8812 Form 2020

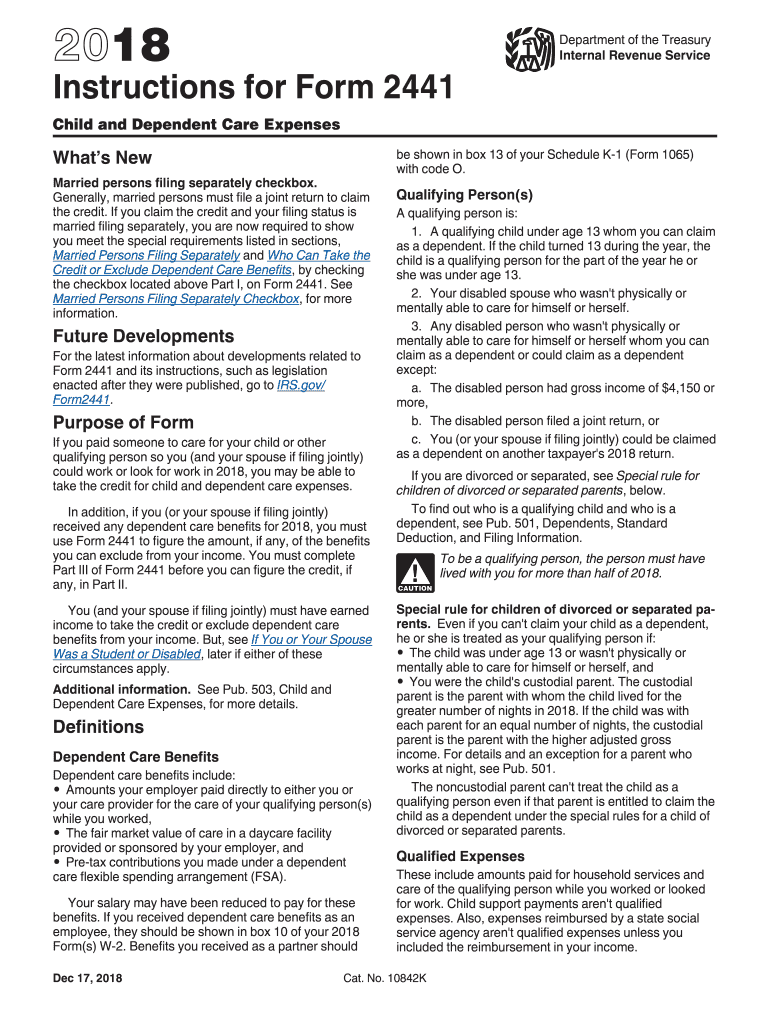

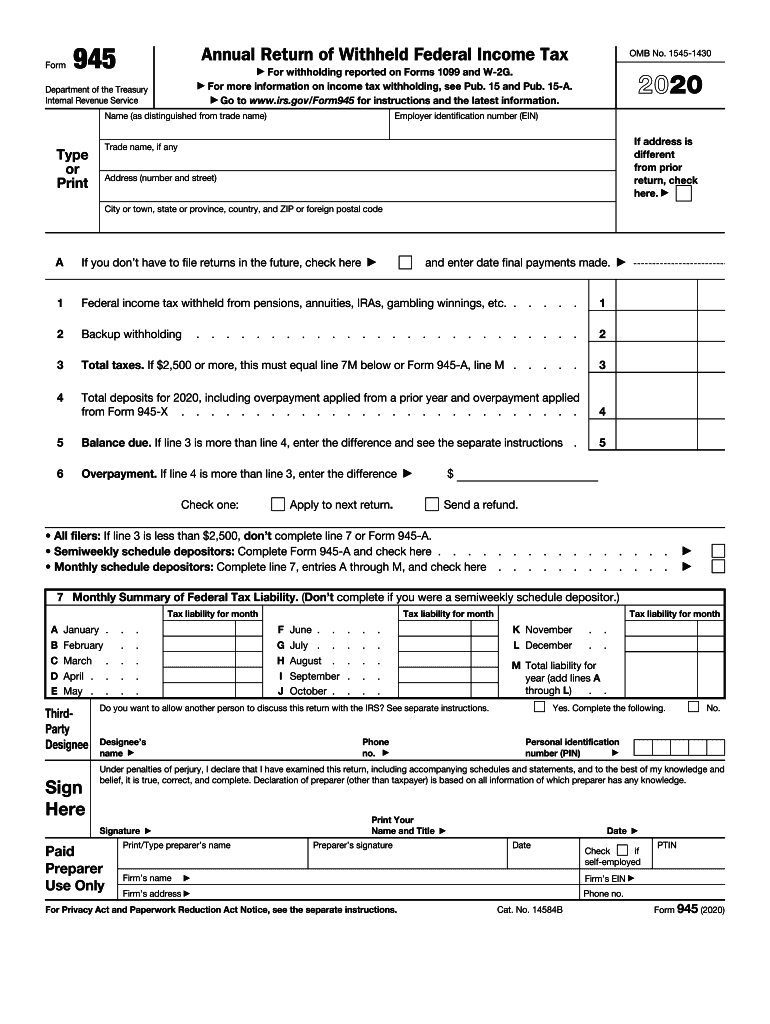

8812 Form 2020 - Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social. The ctc and odc are. Lacerte will automatically generate schedule 8812 to compute the additional child tax credit (ctc) based on your entries. I discuss the 3,600 and 3,000 child tax credit amounts. To preview your 1040 before filing: Irs 1040 schedule 8812 instructions 2020 get irs 1040 schedule 8812 instructions. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Web we overhauled the schedule 8812 of the form 1040 in 2021 to implement these changes under the american rescue plan. Web you'll use form 8812 to calculate your additional child tax credit.

Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. The ctc and odc are. Web enter the information for the tax return. I discuss the 3,600 and 3,000 child tax credit amounts. Web tax forms for irs and state income tax returns. Get ready for tax season deadlines by completing any required tax forms today. A child must be under age 17 at the end of 2022 to be considered a qualifying child. Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social. The ctc and odc are.

Complete, edit or print tax forms instantly. For tax years 2020 and prior: Web tax forms for irs and state income tax returns. A child must be under age 17 at the end of 2022 to be considered a qualifying child. Web we overhauled the schedule 8812 of the form 1040 in 2021 to implement these changes under the american rescue plan. Web solved • by turbotax • 3264 • updated january 25, 2023. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. Web the increased age allowance for qualifying children ended. For example, if the amount. The child tax credit is a partially refundable credit offered.

What Is A 1040sr Worksheet

