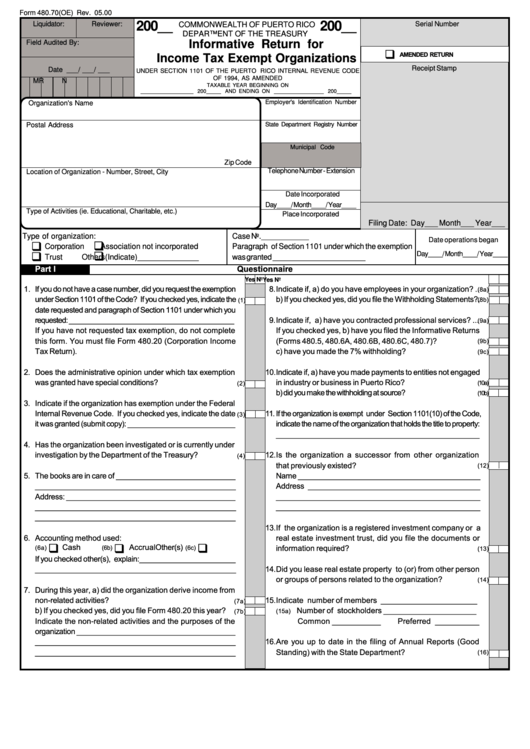

480 Form Puerto Rico

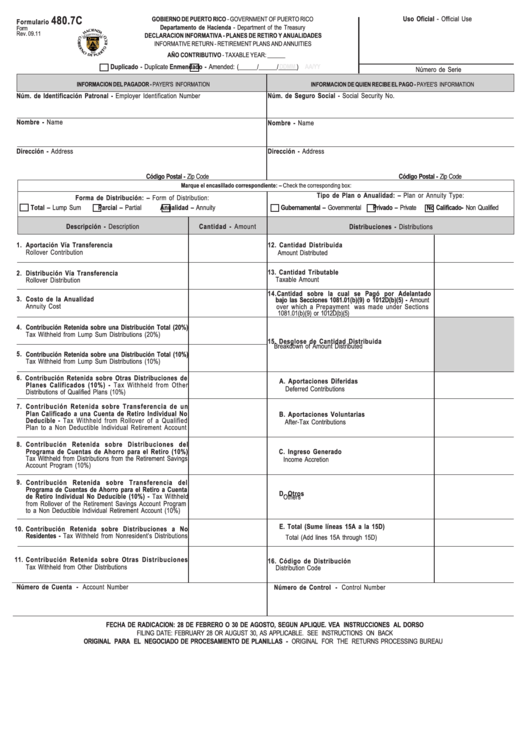

480 Form Puerto Rico - Web 16 rows tax form (click on the link) form name. Web up to $40 cash back form 480 pr is a puerto rico tax form used to report income and withholding taxes for individuals and businesses. 5) se usará para resumir y tramitar los formularios 480.6a, 480.6b, 480.6c, 480.6d, 480.6g, 480.6sp, 480.7, 480.7a, 480.7b, 480.7c,. Go digital and save time with signnow, the best solution. An edocument can be considered legally binding. Web formulario 480.7c form rev. Web form 480.7c must be prepared for each participant or beneficiary of a retirement plan or annuity who, during tax year 2018, received a distribution of income. Web government of puerto rico department of the treasury receipt no. Get ready for tax season deadlines by completing any required tax forms today. Web esta declaración (formulario 480.

Web formulario 480.7c form rev. Web up to $40 cash back form 480 pr is a puerto rico tax form used to report income and withholding taxes for individuals and businesses. Get ready for tax season deadlines by completing any required tax forms today. Web form 480.7c must be prepared for each participant or beneficiary of a retirement plan or annuity who, during tax year 2018, received a distribution of income. Printing and scanning is no longer the best way to manage documents. Web the form 480 puerto rico isn’t an exception. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier for services, distributions, among others,. Easily fill out pdf blank, edit, and sign them. Web residents of puerto rico who are not required to file a u.s.

Get ready for tax season deadlines by completing any required tax forms today. Puerto rico's residents would be very happy to have reform, repeal or exemption. 06.19 20__ 20__ date incorporated or. Ad the jones act places a huge economic burden on puerto rico, and the whole u.s. Find form 480 puerto rico and then click get form to get started. Web form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier for services, distributions, among others,. Web video instructions and help with filling out and completing planillas 2022. Save or instantly send your ready documents. Complete, edit or print tax forms instantly. Web formulario 480.7c form rev.

