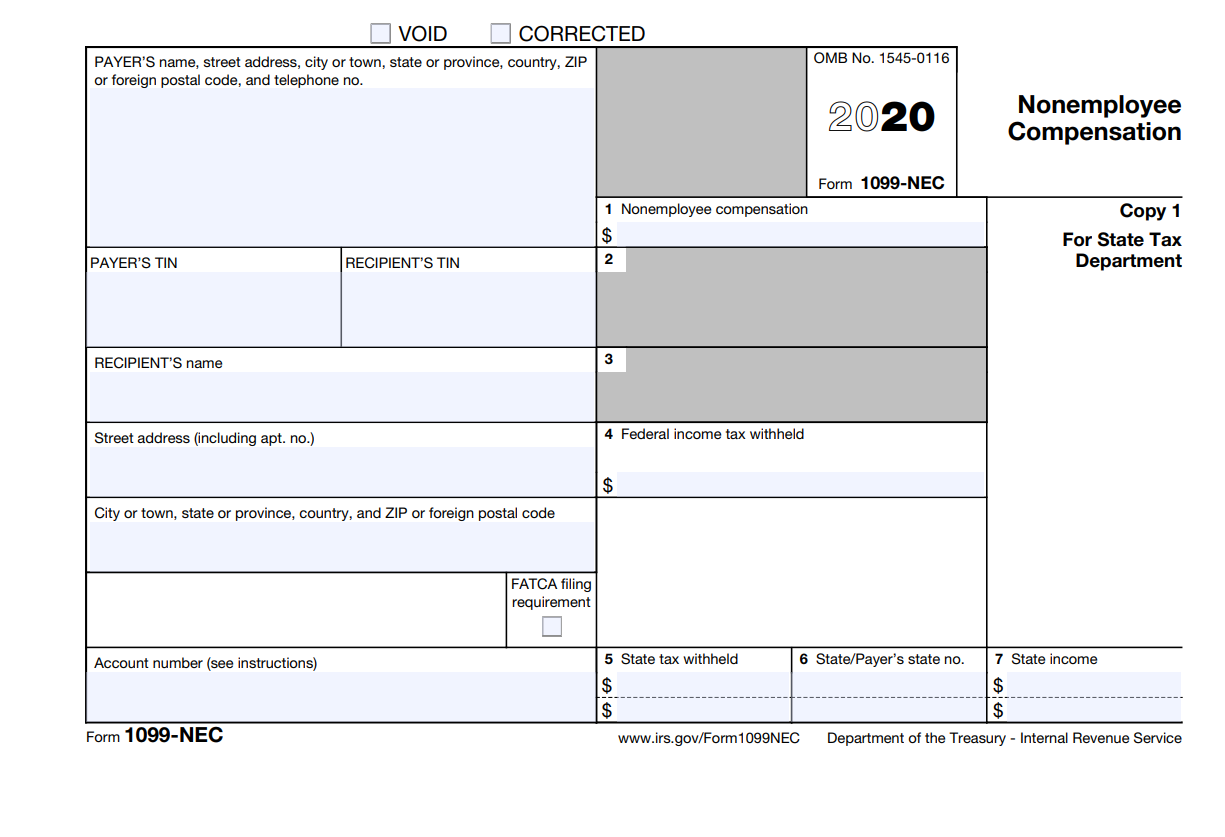

Fill out the nonemployee compensation online and print it out for free. And on box 4, enter the federal tax withheld if any. Submit the copy to the irs by the due date. Compatible with most accounting software systems. Sources of information for the 1099 form; There are also boxes for federal income tax and state income tax withheld, which may be required for taxpayers subject to backup withholding. Current general instructions for certain information returns. Report wages, tips, and other compensation paid to an. The 2021 calendar year comes with changes to business owners’ taxes. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone.

Sources of information for the 1099 form; Submit the copy to the irs by the due date. A payer must backup withhold on compensation (nqdc). Form resized so now it can fit up to 3 per page. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. Compatible with most accounting software systems. Answer although these forms are called information returns, they serve different functions. 10 understanding 1099 form samples. There are also boxes for federal income tax and state income tax withheld, which may be required for taxpayers subject to backup withholding. Web download the template, print it out, or fill it in online.

Form 1099MISC vs Form 1099NEC How are they Different?

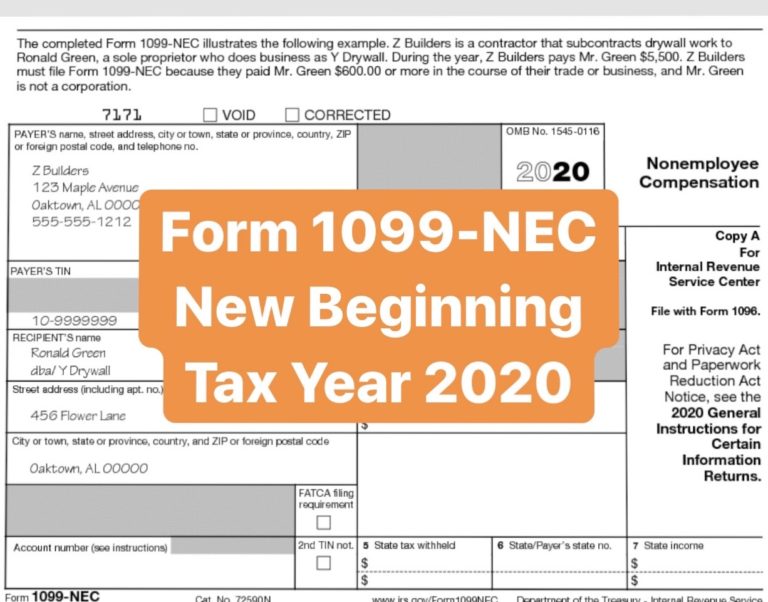

A payer must backup withhold on compensation (nqdc). Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. Copy a for internal revenue service center. Department of the treasury, u.s. Web 9 understanding sources of information for the 1099 form.

