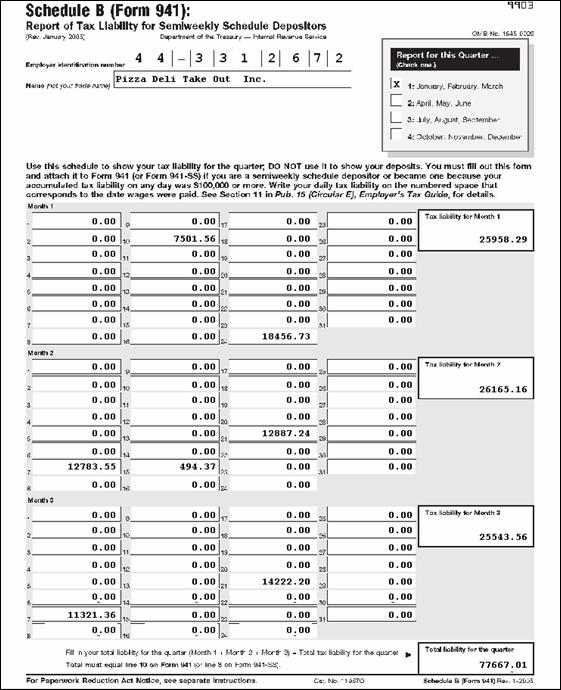

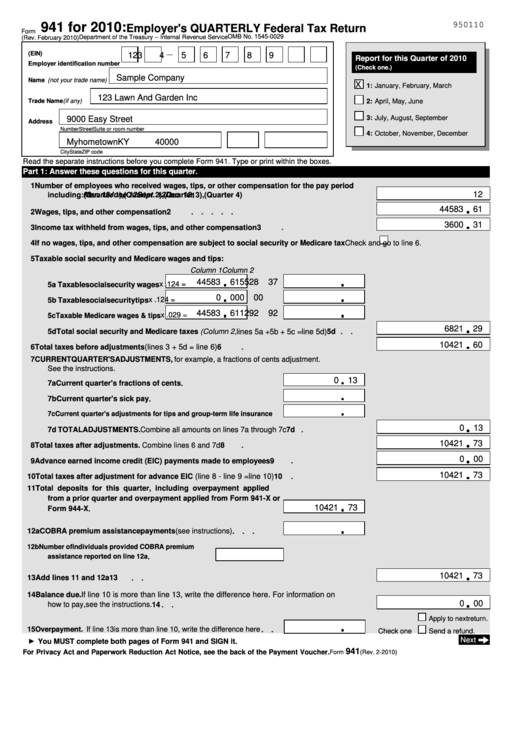

941 Schedule B Form 2023

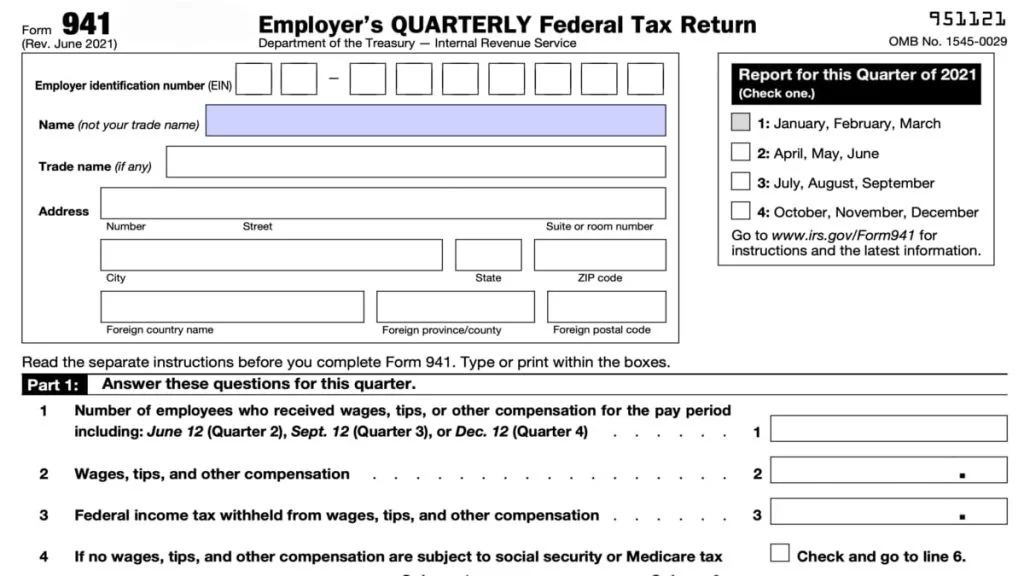

941 Schedule B Form 2023 - Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code Schedule r, allocation schedule for aggregate form 941 filers, and its instructions ; Taxbandits also supports prior year filings of form 941 for 2022, 2021, and 2020. If you haven't received a payment. Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter; Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. It discusses what is new for this version as well as the requirements for completing each form line by line. Web there are a few updates that may affect businesses filing form 941 for the first quarter of 2023. It includes the filing requirements and tips on reconciling and balancing the two forms.

The form 941 for 2023 contains no major changes. July 22, 2023 5:00 a.m. It discusses what is new for this version as well as the requirements for completing each form line by line. Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter; Web the 2023 form 941, employer’s quarterly federal tax return, and its instructions; Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. The wage base limit for social security is $160,200 for the 2023 tax year. Taxbandits also supports prior year filings of form 941 for 2022, 2021, and 2020. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. This is the final week the social security administration is sending out payments for july.

Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Schedule r, allocation schedule for aggregate form 941 filers, and its instructions ; The form 941 for 2023 contains no major changes. Taxbandits also supports prior year filings of form 941 for 2022, 2021, and 2020. The wage base limit for social security is $160,200 for the 2023 tax year. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code Web schedule b is filed with form 941. July 22, 2023 5:00 a.m. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. This is the final week the social security administration is sending out payments for july.

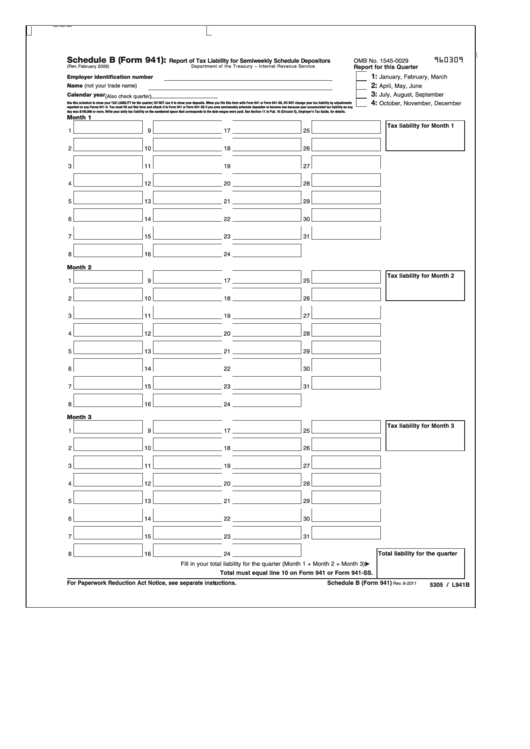

IRS Form 941 Schedule B 2023

If you haven't received a payment. Schedule r, allocation schedule for aggregate form 941 filers, and its instructions ; It includes the filing requirements and tips on reconciling and balancing the two forms. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941.

941.3 941/Schedule B PayMaster Hospitality Manual V8.0

Web the 2023 form 941, employer’s quarterly federal tax return, and its instructions; Web there are a few updates that may affect businesses filing form 941 for the first quarter of 2023. July 22, 2023 5:00 a.m. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers.

