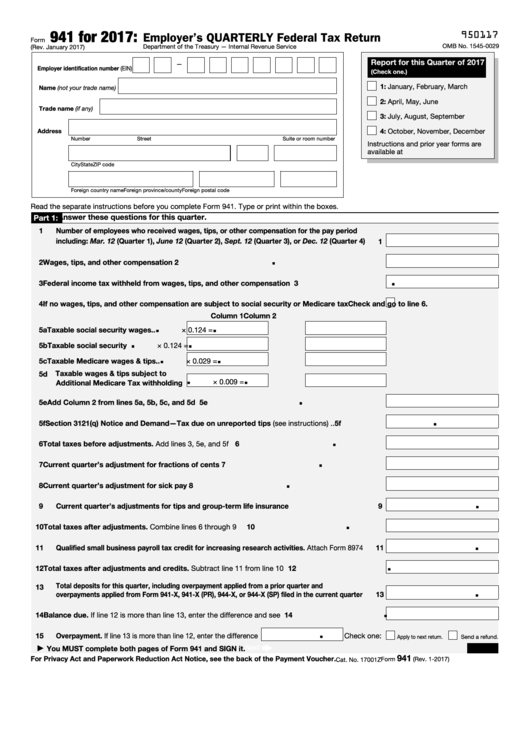

941 Form 2017

941 Form 2017 - When to file and pay. Web for example, if you filed the first three quarterly returns in 2017 and you filed the fourth quarter form 941 on january 31, 2018, the irs treats all tax returns as though they were. Web year to complete ohio it 941, the annual reconciliation. Irs tax form 941 must be filed by employers. Web form 941 for 2021: Web form 941 for 2023: Complete, edit or print tax forms instantly. Provide your information ___ ___ ___ ___ ___ ___. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web june 30, 2017) form 941, which is filed by july 31, 2017, is the first quarter that you can take the qualified small business payroll tax credit for increasing research

Web year to complete ohio it 941, the annual reconciliation. Web report for this quarter of 2017 (check one.) 1: Web form 941 for 2021: Printable irs form 941 for 2017: Employers use form 941 to: Easily fill out pdf blank, edit, and sign them. Web june 30, 2017) form 941, which is filed by july 31, 2017, is the first quarter that you can take the qualified small business payroll tax credit for increasing research You must file returns quarterly unless you. Web be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2017,” “2nd quarter 2017,” “3rd quarter 2017,” or “4th quarter 2017”) on your check or money order. Complete, edit or print tax forms instantly.

You must file returns quarterly unless you. Printable irs form 941 for 2017: Web be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2017,” “2nd quarter 2017,” “3rd quarter 2017,” or “4th quarter 2017”) on your check or money order. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web june 30, 2017) form 941, which is filed by july 31, 2017, is the first quarter that you can take the qualified small business payroll tax credit for increasing research June 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 951121. We need it to figure and collect the right amount of tax. Provide your information ___ ___ ___ ___ ___ ___. Employer’s quarterly federal tax return. Irs tax form 941 must be filed by employers.

New 941 form for second quarter payroll reporting

You must file returns quarterly unless you. Report income taxes, social security tax, or medicare tax withheld from employee's. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web for example, if you filed the first three quarterly returns in 2017 and you filed the fourth quarter form 941 on january 31, 2018,.

Where To File Form 941?

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Report income taxes, social security tax, or medicare tax withheld from employee's. Employers use form 941 to: Get ready for tax season deadlines by completing any required tax forms today. Provide your information ___ ___ ___ ___ ___ ___.

941 Form 2017 Printable Master of Documents

Web june 30, 2017) form 941, which is filed by july 31, 2017, is the first quarter that you can take the qualified small business payroll tax credit for increasing research Complete irs 941 2017 online with us legal forms. Web report for this quarter of 2017 (check one.) 1: Employers use form 941 to: Complete, edit or print tax.

Form 941 Instructions & Info on Tax Form 941 (including Mailing Info)

Web year to complete ohio it 941, the annual reconciliation. You must file returns quarterly unless you. Employer’s quarterly federal tax return. Web form 941 for 2023: Get ready for tax season deadlines by completing any required tax forms today.

