2022 Form 568

2022 Form 568 - It’s no different than an individual state income tax return. Llcs classified as a disregarded entity or. Web the 2021 form 568 limited liability company tax booklet. Line 1—total income from schedule iw. You and your clients should be aware that a disregarded smllc is required to: 565 form (pdf) | 565 booklet; Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. Use amounts of income expected for the 2022 taxable year to estimate the 2022 fee amount. Web form 568 is the tax return of limited liability companies in california. Using black or blue ink, make the check or money.

You and your clients should be aware that a disregarded smllc is required to: Web california defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. Line 1—total income from schedule iw. Web the 2021 form 568 limited liability company tax booklet. Web 2022 partnership and llc income tax returns due and tax due (for calendar year filers). It’s no different than an individual state income tax return. Form 568, limited liability company return of income ftb. Use amounts of income expected for the 2022 taxable year to estimate the 2022 fee amount. Easily fill out pdf blank, edit, and sign them.

Web 568 2022 limited liability company tax booklet this booklet contains: Form 568, limited liability company return of income ftb. 568 form (pdf) | 568 booklet; Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Use form 3522, limited liability company tax voucher to pay the annual tax. Web this form must be filed on or before the original due date of the tax return. Web to complete california form 568 for a partnership, from the main menu of the california return, select: It’s no different than an individual state income tax return. Use amounts of income expected for the 2022 taxable year to estimate the 2022 fee amount. Web 2022 form 568 2022 form 568 limited liability company return of income 2021 form 568 2021 form 568 limited liability company return of income 2020 form 568 2020.

FTB Form 568 Assistance Dimov Tax & CPA Services

Web the 2021 form 568 limited liability company tax booklet. Web enter all payment types (overpayment from prior year, annual tax, fee, etc.) made for the 2022 taxable year on the applicable line of form 568. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Use form 3522, limited liability company tax.

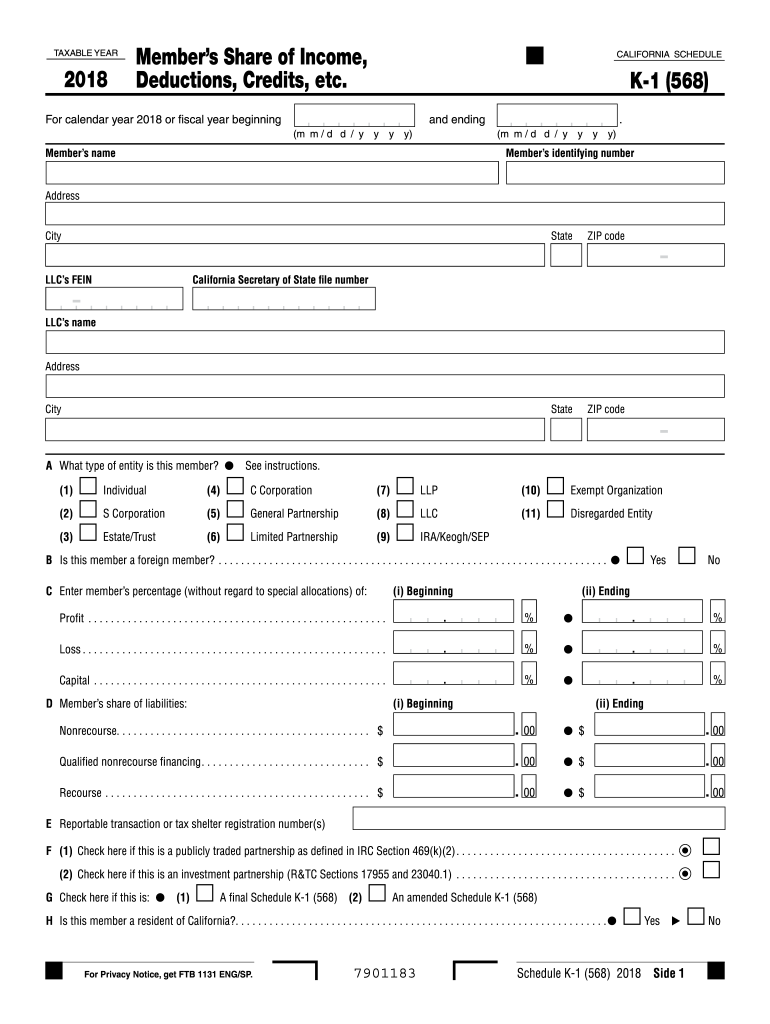

California k 1 instructions Fill out & sign online DocHub

Easily fill out pdf blank, edit, and sign them. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Generally, the granted extension is for six months, which moves the filing deadline to. Web this form must be filed on or before the original due date of the tax return. Web if you.

