941 Schedule B Form

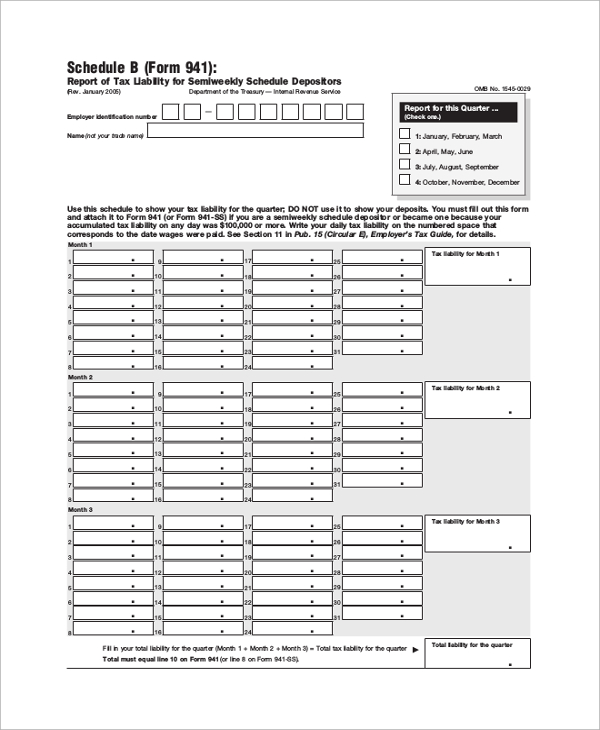

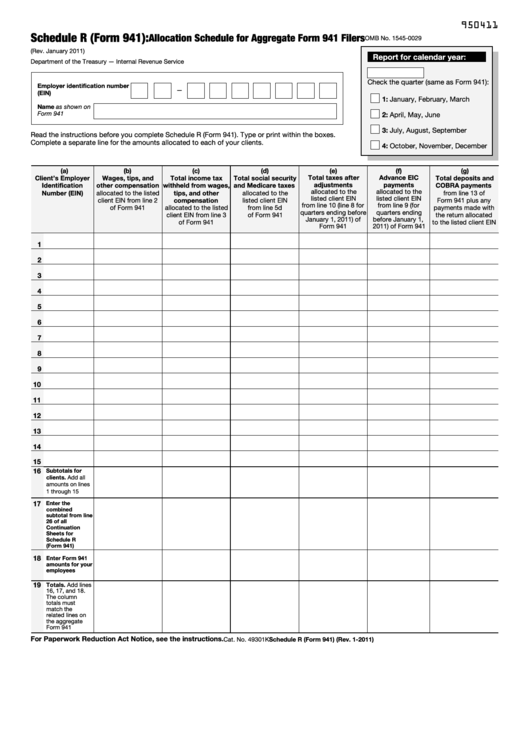

941 Schedule B Form - Format journal, periodical online resource Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). (check one.) employer identification number (ein) — 1: Web what is schedule b (form 941)? Web schedule b is filed with form 941. Schedule b must be filed along with form 941. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Schedule b specifically deals with reporting federal income tax, social security tax, and medicare tax withheld from the employee’s pay. Installment agreement request popular for tax pros; Don’t file schedule b as an attachment to form 944, employer's annual federal tax return.

Employers engaged in a trade or business who pay compensation form 9465; Web schedule b (form 941): Web schedule b is filed with form 941. Web what is schedule b (form 941)? Web schedule b (form 941), report of tax liability for semiweekly schedule depositors [electronic resource]. Schedule b specifically deals with reporting federal income tax, social security tax, and medicare tax withheld from the employee’s pay. Schedule b must be filed along with form 941. Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). Format journal, periodical online resource Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents.