Puerto Rico Internal Revenue Code bastilledesign

Ad the jones act places a huge economic burden on puerto rico, and the whole u.s. Web esta declaración (formulario 480. Get ready for tax season deadlines by completing any required tax forms today. Web government of puerto rico department of the treasury receipt no. Experience the best way to prepare your puerto rico form 480 20 instructions online in.

Form 480.7c Informative Return Retirement Plans And Annuities

Web government of puerto rico department of the treasury receipt no. Working with it using digital tools is different from doing this in the physical world. Web formulario 480.7c form rev. Web form 480.7c must be prepared for each participant or beneficiary of a retirement plan or annuity who, during tax year 2018, received a distribution of income. Get ready.

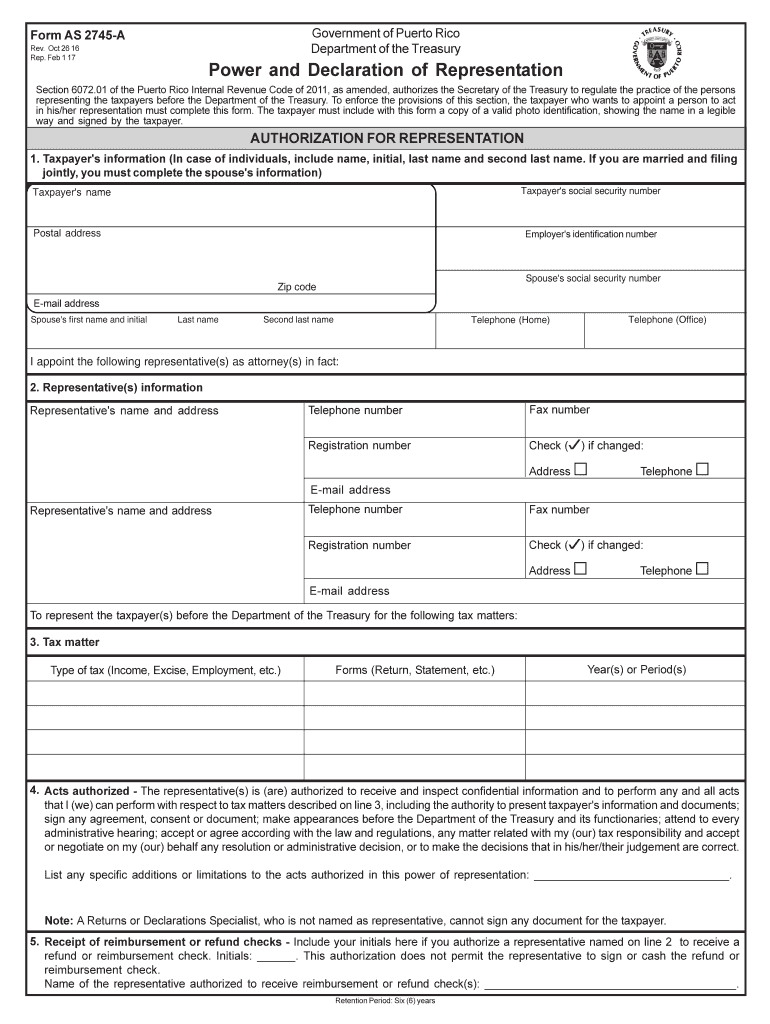

20172021 Form PR AS 2745A Fill Online, Printable, Fillable, Blank

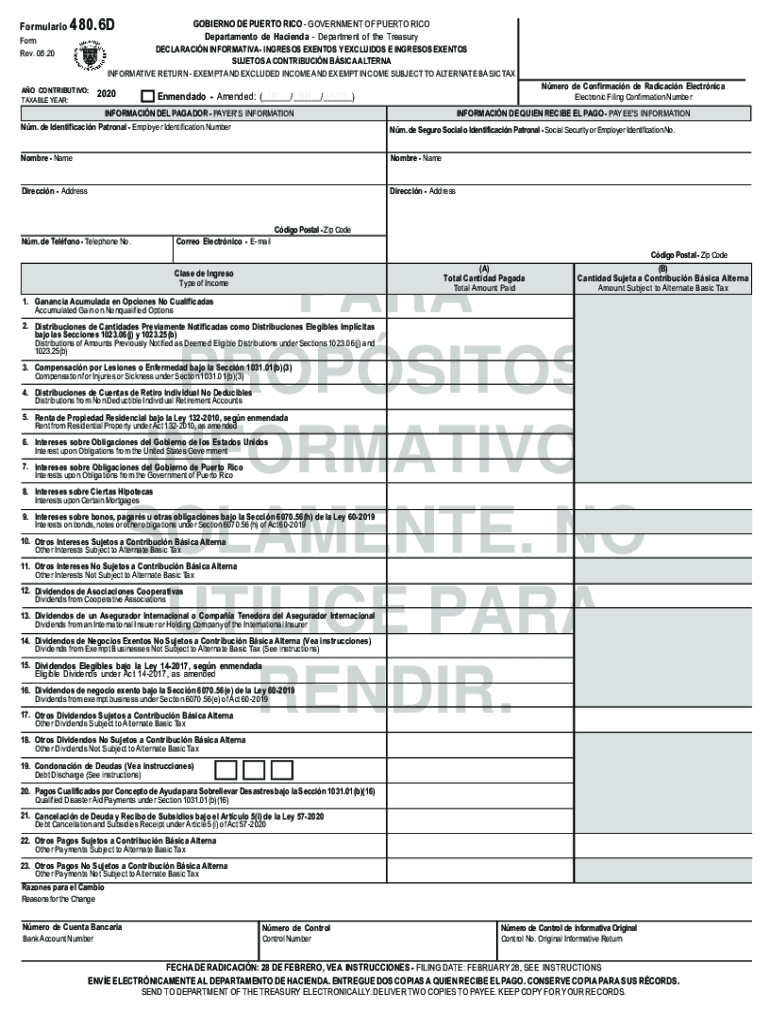

The forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. There are two separate series 480 forms that wealthfront generates for clients who reside in puerto rico: Web video instructions and help with filling out and completing planillas 2022. Go digital and save time with signnow, the best solution. Web up to $40 cash back form.

