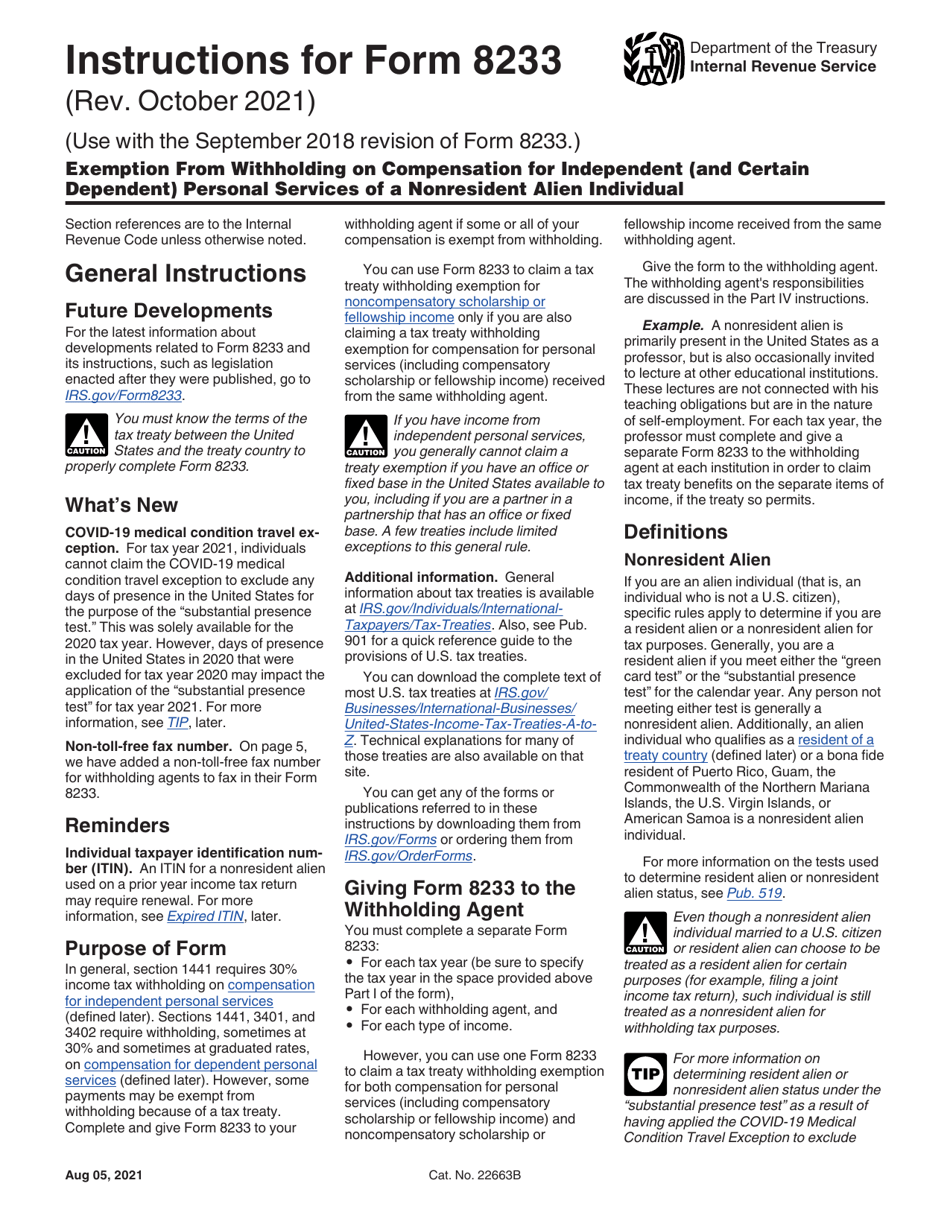

8233 Form Instructions

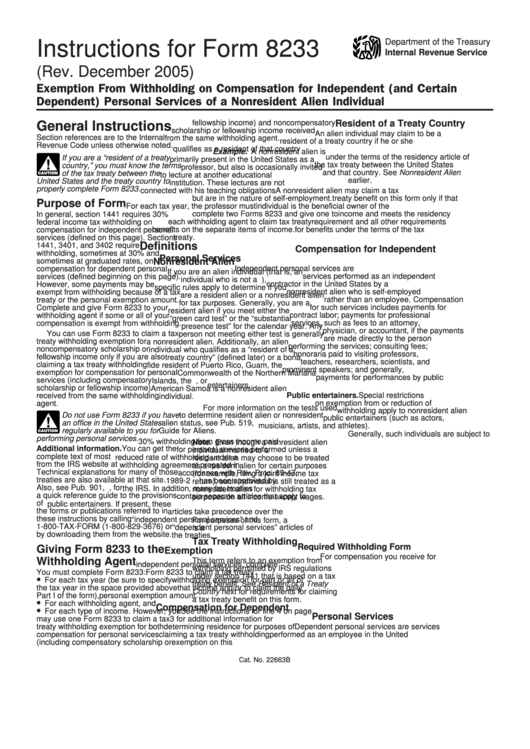

8233 Form Instructions - June 2011) department of the treasury internal revenue service (use with the march 2009 revision of form. December 2001) exemption from withholding on compensation for independent (and. This irm is intended for customer accounts services issues involving form 8233,. Web instructions for form 8233 (rev. If you’ve hired an nra who would like to claim a tax treaty exemption, they must fill out form 8233. The form 8233 must report the payee’s taxpayer identification number (tin) , generally the. Web instructions for form 8233 department of the treasury internal revenue service (rev. Web if form 8023 is filed to make a section 338 election for a target that is or was a controlled foreign corporation (cfc), enter in section c the name of the u.s. Federal 8233 form attachments for. If you are a beneficial owner who is.

June 2011) department of the treasury internal revenue service (use with the march 2009 revision of form. This form is used if an employee is a resident of another. October 2021) department of the treasury internal revenue service (use with the september 2018 revision of form 8233.) exemption. Get ready for tax season deadlines by completing any required tax forms today. Web provide the payor with a properly completed form 8233 for the tax year. Web if form 8023 is filed to make a section 338 election for a target that is or was a controlled foreign corporation (cfc), enter in section c the name of the u.s. This irm is intended for customer accounts services issues involving form 8233,. Federal 8233 form attachments for. Web instructions for form 8233 (rev. Web department of the treasury internal revenue service instructions for form 8233 cat.

22663b paperwork reduction act notice.— we ask for the information on this form to. Web instructions for completing form 8233 *** important reminder *** form 8233 expires every year on december 31. Web instructions for form 8233 (rev. June 2011) department of the treasury internal revenue service (use with the march 2009 revision of form. December 2001) exemption from withholding on compensation for independent (and. The corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service. Web provide the payor with a properly completed form 8233 for the tax year. Ad edit, sign and print tax forms on any device with uslegalforms. This form is used if an employee is a resident of another. This irm is intended for customer accounts services issues involving form 8233,.

