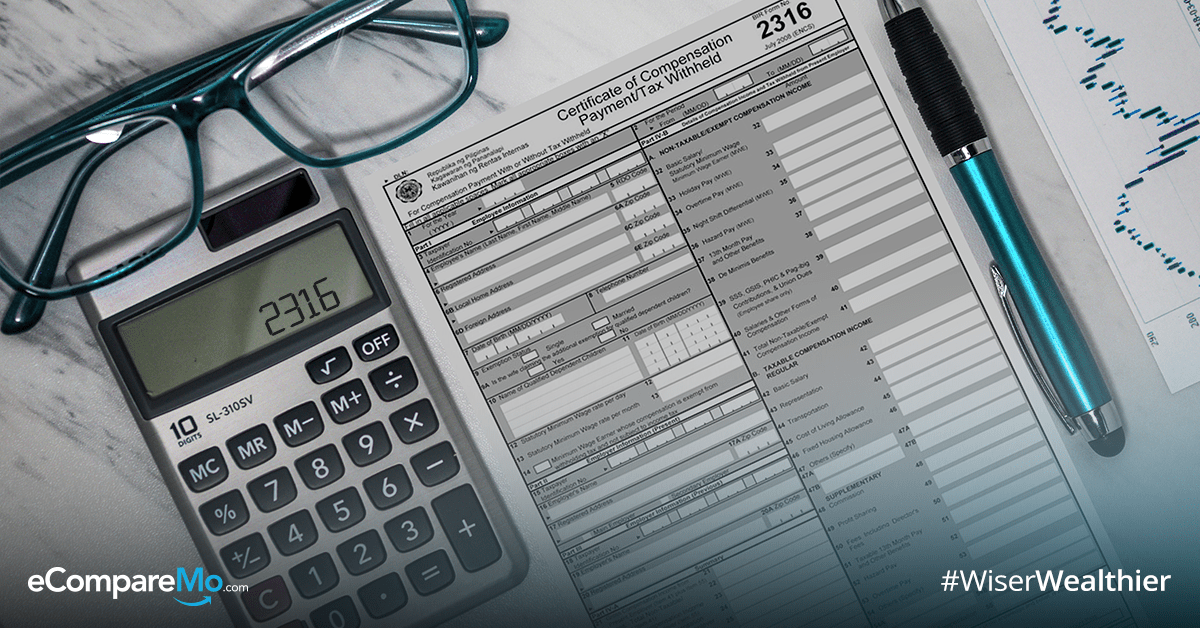

2316 Bir Form

2316 Bir Form - Web the bir form no. 26, 2021, the bir circulated revenue memorandum circular (rmc) no. Web what forms do you use in filing an itr? Web what is bir form 2316 and why is this important? Web the bir form 2316 or certificate of compensation payment/tax withheld is an official document that states an employee's gross income and the appropriate taxes. Under revenue regulations (rr) no. Web the bir form 2316 filed by their employers serves as their aitr (i.e., substituted filing). Its wide collection of forms. Of revenue regulations (rr) no. How to fill out bir 2316.

26, 2021, the bir circulated revenue memorandum circular (rmc) no. Republika ng pilipinas certificate of compensation kagawaran ng pananalapi kawanihan ng rentas internas for compensation payment with or without. How to fill out bir 2316. Web the bir form no. Web the bir form 2316 is an important document that anyone who receives income must submit annually. This form contains your income and the corresponding taxes that your employer withheld from you during the. Web the bir form 2316 or certificate of compensation payment/tax withheld is an official document that states an employee's gross income and the appropriate taxes. Type text, add images, blackout confidential details, add comments, highlights and more. What are the methods used in filing an itr? Web what forms do you use in filing an itr?

How to fill out bir 2316. Web the bir form no. 2316 shall be issued to the employees on or before january 31 of the succeeding calendar year, or on the day on which the last payment of. Cocodoc is the best platform for you to go, offering you a free and modifiable version of bir form 2316 as you desire. The certificate should identify the. Its wide collection of forms. Download | certificate of compensation payment / tax withheld for compensation payment with or without tax withheld. Web the bir form 2316 is an important document that anyone who receives income must submit annually. This form contains your income and the corresponding taxes that your employer withheld from you during the. Of revenue regulations (rr) no.