Form 480 6d puerto rico Fill out & sign online DocHub

Web residents of puerto rico who are not required to file a u.s. Web handy tips for filling out puerto rico 480 form online. Save or instantly send your ready documents. 5) se usará para resumir y tramitar los formularios 480.6a, 480.6b, 480.6c, 480.6d, 480.6g, 480.6sp, 480.7, 480.7a, 480.7b, 480.7c,. Web the form 480 puerto rico isn’t an exception.

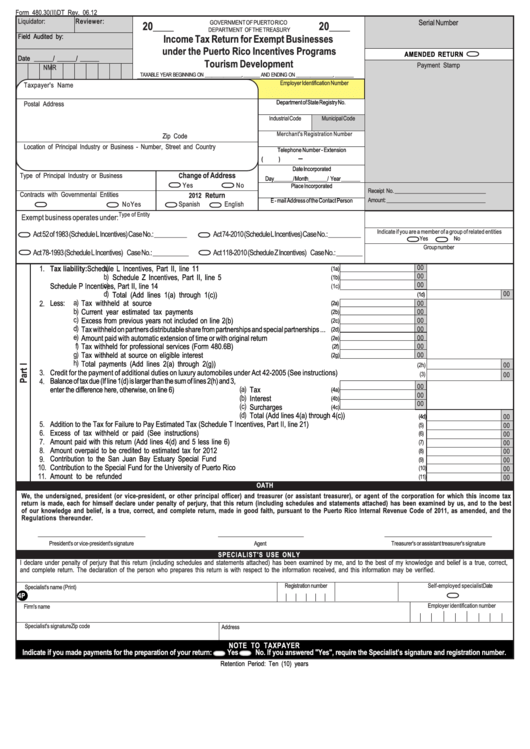

Form 480.30(Ii)dt Tax Return For Exempt Businesses Under The

Web handy tips for filling out puerto rico 480 form online. Web up to $40 cash back form 480 pr is a puerto rico tax form used to report income and withholding taxes for individuals and businesses. Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Get ready for.

2016 Form PR 480.30(II) Fill Online, Printable, Fillable, Blank pdfFiller

Save or instantly send your ready documents. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Easily fill out pdf blank, edit, and sign them. Web handy tips for filling out puerto rico 480 form online. Web the best way to modify and esign form 480 puerto rico without breaking a sweat.