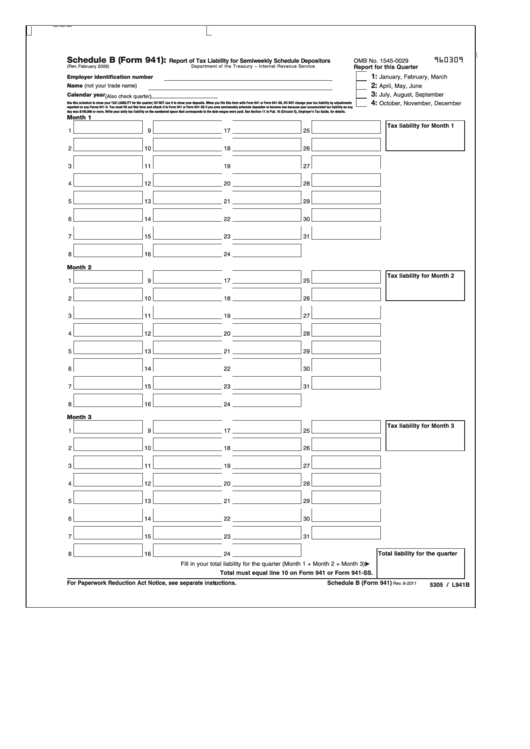

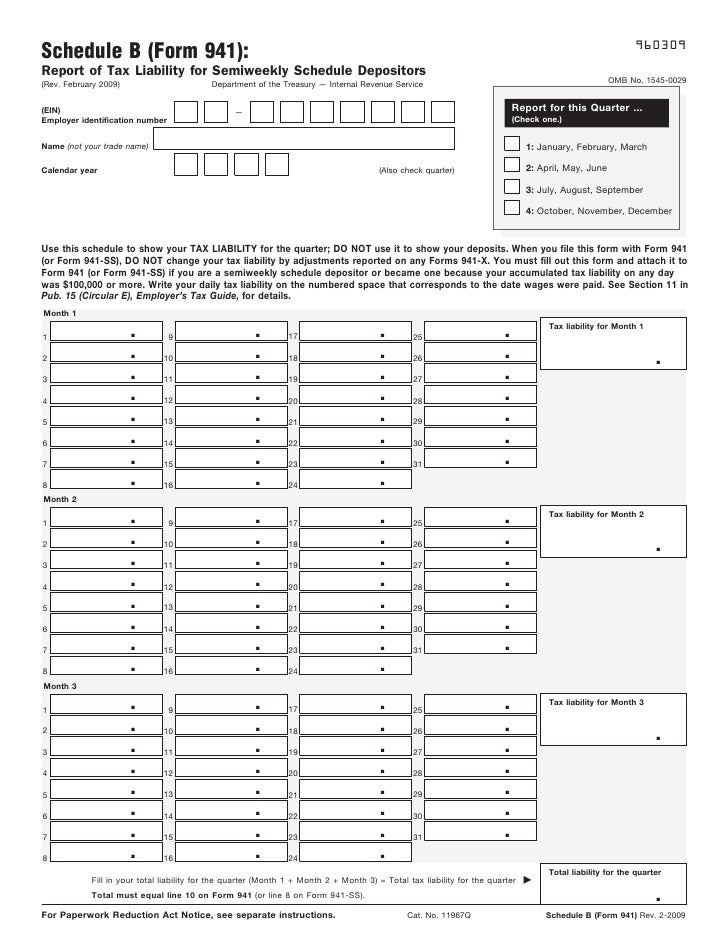

Web the irs form 941 schedule b is a tax form for reporting employer’s tax liabilities for semiweekly pay schedules. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Employers, who report more than $50,000 of employment taxes in the previous period or have accumulated $100,000 or more in tax liability in the current or past calendar year. Format journal, periodical online resource Employers engaged in a trade or business who pay compensation form 9465; Installment agreement request popular for tax pros; If you're a semiweekly schedule depositor and you don’t properly complete and file your schedule b with form 941, the irs may propose an “averaged” ftd penalty. Virgin islands), don’t change your current quarter tax liability by adjustments reported on any form 941. Web the irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. (check one.) employer identification number (ein) — 1:

