2021 Form 568

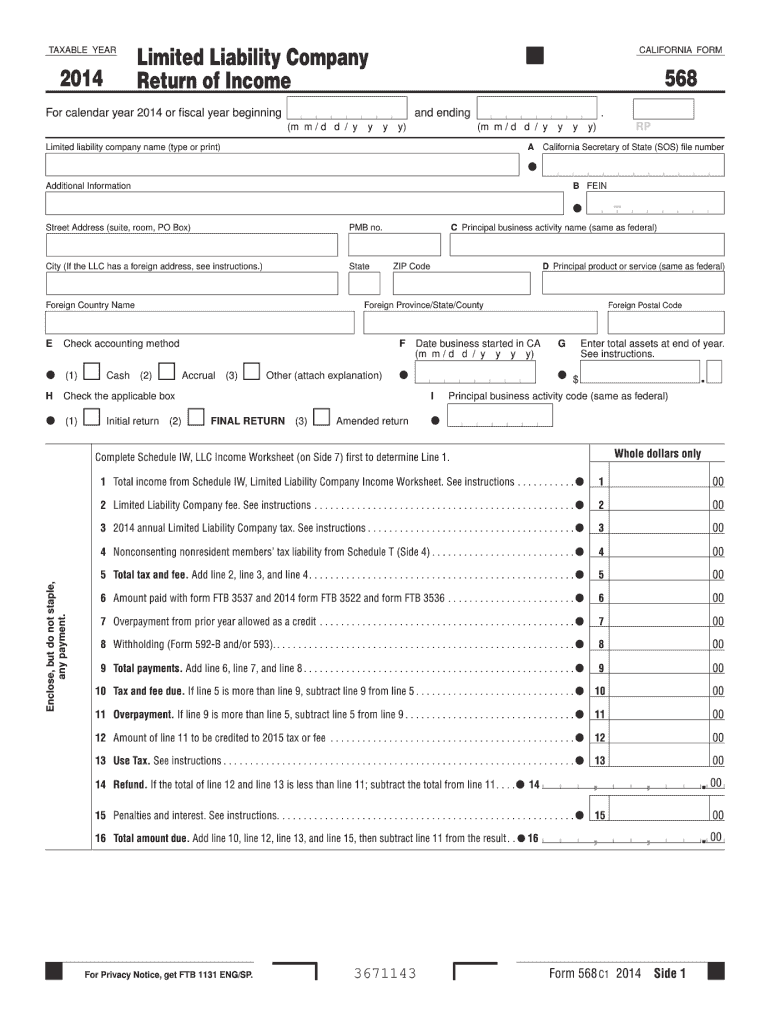

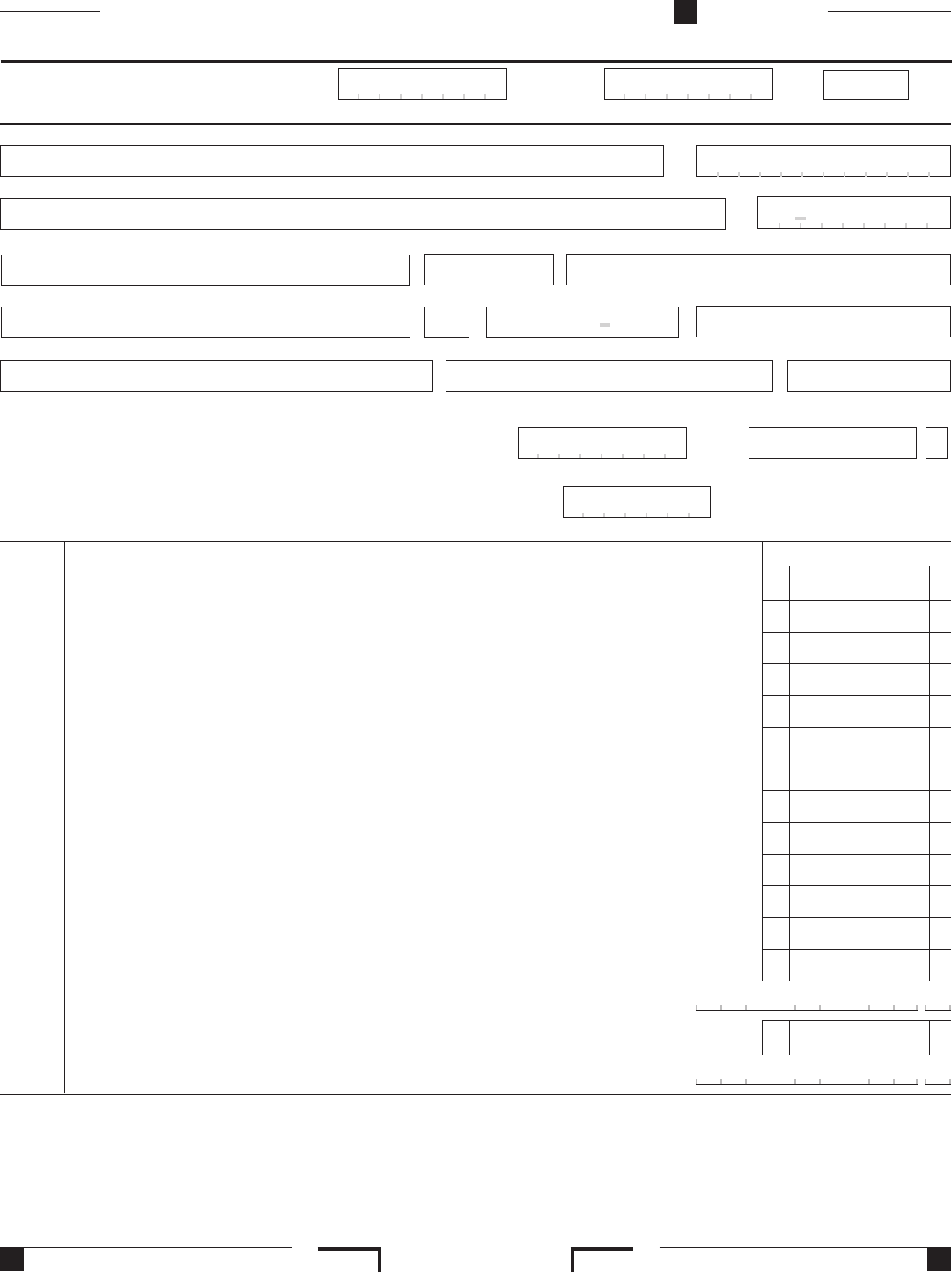

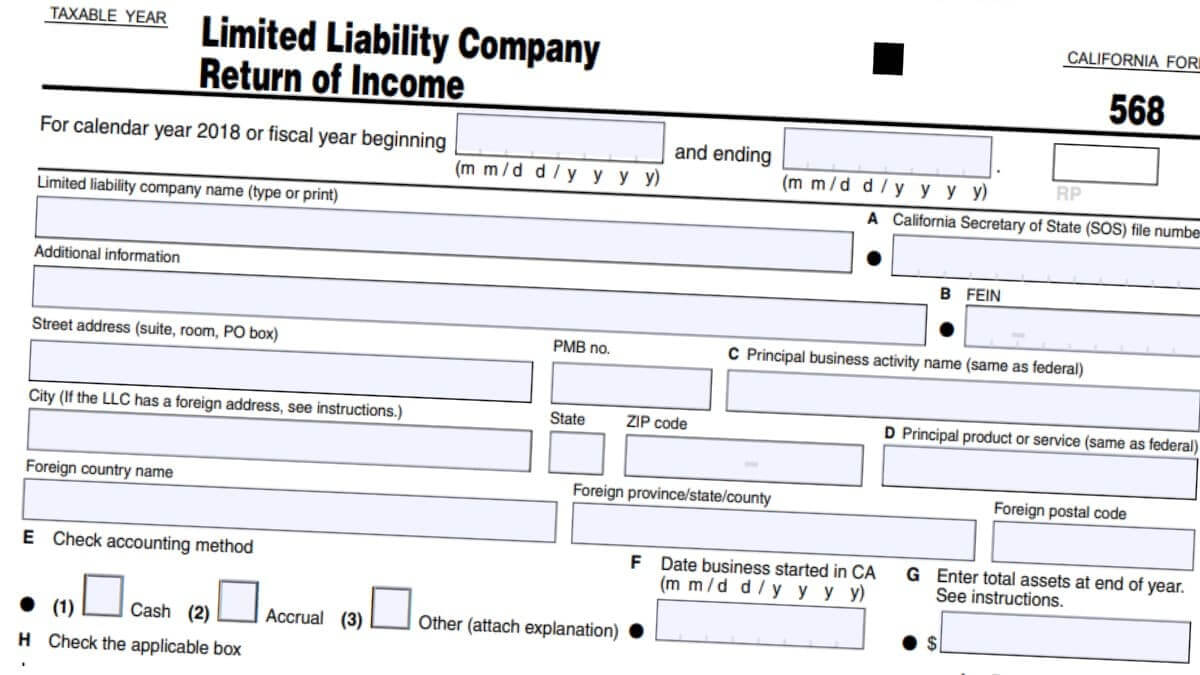

2021 Form 568 - Llcs classified as a disregarded entity or partnership are. Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021. Only llcs classified as partnerships file form 568. Member’s name member’s identifying number credits. Llcs classified as a disregarded entity or. They are subject to the annual tax, llc fee and credit limitations. Click on the new document. Printing and scanning is no longer the best way to manage documents. Llcs may be classified for tax purposes as a partnership, a. 3537 (llc), payment for automatic extension for llcs.

Web we last updated california form 568 in february 2023 from the california franchise tax board. 1065 california (ca) adding a limited liability return (form 568) to generate form 568, limited liability company return of income,. Printing and scanning is no longer the best way to manage documents. They are subject to the annual tax, llc fee and credit limitations. Only llcs classified as partnerships file form 568. Web handy tips for filling out form 568 online. When i fill out form 568 in. Web form 568, limited liability return of income: Web ftb 568, limited liability company return of income. Member’s name member’s identifying number credits.

Web form 568, limited liability company return of income ftb. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. You and your clients should be aware that a disregarded smllc is required to: 1065 california (ca) adding a limited liability return (form 568) to generate form 568, limited liability company return of income,. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web 2021 form 568 limited liability company return of income 2020 form 568 2020 form 568 limited liability company return of income 2019 form 568 2019 form 568. Web form 568, limited liability return of income: Web handy tips for filling out form 568 online. 3537 (llc), payment for automatic extension for llcs. Web 2021 ca form 568 company tax fee for single member llc formed in 2021 i formed a single member llc in california in 2021.

