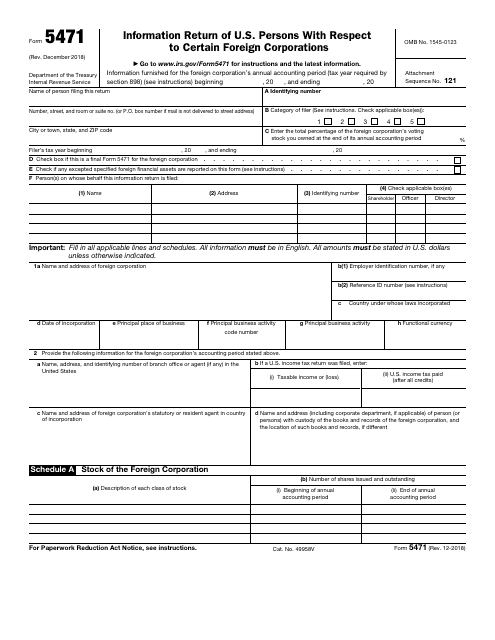

5471 Tax Form

5471 Tax Form - Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Web form 5471 is due with the income tax return of the affected shareholder. Also attach a copy to the entity's. Citizens/u.s residents who are shareholders, officers or directors in certain foreign. For most corporations, that would march 15th or the extended due date. Complete, edit or print tax forms instantly. Persons with respect to certain foreign corporations. Get ready for tax season deadlines by completing any required tax forms today. December 2021) department of the treasury internal revenue service. Web a foreign country or u.s.