Web you'll use form 8812 to calculate your additional child tax credit. Irs 1040 schedule 8812 instructions 2020 get irs 1040 schedule 8812 instructions. I discuss the 3,600 and 3,000 child tax credit amounts. The ctc and odc are. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form.

30++ Child Tax Credit Worksheet 2019

Irs 1040 schedule 8812 instructions 2020 get irs 1040 schedule 8812 instructions. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. The ctc and odc are. The child tax credit is a partially refundable credit offered. Web use schedule 8812 (form 1040) to figure your child tax.

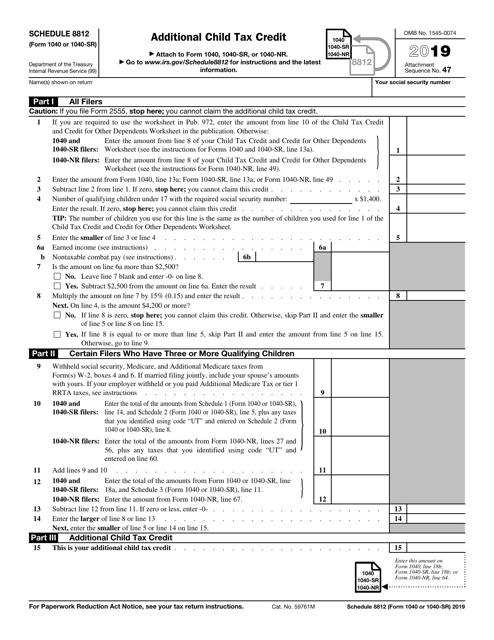

2020 Form IRS 945 Fill Online, Printable, Fillable, Blank pdfFiller

Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Should be completed by all filers to claim the basic. Complete, edit or print tax forms instantly. The ctc and.

Fillable Form 8812 Additional Child Tax Credit printable pdf download

For example, if the amount. To preview your 1040 before filing: Web the schedule 8812 form is found on form 1040, and it’s used to calculate the alternative refundable credit known as “the additional child tax credit”. Should be completed by all filers to claim the basic. Web filling out schedule 8812.

Form 8812 Credit Limit Worksheet A

Web tax forms for irs and state income tax returns. Web we overhauled the schedule 8812 of the form 1040 in 2021 to implement these changes under the american rescue plan. Complete, edit or print tax forms instantly. To preview your 1040 before filing: Irs 1040 schedule 8812 instructions 2020 get irs 1040 schedule 8812 instructions.

Irs Child Tax Credit Fill Out and Sign Printable PDF Template signNow

I discuss the 3,600 and 3,000 child tax credit amounts. Web enter the information for the tax return. Should be completed by all filers to claim the basic. For tax years 2020 and prior: Web tax forms for irs and state income tax returns.