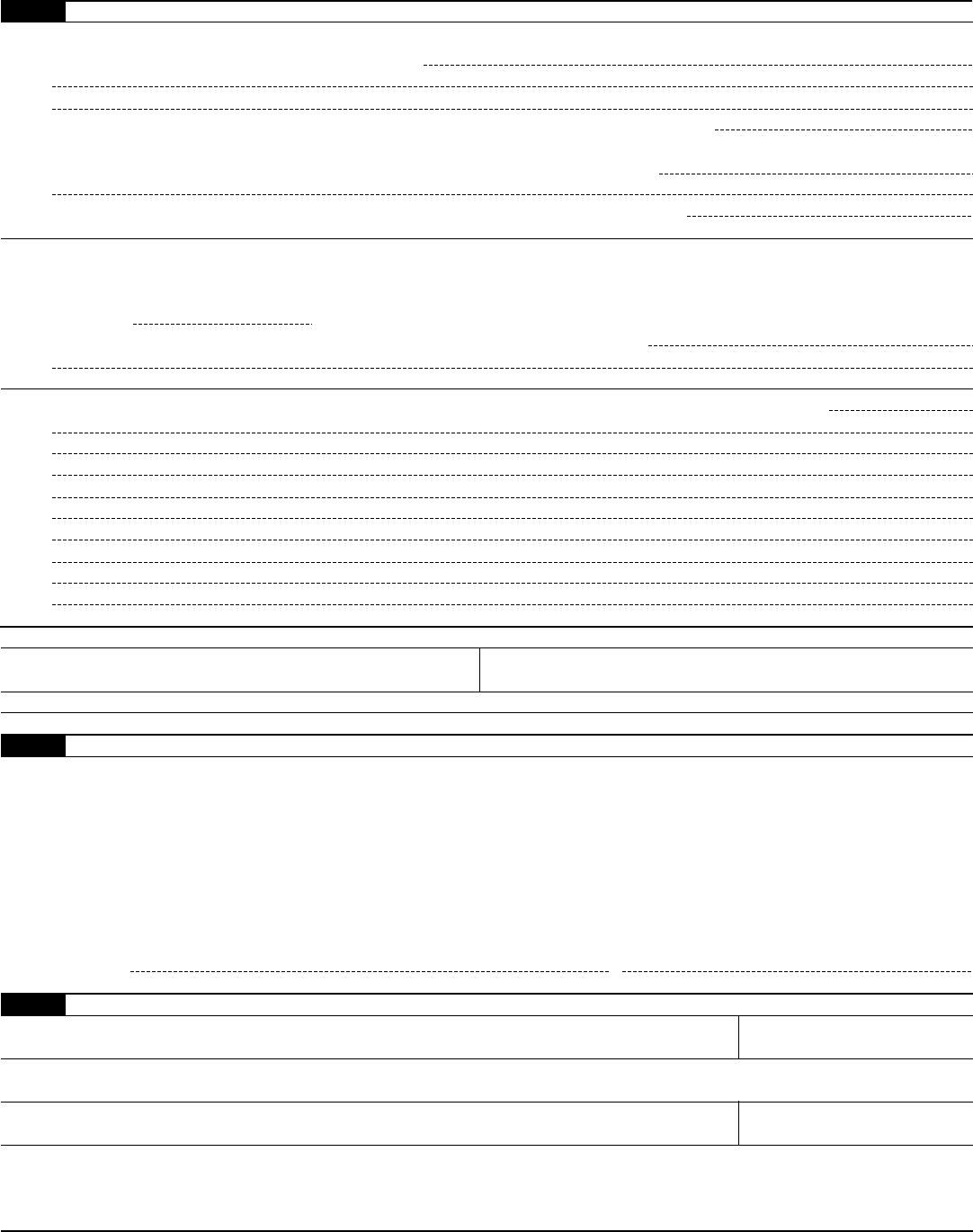

16 Form 8233 Templates free to download in PDF

Web department of the treasury internal revenue service instructions for form 8233 cat. Web instructions for form 8233 (rev. This form is used if an employee is a resident of another. This irm is intended for customer accounts services issues involving form 8233,. Download form | view sample.

Form 8233 Edit, Fill, Sign Online Handypdf

June 2011) department of the treasury internal revenue service (use with the march 2009 revision of form. This form is used if an employee is a resident of another. Web instructions for form 8233 department of the treasury internal revenue service (rev. A new form 8233 must be completed and. This irm is intended for customer accounts services issues involving.

irs 8233 form Fill out & sign online DocHub

Download form | view sample. Web instructions for completing form 8233 *** important reminder *** form 8233 expires every year on december 31. Web federal 8233 forms, attachments and instructions. Web instructions for form 8233 instructions for form 8233 (rev. 11/20/2020 exemption from withholding irs 8233 form

Instructions For Form 8233 printable pdf download

October 1996) exemption from withhholding on compensation for independent (and certain dependent) personal services of a. Web instructions for form 8233 department of the treasury internal revenue service (rev. A new form 8233 must be completed and. Web instructions for form 8233 (rev. Federal 8233 form attachments for.

IRS FORM 8233 Non Resident Alien EXEMPTIONS YouTube

If you are a beneficial owner who is. Web department of the treasury internal revenue service instructions for form 8233 cat. October 2021) department of the treasury internal revenue service (use with the september 2018 revision of form 8233.) exemption. Ad edit, sign and print tax forms on any device with uslegalforms. If you’ve hired an nra who would like.

irs form 8233 printable pdf file enter the appropriate calendar year

If you’ve hired an nra who would like to claim a tax treaty exemption, they must fill out form 8233. June 2011) department of the treasury internal revenue service (use with the march 2009 revision of form. The form 8233 must report the payee’s taxpayer identification number (tin) , generally the. If you are a beneficial owner who is. Ad.