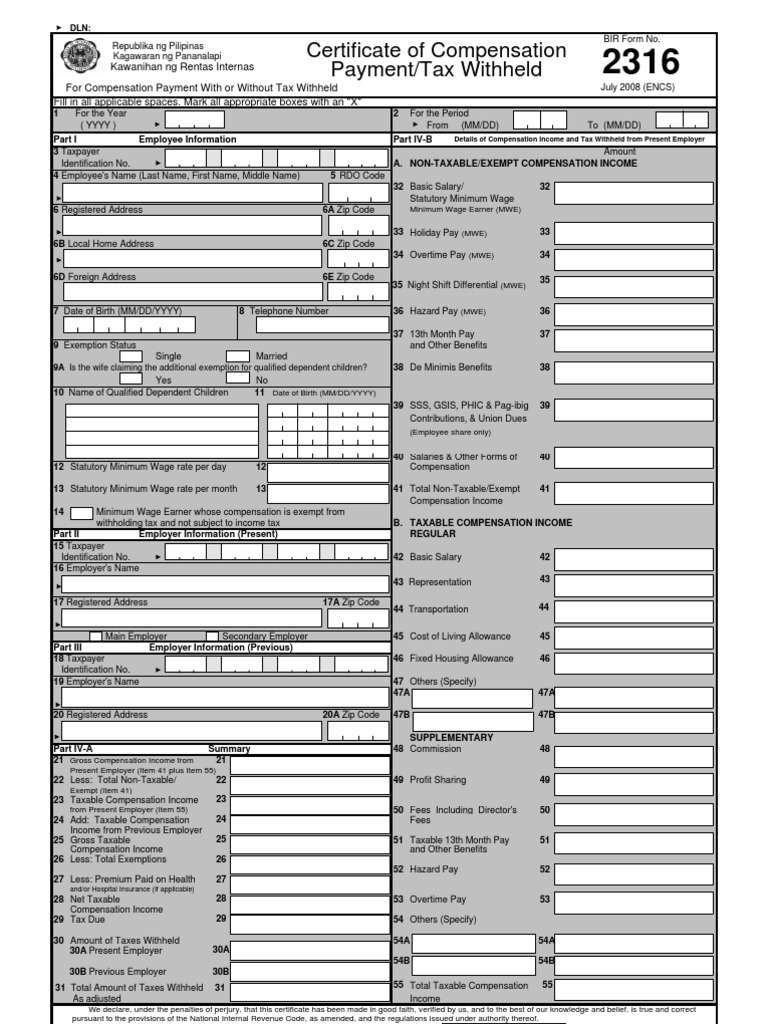

BIR Form 2316

Download | certificate of compensation payment / tax withheld for compensation payment with or without tax withheld. Moreover, employers are required to submit the form on. Its wide collection of forms. Cocodoc is the best platform for you to go, offering you a free and modifiable version of bir form 2316 as you desire. Under revenue regulations (rr) no.

PH BIR 2316 20182022 Form Printable Blank PDF Online

Web bir form 2316 is completed and issued to each employee that receives a salary, wage or any other form of remuneration from the employer. Web looking for bir form 2316 to fill? 2316 shall be issued to the employees on or before january 31 of the succeeding calendar year, or on the day on which the last payment of..

