2012 Form 1040 Instructions

2012 Form 1040 Instructions - Web get federal tax return forms and file by mail. , 2012, ending , 20. Web taxable income on form 1040, line 43, is $25,300. Earned income credit (eic) if children lived with you. Web get federal tax forms. Department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space. Web you may benefit from filing form 1040a or 1040 in 2012 due to the following tax law changes for 2012, you may benefit from filing form 1040a or 1040, even if you normally file form 1040ez. If a joint return, spouse’s first name and initial. For details on these and other changes, see what s new, in these instructions. Next, they find the column for married filing jointly and read down the column.

Department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space. 31, 2012, or other tax year beginning. The amount shown where the taxable income line and filing status column meet is $2,929. Web taxable income on form 1040, line 43, is $25,300. Federal form 1040ez, 1040a, schedule a, b, c and others. Next, they find the column for married filing jointly and read down the column. This is the tax amount they should enter on form 1040, line 44. , 2012, ending , 20. Get the current filing year’s forms, instructions, and publications for free from the irs. Web download, prepare, and file 1040 forms here.

Earned income credit (eic) if children lived with you. If a joint return, spouse’s first name and initial. Web get federal tax return forms and file by mail. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space. Web get federal tax forms. Web you may benefit from filing form 1040a or 1040 in 2012 due to the following tax law changes for 2012, you may benefit from filing form 1040a or 1040, even if you normally file form 1040ez. , 2012, ending , 20. Get the current filing year’s forms, instructions, and publications for free from the irs. Web download, prepare, and file 1040 forms here.

2020 Irs 1040 Schedule Instructions Fill Out and Sign Printable PDF

Your first name and initial. 31, 2012, or other tax year beginning. For details on these and other changes, see what s new, in these instructions. This is the tax amount they should enter on form 1040, line 44. Next, they find the column for married filing jointly and read down the column.

Download 1040 Instructions for Free Page 58 FormTemplate

Web taxable income on form 1040, line 43, is $25,300. Web form 1040a and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1040a. For details on these and other changes, see what s new, in these instructions. Web get federal tax return forms and file by mail. Earned income credit (eic) if children lived with you.

Irs Form 1040 Line 79 Instructions Form Resume Examples

For details on these and other changes, see what s new, in these instructions. If a joint return, spouse’s first name and initial. 2012 irs income tax forms and schedules: Next, they find the column for married filing jointly and read down the column. Web form 1040a and its instructions, such as legislation enacted after they were published, go to.

2012 tax return form 1040 instructions

Web taxable income on form 1040, line 43, is $25,300. Next, they find the column for married filing jointly and read down the column. If a joint return, spouse’s first name and initial. For details on these and other changes, see what s new, in these instructions. Individual income tax return 2012.

Nj State Tax Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

If a joint return, spouse’s first name and initial. For details on these and other changes, see what s new, in these instructions. Get the current filing year’s forms, instructions, and publications for free from the irs. Web get federal tax forms. Web taxable income on form 1040, line 43, is $25,300.