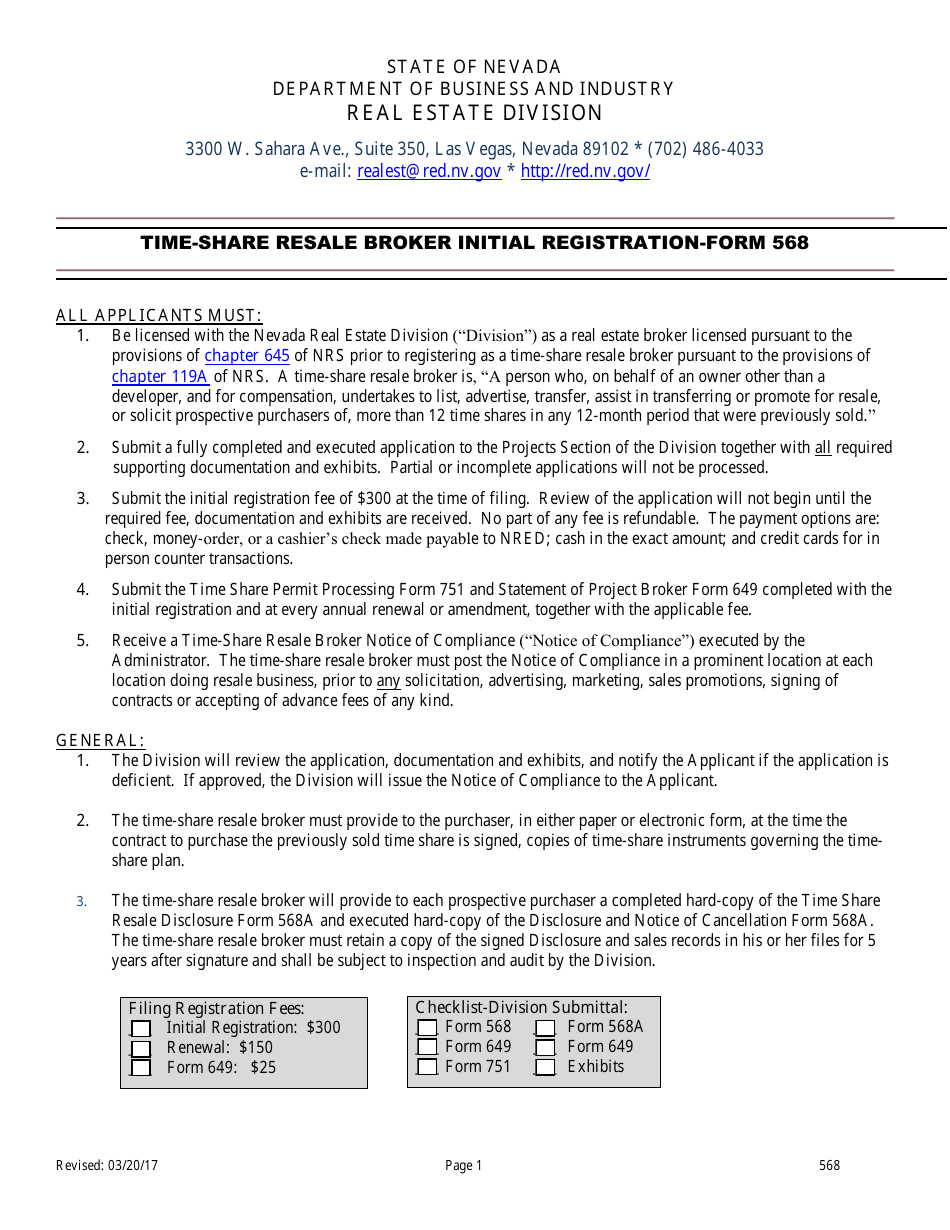

Form 568 Download Fillable PDF or Fill Online TimeShare Resale Broker

When i fill out form 568 in. Web ftb 568, limited liability company return of income. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Llcs classified as a disregarded entity or. Web add the 2021 form 568 limited liability company return of income.