1099NEC Software to Create, Print & EFile IRS Form 1099NEC

Fees paid by one professional. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. For privacy act and paperwork reduction act notice, see the. Report wages, tips, and other compensation paid to an. Department of the treasury, u.s.

Understanding 1099 Form Samples

10 understanding 1099 form samples. Fill out the nonemployee compensation online and print it out for free. For internal revenue service center. Web download the template, print it out, or fill it in online. For privacy act and paperwork reduction act notice, see the.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Fill out the nonemployee compensation online and print it out for free. Sources of information for the 1099 form; Department of the treasury, u.s. Businesses use it to report nonemployee compensation as well as direct sales of $5,000 or more of consumer products. Shows nonemployee compensation and/or nonqualified deferred box 4.

1099NEC 2020 Sample Form Crestwood Associates

For internal revenue service center. Web download the template, print it out, or fill it in online. There are also boxes for federal income tax and state income tax withheld, which may be required for taxpayers subject to backup withholding. Department of the treasury, u.s. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone.

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

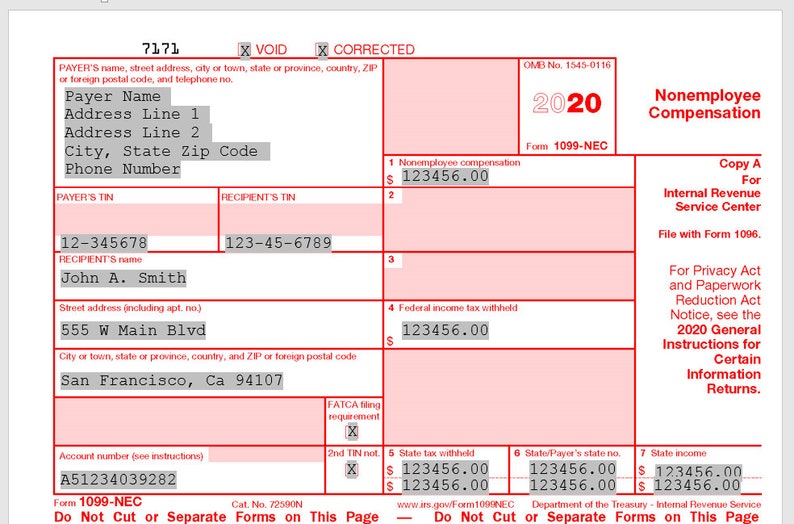

Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact number. Web 9 understanding sources of information for the 1099 form. Web what's new for 2021. Copy a for internal revenue service center. Professional service fees to attorneys (including law firms established as corporations), accountants, architects,.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

There are also boxes for federal income tax and state income tax withheld, which may be required for taxpayers subject to backup withholding. Fees paid by one professional. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. For internal revenue service center. Professional service fees to attorneys (including law firms established as corporations), accountants,.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. Form resized so now it can fit up to 3 per page. The 2021 calendar year comes with changes to business owners’ taxes. Businesses use it to report nonemployee compensation as well as direct sales of $5,000 or more of consumer products. 2020 general instructions.

IRS Form 1099 Reporting for Small Business Owners

Answer although these forms are called information returns, they serve different functions. And on box 4, enter the federal tax withheld if any. Businesses use it to report nonemployee compensation as well as direct sales of $5,000 or more of consumer products. Boxes on the left side of the form require the payer and recipient details such as tin, name.

What is Form 1099NEC for Nonemployee Compensation

Report wages, tips, and other compensation paid to an. Copy a for internal revenue service center. New box 2 checkbox (payer made direct sales totaling $5,000 or more of consumer products to recipient for resale) removed fatca checkbox. Web download the template, print it out, or fill it in online. There are also boxes for federal income tax and state.

Sources Of Information For The 1099 Form;

Professional service fees to attorneys (including law firms established as corporations), accountants, architects, etc. For internal revenue service center. Report wages, tips, and other compensation paid to an. A payer must backup withhold on compensation (nqdc).

Department Of The Treasury, U.s.

Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact number. Fees paid by one professional. The 2021 calendar year comes with changes to business owners’ taxes. And on box 4, enter the federal tax withheld if any.

For Privacy Act And Paperwork Reduction Act Notice, See The.

Current general instructions for certain information returns. Shows nonemployee compensation and/or nonqualified deferred box 4. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. Answer although these forms are called information returns, they serve different functions.

2020 General Instructions For Certain Information Returns.

What’s the filing deadline for a 1099? Compatible with most accounting software systems. Follow the instructions included in the document to enter the data. There are also boxes for federal income tax and state income tax withheld, which may be required for taxpayers subject to backup withholding.