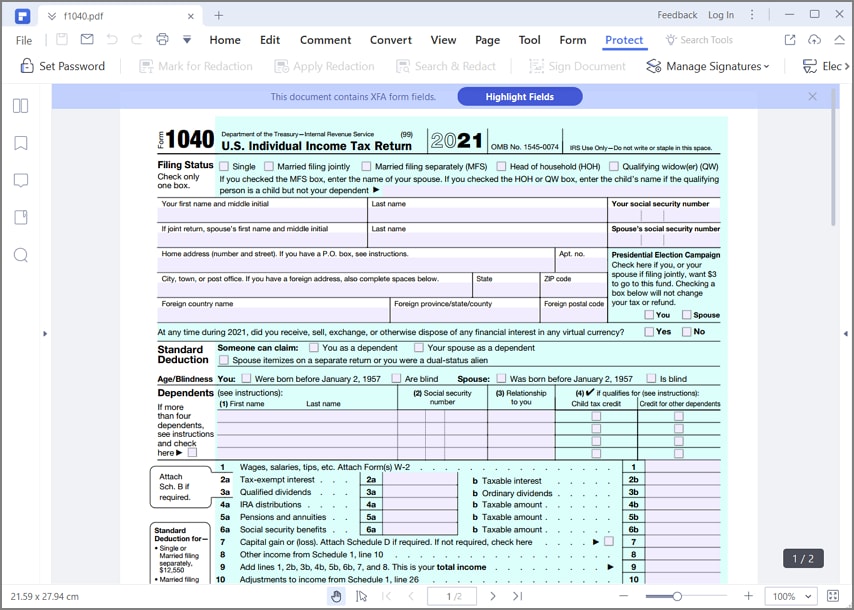

2023 Form W-4P

2023 Form W-4P - Otherwise, skip to step 5. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Members who terminated employment and want to withdraw or roll over. Web december 30, 2022. See page 2 for more information on each step, who can claim. It is used by a payee to change the default withholding election on ineligible rollover periodic. The significant changes include updates to the marital category, modifications to the reporting of other sources of income,. Web futureplan erisa team september 19 2022. This is not the first early. Web january 30, 2023.

Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Members who terminated employment and want to withdraw or roll over. This is not the first early. Web january 30, 2023. Web december 30, 2022. It is used by a payee to change the default withholding election on ineligible rollover periodic. The significant changes include updates to the marital category, modifications to the reporting of other sources of income,. Web futureplan erisa team september 19 2022. See page 2 for more information on each step, who can claim. Otherwise, skip to step 5.

2 by the internal revenue service. Web futureplan erisa team september 19 2022. It is used by a payee to change the default withholding election on ineligible rollover periodic. Members who terminated employment and want to withdraw or roll over. Web january 30, 2023. Otherwise, skip to step 5. Web december 30, 2022. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. See page 2 for more information on each step, who can claim. This is not the first early.