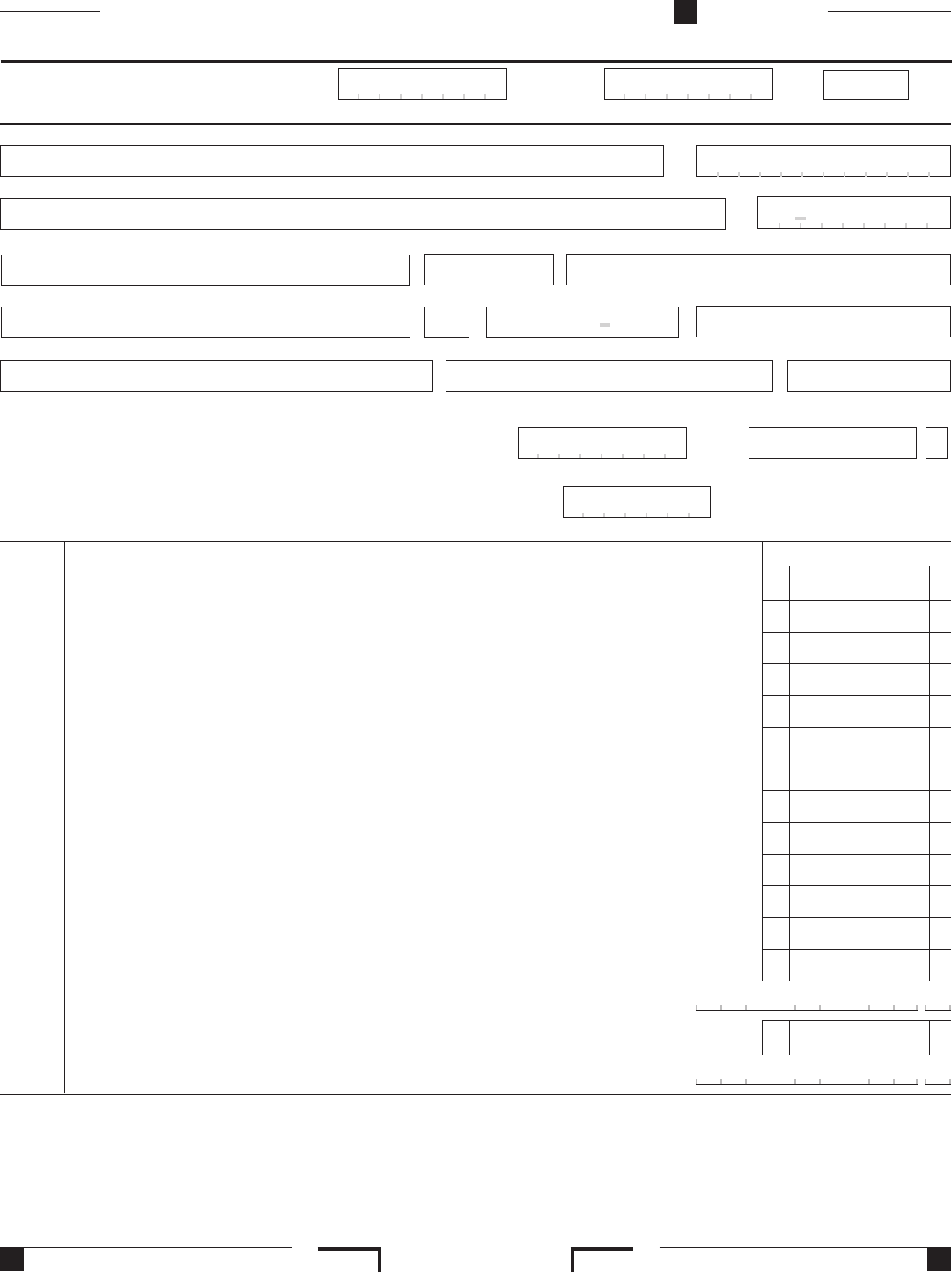

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 568, limited liability return of income: Web 2022 form 568 2022 form 568 limited liability company return of income 2021 form 568 2021 form 568 limited liability company return of income 2020 form 568 2020. Web form 568 california — limited liability company return of income download this form print this form it appears you don't have a.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Web to complete california form 568 for a partnership, from the main menu of the california return, select: 568 form (pdf) | 568 booklet; Web form 568, limited liability return of income: Web 2022 form 568 2022 form 568 limited liability company return of income 2021 form 568 2021 form 568 limited liability company return of income 2020 form 568.