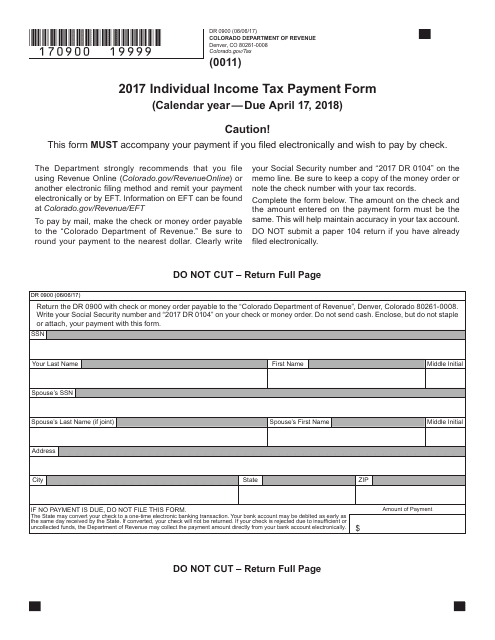

Form 941 2017

You must file returns quarterly unless you. Web be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2017,” “2nd quarter 2017,” “3rd quarter 2017,” or “4th quarter 2017”) on your check or money order. Employers use form 941 to: Irs tax form 941 must be filed by employers. Web ein, “form 941,” and the tax.

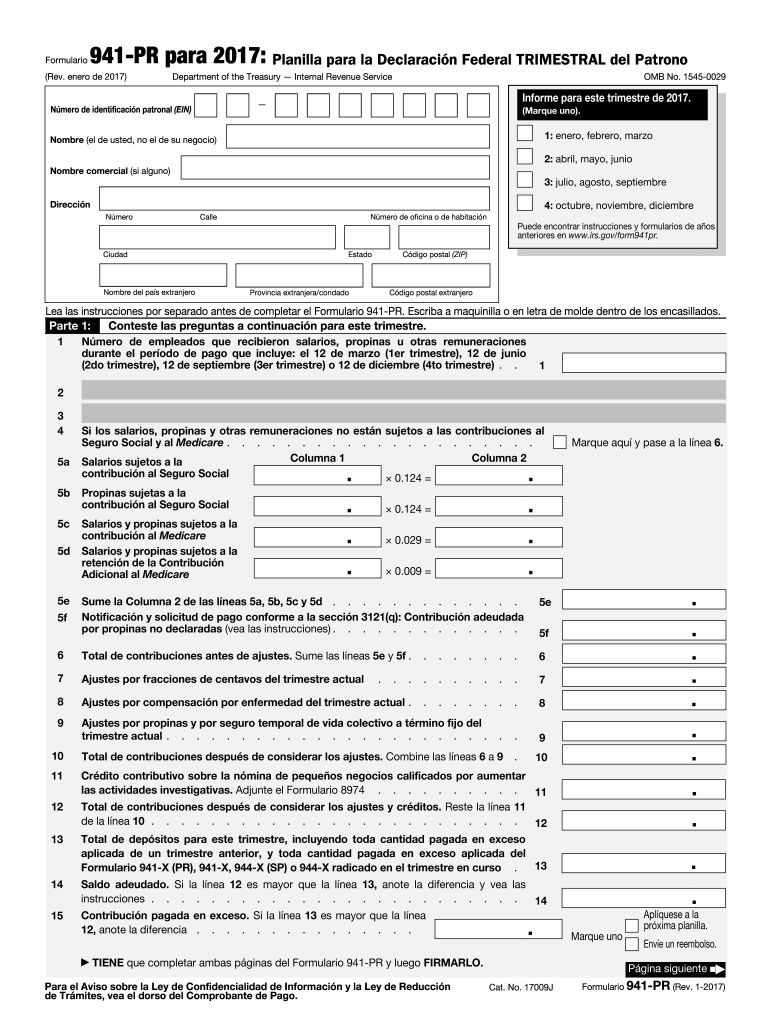

2017 Form IRS 941PR Fill Online, Printable, Fillable, Blank pdfFiller

Irs tax form 941 must be filed by employers. Easily fill out pdf blank, edit, and sign them. Web be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2017,” “2nd quarter 2017,” “3rd quarter 2017,” or “4th quarter 2017”) on your check or money order. January 2017) department of the treasury — internal revenue service..

