1099 Tax Form Deadline

1099 Tax Form Deadline - If you are filing through paper forms, the due date is february 28. Web the following are exceptions to the filing deadlines shown above. Businesses that withhold taxes from their employee's. Web firms that file for a client tax form extension will have until march 15, 2023, to postmark the consolidated 1099 form. Web 2022 deadlines for 1099 forms. Do not send a form (1099, 5498,. The electronic filing due date is march 31 for the. File your form 2290 online & efile with the irs. Web the deadline for most of the 1099 forms is january 31st of the tax year. Web individuals and families.

Check return status (refund or. Businesses that withhold taxes from their employee's. 201, the due dates for all 1099 forms have been accelerated and brought forward from the 28 th of. Web 2 days agothe employee retention credit could amount to $26,000 per employee. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Additions to tax and interest calculator; This is the only form with the same requirement for. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. If you are filing through paper forms, the due date is february 28. File your form 2290 online & efile with the irs.

Actually, that’s been the case for a while. This is the only form with the same requirement for. Web 2 days agothe employee retention credit could amount to $26,000 per employee. Web 2022 deadlines for 1099 forms. Web firms that file for a client tax form extension will have until march 15, 2023, to postmark the consolidated 1099 form. Send 1099 form to the recipient by january 31, 2022. Web one is the due date to send the recipient copy and the second is the due date to file the tax form with the irs. Web the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web the 1099 nec has a due date of january 31 for all filings (due to recipients, filing mailed to the irs, electronic filing to the irs). The electronic filing due date is march 31 for the.

NEW FORM 1099 DEADLINE DATE

Web however, according to the path act, p.l. Generally, the deadline for filing electronically will. Web 2 days agothe employee retention credit could amount to $26,000 per employee. Tax payers filing the paper forms should file them by 28 th february. For contextual purposes, this discussion will address the specific due.

1099 Letter Request Sample W 9 Request Letter Doc Sample W 9 Request

Web the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web the 1099 nec has a due date of january 31 for all filings (due to recipients, filing mailed to the irs, electronic filing to the irs). Additions to tax and interest calculator; Actually, that’s been the case for.