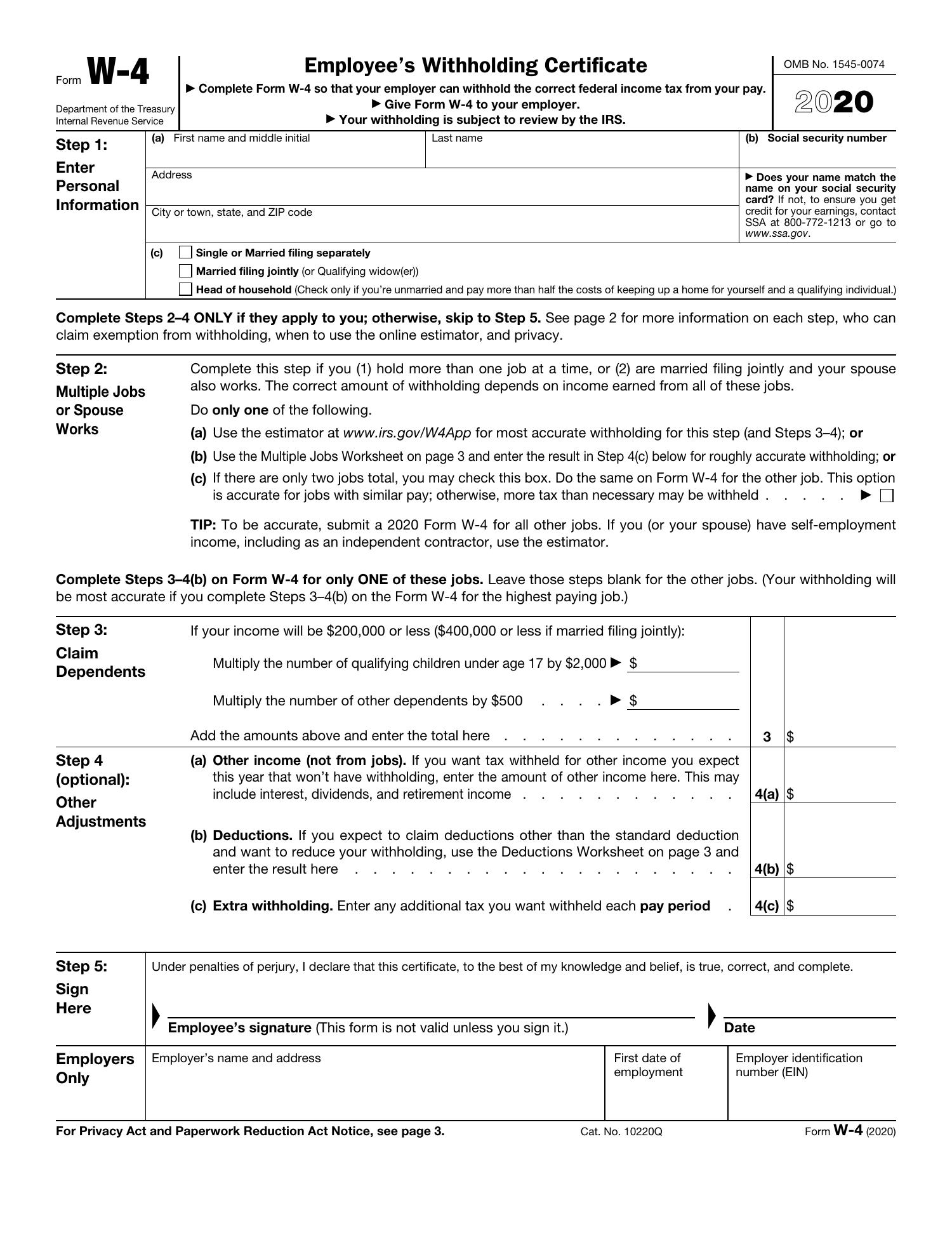

Form W 4 Worksheet —

See page 2 for more information on each step, who can claim. Otherwise, skip to step 5. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. It is used by a payee to change the default withholding election on ineligible rollover periodic. Web january 30, 2023.