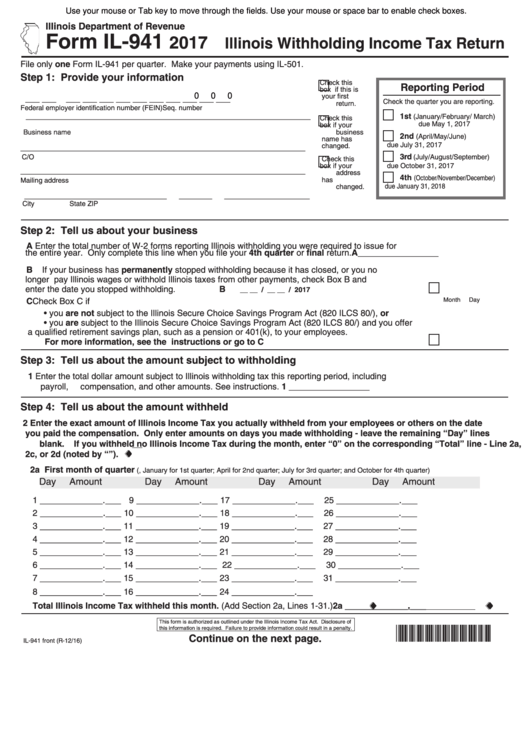

Fillable Form Il941 Illinois Withholding Tax Return 2017

Web report for this quarter of 2017 (check one.) 1: Web for example, if you filed the first three quarterly returns in 2017 and you filed the fourth quarter form 941 on january 31, 2018, the irs treats all tax returns as though they were. Web be sure to enter your ein, “form 941,” and the tax period (“1st quarter.

How to Complete Form 941 in 5 Simple Steps

You must file returns quarterly unless you. Employers use form 941 to: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web be sure to enter your ein, “form 941,” and the tax.

Instructions For Form 941Ss Employer'S Quarterly Federal Tax

Employers use form 941 to: Web year to complete ohio it 941, the annual reconciliation. Web ein, “form 941,” and the tax period (“1st quarter 2017,” “2nd quarter 2017,” “3rd quarter 2017,” or “4th quarter 2017”) on your check or money order. Web about form 941, employer's quarterly federal tax return. Irs tax form 941 must be filed by employers.

Fillable Form 941 Employer'S Quarterly Federal Tax Return 2017

Complete, edit or print tax forms instantly. We need it to figure and collect the right amount of tax. Employer’s quarterly federal tax return. Web about form 941, employer's quarterly federal tax return. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states.

Web Be Sure To Enter Your Ein, “Form 941,” And The Tax Period (“1St Quarter 2017,” “2Nd Quarter 2017,” “3Rd Quarter 2017,” Or “4Th Quarter 2017”) On Your Check Or Money Order.

Web ein, “form 941,” and the tax period (“1st quarter 2017,” “2nd quarter 2017,” “3rd quarter 2017,” or “4th quarter 2017”) on your check or money order. Web human resources & payroll. Web report for this quarter of 2017 (check one.) 1: You must file returns quarterly unless you.

Web For Example, If You Filed The First Three Quarterly Returns In 2017 And You Filed The Fourth Quarter Form 941 On January 31, 2018, The Irs Treats All Tax Returns As Though They Were.

Web year to complete ohio it 941, the annual reconciliation. Printable irs form 941 for 2017: Provide your information ___ ___ ___ ___ ___ ___. When to file and pay.

We Need It To Figure And Collect The Right Amount Of Tax.

Web form 941 for 2021: Employer’s quarterly federal tax return. Employers use form 941 to: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122.

Irs Tax Form 941 Must Be Filed By Employers.

Complete irs 941 2017 online with us legal forms. Complete, edit or print tax forms instantly. January 2017) department of the treasury — internal revenue service. June 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 951121.