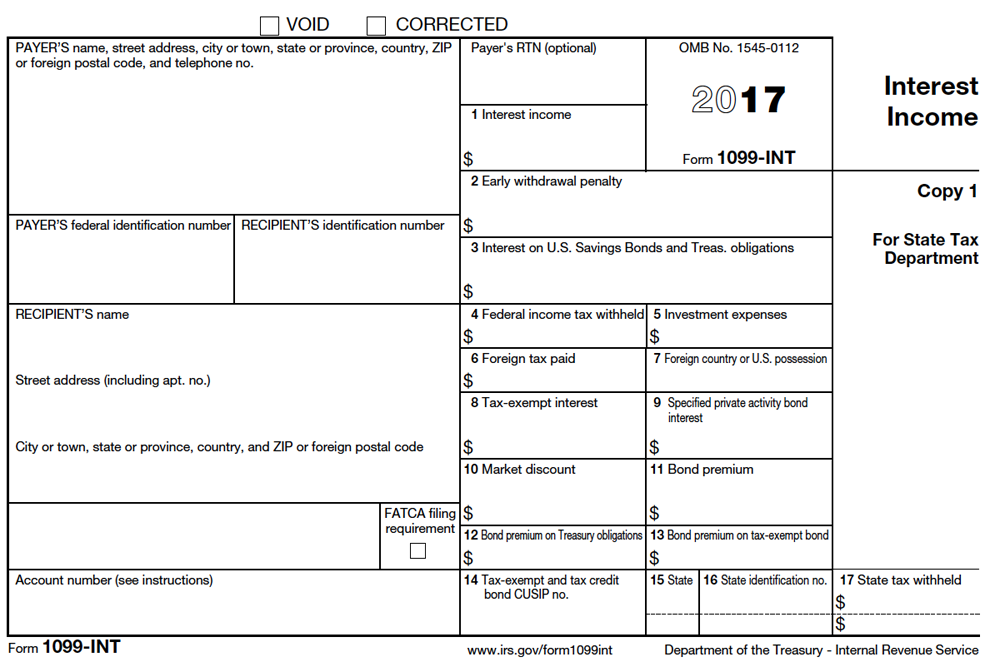

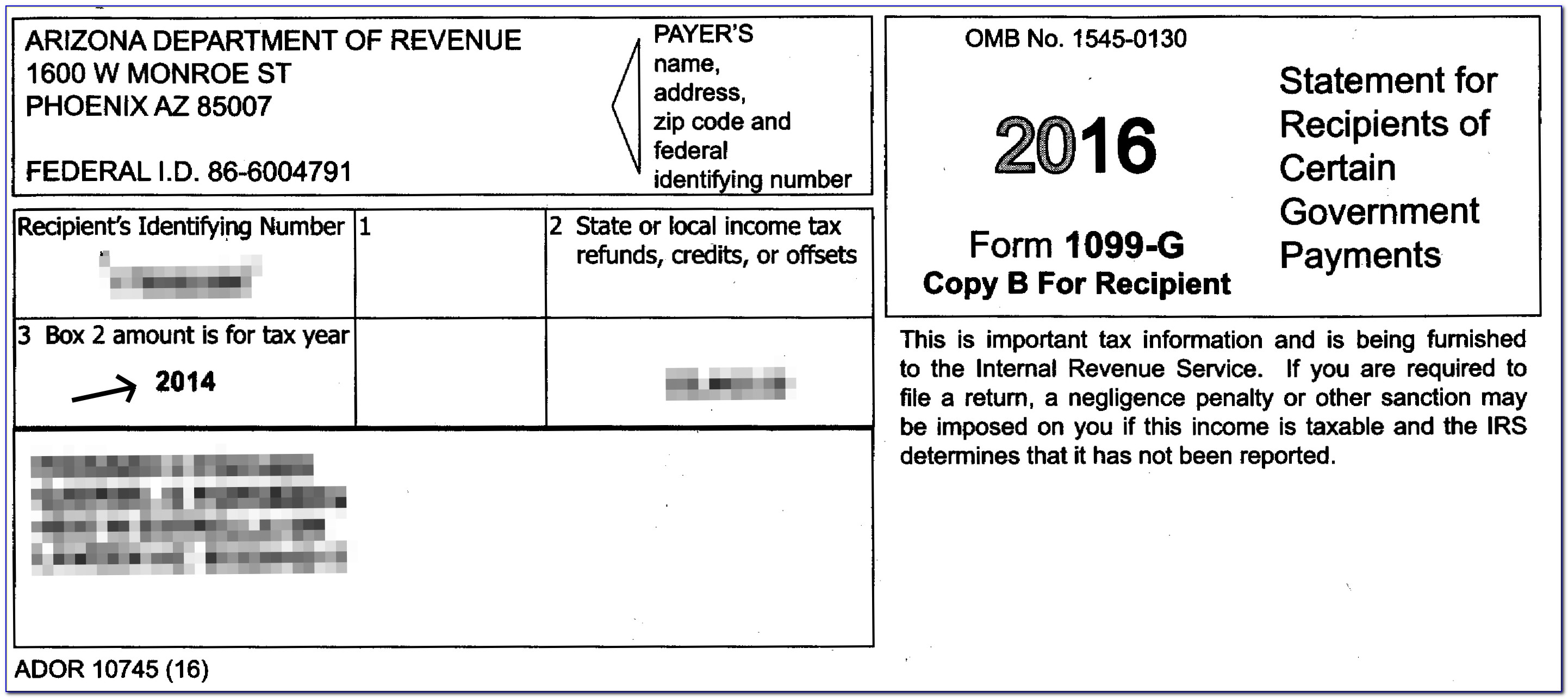

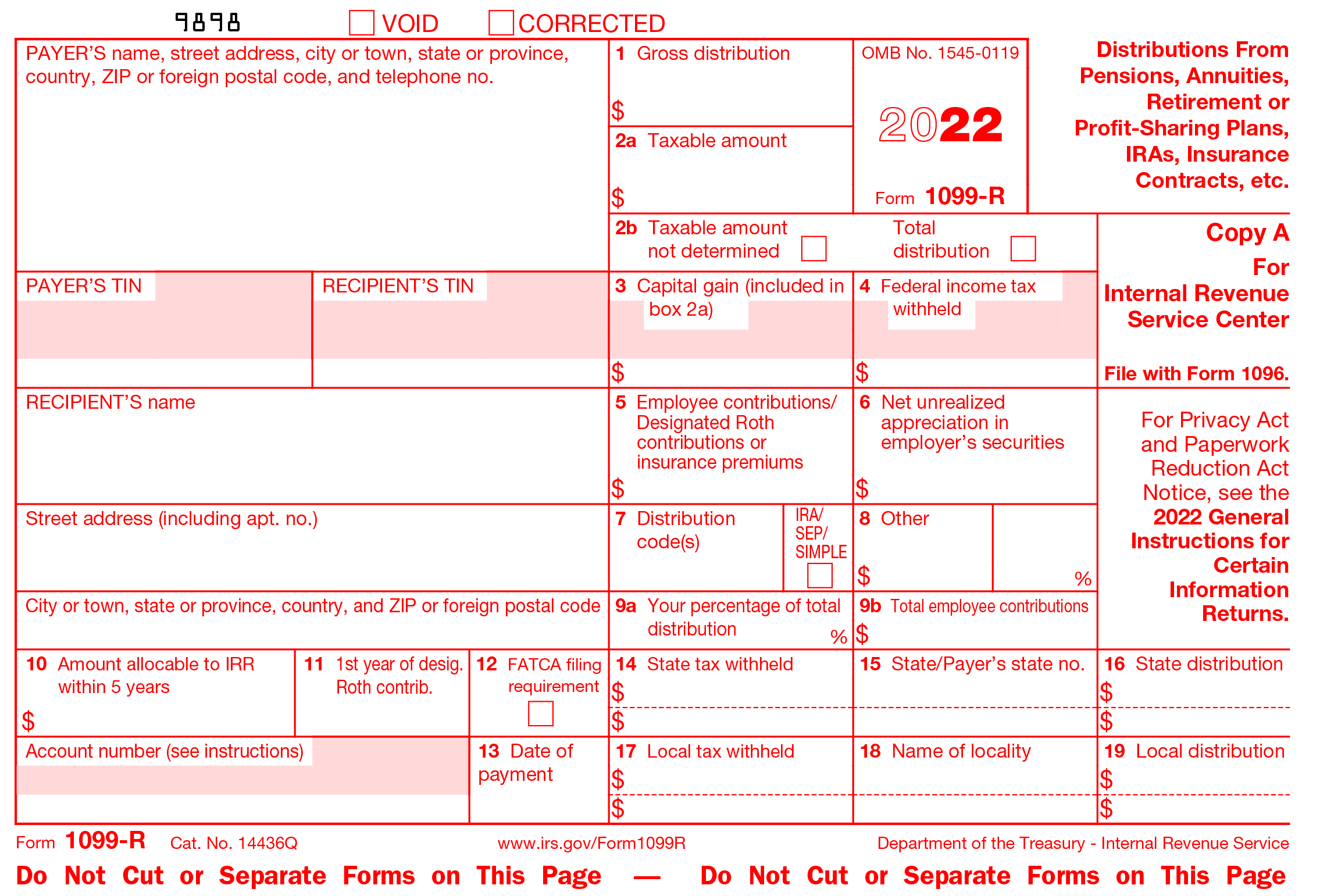

Tax Information Regarding Forms 1099R and 1099INT That We Send

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web the deadline for most of the 1099 forms is january 31st of the tax year. Learn more about how to simplify your businesses 1099 reporting. Web before you get subjected to.

New Form 1099 Deadline Be Prepared and Beat It!

Actually, that’s been the case for a while. Web the form 1099 misc recipient copy deadline is january 31. Web 2 days agothe employee retention credit could amount to $26,000 per employee. Get irs approved instant schedule 1 copy. Web one is the due date to send the recipient copy and the second is the due date to file the.

Filing 1099 Forms In Pa Universal Network

Web one is the due date to send the recipient copy and the second is the due date to file the tax form with the irs. Web the deadline for most of the 1099 forms is january 31st of the tax year. 201, the due dates for all 1099 forms have been accelerated and brought forward from the 28 th.

