4972 Tax Form

4972 Tax Form - Current revision form 4972 pdf recent developments none at this time. Web what is irs form 4972: 2020 tax computation schedule for line 19 and line 22 line 4: Web to calculate the tax on this, john would use irs form 4972. Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. See capital gain election, later. Multiply line 17 by 10%.21. Other items you may find useful all form 4972 revisions John would first enter his total distribution amount ($200,000) on the form. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill.

2020 tax computation schedule for line 19 and line 22 line 4: Web to calculate the tax on this, john would use irs form 4972. The biggest requirement is that you have to be born before january 2, 1936. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. Multiply line 17 by 10%.21. See capital gain election, later. Current revision form 4972 pdf recent developments none at this time. Web what is irs form 4972: John would first enter his total distribution amount ($200,000) on the form. Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements.

Web to calculate the tax on this, john would use irs form 4972. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. Web what is irs form 4972: See capital gain election, later. 2020 tax computation schedule for line 19 and line 22 line 4: Current revision form 4972 pdf recent developments none at this time. The biggest requirement is that you have to be born before january 2, 1936. Other items you may find useful all form 4972 revisions John would first enter his total distribution amount ($200,000) on the form.

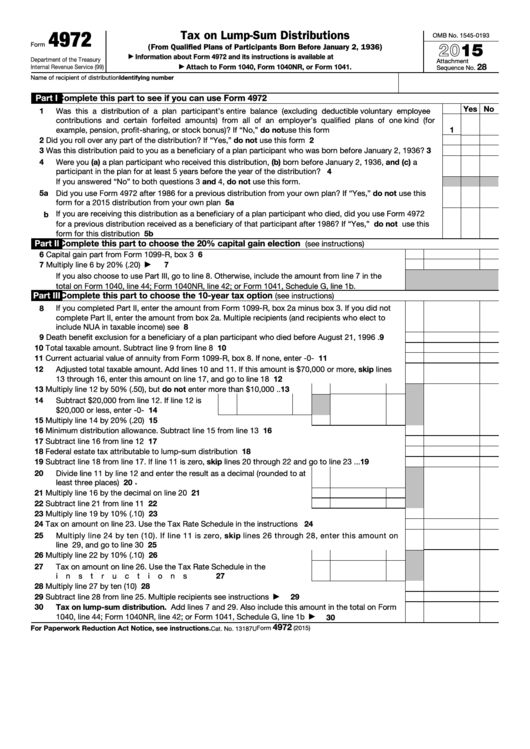

Fillable Form 4972 Tax On LumpSum Distributions 2015 printable pdf

Multiply line 17 by 10%.21. John would first enter his total distribution amount ($200,000) on the form. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. The biggest requirement is that you have to be born before january 2, 1936. Web however, irs form 4972 allows you to claim preferential tax.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. Web to calculate the tax on this, john would use irs form 4972. Current revision form 4972 pdf recent developments none at this time. Other items you may find useful all form 4972 revisions John would first enter his total distribution amount.

4972K Kentucky Tax on Lump Sum Distribution Form 42A740S21

Other items you may find useful all form 4972 revisions Multiply line 17 by 10%.21. Current revision form 4972 pdf recent developments none at this time. The biggest requirement is that you have to be born before january 2, 1936. 2020 tax computation schedule for line 19 and line 22 line 4:

Tax Reporting For Stock Compensation Understanding Form W2, Form 3922

Other items you may find useful all form 4972 revisions Current revision form 4972 pdf recent developments none at this time. John would first enter his total distribution amount ($200,000) on the form. Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. 9 minutes normally, a lump sum distribution.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

The biggest requirement is that you have to be born before january 2, 1936. John would first enter his total distribution amount ($200,000) on the form. Web what is irs form 4972: Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. Current revision form 4972 pdf recent developments none.