Form 568 Fill Out and Sign Printable PDF Template signNow

Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. Line 1—total income from schedule iw. You and your clients should be aware that a disregarded smllc is required to: Llcs classified as a disregarded entity or. Easily fill out pdf blank, edit, and sign them.

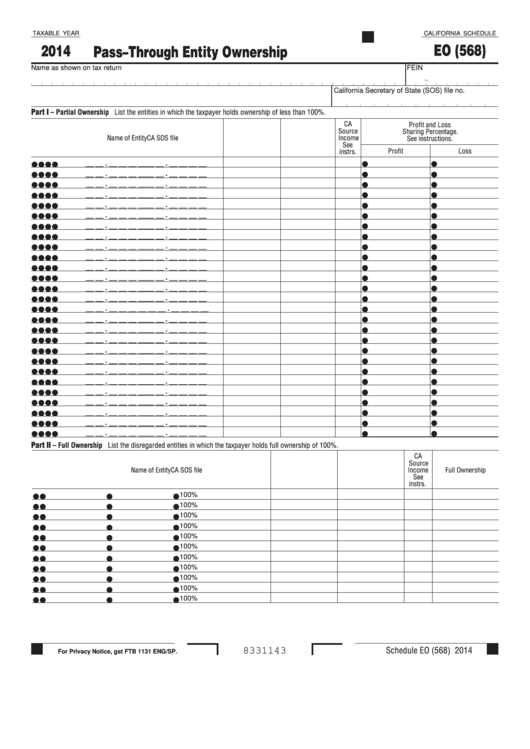

Fillable Online ftb ca section 568 final k 1 form Fax Email Print

Web this form must be filed on or before the original due date of the tax return. Web if you have an llc, here’s how to fill in the california form 568: Llcs classified as a disregarded entity or. Easily fill out pdf blank, edit, and sign them. Generally, the granted extension is for six months, which moves the filing.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Web 2022 partnership and llc income tax returns due and tax due (for calendar year filers). Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Easily fill out pdf blank, edit, and sign them. Form 568, limited liability company return of income ftb. Web the 2021.