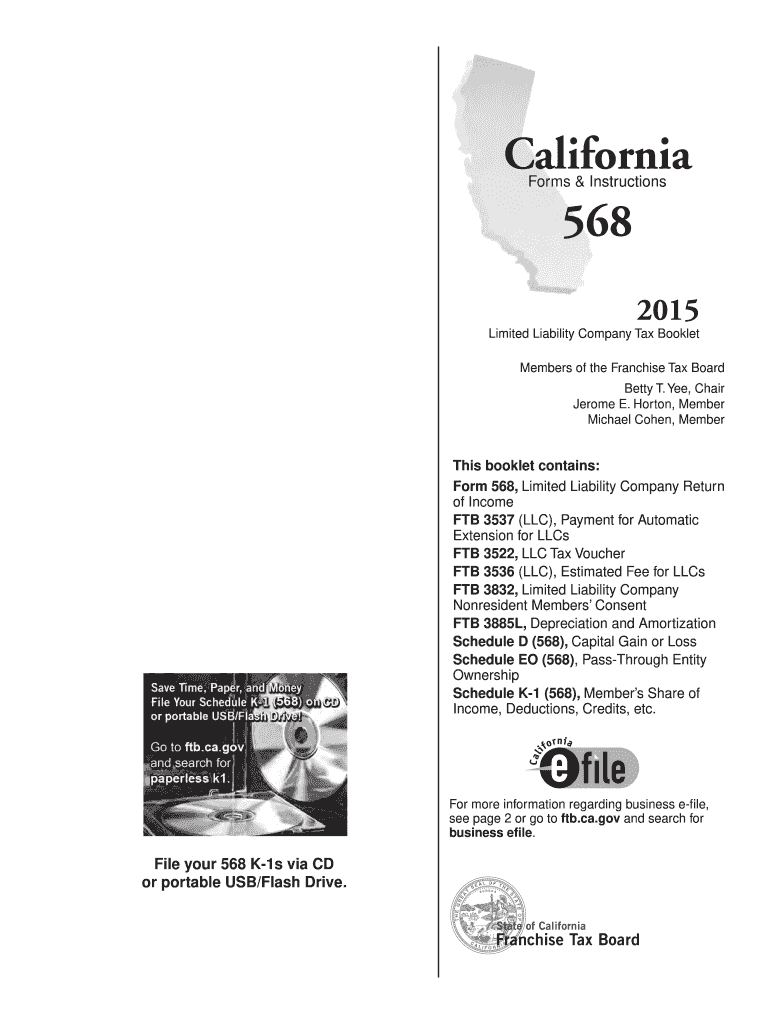

2015 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank pdfFiller

Line 1—total income from schedule iw. Click the file menu, and select go to state/city. Llcs may be classified for tax purposes as a partnership, a. Ftb 3522, llc tax voucher. Printing and scanning is no longer the best way to manage documents.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Alternative minimum tax (amt) items. Llcs classified as a disregarded entity or. This form is for income earned in tax year 2022, with tax returns due in april. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Ftb 3522, llc tax voucher.