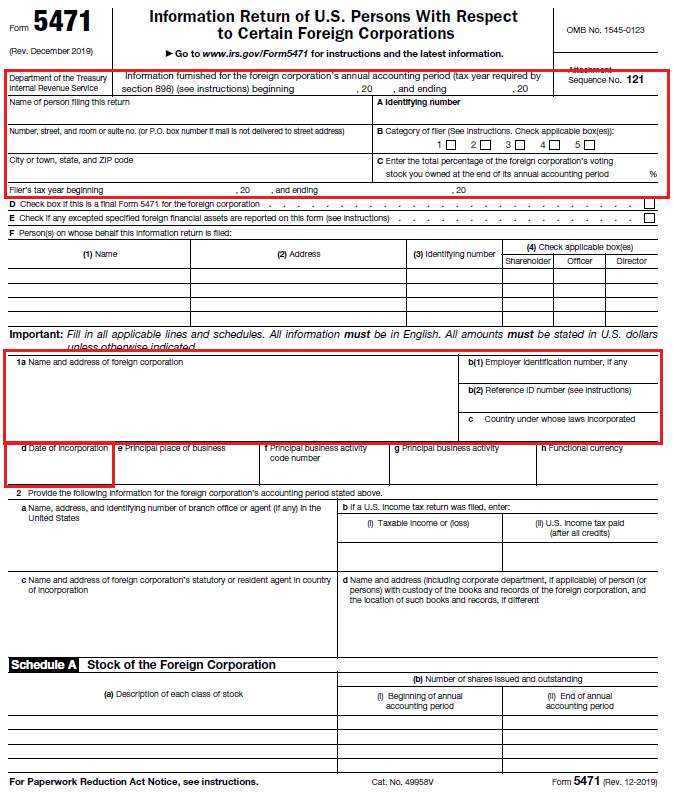

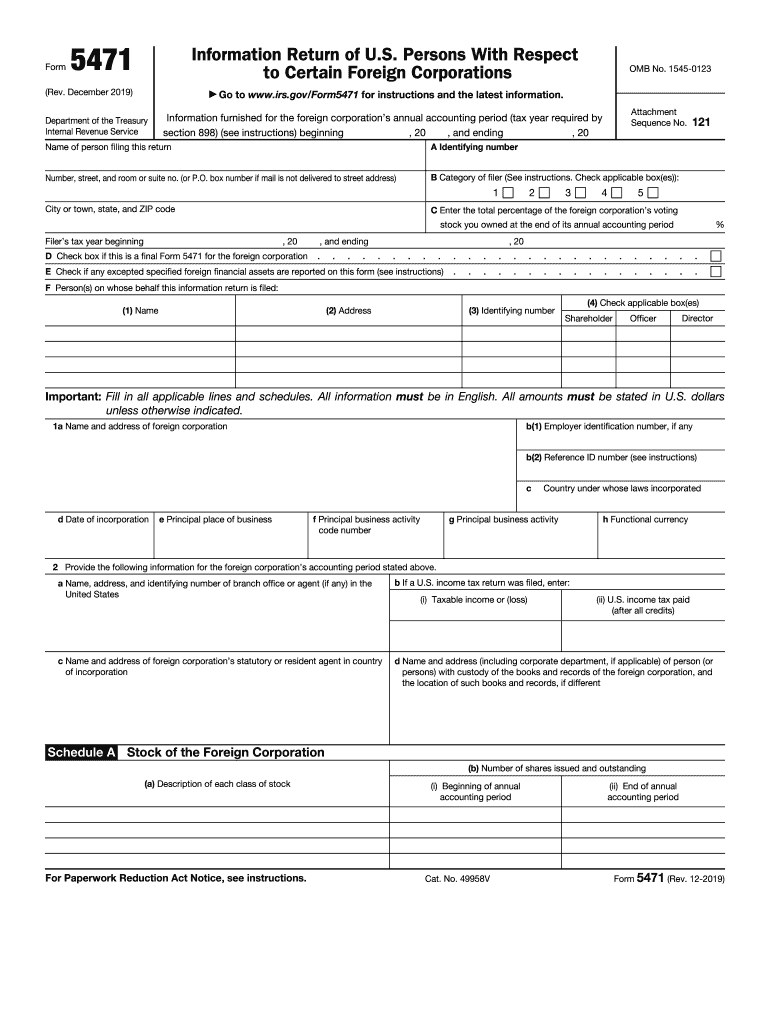

Persons with respect to certain foreign corporations. Web a foreign country or u.s. Ad download or email irs 5471sj & more fillable forms, register and subscribe now! Form 5471, officially called the information return of u.s. Persons with respect to certain foreign corporations. December 2021) department of the treasury internal revenue service. Corporation or a foreign corporation engaged in a u.s. Web the irs tax form 5471 is an information return (not tax return) required for u.s. The december 2021 revision of separate. For most corporations, that would march 15th or the extended due date.

December 2021) department of the treasury internal revenue service. 63rd st.) using cash, check or credit card. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Ad download or email irs 5471sj & more fillable forms, register and subscribe now! Go to irs website and download say 2018 form 5471 or 2017 form 5471. From there open it the irs 5471 with pdfelement. Person filing form 8865, any required statements to qualify for the. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the. Citizens/u.s residents who are shareholders, officers or directors in certain foreign.

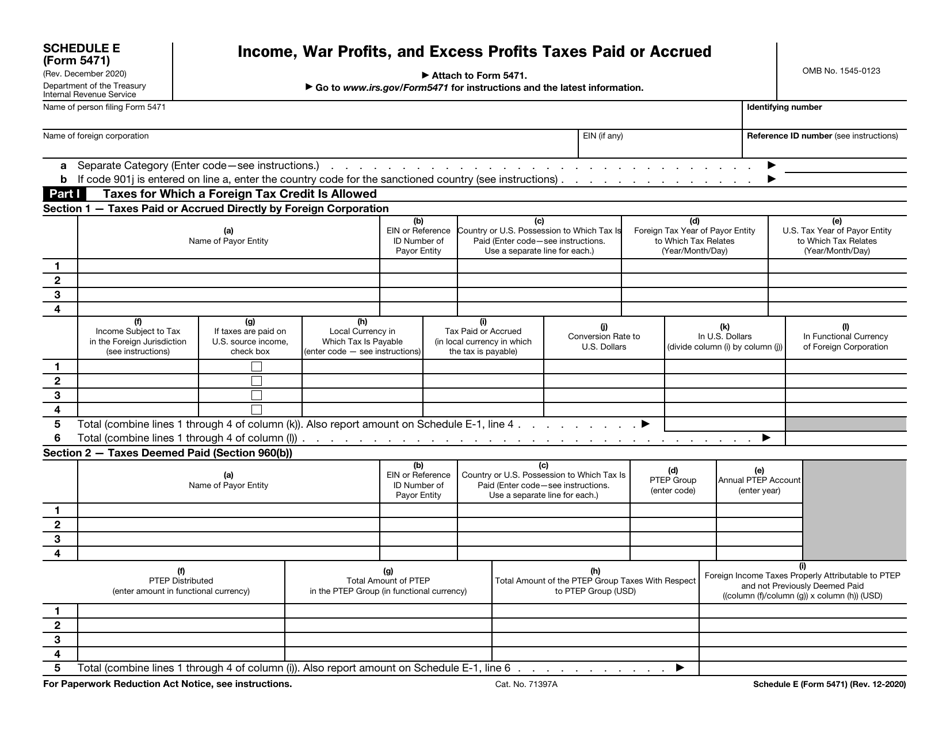

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web form 5471 is due with the income tax return of the affected shareholder. Web form 5471 was significantly revised after the tax cuts and jobs act was enacted in 2017. Web what is form 5471? Web officially known as form 5471, information return of us persons with respect to certain foreign corporations, this form is required along with your.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