941 Form 2023

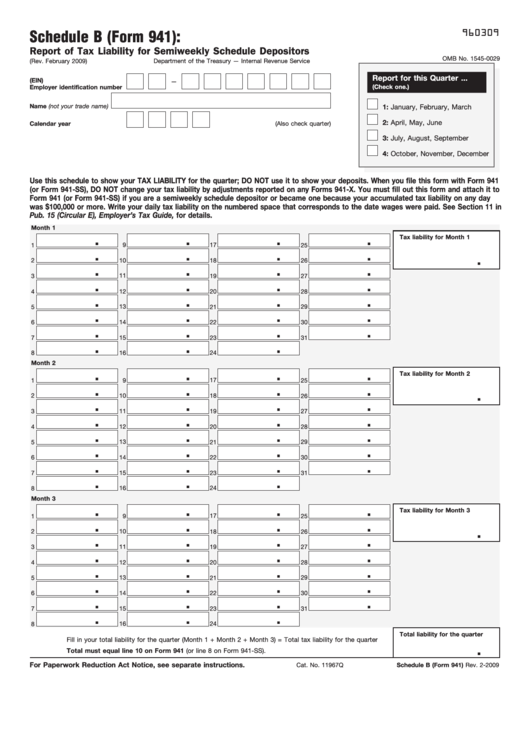

It includes the filing requirements and tips on reconciling and balancing the two forms. The wage base limit for social security is $160,200 for the 2023 tax year. Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter; Therefore, the due date of schedule b is the same as the due date for.

Fillable Schedule B (Form 941) Report Of Tax Liability For Semiweekly

Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. This is the final week the social security administration is sending out payments for july. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Schedule r, allocation schedule for aggregate form 941.

Form 941 (Schedule R) Allocation Schedule for Aggregate Form 941

Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. The instructions for schedule b, report of tax liability for semiweekly schedule depositors; Don't use it to show your deposits. Web schedule b is filed with form 941. Therefore, the.

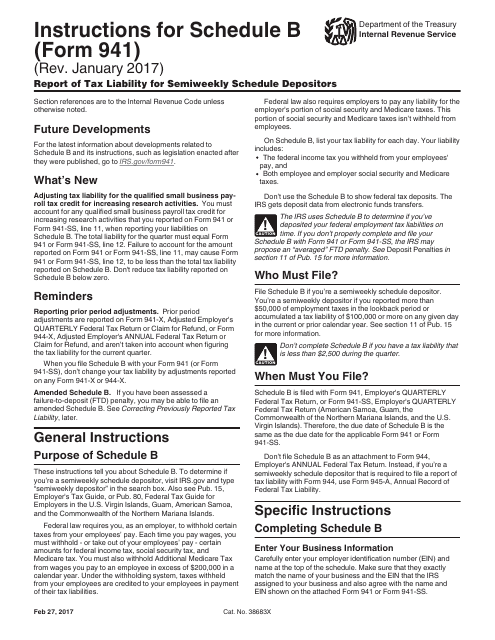

Download Instructions for IRS Form 941 Schedule B Report of Tax

Don't use it to show your deposits. July 22, 2023 5:00 a.m. Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. Web the 2023 form 941, employer’s quarterly federal tax return, and its instructions; Web calendar year (also check quarter) use this schedule to show your tax liability for the quarter;

941 form 2020 schedule b Fill Online, Printable, Fillable Blank

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code Don't use it to show your deposits. Web the 2023 form 941,.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

July 22, 2023 5:00 a.m. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Web the 2023 form 941, employer’s quarterly federal tax return, and its instructions; If you haven't received a payment. The wage base limit for social security is $160,200 for the 2023 tax year.

Form 941 Employers Quarterly Federal Tax Return, Schedule B (Form 941

Web there are a few updates that may affect businesses filing form 941 for the first quarter of 2023. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. The wage base limit for social security is $160,200 for the 2023 tax year. Rock hill, sc / accesswire / july 28, 2023 / the.

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Web the 2023 form 941, employer’s quarterly federal tax return, and its instructions; Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. This.

Web Calendar Year (Also Check Quarter) Use This Schedule To Show Your Tax Liability For The Quarter;

The instructions for schedule b, report of tax liability for semiweekly schedule depositors; Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. July 22, 2023 5:00 a.m. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents.

Taxbandits Also Supports Prior Year Filings Of Form 941 For 2022, 2021, And 2020.

This is the final week the social security administration is sending out payments for july. It includes the filing requirements and tips on reconciling and balancing the two forms. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. Don't use it to show your deposits.

If You Haven't Received A Payment.

Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. Web there are a few updates that may affect businesses filing form 941 for the first quarter of 2023. Schedule r, allocation schedule for aggregate form 941 filers, and its instructions ; The wage base limit for social security is $160,200 for the 2023 tax year.

Rock Hill, Sc / Accesswire / July 28, 2023 / The Next Business Day, Monday, July 31, 2023, Is The Deadline For Employers To File Form 941 With The Irs.

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Web schedule b is filed with form 941. Web the 2023 form 941, employer’s quarterly federal tax return, and its instructions; March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code