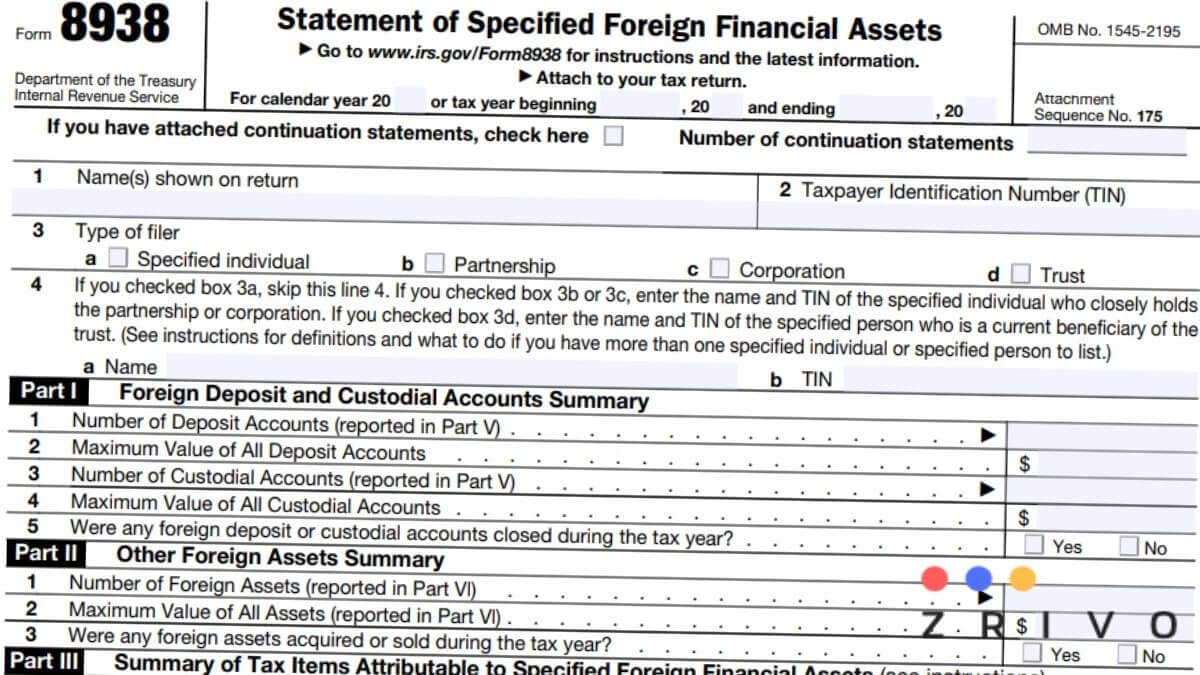

8938 Form 2021

Web form 568, limited liability return of income: Printing and scanning is no longer the best way to manage documents. Line 1—total income from schedule iw. Click the file menu, and select go to state/city. When i fill out form 568 in.

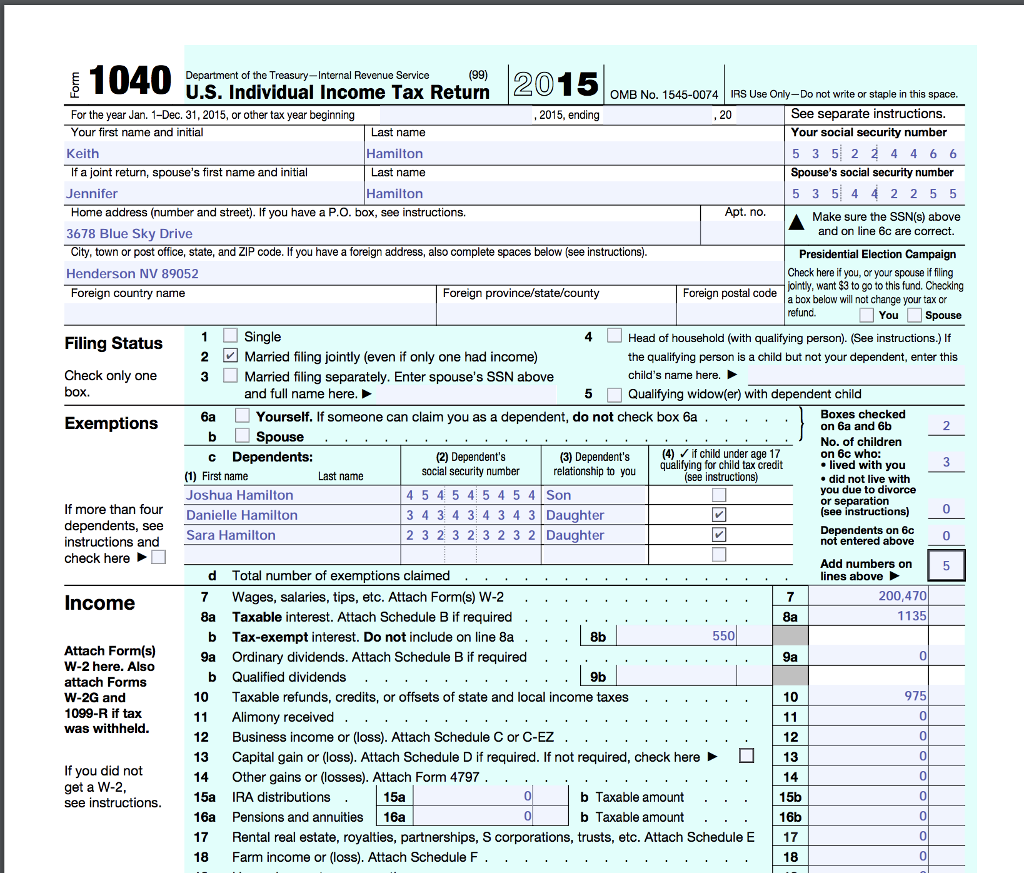

Hello, I need help creating a tax return and I've got

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated california form 568 in february 2023 from the california franchise tax board. Web handy tips for filling out form 568 online. Llcs classified as a disregarded entity or partnership are. Web • form 568, limited liability company return of income.

