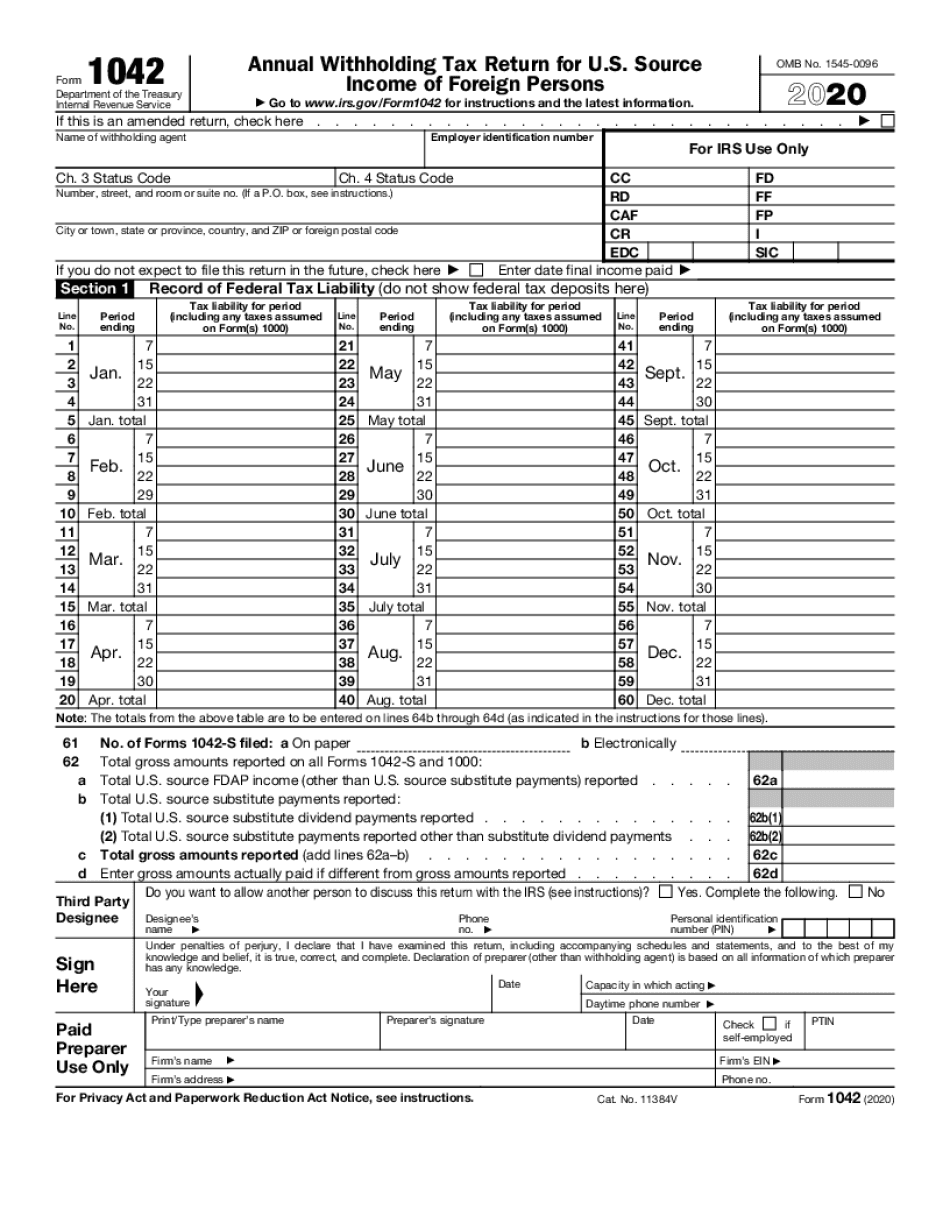

2021 Form 1042

2021 Form 1042 - In addition to dedicating greater. Web we last updated the annual withholding tax return for u.s. Ad upload, modify or create forms. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Source income subject to withholding, to the internal revenue service. M requests that the $15 overpayment be credited to its 2022 form 1042 rather. 15 by the internal revenue service. Source income of foreign persons. The proposed changes might impact qi reporting moving forward. Source income subject to withholding, were released jan.

Register and subscribe now to work on your irs form 1042 & more fillable forms. Source income subject to withholding, were released jan. Source income subject to withholding, to the internal revenue service. Final sample excel import file: On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding agents to. Web we last updated the annual withholding tax return for u.s. The proposed changes might impact qi reporting moving forward. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 1042, annual withholding tax return for u.s. Web on its timely filed 2021 form 1042, m reports $15 as its total tax liability and $30 as its total deposits.

