2022 Form 5329

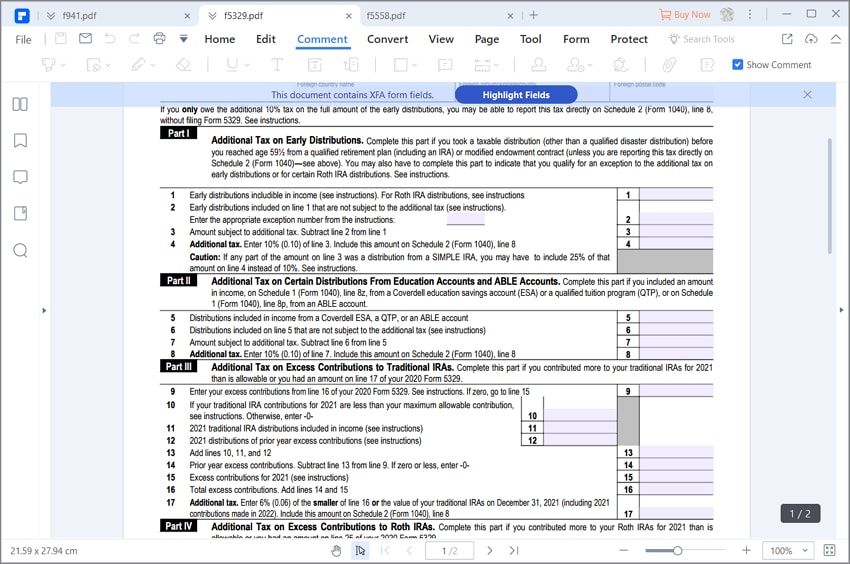

2022 Form 5329 - Try it for free now! Web screen 13.1, pensions, code 37 must be unchecked on all distributions in order to have form 5329 print. Web after taking the rmd, file form 5329 for each year an rmd was missed. Web per irs instructions for form 5329: This form is called “additional taxes on. Note that the form should be the version for that year (i.e., reporting a missed rmd for the tax. The program calculates the tax at fifty percent and carries it to form 1040, page 2. Purpose of form use form 5329 to report additional taxes on: Complete irs tax forms online or print government tax documents. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries.

Upload, modify or create forms. The program calculates the tax at fifty percent and carries it to form 1040, page 2. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. Web per irs instructions for form 5329: Note that the form should be the version for that year (i.e., reporting a missed rmd for the tax. Web december 14, 2022 18:10. Purpose of form use form 5329 to report additional taxes on: Complete irs tax forms online or print government tax documents. Ad get ready for tax season deadlines by completing any required tax forms today. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries.

The program calculates the tax at fifty percent and carries it to form 1040, page 2. Upload, modify or create forms. This form is called “additional taxes on. Failure to withdraw a required minimum distribution (rmd) from an ira, 401 (k) or similar account by the deadline can result in a 50% additional tax. Purpose of form use form 5329 to report additional taxes on: Use form 5329 to report additional taxes on: Complete irs tax forms online or print government tax documents. Web after taking the rmd, file form 5329 for each year an rmd was missed. When and where to file. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,

A tax nightmare Excess IRA contributions Financial Planning

Web purpose of form use form 5329 to report additional taxes on: Purpose of form use form 5329 to report additional taxes on: Upload, modify or create forms. Complete irs tax forms online or print government tax documents. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in.