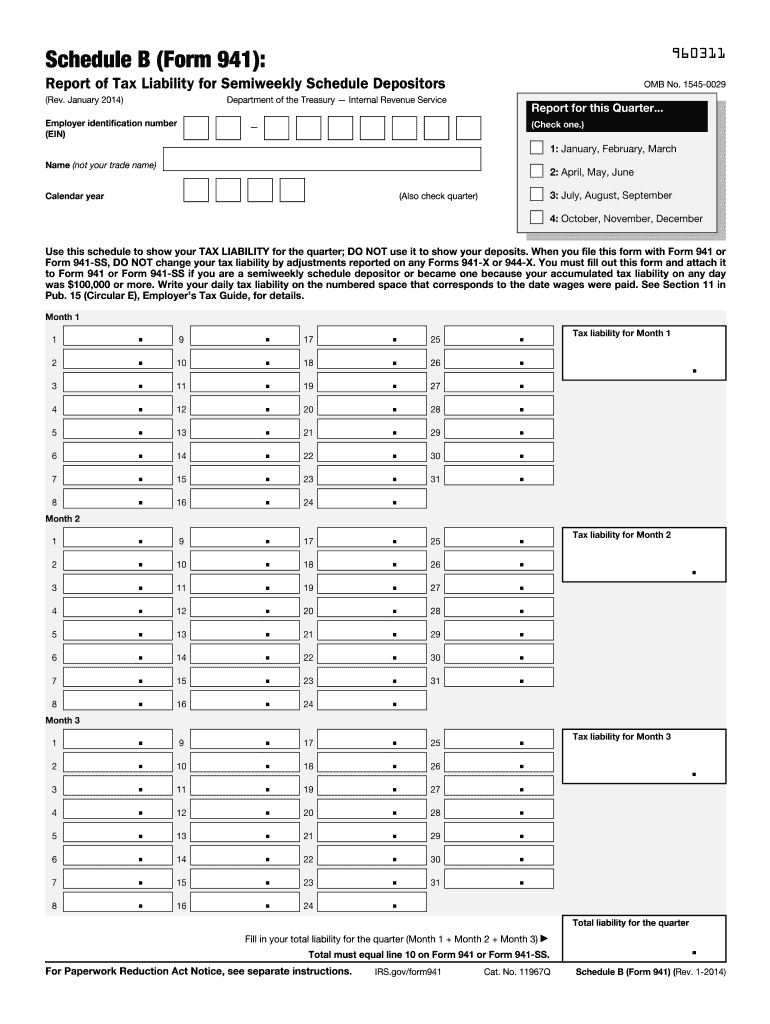

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

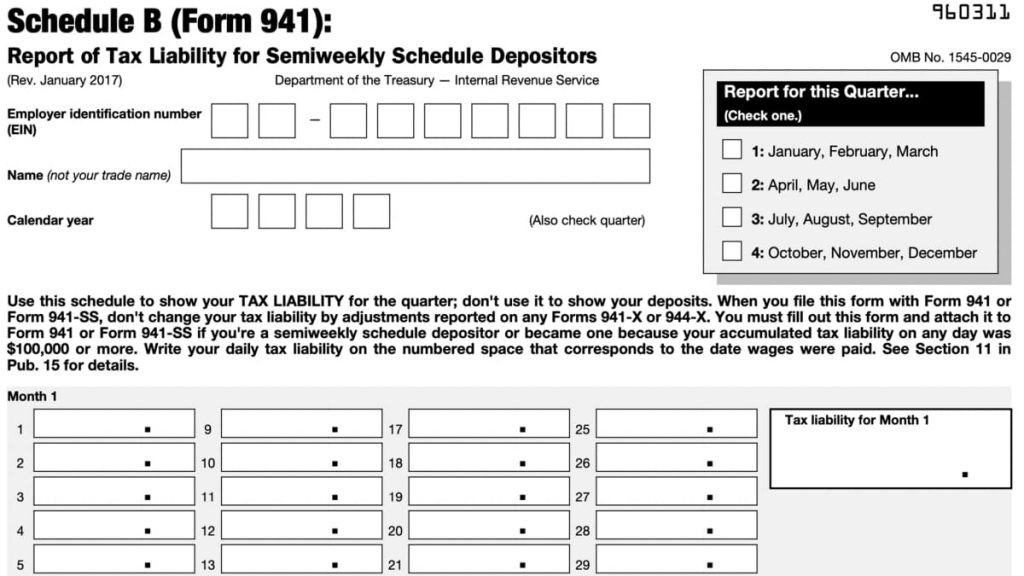

Web what is schedule b (form 941)? Web schedule b (form 941): Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Report of tax liability for semiweekly schedule depositors (rev.