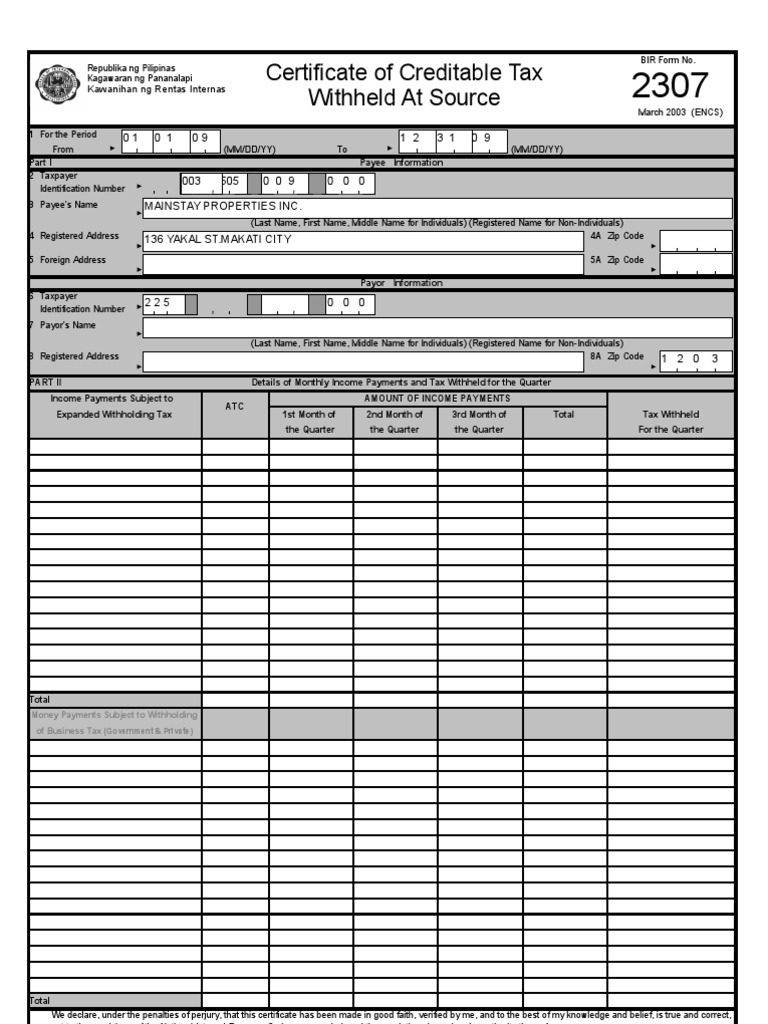

bir 2316 philippin news collections

Web edit your bir form 2316 online. What are the methods used in filing an itr? Of revenue regulations (rr) no. Web bir 2316, also known as certificate of compensation payment/tax withheld for compensation payment with or without tax withheld can be generated under this tab. Web bir form 2316 is completed and issued to each employee that receives a.

bir 2316 philippin news collections

Its wide collection of forms. Draw your signature, type it,. 26, 2021, the bir circulated revenue memorandum circular (rmc) no. Republika ng pilipinas certificate of compensation kagawaran ng pananalapi kawanihan ng rentas internas for compensation payment with or without. This form contains your income and the corresponding taxes that your employer withheld from you during the.

Breanna New 2316 Bir Form 2019

Cocodoc is the best platform for you to go, offering you a free and modifiable version of bir form 2316 as you desire. Type text, add images, blackout confidential details, add comments, highlights and more. Web looking for bir form 2316 to fill? Its wide collection of forms. Download | certificate of compensation payment / tax withheld for compensation payment.