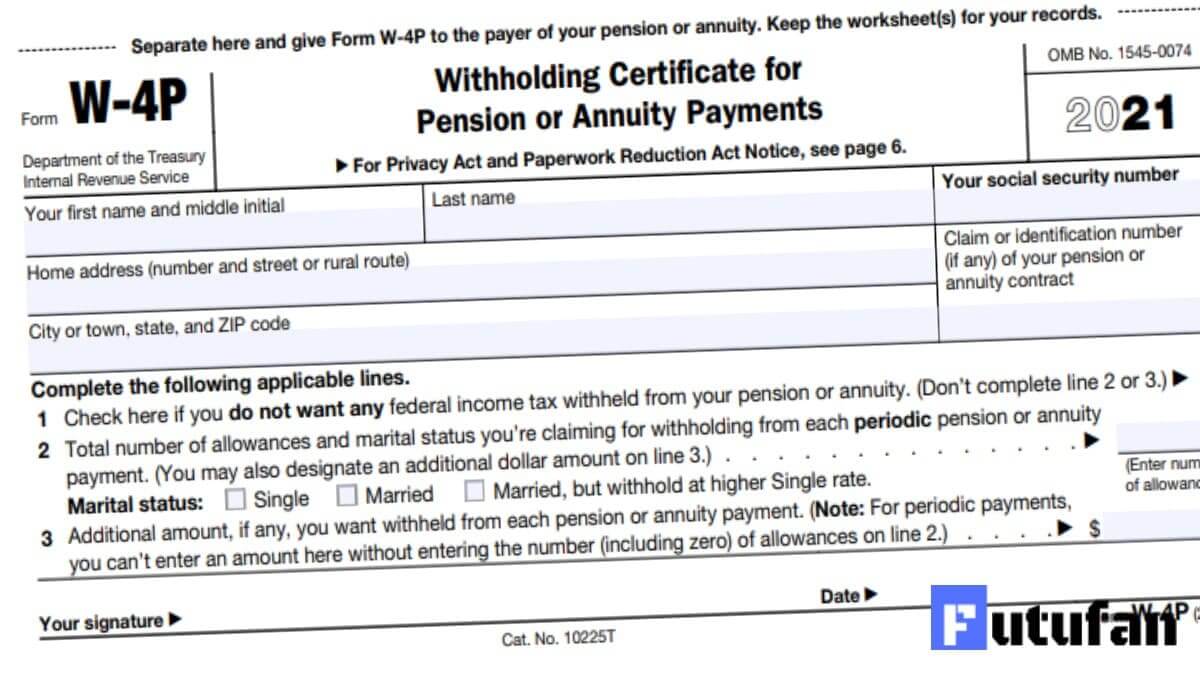

W4P Form 2022 2023

Web futureplan erisa team september 19 2022. Web january 30, 2023. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Otherwise, skip to step 5. The significant changes include updates to the marital category, modifications to the reporting of other sources of income,.