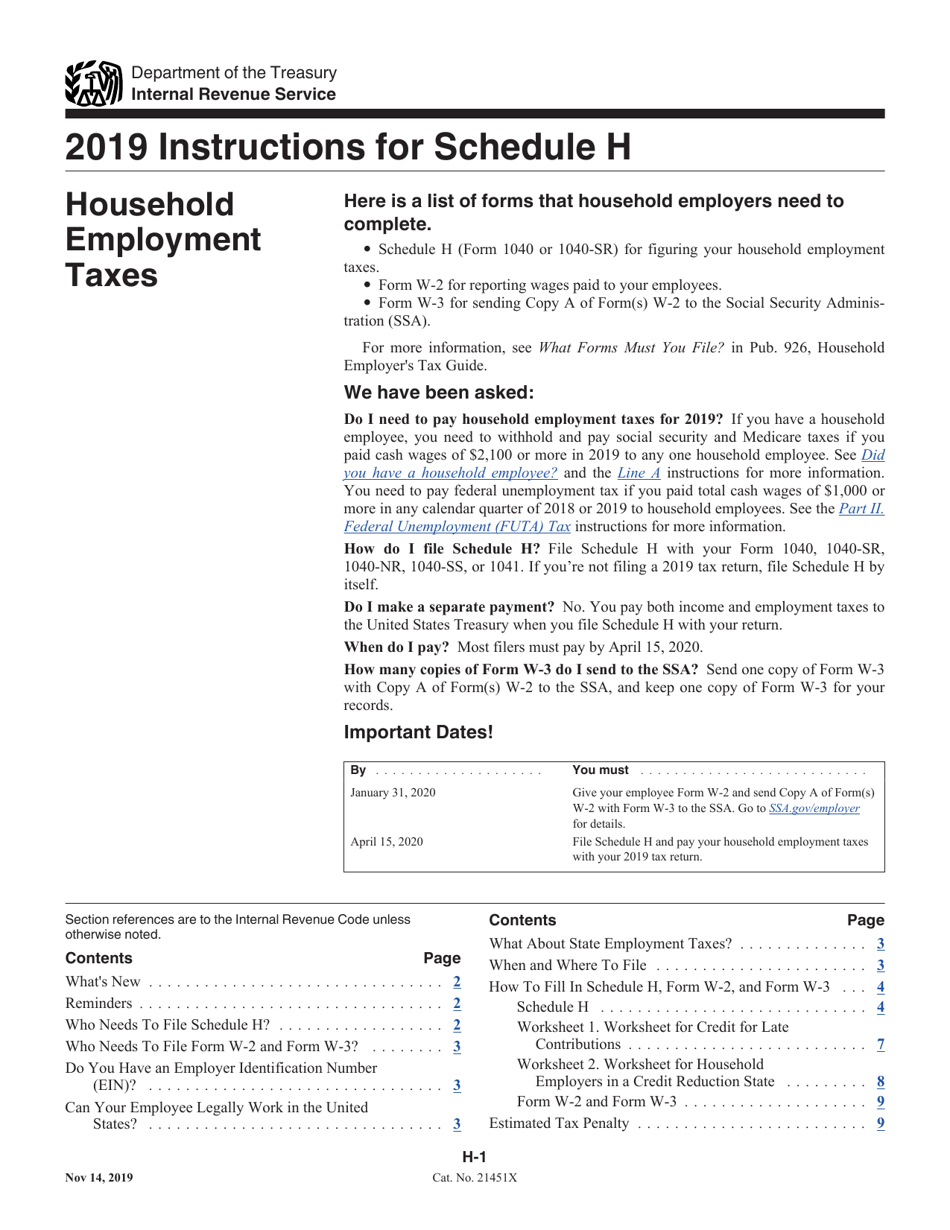

Download Instructions for IRS Form 1040, 1040SR Schedule H Household

Department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space. Individual income tax return 2012. Web get federal tax forms. The amount shown where the taxable income line and filing status column meet is $2,929. Federal form 1040ez, 1040a, schedule a, b, c and others.

Download 1040 Instructions for Free Page 21 FormTemplate

Web form 1040a and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1040a. Web taxable income on form 1040, line 43, is $25,300. Web you may benefit from filing form 1040a or 1040 in 2012 due to the following tax law changes for 2012, you may benefit from filing form 1040a or 1040, even if you.

Fillable IRS Instructions 1040 2018 2019 Online PDF Template

Web taxable income on form 1040, line 43, is $25,300. Deduction for educator expenses in 2012 irs income tax forms and schedules: Individual income tax return 2012. Get the current filing year’s forms, instructions, and publications for free from the irs.

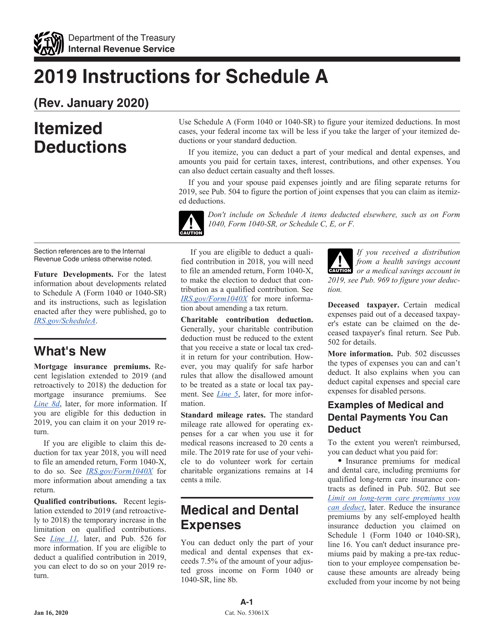

Download Instructions for IRS Form 1040, 1040SR Schedule A Itemized

2012 irs income tax forms and schedules: If a joint return, spouse’s first name and initial. , 2012, ending , 20. Get the current filing year’s forms, instructions, and publications for free from the irs. Deduction for educator expenses in