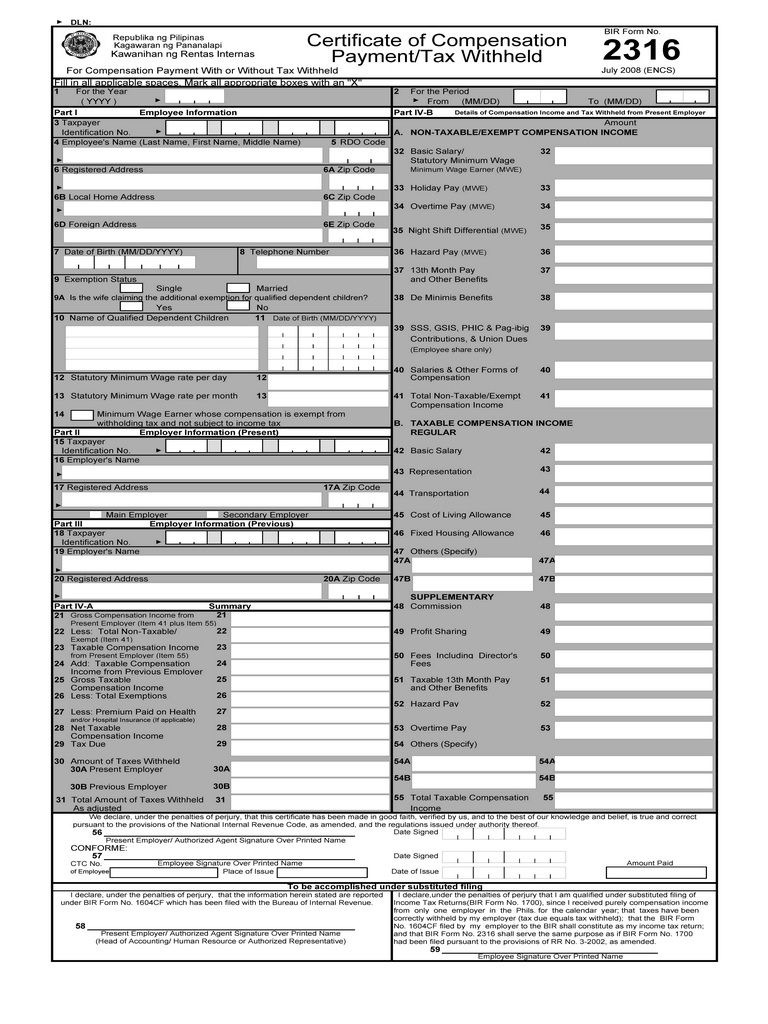

Ultimate Guide on How to Fill Out BIR Form 2316 FullSuite

Republika ng pilipinas certificate of compensation kagawaran ng pananalapi kawanihan ng rentas internas for compensation payment with or without. How to fill out bir 2316. Web edit your bir form 2316 online. Moreover, employers are required to submit the form on. Web what forms do you use in filing an itr?

BIR Form 2316 Everything You Need to Know FullSuite

Web bir 2316, also known as certificate of compensation payment/tax withheld for compensation payment with or without tax withheld can be generated under this tab. Web the bir form 2316 is an important document that anyone who receives income must submit annually. The certificate should identify the. Its wide collection of forms. This form contains your income and the corresponding.

BIR form no. 2316 [Download PDF]

Web looking for bir form 2316 to fill? Its wide collection of forms. Web what forms do you use in filing an itr? What are the methods used in filing an itr? Web the bir form no.

bir 2316 philippin news collections

Type text, add images, blackout confidential details, add comments, highlights and more. Under revenue regulations (rr) no. Web bir form 2316 is completed and issued to each employee that receives a salary, wage or any other form of remuneration from the employer. Republika ng pilipinas certificate of compensation kagawaran ng pananalapi kawanihan ng rentas internas for compensation payment with or.

All Your Questions About BIR Form 2316, Answered

What are the methods used in filing an itr? Sign it in a few clicks. Web the bir form 2316 or certificate of compensation payment/tax withheld is an official document that states an employee's gross income and the appropriate taxes. The certificate should identify the. Web what forms do you use in filing an itr?

2316 Shall Be Issued To The Employees On Or Before January 31 Of The Succeeding Calendar Year, Or On The Day On Which The Last Payment Of.

Web the bir form 2316 or certificate of compensation payment/tax withheld is an official document that states an employee's gross income and the appropriate taxes. Web bir form 2316 is completed and issued to each employee that receives a salary, wage or any other form of remuneration from the employer. Draw your signature, type it,. Sign it in a few clicks.

Of Revenue Regulations (Rr) No.

Type text, add images, blackout confidential details, add comments, highlights and more. Web bir 2316, also known as certificate of compensation payment/tax withheld for compensation payment with or without tax withheld can be generated under this tab. Web edit your bir form 2316 online. What are the methods used in filing an itr?

Web The Bir Form 2316 Is An Important Document That Anyone Who Receives Income Must Submit Annually.

Republika ng pilipinas certificate of compensation kagawaran ng pananalapi kawanihan ng rentas internas for compensation payment with or without. Its wide collection of forms. Download | certificate of compensation payment / tax withheld for compensation payment with or without tax withheld. This form contains your income and the corresponding taxes that your employer withheld from you during the.

Web Looking For Bir Form 2316 To Fill?

Web what forms do you use in filing an itr? Moreover, employers are required to submit the form on. Web the bir form no. Web what is bir form 2316 and why is this important?

![BIR form no. 2316 [Download PDF]](https://cdn.vdocuments.site/img/1200x630/reader015/image/20180711/54fd46e24a7959d43c8b50e1.png)