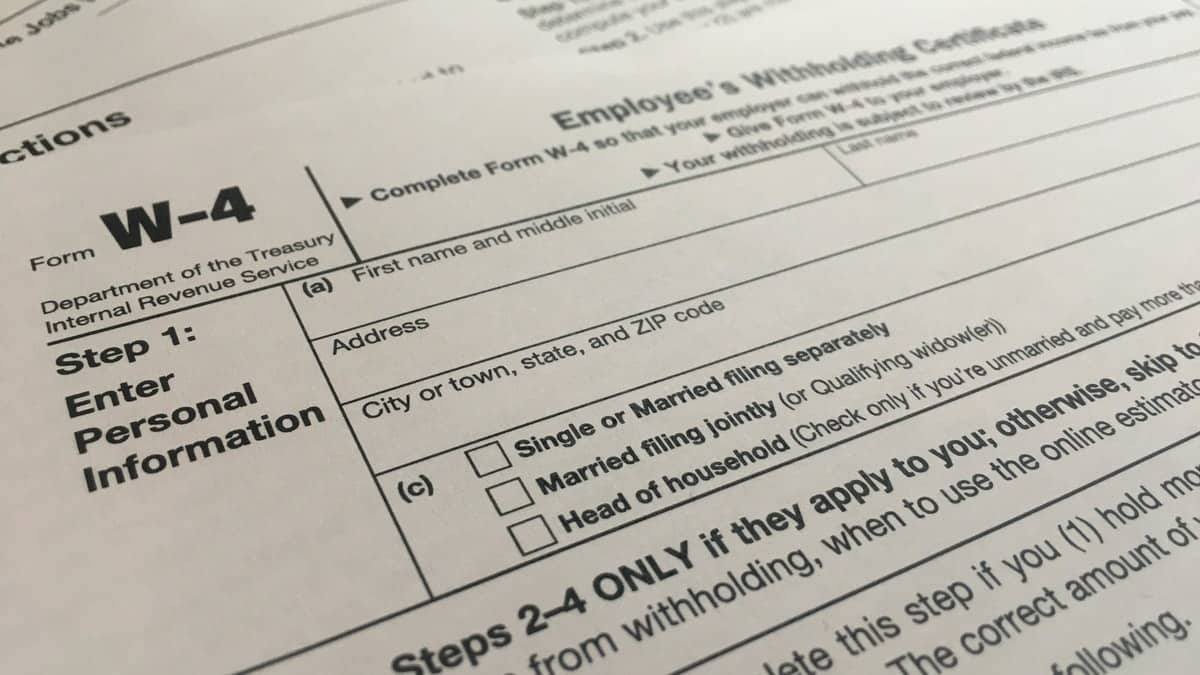

W4 Form 2023 Instructions

Web december 30, 2022. Members who terminated employment and want to withdraw or roll over. Otherwise, skip to step 5. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web futureplan erisa team september 19 2022.

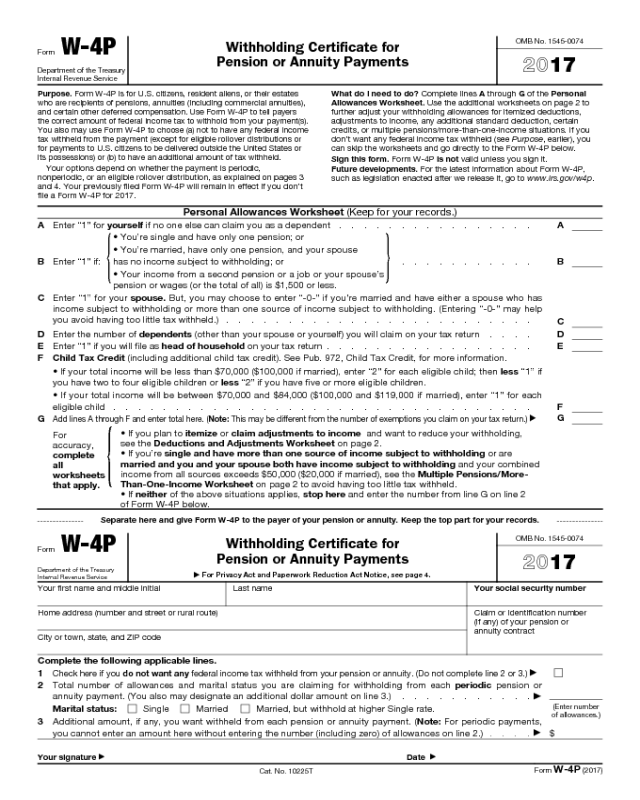

Fillable W 4p Form Printable Printable Forms Free Online

This is not the first early. Members who terminated employment and want to withdraw or roll over. It is used by a payee to change the default withholding election on ineligible rollover periodic. See page 2 for more information on each step, who can claim. Otherwise, skip to step 5.