Form 4972 Turbotax Fill Out and Sign Printable PDF Template signNow

See capital gain election, later. 2020 tax computation schedule for line 19 and line 22 line 4: Web to calculate the tax on this, john would use irs form 4972. Current revision form 4972 pdf recent developments none at this time. Other items you may find useful all form 4972 revisions

Documents to Bring To Tax Preparer Tax Documents Checklist

Other items you may find useful all form 4972 revisions 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. Current revision form 4972 pdf recent developments none at this time. 2020 tax computation schedule for line 19 and line 22 line 4: The biggest requirement is that you have to be.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. John would first enter his total distribution amount ($200,000) on the form. Multiply line 17 by 10%.21. Other items you may find.

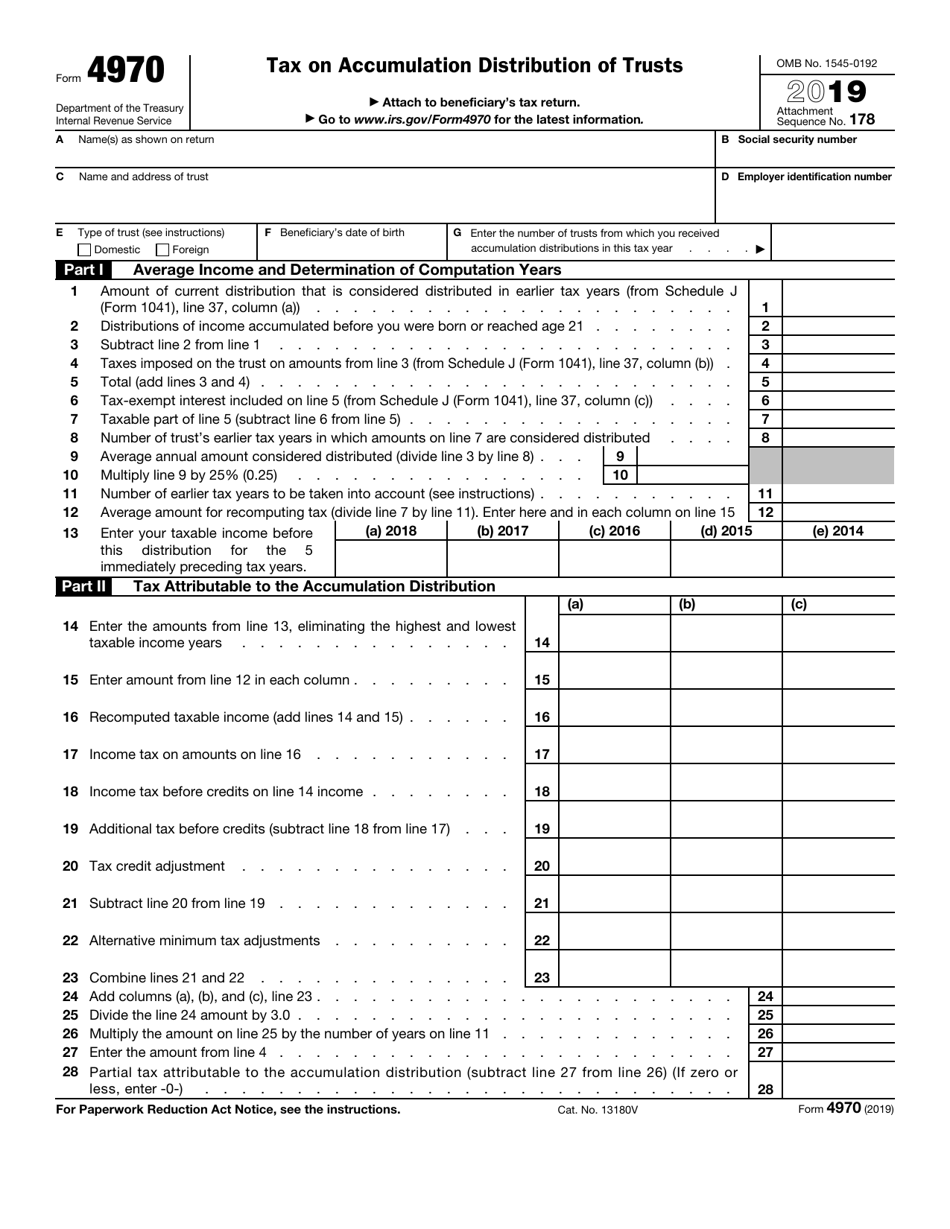

IRS Form 4970 Download Fillable PDF or Fill Online Tax on Accumulation

Multiply line 17 by 10%.21. Other items you may find useful all form 4972 revisions The biggest requirement is that you have to be born before january 2, 1936. 2020 tax computation schedule for line 19 and line 22 line 4: Web what is irs form 4972:

