540 2Ez Form

540 2Ez Form - Web handy tips for filling out form 540 2ez online. Web fill out each fillable area. Determine if you qualify to use form 540 2ez. This form is for income earned in tax year 2022, with tax returns due in april. Web things you need to know before you complete. Ensure the information you fill in 540 2ez form with math is updated and correct. Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. Sign it in a few clicks draw your signature, type it,. The form 540 2ez is a tax form that allows taxpayers to claim their dependents. Web the range that includes your income from form 540 2ez, line continued on next page.

Web fill out each fillable area. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. See the table on page 4. (continued) if your income is over $100,000 use form 540, or file online. Ensure the information you fill in 540 2ez form with math is updated and correct. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web things you need to know before you complete. Citizens of the state with moderate incomes and few deductions can save. This form is for income earned in tax year 2022, with tax returns due in april. The form 540 2ez is a tax form that allows taxpayers to claim their dependents.

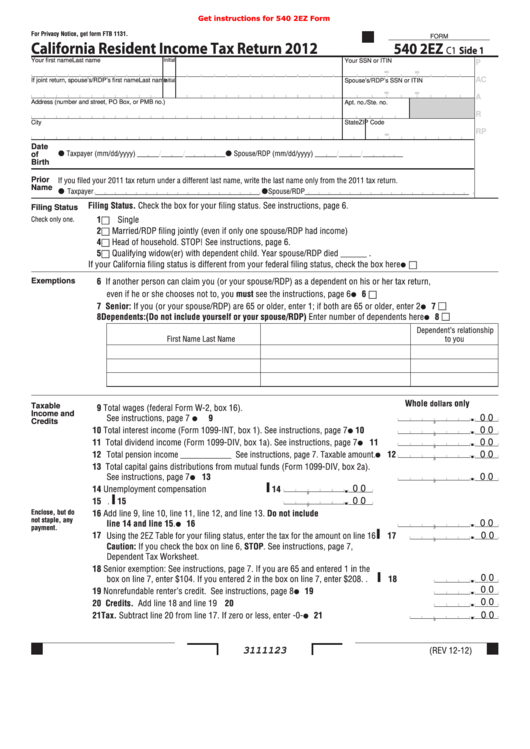

To do this, you'll need the social security number. For privacy notice, get form ftb 1131. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web things you need to know before you complete. This form is for income earned in tax year 2022, with tax returns due in april. Web form 540 2ez booklet 540 es estimated tax for individuals 540 es tax voucher help with california tax laws it’s important to avoid state tax issues and potential financial liability. Web qualifying surviving spouse/rdp with dependent child. The form 540 2ez is a tax form that allows taxpayers to claim their dependents. * california taxable income enter line 19 of 2022 form 540 or form 540nr. (continued) if your income is over $100,000 use form 540, or file online.