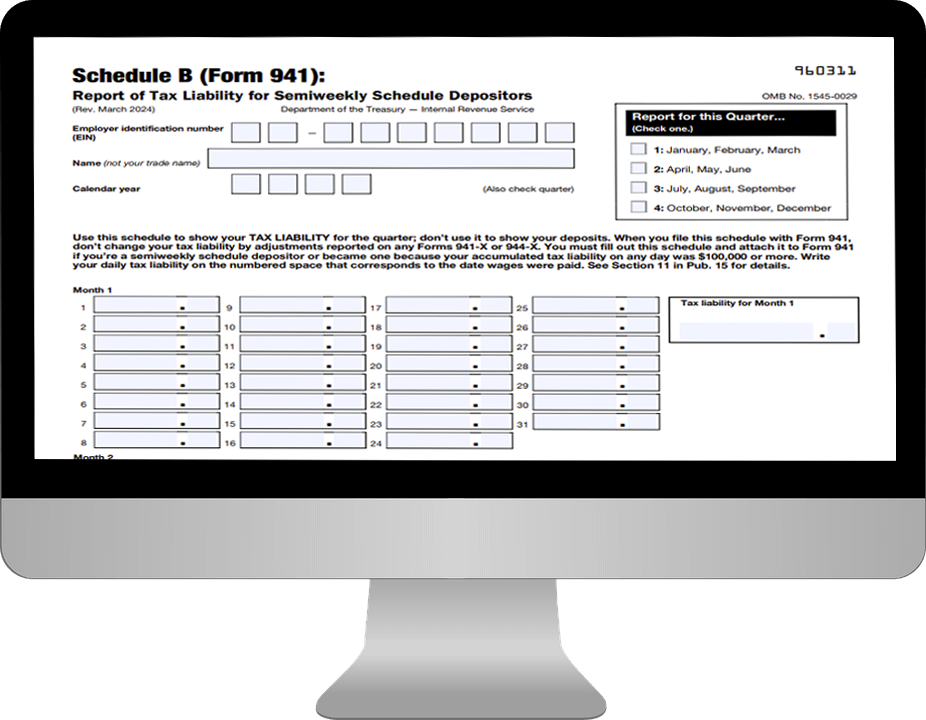

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Employers, who report more than $50,000 of employment taxes in the previous period or have accumulated $100,000 or more in tax liability in the current or past calendar year. Schedule b specifically deals with reporting federal income tax, social security tax, and medicare tax.

IRS Fillable Form 941 2023

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Employers engaged in a trade or business who pay compensation form 9465; Report of tax liability for semiweekly schedule depositors (rev. Schedule b must be filed along with form 941. Web the irs released final instructions for form 941 (employer’s quarterly.

FREE 8+ Sample Schedule Forms in PDF

Format journal, periodical online resource If you're a semiweekly schedule depositor and you don’t properly complete and file your schedule b with form 941, the irs may propose an “averaged” ftd penalty. Form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. (check one.) employer identification.

