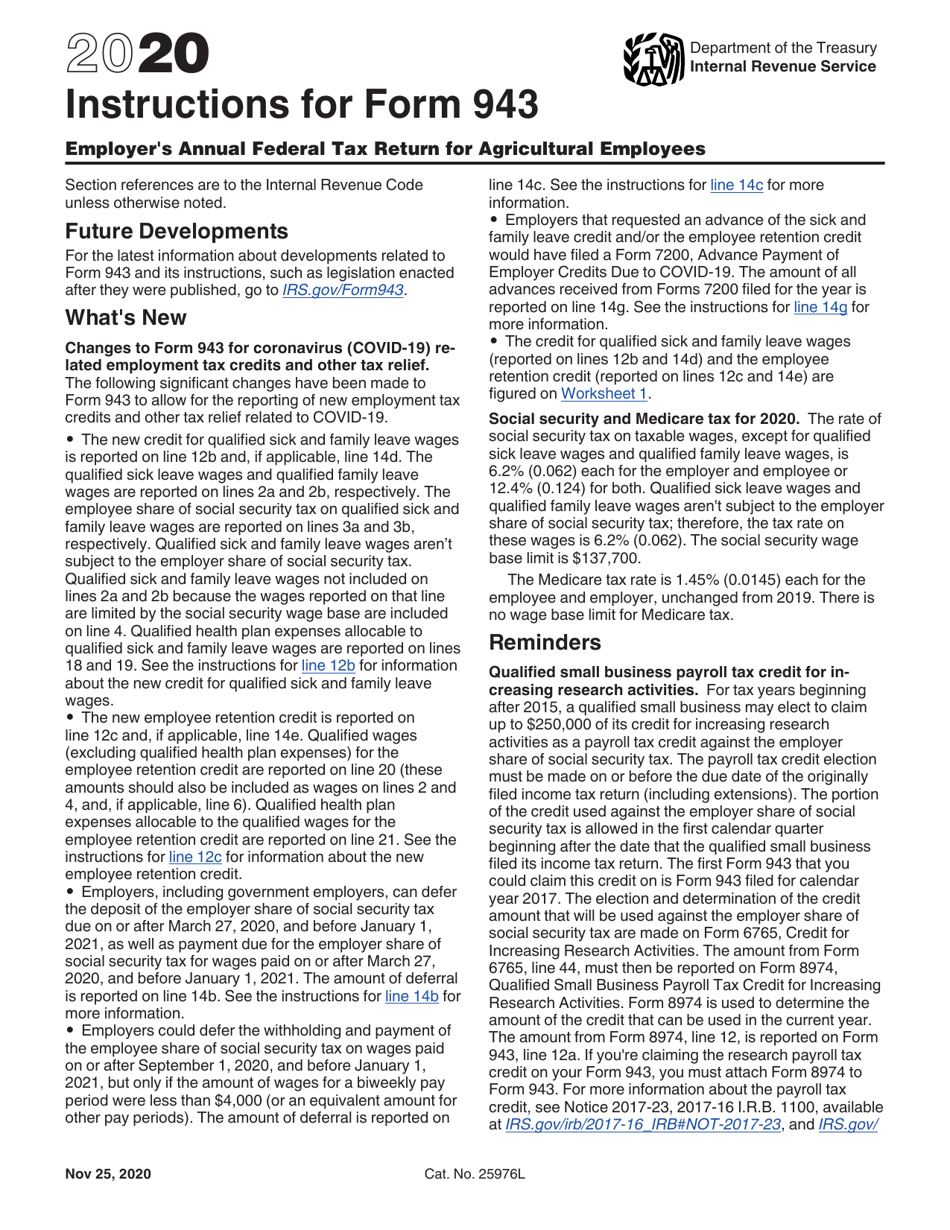

2020 Form 943

2020 Form 943 - Web schedule r (form 943) has been revised to accommodate all of the new lines added to the 2020 form 943. Web form 943, is the employer's annual federal tax return for agricultural employees. Exception for exempt organizations, federal,. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. It is used to record how much income tax,. For more information, see the instructions for. Web you must complete this form if you’re a semiweekly schedule depositor or became one because your accumulated tax liability during any month was $100,000 or more. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Let’s discuss 943 filing requirements, how to efile, and. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file.

Web finalized versions of the 2020 form 943 and its instructions were released nov. Web use this form to correct errors you made on form 943, employer’s annual federal tax return for agricultural employees. Web you must complete this form if you’re a semiweekly schedule depositor or became one because your accumulated tax liability during any month was $100,000 or more. Exception for exempt organizations, federal,. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web schedule r (form 943) has been revised to accommodate all of the new lines added to the 2020 form 943. The 2020 form 943 (pr) is available for use by puerto rico employers. Let’s discuss 943 filing requirements, how to efile, and. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022.

Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and. Revision of a currently approved. It is used to record how much income tax,. Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web form 943, is the employer's annual federal tax return for agricultural employees. Web address as shown on form 943.