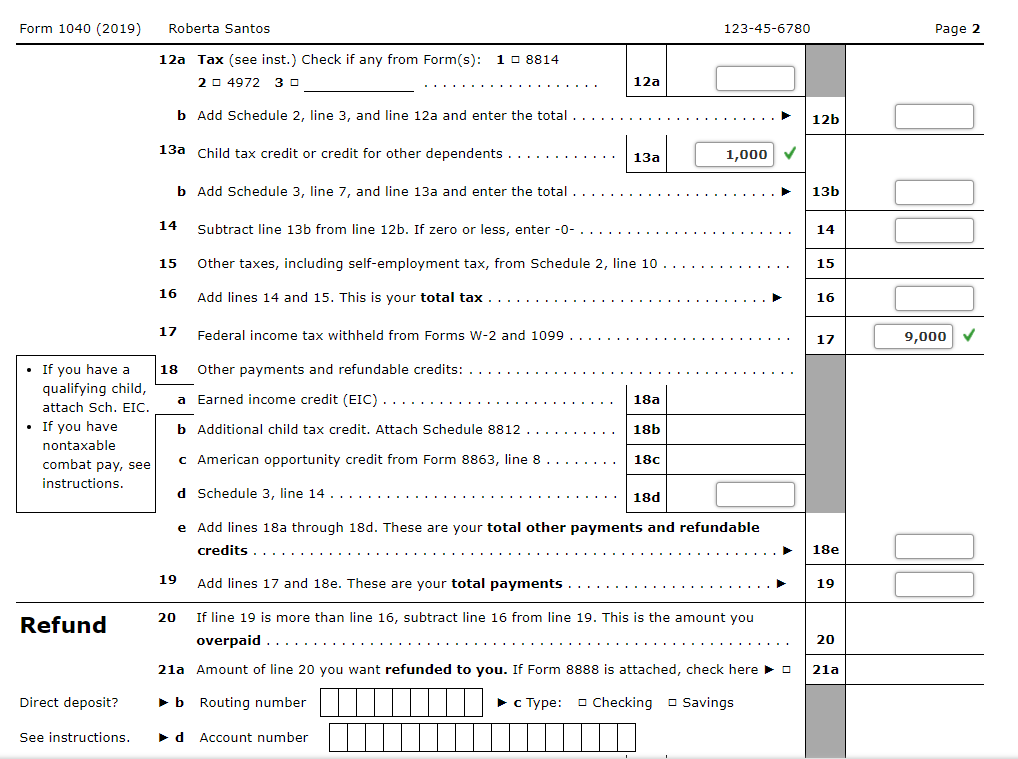

Solved Note This problem is for the 2019 tax year. Roberta

John would first enter his total distribution amount ($200,000) on the form. The biggest requirement is that you have to be born before january 2, 1936. 9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. Current revision form 4972 pdf recent developments none at this time. Web to calculate the tax.

Web To Calculate The Tax On This, John Would Use Irs Form 4972.

9 minutes normally, a lump sum distribution from qualified retirement plans can result in a huge tax bill. Current revision form 4972 pdf recent developments none at this time. See capital gain election, later. Web however, irs form 4972 allows you to claim preferential tax treatment if you meet a series of special requirements.

Web What Is Irs Form 4972:

Multiply line 17 by 10%.21. Other items you may find useful all form 4972 revisions The biggest requirement is that you have to be born before january 2, 1936. John would first enter his total distribution amount ($200,000) on the form.