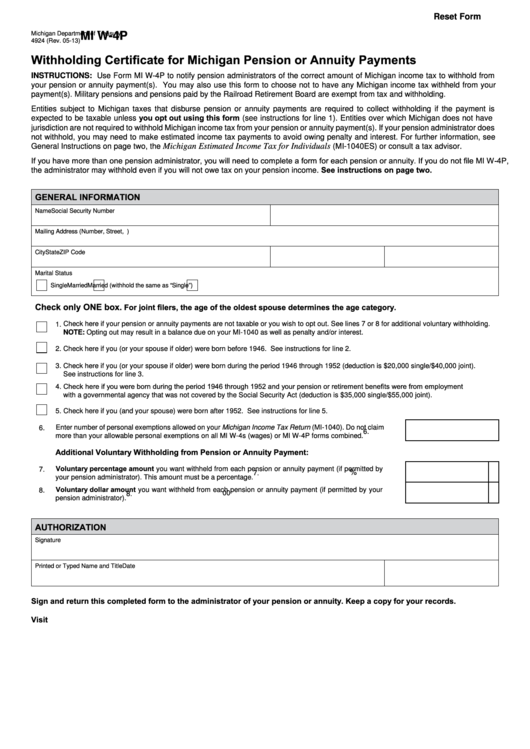

Fillable Form Mi W4p Withholding Certificate For Michigan Pension Or

Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web january 30, 2023. See page 2 for more information on each step, who can claim. This is not the first early. 2 by the internal revenue service.

North Carolina W4 App

See page 2 for more information on each step, who can claim. Members who terminated employment and want to withdraw or roll over. 2 by the internal revenue service. Web january 30, 2023. It is used by a payee to change the default withholding election on ineligible rollover periodic.

Formulaire IRS W4P remplissezle de manière efficace

It is used by a payee to change the default withholding election on ineligible rollover periodic. Web january 30, 2023. This is not the first early. Otherwise, skip to step 5. See page 2 for more information on each step, who can claim.

Are You Ready? Big Changes to the 2020 Federal W4 Withholding Form

2 by the internal revenue service. Otherwise, skip to step 5. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. It is used by a payee to change the default withholding election on ineligible rollover periodic. See page 2 for more information on each step, who can claim.

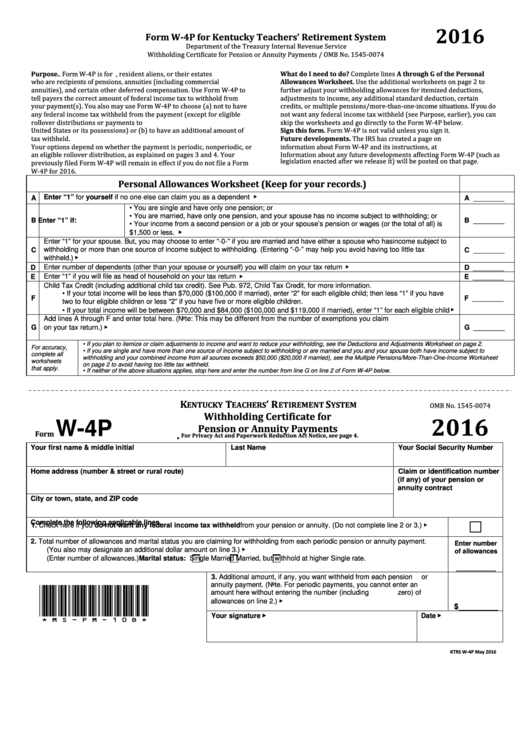

Form W4p Kentucky Teachers' Retirement System Withholding Certificate

It is used by a payee to change the default withholding election on ineligible rollover periodic. This is not the first early. Otherwise, skip to step 5. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. The significant changes include updates to the marital category, modifications to the reporting of.

Form W4 2020.pdf DocDroid

Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web futureplan erisa team september 19 2022. Members who terminated employment and want to withdraw or roll over. Web january 30, 2023. The significant changes include updates to the marital category, modifications to the reporting of other sources of income,.

Citizens, Resident Aliens, Or Their Estates Who Are Recipients Of Pensions, Annuities (Including Commercial Annuities), And Certain Other Deferred.

Web january 30, 2023. 2 by the internal revenue service. Otherwise, skip to step 5. This is not the first early.

The Significant Changes Include Updates To The Marital Category, Modifications To The Reporting Of Other Sources Of Income,.

Web december 30, 2022. It is used by a payee to change the default withholding election on ineligible rollover periodic. See page 2 for more information on each step, who can claim. Members who terminated employment and want to withdraw or roll over.