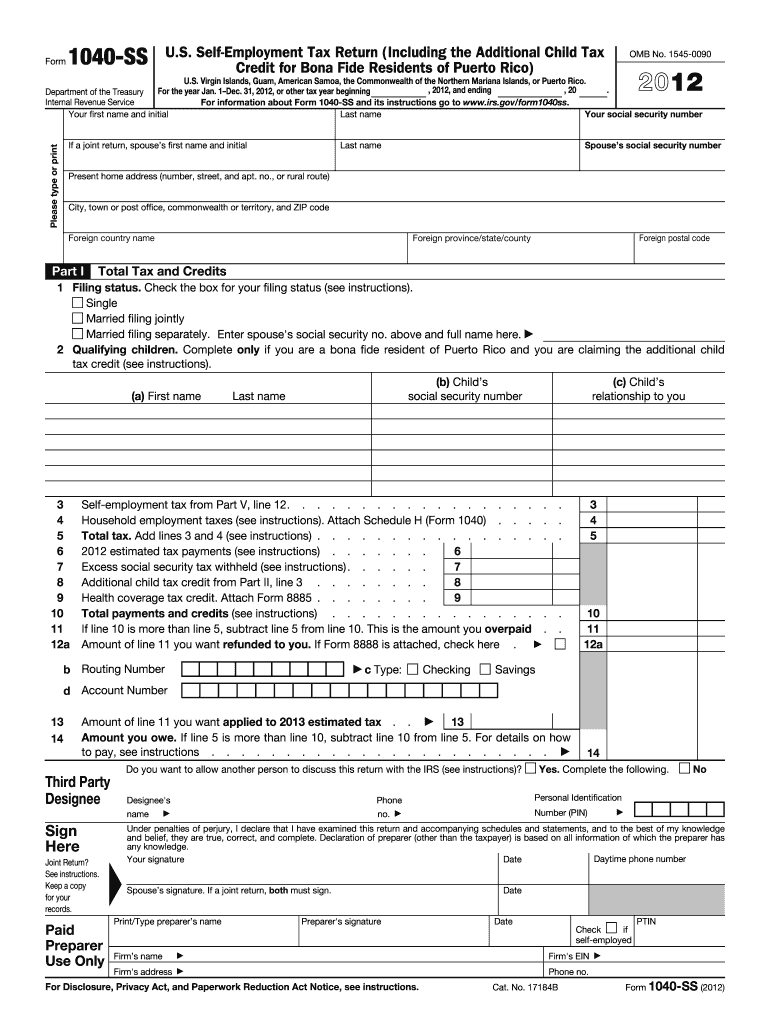

IRS 1040SS 2012 Fill out Tax Template Online US Legal Forms

The amount shown where the taxable income line and filing status column meet is $2,929. 31, 2012, or other tax year beginning. If a joint return, spouse’s first name and initial. Next, they find the column for married filing jointly and read down the column. Web get federal tax forms.

Irs Use Only—Do Not Write Or Staple In This Space.

Individual income tax return 2012. Federal form 1040ez, 1040a, schedule a, b, c and others. , 2012, ending , 20. Web taxable income on form 1040, line 43, is $25,300.

2012 Irs Income Tax Forms And Schedules:

Web form 1040a and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1040a. Web get federal tax forms. Your first name and initial. Get the current filing year’s forms, instructions, and publications for free from the irs.

Deduction For Educator Expenses In

Next, they find the column for married filing jointly and read down the column. Earned income credit (eic) if children lived with you. If a joint return, spouse’s first name and initial. For details on these and other changes, see what s new, in these instructions.

The Amount Shown Where The Taxable Income Line And Filing Status Column Meet Is $2,929.

Web get federal tax return forms and file by mail. This is the tax amount they should enter on form 1040, line 44. Web download, prepare, and file 1040 forms here. Department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space.