Adp Rollover 401K Form

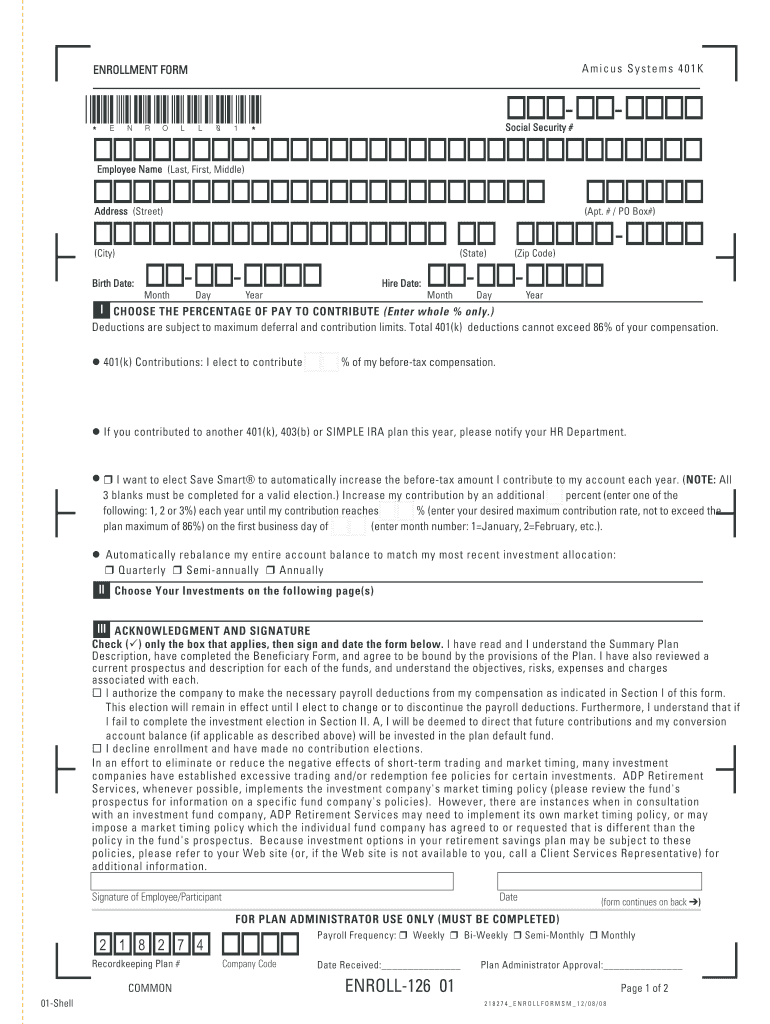

Adp Rollover 401K Form - Web make 401(k) retirement plans easy with our solutions. Help & support page for logging into adp 401k plans. Please refer to the distribution statement provided by prior 401(k) provider for this information. Learn more about our 401(k) plan management tools, simple plan setup, time savings, & more. You may download the app from the apple app store® and google play®1 what is a 401(k) plan? Web • for roth 401(k) rollover amounts: Web adp rollover form process. Web if you have a 401(k) retirement plan at adp, inc. Enjoy smart fillable fields and interactivity. Help & support page for logging into adp 401k plans.

Enjoy smart fillable fields and interactivity. This year allows adp to track your contribution for taxation purposes. Web adp 401k retirement plan login. Web adp rollover form process. I recently started a new job, and received a check from fidelity, my old 401k provider, in order to start the rollover process. The preparing of lawful documents can. