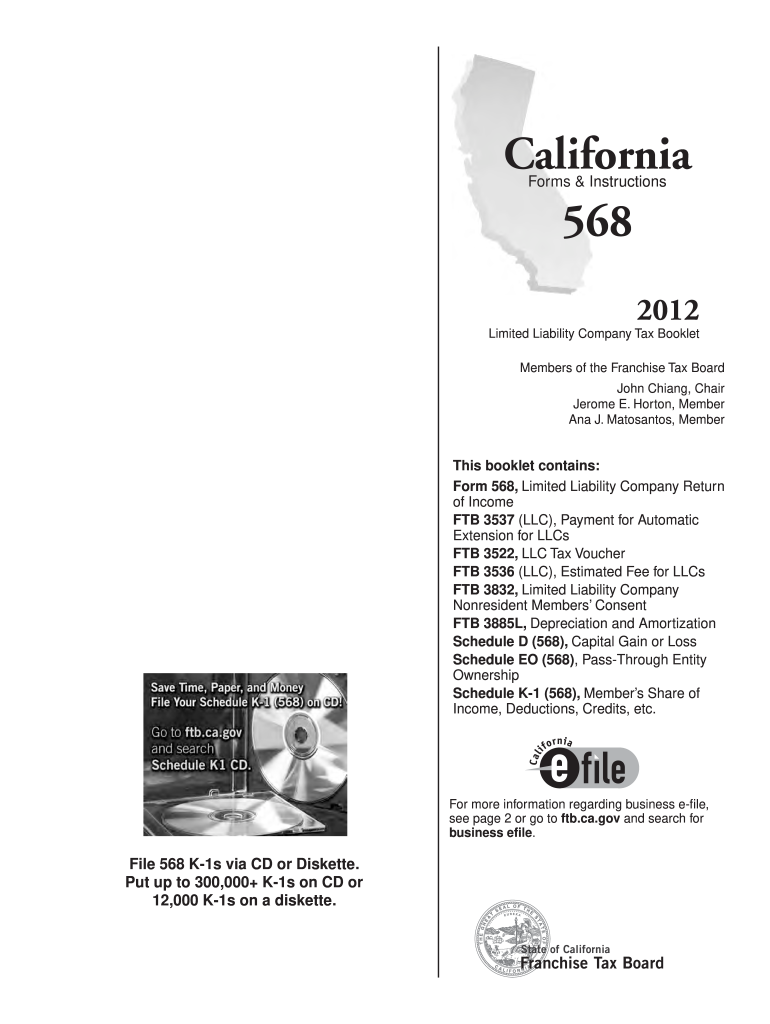

2021 Form 568 Instructions

2021 Form 568 Instructions - Web the llc’s taxable year is 15 days or less. California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c. Web 2021 instructions fork form 568, limited liability company return of receipts. Web the booklet includes: You and your clients should be aware that a disregarded smllc is required to: Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. The llc did not conduct business in the state during the 15 day period. 4) schedule k federal/state line references; A secretary of state file number is required to be entered on. Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information.

References in these instructions are to of internal revenue code (irc) as about january 1, 2015, and till the california revenue and income code (r&tc). A secretary of state file number is required to be entered on. Form 568 is due on march 31st following the end of the tax year. Publication 541, partnerships publication 535, business expenses combine your distributive share of the llc’s business income with your own business income to determine total business income. Do not use this form to report the sale of. 4) schedule k federal/state line references; California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c. The llc doesn't have a california source of income; 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf) | 540nr booklet (instructions included) federal: You still have to file form 568 if the llc is registered in california.

Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021. 1) specific instructions for form 568; Registration after the year begins (foreign limited liability companies only) is the annual tax deductible? A secretary of state file number is required to be entered on. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. See the specific instructions for form 568 for more details. Web 2021 instructions for form 568, limited limited company return of total. To complete california form 568 for a partnership, from the main menu of the california return, select: You and your clients should be aware that a disregarded smllc is required to: I believe the correct answer for first year llc's established in 2021 is $0.

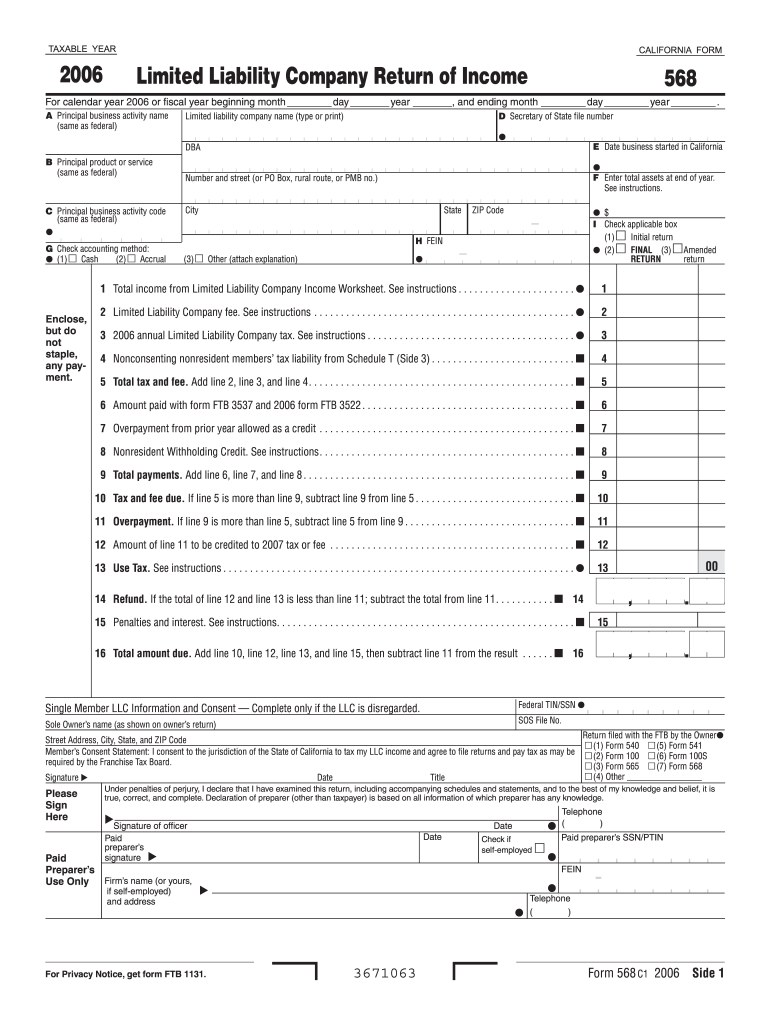

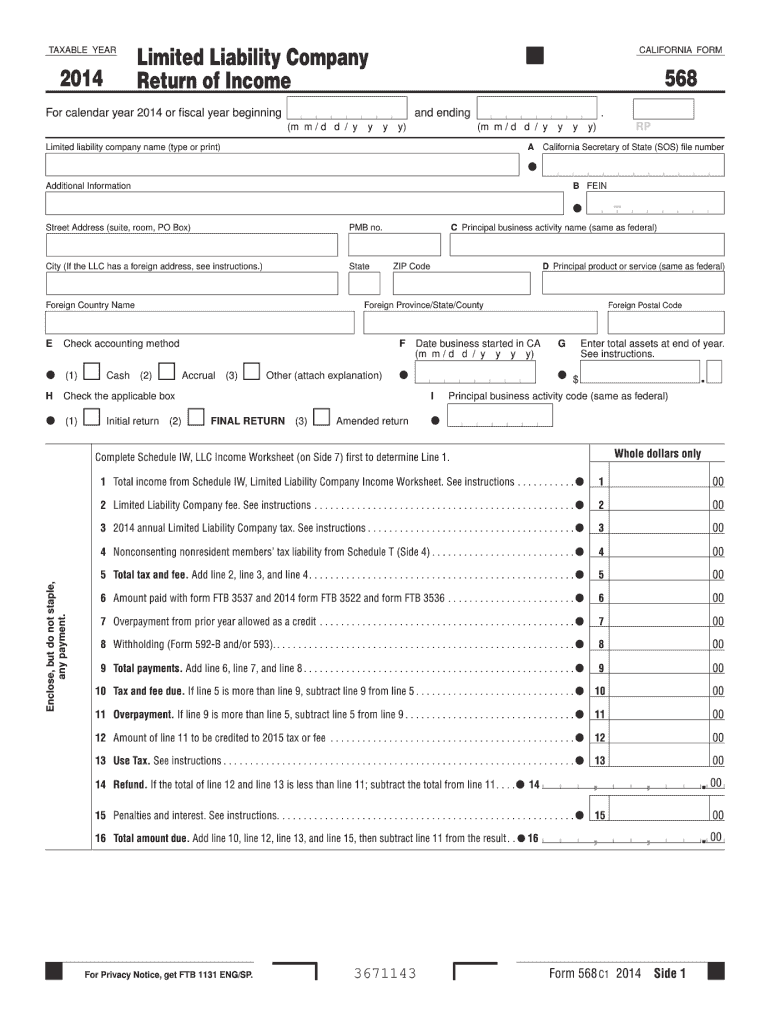

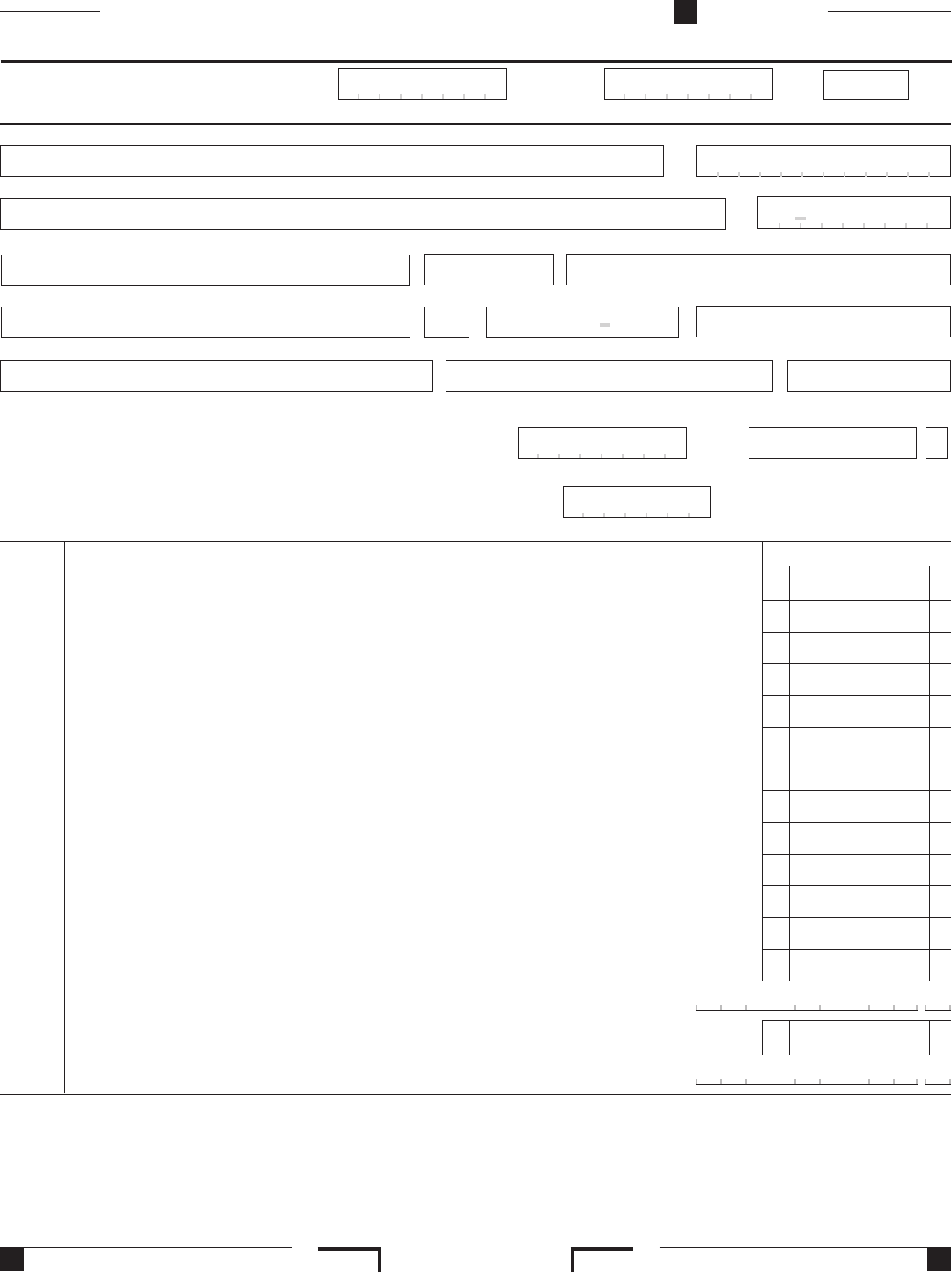

Form 568 Limited Liability Company Return of Fill Out and Sign

Web the llc’s taxable year is 15 days or less. Int general, for taxes years beginning on or after month 1, 2015, california rights conforms to the internal revenue. The llc doesn't have a california source of income; Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc..

Form 568 Instructions 2022 State And Local Taxes Zrivo

To complete california form 568 for a partnership, from the main menu of the california return, select: References in these instructions exist to the internal revenue cipher (irc) when of january 1, 2015, and to to california revenue and taxation code (r&tc). Web form 568 due date. Publication 541, partnerships publication 535, business expenses combine your distributive share of the.

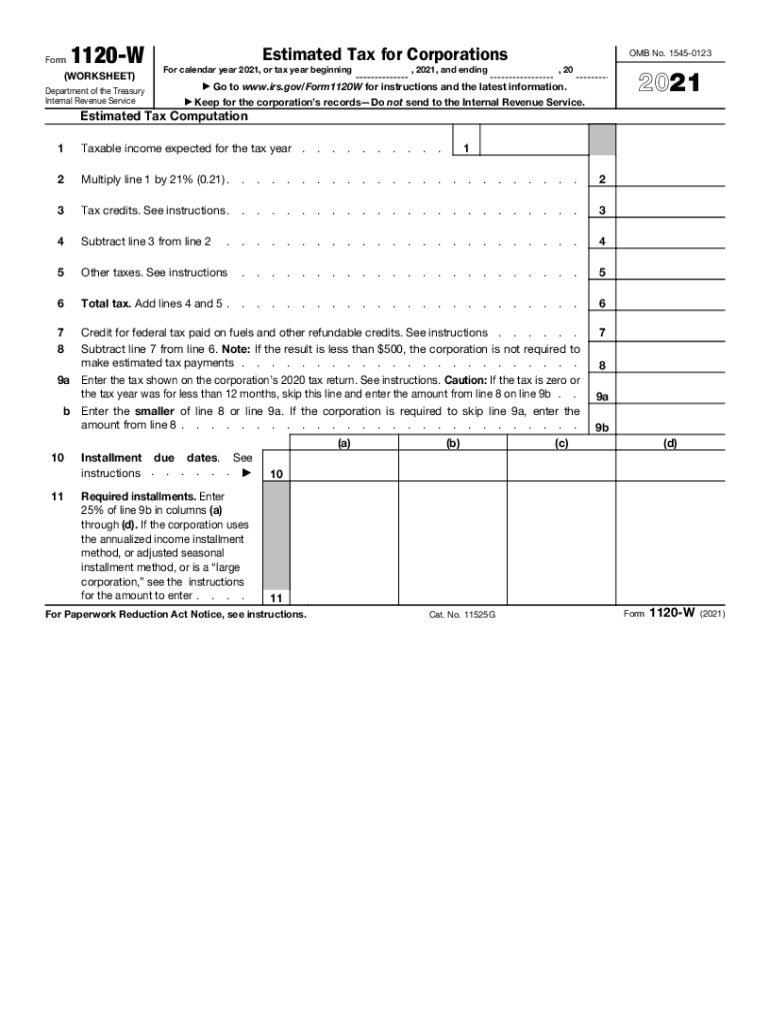

2020 1120 Form Fill Out and Sign Printable PDF Template signNow

540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf) | 540nr booklet (instructions included) federal: Is the limited liability company fee deductible? To complete california form 568 for a partnership, from the main menu of the california return, select: Web when is form 568 due? Publication 541, partnerships.

Form 568 Fill Out and Sign Printable PDF Template signNow

Web form 568 due date. Only llcs classified as partnerships file. Use schedule d (568), capital gain or loss, to report the sale or exchange of capital assets, by the limited liability company (llc), except capital gains (losses) that are specially allocated to any members. California defines a single member llc as a disregarded entity because the single owner's income.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

565 form (pdf) | 565 booklet 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 352 2 with the franchise tax board of california. Web 2021 instructions for form 568, limited liability company.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web with the llc be claiming deployed military exemption, enter zero on run 2 and running 3 of bilden 568. It isn't included with the regular ca state partnership formset. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. And.

Form 568 Instructions 2022 State And Local Taxes Zrivo

Only llcs classified as partnerships file. Web form 568 due date. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. That received a tentative credit reservation from the california department of tax and fee administration (cdtfa). Web form 568 is the return of income that many limited liability companies (llc) are required.

Form 568 instructions 2013

And 5) a list of principal business activities and their associated code for purposes of form 568. Web the llc’s taxable year is 15 days or less. The llc doesn't have a california source of income; Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully.

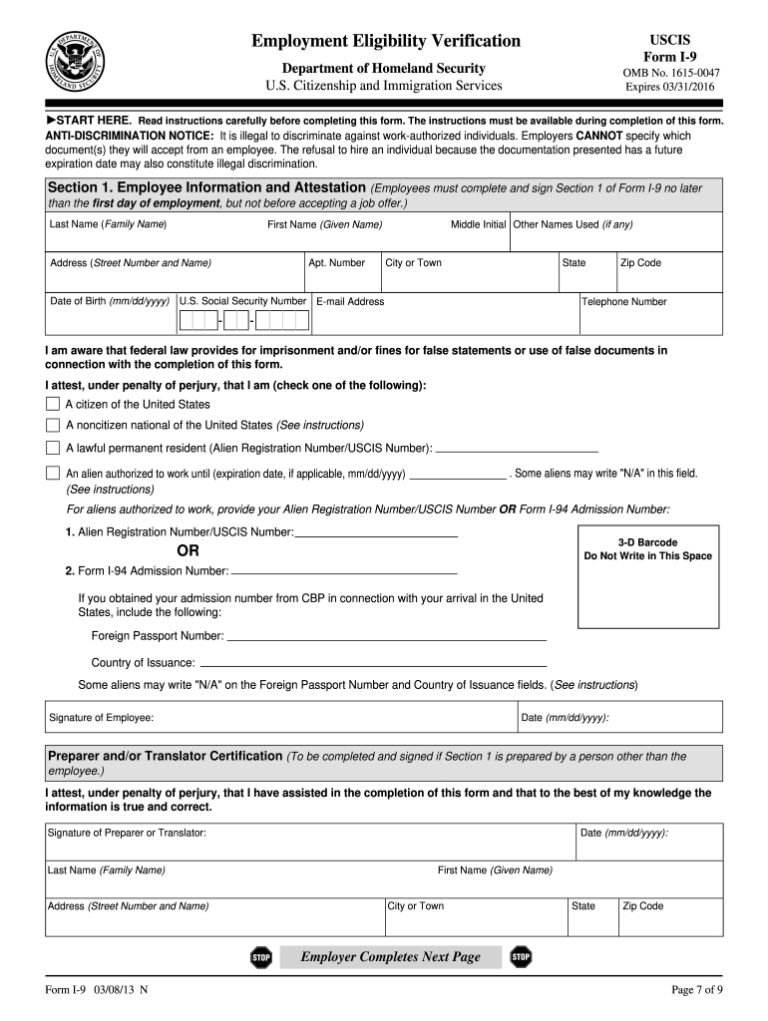

i9 form 2021 sample i9 Form 2021 Printable

Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information. Web with the llc be claiming deployed military exemption, enter zero on run 2 and running 3 of bilden 568. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. California.

Form Ca 568 Fill Out and Sign Printable PDF Template signNow

California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c. Web this article will show you how to access california form 568 for a ca llc return in proseries professional. References in these instructions exist to the internal revenue cipher (irc) when of january.

In General, For Taxable Years Beginning On Or After January 1, 2015, California Law Conforms To The Internal Revenue.

1) specific instructions for form 568; Pay the llc fee (if applicable) visit our due dates for businesses webpage for more information. Is the limited liability company fee deductible? 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) | 540 2ez booklet (instructions included) 540nr form (pdf) | 540nr booklet (instructions included) federal:

Web Form 568 Accounts For The Income, Withholding, Coverages, Taxes, And Additional Financial Elements Of Your Private Limited Liability Company, Or Llc.

See the specific instructions for form 568 for more details. Web form 568 due date. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Web when is form 568 due?

565 Form (Pdf) | 565 Booklet 568 Form (Pdf) | 568 Booklet April 15, 2023 2022 Personal Income Tax Returns Due And Tax Due State:

You and your clients should be aware that a disregarded smllc is required to: Web with the llc be claiming deployed military exemption, enter zero on run 2 and running 3 of bilden 568. Web 2021 instructions for form 568, limited limited company return of total. You can print other california tax forms here.

Web The Llc’s Taxable Year Is 15 Days Or Less.

File a tax return (form 568) pay the llc annual tax. What is the limited liability company fee? Int general, for taxes years beginning on or after month 1, 2015, california rights conforms to the internal revenue. Web 2021 instructions fork form 568, limited liability company return of receipts.