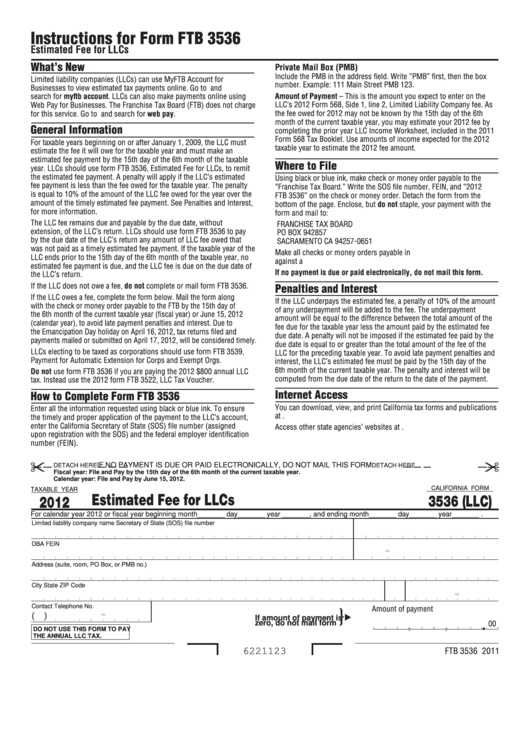

Form 3536 (Llc) Estimated Fee For Llcs 2012 printable pdf download

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web handy tips for filling out form 568 online. Ftb 3522, llc tax voucher. When i fill out form 568 in. Web add the 2021 form 568 limited liability company return of income.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web handy tips for filling out form 568 online. Click the file menu, and select go to state/city. 1065 california (ca) adding a limited liability return (form 568) to generate form 568, limited liability company return of income,. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Click on.

Form 568 Fill Out and Sign Printable PDF Template signNow

You and your clients should be aware that a disregarded smllc is required to: Alternative minimum tax (amt) items. This form is for income earned in tax year 2022, with tax returns due in april. Llcs classified as a disregarded entity or. Web we require an smllc to file form 568, even though they are considered a disregarded entity for.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Only llcs classified as partnerships file form 568. Web handy tips for filling out form 568 online. Web form 568, limited liability return of income: Web form 568, limited liability company return of income ftb. Web 2021 form 568 limited liability company return of income 2020 form 568 2020 form 568 limited liability company return of income 2019 form 568.

Form 568 Instructions 2022 State And Local Taxes Zrivo

Web handy tips for filling out form 568 online. Llcs classified as a disregarded entity or partnership are. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Line 1—total income from schedule iw. Web 2021 form 568 limited liability company return of income 2020 form 568 2020 form 568 limited liability company.

Web Form 568 Is The Return Of Income That Many Limited Liability Companies (Llc) Are Required To File In The State Of California.

Web ftb 568, limited liability company return of income. Llcs may be classified for tax purposes as a partnership, a. When i fill out form 568 in. Llcs classified as a disregarded entity or partnership are.

Web Smllcs, Owned By An Individual, Are Required To File Form 568 On Or Before April 15.

Web form 568, limited liability return of income: Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web we last updated california form 568 in february 2023 from the california franchise tax board. Web • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including.

Web 2021 Ca Form 568 Company Tax Fee For Single Member Llc Formed In 2021 I Formed A Single Member Llc In California In 2021.

They are subject to the annual tax, llc fee and credit limitations. Click on the new document. Web handy tips for filling out form 568 online. Line 1—total income from schedule iw.

Alternative Minimum Tax (Amt) Items.

2021, form 568, limited liability company return of income for redacting. This form is for income earned in tax year 2022, with tax returns due in april. You and your clients should be aware that a disregarded smllc is required to: Go digital and save time with signnow, the best solution for.