It is a required form for taxpayers who are officers,. 12th st.) or at the water services department (4800 e. Web form 5471 is due with the income tax return of the affected shareholder. Person filing form 8865, any required statements to qualify for the. Web instructions for form 5471(rev.

IRS Issues Updated New Form 5471 What's New?

December 2021) department of the treasury internal revenue service. Web what is form 5471? Web the irs tax form 5471 is an information return (not tax return) required for u.s. Web a foreign country or u.s. Persons with respect to certain foreign corporations.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule J SF

Web the irs tax form 5471 is an information return (not tax return) required for u.s. Get ready for tax season deadlines by completing any required tax forms today. Web form 5471 was significantly revised after the tax cuts and jobs act was enacted in 2017. Web a foreign country or u.s. Web a form 5471 is also known as.

What is a Dormant Foreign Corporation?

Complete, edit or print tax forms instantly. Ad download or email irs 5471sj & more fillable forms, register and subscribe now! Form 5471, officially called the information return of u.s. Web the irs tax form 5471 is an information return (not tax return) required for u.s. Web failure to timely file a form 5471 or form 8865 is generally subject.

Substantial Compliance Form 5471 Advanced American Tax

From there open it the irs 5471 with pdfelement. Web instructions for form 5471(rev. Web what is form 5471? Persons with respect to certain foreign corporations, is an information statement. Web officially known as form 5471, information return of us persons with respect to certain foreign corporations, this form is required along with your expat taxes for us citizens.

2019 Form IRS 5471 Fill Online, Printable, Fillable, Blank pdfFiller

Web the irs tax form 5471 is an information return (not tax return) required for u.s. Corporation or a foreign corporation engaged in a u.s. Web form 5471 is due with the income tax return of the affected shareholder. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Complete, edit or print tax forms.

Guide to Form 5471 Schedule E and Schedule H SF Tax Counsel

Persons with respect to certain foreign corporations. Citizens/u.s residents who are shareholders, officers or directors in certain foreign. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web officially known as form 5471, information return of us persons with respect to certain foreign corporations, this form is required along with your expat taxes for.

IRS Form 5471 Download Fillable PDF or Fill Online Information Return

Go to irs website and download say 2018 form 5471 or 2017 form 5471. Web a foreign country or u.s. Ad download or email irs 5471sj & more fillable forms, register and subscribe now! Persons with respect to certain foreign corporations, is an information statement. Person filing form 8865, any required statements to qualify for the.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule P

Get ready for tax season deadlines by completing any required tax forms today. Web form 5471 is due with the income tax return of the affected shareholder. For most corporations, that would march 15th or the extended due date. Person filing form 8865, any required statements to qualify for the. Go to irs website and download say 2018 form 5471.

Person Filing Form 8865, Any Required Statements To Qualify For The.

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; 63rd st.) using cash, check or credit card. Web officially known as form 5471, information return of us persons with respect to certain foreign corporations, this form is required along with your expat taxes for us citizens. Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and.

Form 5471, Officially Called The Information Return Of U.s.

Complete, edit or print tax forms instantly. For most corporations, that would march 15th or the extended due date. Web form 5471 is due with the income tax return of the affected shareholder. Web failure to timely file a form 5471 or form 8865 is generally subject to a $10,000 penalty per information return, plus an additional $10,000 for each month the.

December 2021) Department Of The Treasury Internal Revenue Service.

The december 2021 revision of separate. Citizens/u.s residents who are shareholders, officers or directors in certain foreign. Also attach a copy to the entity's. Click on open file and select.

Web The Irs Tax Form 5471 Is An Information Return (Not Tax Return) Required For U.s.

Web form 5471 was significantly revised after the tax cuts and jobs act was enacted in 2017. It is a required form for taxpayers who are officers,. Web instructions for form 5471(rev. And we've made yearly updates based on regulatory guidance that's been issued since.