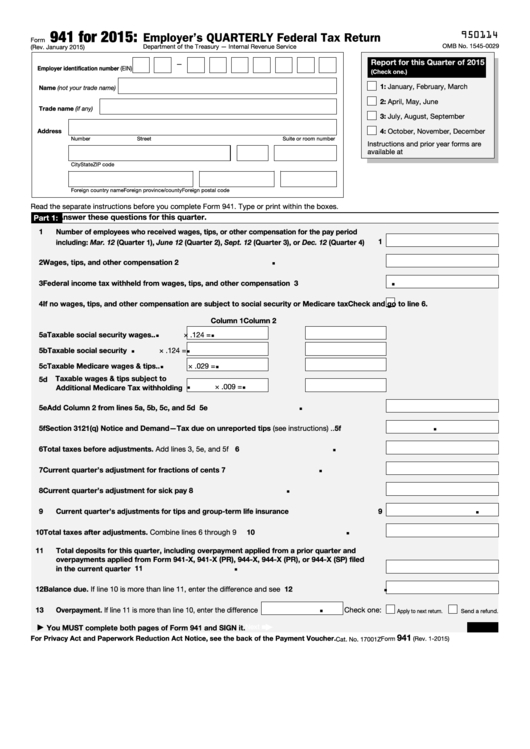

Drafts of Form 943, 944 and 940 are Now Available with COVID19 Changes

Let’s discuss 943 filing requirements, how to efile, and. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web form 943, is the employer's annual federal tax return for agricultural employees. Ad download or email irs 943 & more fillable forms, register and subscribe now!.

Federal Tax Form For Employee 2023

Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Form 943, employer’s annual federal tax. Web address as shown on form 943. Let’s discuss 943 filing requirements, how to efile, and. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees,.

IRS Form 943 Online Efile 943 for 4.95 Form 943 for 2020

Ad download or email irs 943 & more fillable forms, register and subscribe now! • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Revision of a currently approved. Exception for exempt organizations, federal,. Web form 943, is the employer's annual federal tax return for.

Download Instructions for IRS Form 943 Employer's Annual Federal Tax

Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web address as shown on form 943. Web schedule r (form 943) has been revised to accommodate all of the new lines added to the 2020 form 943. Web.

Irs Form 943 Complete PDF Tenplate Online in PDF

The 2020 form 943 (pr) is available for use by puerto rico employers. Form 943, employer’s annual federal tax. Web 12/03/2020 form 943 (schedule r) allocation schedule for aggregate form 943 filers 1222 12/07/2022 form 4361: Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file..

2022 irs form 945 instructions Fill Online, Printable, Fillable Blank

It is used to record how much income tax,. Web finalized versions of the 2020 form 943 and its instructions were released nov. For more information, see the instructions for. Web form 943, is the employer's annual federal tax return for agricultural employees. Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers.

Missouri form 943 Fill out & sign online DocHub

Web 12/03/2020 form 943 (schedule r) allocation schedule for aggregate form 943 filers 1222 12/07/2022 form 4361: Ad download or email irs 943 & more fillable forms, register and subscribe now! For more information, see the instructions for. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on.

IRS Instruction 943 20202021 Fill out Tax Template Online US Legal

Web 12/03/2020 form 943 (schedule r) allocation schedule for aggregate form 943 filers 1222 12/07/2022 form 4361: Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Form 943, employer’s annual federal tax. Web we last updated the employer's annual federal tax return for agricultural employees in february.

Fill Free fillable F943 Accessible 2019 Form 943 PDF form

Web use this form to correct errors you made on form 943, employer’s annual federal tax return for agricultural employees. It is used to record how much income tax,. Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. 30 by the internal revenue service. Web you must.

2020 form 943 instructions Fill Online, Printable, Fillable Blank

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Web you must complete this form if you’re a semiweekly schedule.

• Enclose Your Check Or Money Order Made Payable To “United States Treasury.” Be Sure To Enter Your Ein, “Form 943,” And “2022” On Your.

Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Web form 943, is the employer's annual federal tax return for agricultural employees. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web use this form to correct errors you made on form 943, employer’s annual federal tax return for agricultural employees.

Web Up To $32 Cash Back Form 943, Employer’s Annual Federal Tax Return For Agricultural Employees, Is Used To Report Federal Income Tax, Social Security And.

It is used to record how much income tax,. The 2020 form 943 (pr) is available for use by puerto rico employers. Web address as shown on form 943. Web in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form 943 filed for 2022.

Ad Download Or Email Irs 943 & More Fillable Forms, Register And Subscribe Now!

For more information, see the instructions for. Form 943, employer’s annual federal tax. In other words, it is a tax form used to report federal income tax, social. Web schedule r (form 943) has been revised to accommodate all of the new lines added to the 2020 form 943.

Web Finalized Versions Of The 2020 Form 943 And Its Instructions Were Released Nov.

Web you must complete this form if you’re a semiweekly schedule depositor or became one because your accumulated tax liability during any month was $100,000 or more. Revision of a currently approved. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. 30 by the internal revenue service.