2016 california resident tax return form 540 2ez Earned

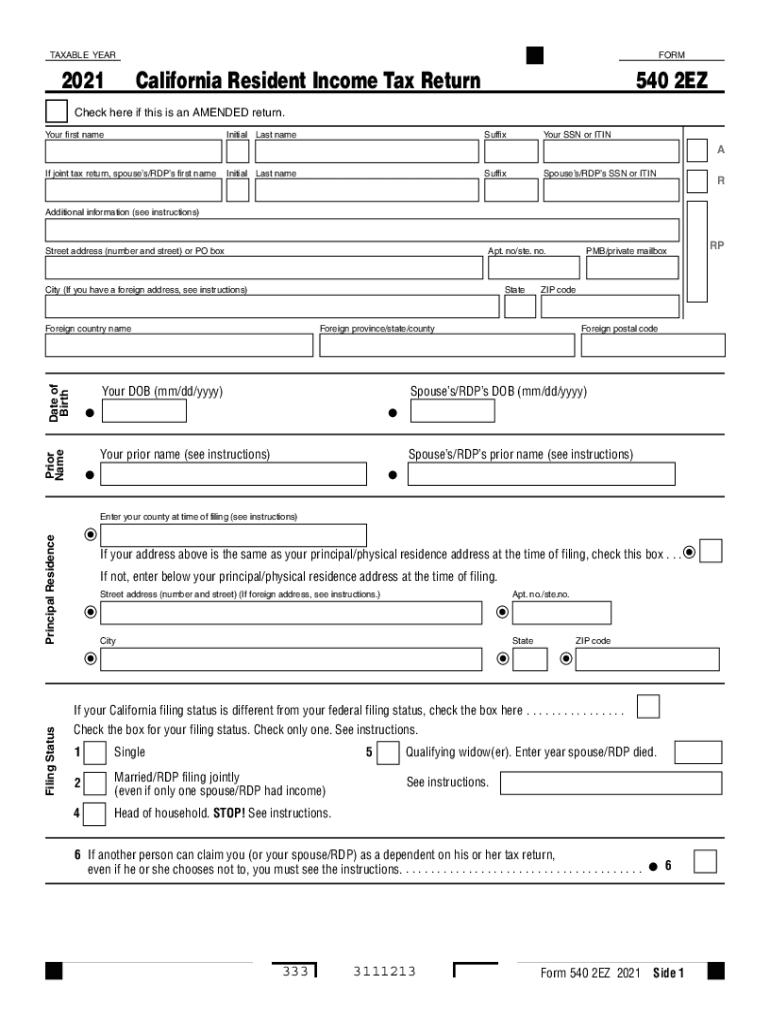

Web qualifying surviving spouse/rdp with dependent child. Web form 540 2ez 2021 333. Sign it in a few clicks draw your signature, type it,. I have been with turbo tax for 8 years. For privacy notice, get form ftb 1131.

20212023 Form CA FTB 540 2EZ Fill Online, Printable, Fillable, Blank

Web 11,930 satisfied customers. This form is for income earned in tax year 2022, with tax returns due in april. Web fill out each fillable area. For privacy notice, get form ftb 1131. Web qualifying surviving spouse/rdp with dependent child.

540 2EZ Form Franchise Tax Board CA.gov Fill out & sign online

This form is for income earned in tax year 2022, with tax returns due in april. (continued) if your income is over $100,000 use form 540, or file online. Web things you need to know before you complete. I have been with turbo tax for 8 years. Web 11,930 satisfied customers.

20202022 Form CA 540 2EZ Tax Booklet Fill Online, Printable, Fillable

Web handy tips for filling out form 540 2ez online. Citizens of the state with moderate incomes and few deductions can save. Web form 540 2ez 2021 333. For privacy notice, get form ftb 1131. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more.