Source income of foreign persons. Source income of foreign persons in january 2023, so this is the latest version of form 1042, fully updated for tax. Web we last updated the annual withholding tax return for u.s. Source income subject to withholding, to the internal revenue service. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Web form 1042, annual withholding tax return for u.s. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Web on its timely filed 2021 form 1042, m reports $15 as its total tax liability and $30 as its total deposits. Final sample excel import file: Complete, edit or print tax forms instantly.

3.21.111 Chapter Three and Chapter Four Withholding Returns Internal

M requests that the $15 overpayment be credited to its 2022 form 1042 rather. Web on its timely filed 2021 form 1042, m reports $15 as its total tax liability and $30 as its total deposits. Source income of foreign persons in january 2023, so this is the latest version of form 1042, fully updated for tax. Web april 6,.

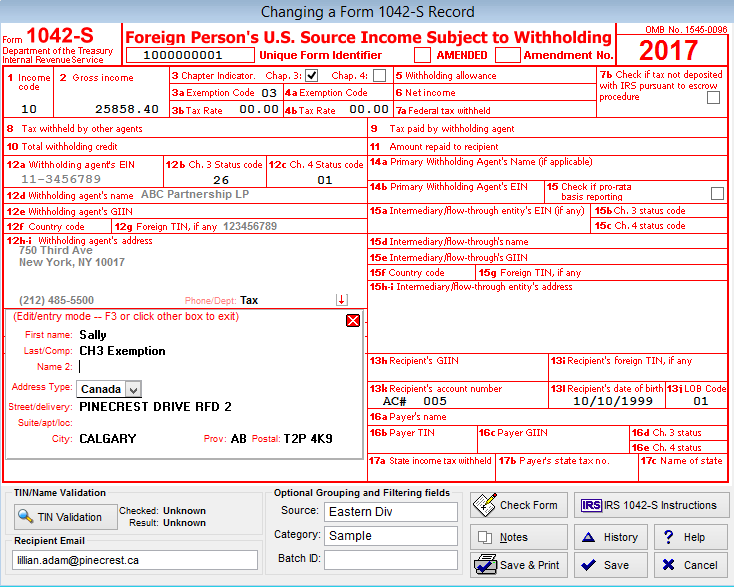

IRS Form 1042s What It is & 1042s Instructions Tipalti

Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Source income subject to withholding, were released jan. In addition to dedicating greater. See form 1042 and its instructions for more. Ad get ready for tax season deadlines.

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

M requests that the $15 overpayment be credited to its 2022 form 1042 rather. Web we last updated the annual withholding tax return for u.s. Source income subject to withholding, to the internal revenue service. Web on its timely filed 2021 form 1042, m reports $15 as its total tax liability and $30 as its total deposits. If you have.

Business Form Cp 00 30 Darrin Kenney's Templates

Ad upload, modify or create forms. On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding agents to. Register and subscribe now to work on your irs form 1042 & more fillable forms. Source income subject to withholding, were released jan. Complete, edit or print tax forms instantly.

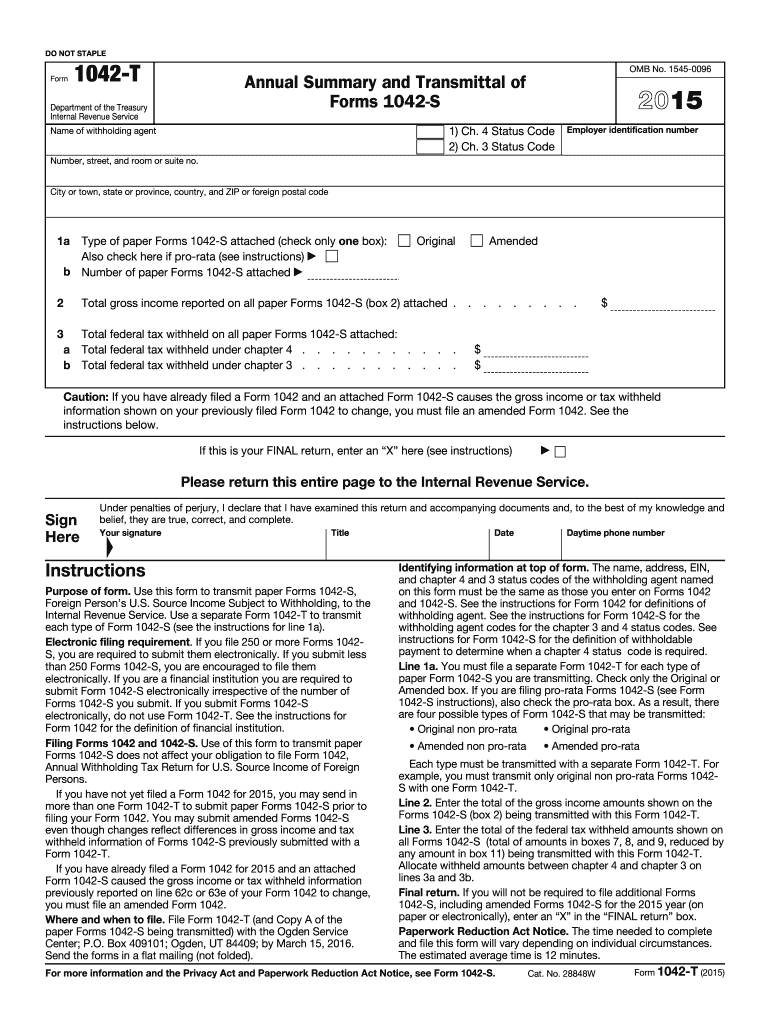

Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs Fill

In addition to dedicating greater. Web we last updated the annual withholding tax return for u.s. Source income subject to withholding Source income of foreign persons, is used for that purpose. Source income of foreign persons.

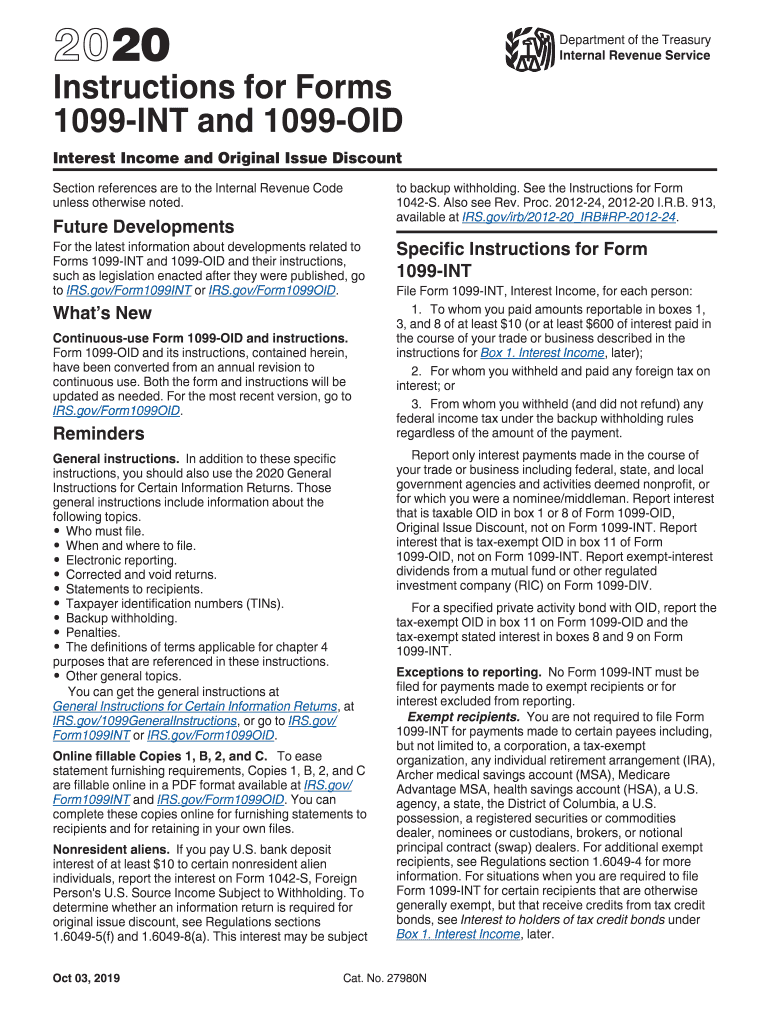

1099 Form 2019 Printable Form Fill Out and Sign Printable PDF

Ad upload, modify or create forms. Web form 1042, annual withholding tax return for u.s. Source income of foreign persons, is used for that purpose. See form 1042 and its instructions for more. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are.