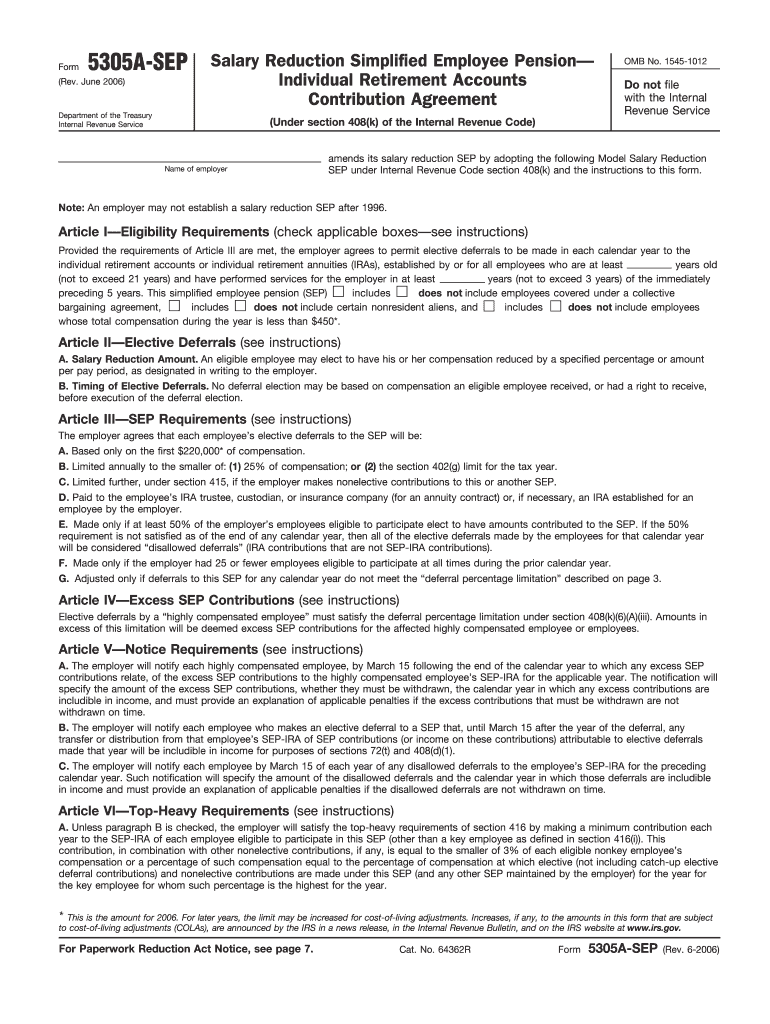

20062022 Form IRS 5305ASEP Fill Online, Printable, Fillable, Blank

Web december 14, 2022 18:10. Ad get ready for tax season deadlines by completing any required tax forms today. Note that the form should be the version for that year (i.e., reporting a missed rmd for the tax. Ad get ready for tax season deadlines by completing any required tax forms today. Web the table below explains exceptions to form.