IRS 1040 Schedule 8812 Instructions 2020 Fill out Tax Template Online

A child must be under age 17 at the end of 2022 to be considered a qualifying child. Your refund is reported on form 1040 line 35a. Complete, edit or print tax forms instantly. Web enter the information for the tax return. The ctc and odc are.

Irs Child Tax Credit Form 2020 Trending US

The ctc and odc are. Web tax forms for irs and state income tax returns. For example, if the amount. Web you'll use form 8812 to calculate your additional child tax credit. For tax years 2020 and prior:

Check Economic Impact Payments and Advanced Child Tax Credit

Web enter the information for the tax return. For tax years 2020 and prior: A child must be under age 17 at the end of 2022 to be considered a qualifying child. Use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. To preview.

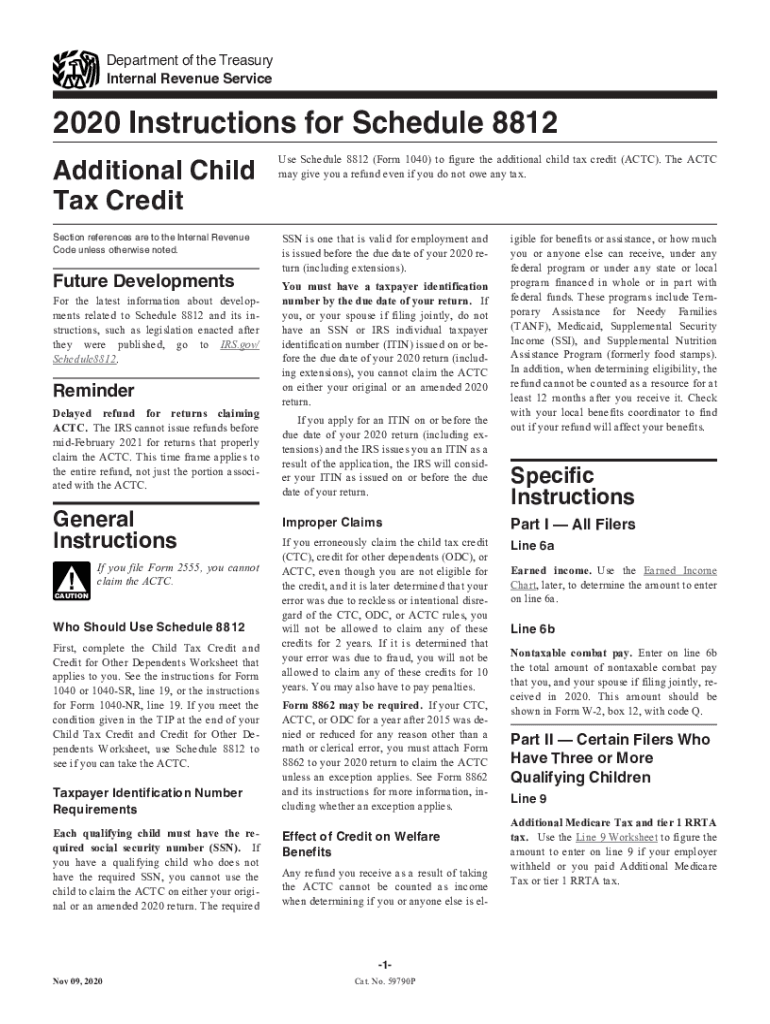

Form 2441 Instructions Fill Out and Sign Printable PDF Template signNow

The ctc and odc are. Web we overhauled the schedule 8812 of the form 1040 in 2021 to implement these changes under the american rescue plan. Web the increased age allowance for qualifying children ended. For tax years 2020 and prior: For example, if the amount.

The Ctc And Odc Are.

Your refund is reported on form 1040 line 35a. To preview your 1040 before filing: Resident the taxpayer and child must meet other eligibility requirements to qualify, including relationship, joint return, and social. Web we overhauled the schedule 8812 of the form 1040 in 2021 to implement these changes under the american rescue plan.

Web Solved • By Turbotax • 3264 • Updated January 25, 2023.

For tax years 2020 and prior: I discuss the 3,600 and 3,000 child tax credit amounts. Web enter the information for the tax return. Review your form 1040 lines 24 thru 35.

For Example, If The Amount.

Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). The ctc and odc are. The child tax credit is a partially refundable credit offered. Web tax forms for irs and state income tax returns.

So Which Of These Forms Was Reactivated For 2021.

Should be completed by all filers to claim the basic. Web in this video i discuss how to fill out out the child tax credit schedule, schedule 8812 on the form 1040. Complete, edit or print tax forms instantly. Web the increased age allowance for qualifying children ended.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png)