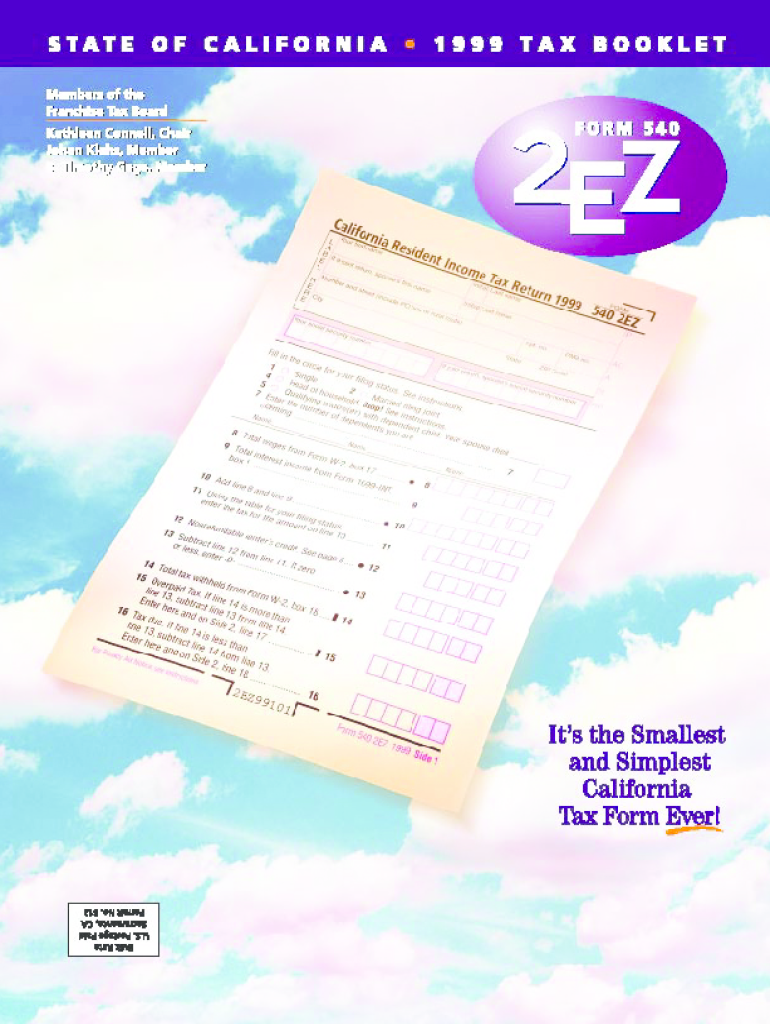

Fillable Online ftb ca 540 2ez 1999 fillable form Fax Email Print

(continued) if your income is over $100,000 use form 540, or file online. Web qualifying surviving spouse/rdp with dependent child. I have been with turbo tax for 8 years. Printing and scanning is no longer the best way to manage documents. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more.

Fillable Form 540 2ez C1 California Resident Tax Return 2012

(continued) if your income is over $100,000 use form 540, or file online. For privacy notice, get form ftb 1131. Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. Add line 29, line 31, line 33, and line 34. Web the range that includes your income from form 540 2ez, line.

2014 Form 540 2Ez California Resident Tax Return Edit, Fill

Recently i attempted to do my fed. For privacy notice, get form ftb 1131. Sign it in a few clicks draw your signature, type it,. * california taxable income enter line 19 of 2022 form 540 or form 540nr. Add the date to the form using the date option.

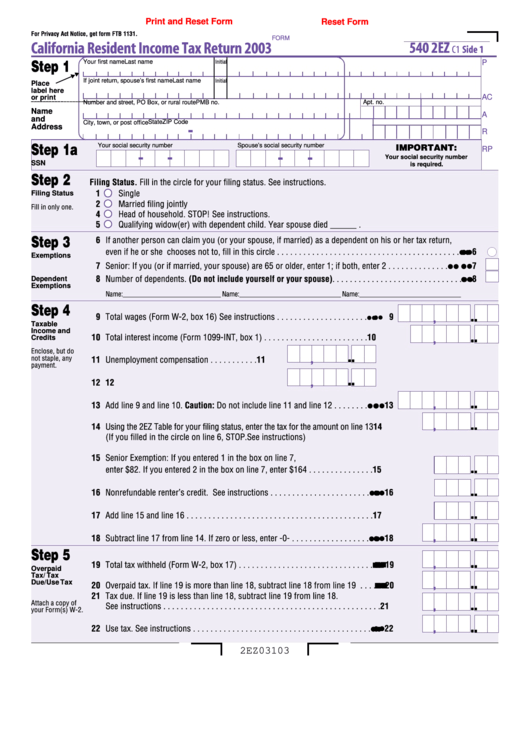

Fillable Form 540 2ez California Resident Tax Return 2003

This form is for income earned in tax year 2022, with tax returns due in april. * california taxable income enter line 19 of 2022 form 540 or form 540nr. Recently i attempted to do my fed. This form is for income earned in tax year 2022, with tax returns due in april. Web things you need to know before.