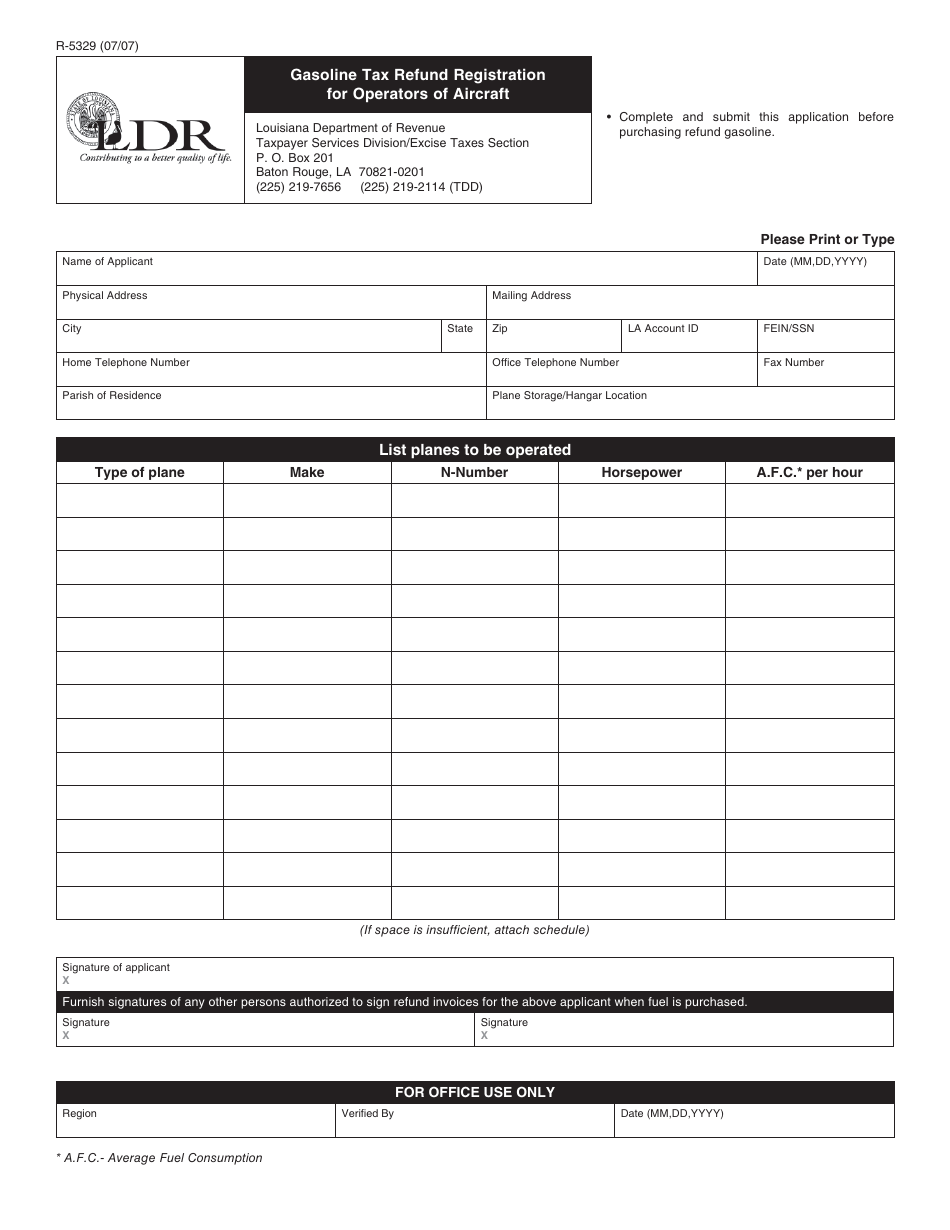

Form R5329 Download Printable PDF or Fill Online Gasoline Tax Refund

Web december 14, 2022 18:10. Note that the form should be the version for that year (i.e., reporting a missed rmd for the tax. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, Upload, modify or create forms. Web enter the excess accumulation information for form 5329, part viii.

How to fill out Form 5329.. Avoid Required Minimum Distribution 50

The address is only required when form 5329 is not being filed with. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. This form is called “additional taxes on. Web enter the excess accumulation information for form 5329, part viii.

Modo semplice per compilare il modulo IRS 5329

Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. When and where to file. Try it for free now! Ad get ready for tax season deadlines by completing any required tax forms today. This form is called “additional taxes on.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas,. Use form 5329 to report additional taxes on: Failure to withdraw a required minimum distribution (rmd) from an ira, 401 (k) or similar account by the deadline can result in a 50% additional tax. The address is only required when form 5329 is not being filed with..