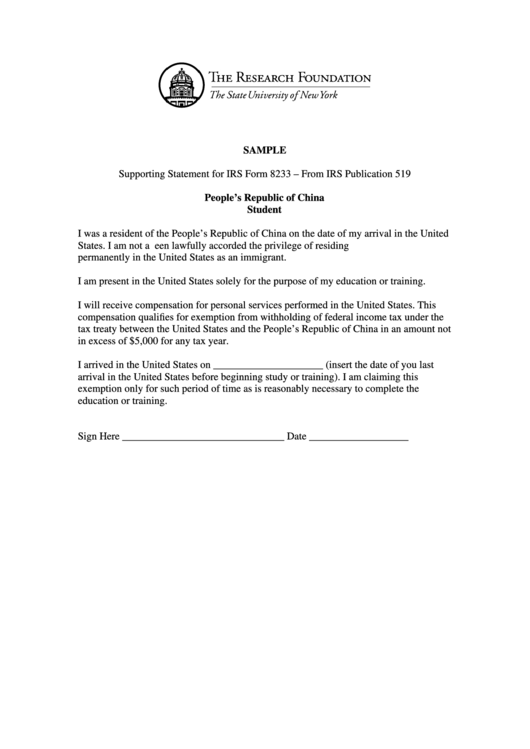

Forms Near Eastern Studies Program

October 1996) exemption from withhholding on compensation for independent (and certain dependent) personal services of a. Web what do employers need to know about form 8233? Web instructions for form 8233 (rev. The corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service. Federal 8233 form attachments for.

Form 8233 Edit, Fill, Sign Online Handypdf

Download form | view sample. Get ready for tax season deadlines by completing any required tax forms today. 22663b paperwork reduction act notice.— we ask for the information on this form to. Web if form 8023 is filed to make a section 338 election for a target that is or was a controlled foreign corporation (cfc), enter in section c.

Download Instructions for IRS Form 8233 Exemption From Withholding on

11/20/2020 exemption from withholding irs 8233 form Receiving compensation for dependent personal services performed in the united states and you. Web federal 8233 forms, attachments and instructions. Web instructions for form 8233 (rev. Web you can use form 8233 to claim a taxtreaty withholding exemption for noncompensatory scholarship or fellowship income only if you are alsoclaiming a tax treaty.

W8BEN Form and Instructions Irs Tax Forms Withholding Tax

Download form | view sample. October 2021) department of the treasury internal revenue service (use with the september 2018 revision of form 8233.) exemption. 22663b paperwork reduction act notice.— we ask for the information on this form to. Get ready for tax season deadlines by completing any required tax forms today. October 1996) exemption from withhholding on compensation for independent.

June 2011) Department Of The Treasury Internal Revenue Service (Use With The March 2009 Revision Of Form.

Receiving compensation for dependent personal services performed in the united states and you. Federal 8233 form attachments for students. The corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service. This form is used if an employee is a resident of another.

Web Department Of The Treasury Internal Revenue Service Instructions For Form 8233 Cat.

Web instructions for form 8233 (rev. This irm is intended for customer accounts services issues involving form 8233,. Web you can use form 8233 to claim a taxtreaty withholding exemption for noncompensatory scholarship or fellowship income only if you are alsoclaiming a tax treaty. Web provide the payor with a properly completed form 8233 for the tax year.

Web What Do Employers Need To Know About Form 8233?

Web if form 8023 is filed to make a section 338 election for a target that is or was a controlled foreign corporation (cfc), enter in section c the name of the u.s. December 2001) exemption from withholding on compensation for independent (and. Web instructions for completing form 8233 *** important reminder *** form 8233 expires every year on december 31. October 2021) department of the treasury internal revenue service (use with the september 2018 revision of form 8233.) exemption.

11/20/2020 Exemption From Withholding Irs 8233 Form

The form 8233 must report the payee’s taxpayer identification number (tin) , generally the. If you are a beneficial owner who is. Ad edit, sign and print tax forms on any device with uslegalforms. A new form 8233 must be completed and.