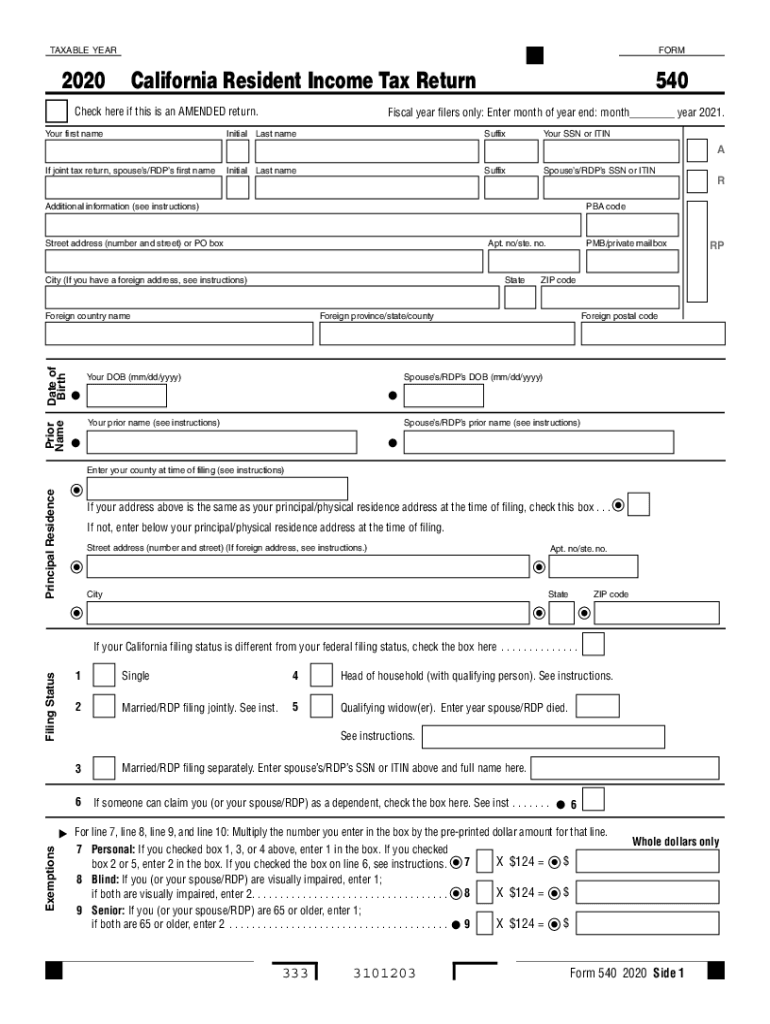

Ca540 Fill Out and Sign Printable PDF Template signNow

Web things you need to know before you complete. I have been with turbo tax for 8 years. Web the range that includes your income from form 540 2ez, line continued on next page. This form is for income earned in tax year 2022, with tax returns due in april. Go digital and save time with signnow, the best solution.

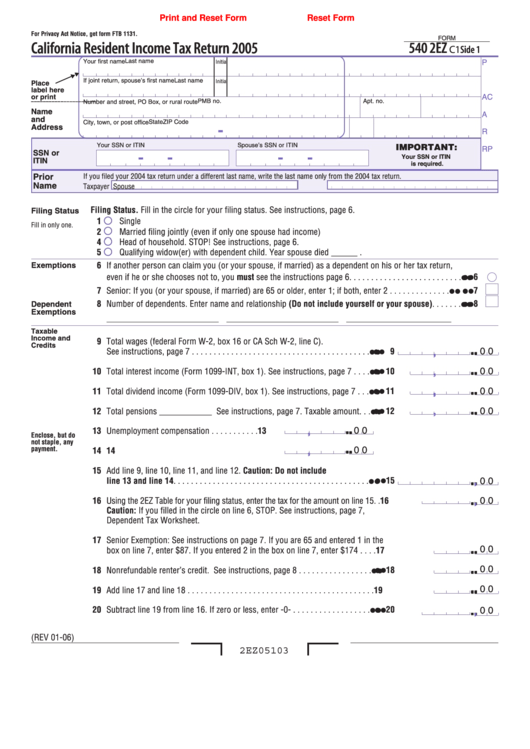

Fillable Form 540 2ez California Resident Tax Return 2005

Printing and scanning is no longer the best way to manage documents. Ensure the information you fill in 540 2ez form with math is updated and correct. Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. Go digital and save time with signnow, the best solution for. I have been with.

To Do This, You'll Need The Social Security Number.

Recently i attempted to do my fed. This form is for income earned in tax year 2022, with tax returns due in april. Go digital and save time with signnow, the best solution for. Web 11,930 satisfied customers.

Web Handy Tips For Filling Out Form 540 2Ez Online.

I have been with turbo tax for 8 years. Web form 540 2ez 2021 333. (continued) if your income is over $100,000 use form 540, or file online. Ensure the information you fill in 540 2ez form with math is updated and correct.

Web The 540 2Ez Is A Simplified California State Tax Form For Residents Who Meet Certain Filing Requirements.

Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Enclose, but do not staple,. Add the date to the form using the date option. I have been with turbo tax for 8 years.

The Form 540 2Ez Is A Tax Form That Allows Taxpayers To Claim Their Dependents.

See the table on page 4. Printing and scanning is no longer the best way to manage documents. * california taxable income enter line 19 of 2022 form 540 or form 540nr. Determine if you qualify to use form 540 2ez.