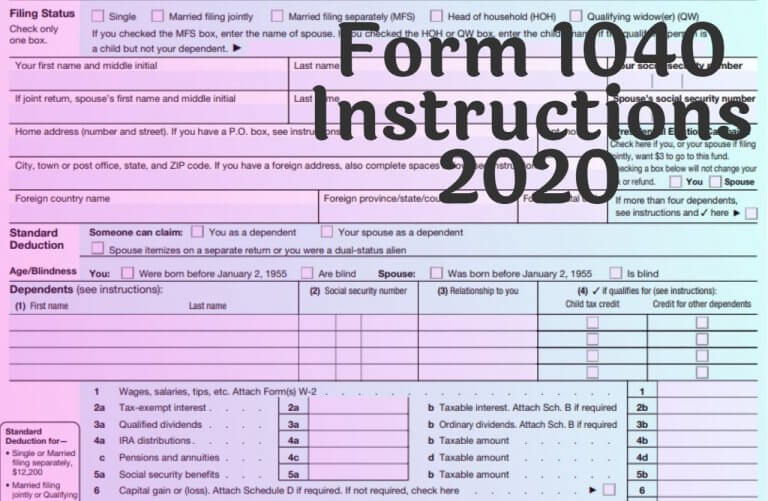

Form 1040 Instructions 2020

Web after taking the rmd, file form 5329 for each year an rmd was missed. Web purpose of form use form 5329 to report additional taxes on: Purpose of form use form 5329 to report additional taxes on: This form is called “additional taxes on. Web enter the excess accumulation information for form 5329, part viii.

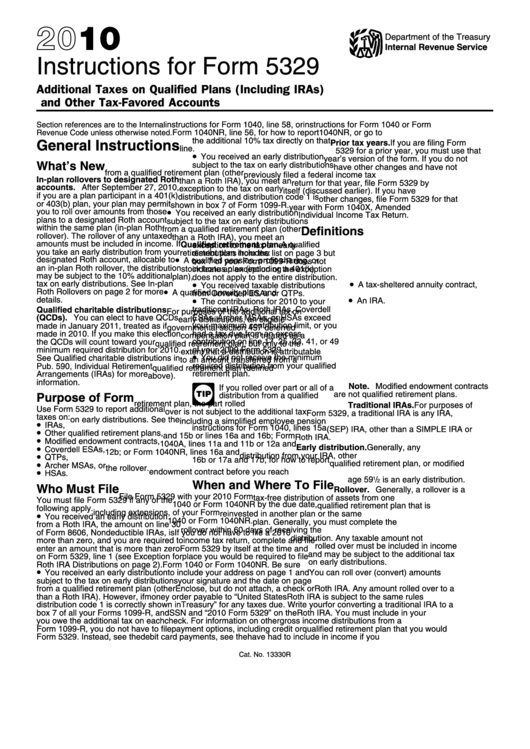

Instructions For Form 5329 2010 printable pdf download

Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. Web december 14, 2022 18:10. Upload, modify or create forms. Ad get ready for tax season deadlines by completing any required tax forms today. The program calculates the tax at fifty percent and carries it to form 1040, page 2.

Form 5329 Instructions & Exception Information for IRS Form 5329

File form 5329 with your 2022 form 1040, 1040. Web after taking the rmd, file form 5329 for each year an rmd was missed. Try it for free now! The address is only required when form 5329 is not being filed with. This form is called “additional taxes on.

Rmd penalty waiver request letter sample format Fill online

Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web per irs instructions for form 5329: File form 5329 with your 2022 form 1040, 1040. Web april 4, 2023 4:59 pm 0 reply bookmark icon lindas5247 expert alumni you will need a form 5329 for.

Web After Taking The Rmd, File Form 5329 For Each Year An Rmd Was Missed.

This form is called “additional taxes on. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. Complete irs tax forms online or print government tax documents. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas,.

Upload, Modify Or Create Forms.

Web december 14, 2022 18:10. Web per irs instructions for form 5329: Failure to withdraw a required minimum distribution (rmd) from an ira, 401 (k) or similar account by the deadline can result in a 50% additional tax. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,

When And Where To File.

Web april 4, 2023 4:59 pm 0 reply bookmark icon lindas5247 expert alumni you will need a form 5329 for either of these situations: Web purpose of form use form 5329 to report additional taxes on: Ad get ready for tax season deadlines by completing any required tax forms today. Note that the form should be the version for that year (i.e., reporting a missed rmd for the tax.

Web Use Form 5329 To Report Additional Taxes On Iras, Other Qualified Retirement Plans, Modified Endowment Contracts, Coverdell Esas, Qtps, Archer Msas, Or Hsas.

Try it for free now! Purpose of form use form 5329 to report additional taxes on: Web screen 13.1, pensions, code 37 must be unchecked on all distributions in order to have form 5329 print. The program calculates the tax at fifty percent and carries it to form 1040, page 2.