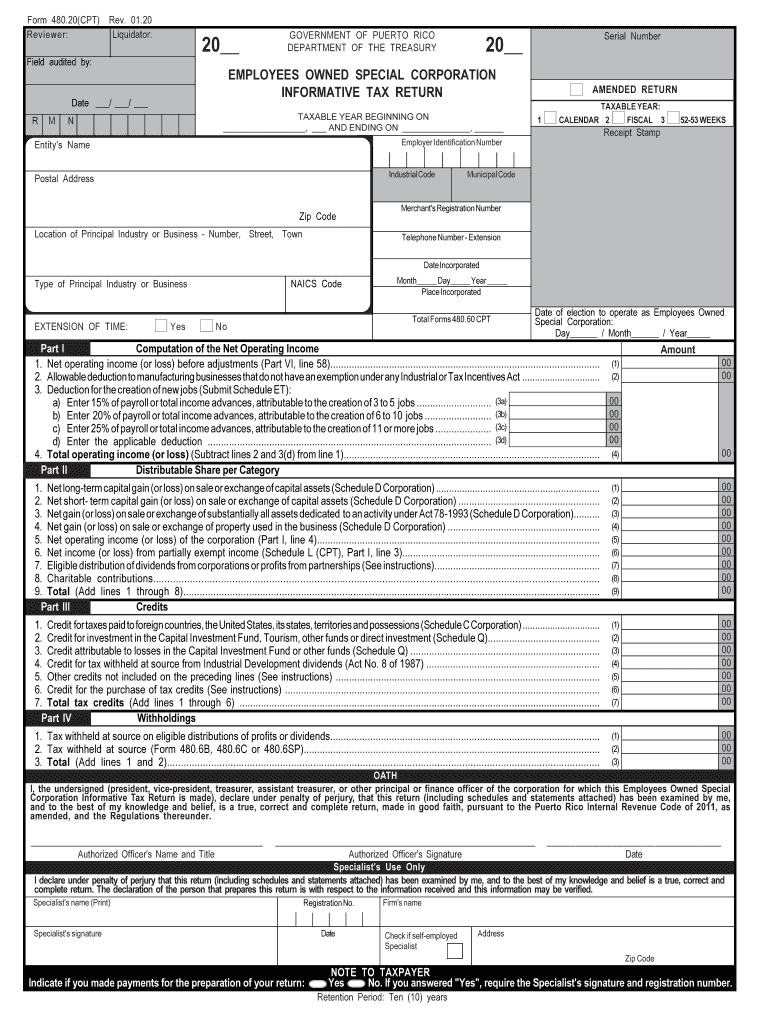

480 20 CPT Rev 01 20 480 20 CPT Rev 01 20 Fill Out and Sign Printable

Go digital and save time with signnow, the best solution. It covers investment income that has been subject to puerto rico source withholding. Sign it in a few clicks draw your signature, type it,. Web residents of puerto rico who are not required to file a u.s. Web handy tips for filling out puerto rico 480 form online.

Puerto Rico Corporation Tax Return Fill Out and Sign Printable

Web residents of puerto rico who are not required to file a u.s. Experience the best way to prepare your puerto rico form 480 20 instructions online in a matter of. Web the best way to modify and esign form 480 puerto rico without breaking a sweat. Web the form 480 puerto rico isn’t an exception. There are two separate.

Form 480 Puerto Rico Fill Out and Sign Printable PDF Template signNow

Web the best way to modify and esign form 480 puerto rico without breaking a sweat. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web form 480.7c must be prepared for each participant or beneficiary of a retirement plan or annuity who,.

2012 Form PR 480.20 Fill Online, Printable, Fillable, Blank pdfFiller

An edocument can be considered legally binding. Web video instructions and help with filling out and completing planillas 2022. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

To Fill Out Form 480 Pr, You Will Need To.

An edocument can be considered legally binding. It covers investment income that has been subject to puerto rico source withholding. Web the best way to modify and esign form 480 puerto rico without breaking a sweat. Web form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier for services, distributions, among others,.

Printing And Scanning Is No Longer The Best Way To Manage Documents.

The forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. Web form 480.7c must be prepared for each participant or beneficiary of a retirement plan or annuity who, during tax year 2018, received a distribution of income. Get ready for tax season deadlines by completing any required tax forms today. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more.

Save Or Instantly Send Your Ready Documents.

5) se usará para resumir y tramitar los formularios 480.6a, 480.6b, 480.6c, 480.6d, 480.6g, 480.6sp, 480.7, 480.7a, 480.7b, 480.7c,. Puerto rico's residents would be very happy to have reform, repeal or exemption. Web esta declaración (formulario 480. Web video instructions and help with filling out and completing planillas 2022.

There Are Two Separate Series 480 Forms That Wealthfront Generates For Clients Who Reside In Puerto Rico:

Easily fill out pdf blank, edit, and sign them. 06.19 20__ 20__ date incorporated or. Web the form 480 puerto rico isn’t an exception. Web up to $40 cash back form 480 pr is a puerto rico tax form used to report income and withholding taxes for individuals and businesses.