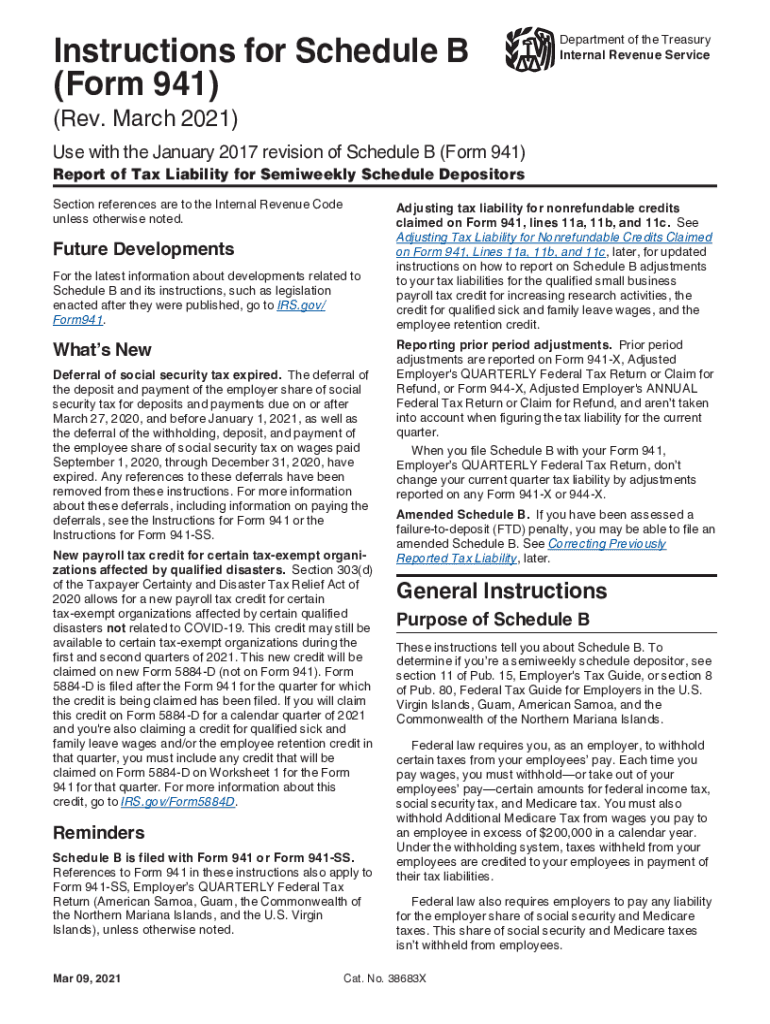

IRS Instructions 941 Schedule B 20212022 Fill and Sign Printable

Report of tax liability for semiweekly schedule depositors (rev. Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. (check.

2018 Schedule 941 Fill Out and Sign Printable PDF Template signNow

Web the irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Web schedule b (form 941): Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). Schedule b must.

Fillable Schedule R (Form 941) Allocation Schedule For Aggregate Form

Report of tax liability for semiweekly schedule depositors (rev. Installment agreement request popular for tax pros; Web the irs form 941 schedule b is a tax form for reporting employer’s tax liabilities for semiweekly pay schedules. This will help taxpayers feel more prepared when. Employers engaged in a trade or business who pay compensation form 9465;

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). This will help taxpayers feel more prepared when. Schedule b specifically deals with reporting federal income tax, social security tax, and medicare tax withheld from the.

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Web the irs form 941 schedule b is a tax form for reporting employer’s tax liabilities for semiweekly pay schedules. Web schedule b (form 941): Web what is schedule b (form 941)? Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Form 941 is an information form in the payroll form series which.

941 Form 2023 schedule b Fill online, Printable, Fillable Blank

Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Web the irs form 941 schedule b is a tax form for reporting employer’s tax liabilities for semiweekly pay schedules. Web what is schedule b (form 941)? Web schedule b (form 941): Format journal, periodical online resource

Employers Engaged In A Trade Or Business Who Pay Compensation Form 9465;

Schedule b specifically deals with reporting federal income tax, social security tax, and medicare tax withheld from the employee’s pay. If you're a semiweekly schedule depositor and you don’t properly complete and file your schedule b with form 941, the irs may propose an “averaged” ftd penalty. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents. Format journal, periodical online resource

Therefore, The Due Date Of Schedule B Is The Same As The Due Date For The Applicable Form 941.

Schedule b must be filed along with form 941. Form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Web what is schedule b (form 941)? Web schedule b is filed with form 941.

(Check One.) Employer Identification Number (Ein) — 1:

Web schedule b (form 941), report of tax liability for semiweekly schedule depositors [electronic resource]. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. Employers, who report more than $50,000 of employment taxes in the previous period or have accumulated $100,000 or more in tax liability in the current or past calendar year. Report of tax liability for semiweekly schedule depositors (rev.

This Will Help Taxpayers Feel More Prepared When.

Web the irs form 941 schedule b is a tax form for reporting employer’s tax liabilities for semiweekly pay schedules. Virgin islands), don’t change your current quarter tax liability by adjustments reported on any form 941. Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). Web schedule b (form 941):