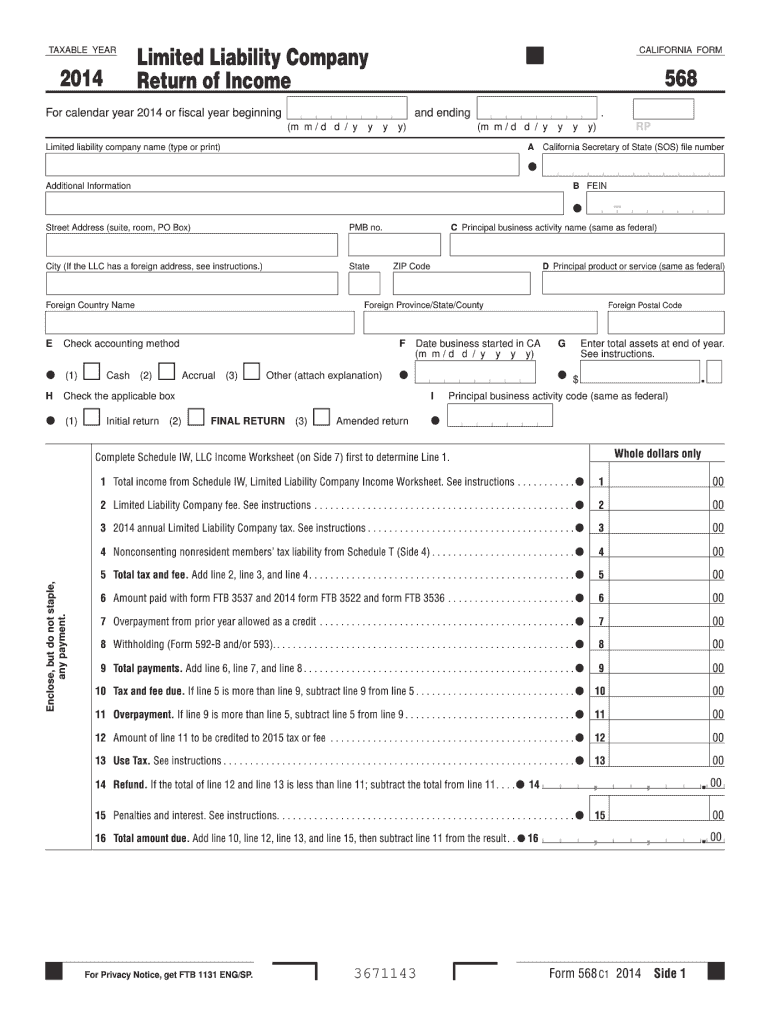

Fillable Form California Schedule Eo (568) PassThrough Entity

It’s no different than an individual state income tax return. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web accessing the california form 568 for an llc return solved • by intuit • 15 • updated november 17, 2022 this article will show you how.

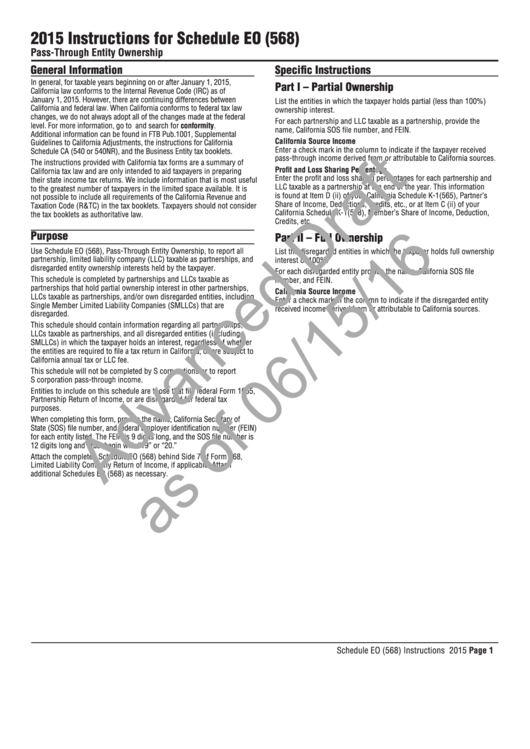

Instructions For Schedule Eo (568) Draft PassThrough Entity

You and your clients should be aware that a disregarded smllc is required to: Web accessing the california form 568 for an llc return solved • by intuit • 15 • updated november 17, 2022 this article will show you how to access california. 568 form (pdf) | 568 booklet; Web california defines a single member llc as a disregarded.

Form 568 Instructions 2022 State And Local Taxes Zrivo

Web california defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss. The same as any other type of tax return, you’ll. 1065 california (ca) adding a limited liability return (form 568) to generate form 568, limited liability company return of income,..

Web Form 568 Instructions 2022 Rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 Satisfied 60 Votes How To Fill Out And Sign Form 568 Online?

Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. Web form 568 is the tax return of limited liability companies in california. Web if you have an llc, here’s how to fill in the california form 568: Save or instantly send your ready documents.

It’s No Different Than An Individual State Income Tax Return.

Web form 568 california — limited liability company return of income download this form print this form it appears you don't have a pdf plugin for this browser. Web 568 2022 limited liability company tax booklet this booklet contains: Web accessing the california form 568 for an llc return solved • by intuit • 15 • updated november 17, 2022 this article will show you how to access california. You and your clients should be aware that a disregarded smllc is required to:

Get Your Online Template And Fill It In.

Web california defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss. 568 form (pdf) | 568 booklet; Web mail form 568 with payment to: 1065 california (ca) adding a limited liability return (form 568) to generate form 568, limited liability company return of income,.

Web Form 568 Is The Return Of Income That Many Limited Liability Companies (Llc) Are Required To File In The State Of California.

Using black or blue ink, make the check or money. Web enter all payment types (overpayment from prior year, annual tax, fee, etc.) made for the 2022 taxable year on the applicable line of form 568. Llcs classified as a disregarded entity or. Web this form must be filed on or before the original due date of the tax return.