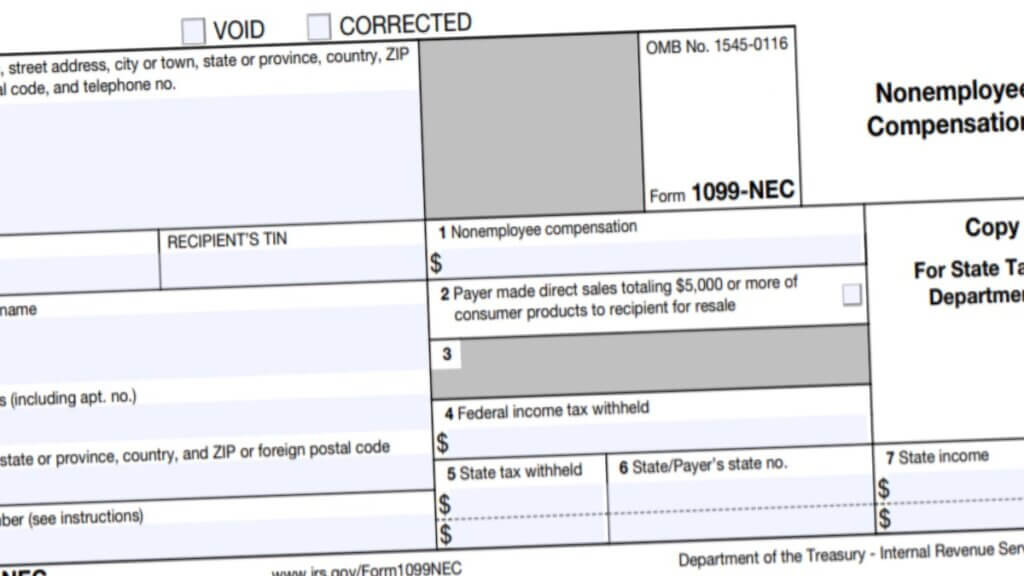

1099 NEC Form 2022

Get irs approved instant schedule 1 copy. The irs generally doesn’t permit additional extensions beyond the initial. File your form 2290 today avoid the rush. This is the only form with the same requirement for. Additions to tax and interest calculator;

Tax Resources

Additions to tax and interest calculator; Ad don't leave it to the last minute. Web before you get subjected to penalties, here are the details: Actually, that’s been the case for a while. Do not send a form (1099, 5498,.

1099 Filing 2018 Deadline Fresh Free Fillable 1099 Misc Form 2018 Da

$50 per information return, in case if you correctly file within 30 days of the due date. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web the 1099 nec has a due date of january 31 for all filings (due to recipients, filing mailed to the irs, electronic filing to the irs). Since april 15 falls.

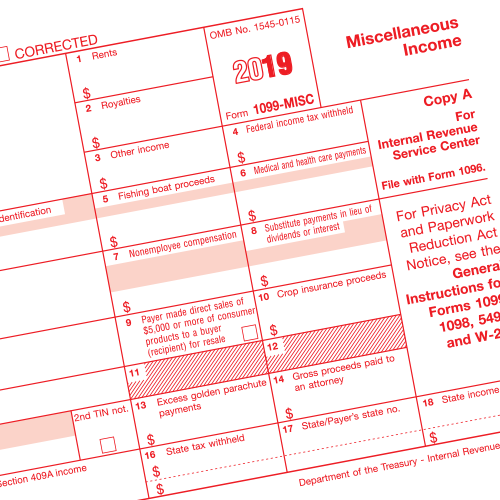

Federal 1099 Filing Requirements (1099MISC & 1099K) Irs forms, What

File your form 2290 today avoid the rush. Web individuals and families. Generally, the deadline for filing electronically will. Web the following are exceptions to the filing deadlines shown above. Learn more about how to simplify your businesses 1099 reporting.

Efile 2022 Form 1099R Report the Distributions from Pensions

File your form 2290 online & efile with the irs. Web one is the due date to send the recipient copy and the second is the due date to file the tax form with the irs. File your form 2290 today avoid the rush. Web the deadline for most of the 1099 forms is january 31st of the tax year..

The Electronic Filing Due Date Is March 31 For The.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Quarterly payroll and excise tax returns normally due on may 1. Web however, according to the path act, p.l. Check return status (refund or.

Web 2022 Deadlines For 1099 Forms.

$50 per information return, in case if you correctly file within 30 days of the due date. 201, the due dates for all 1099 forms have been accelerated and brought forward from the 28 th of. Web the 1099 nec has a due date of january 31 for all filings (due to recipients, filing mailed to the irs, electronic filing to the irs). Learn more about how to simplify your businesses 1099 reporting.

This Is The Only Form With The Same Requirement For.

Web the form 1099 misc recipient copy deadline is january 31. File your form 2290 online & efile with the irs. Web the following are exceptions to the filing deadlines shown above. Since april 15 falls on a saturday, and emancipation day.

Businesses That Withhold Taxes From Their Employee's.

Web before you get subjected to penalties, here are the details: Get irs approved instant schedule 1 copy. Send 1099 form to the recipient by january 31, 2022. Do not send a form (1099, 5498,.