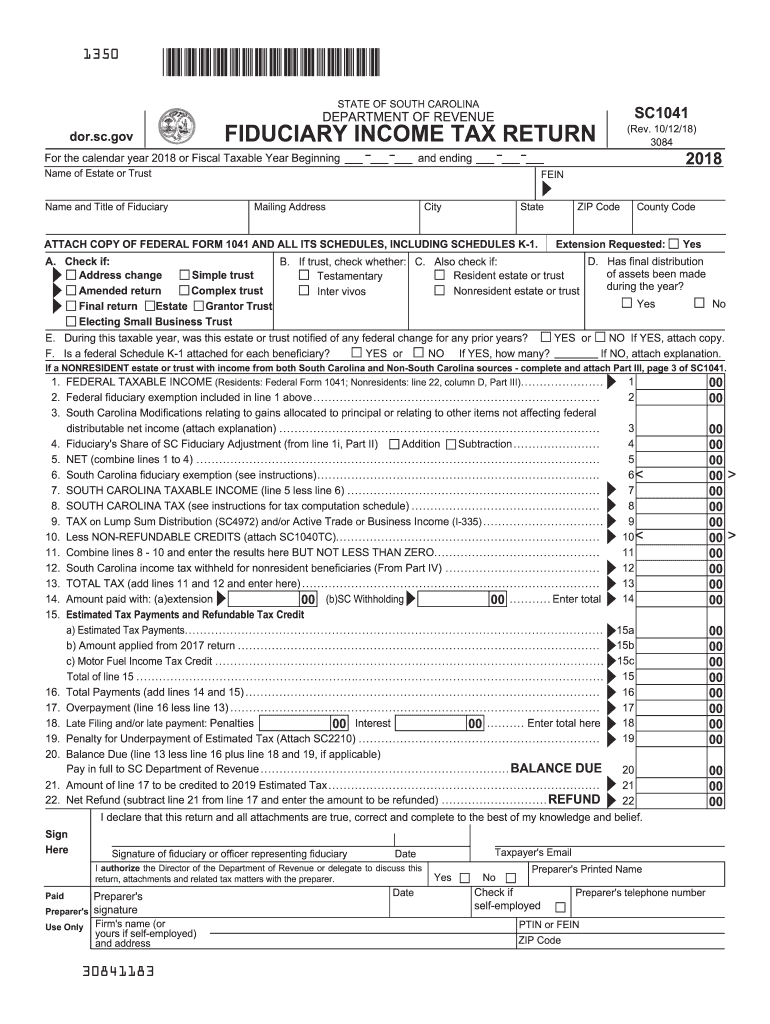

Sc 1041 Fill Out and Sign Printable PDF Template signNow

Web april 6, 2021 · 5 minute read. Ad upload, modify or create forms. On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding agents to. If you have questions about. Ad get ready for tax season deadlines by completing any required tax forms today.

Irs 1042 s instructions 2019

Try it for free now! Source income subject to withholding Web we last updated the annual withholding tax return for u.s. In addition to dedicating greater. Final sample excel import file:

2020 Form 1042 Fill Out and Sign Printable PDF Template signNow

Try it for free now! On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding agents to. Web april 6, 2021 · 5 minute read. Source income of foreign persons in january 2023, so this is the latest version of form 1042, fully updated for tax. See form 1042 and its instructions.

Social Security Award Letter 2021 magiadeverao

15 by the internal revenue service. Web we last updated the annual withholding tax return for u.s. Source income of foreign persons, is used for that purpose. Source income of foreign persons. Register and subscribe now to work on your irs form 1042 & more fillable forms.

Source Income Of Foreign Persons, Is Used For That Purpose.

Complete, edit or print tax forms instantly. Web form 1042, annual withholding tax return for u.s. Web taxes federal tax forms federal tax forms learn how to get tax forms. M requests that the $15 overpayment be credited to its 2022 form 1042 rather.

Source Income Subject To Withholding, Were Released Jan.

15 by the internal revenue service. In addition to dedicating greater. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are.

Source Income Of Foreign Persons.

The proposed changes might impact qi reporting moving forward. Ad upload, modify or create forms. See form 1042 and its instructions for more. Web we last updated the annual withholding tax return for u.s.

Web On Its Timely Filed 2021 Form 1042, M Reports $15 As Its Total Tax Liability And $30 As Its Total Deposits.

On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding agents to. Register and subscribe now to work on your irs form 1042 & more fillable forms. Ad get ready for tax season deadlines by completing any required tax forms today. If you have questions about.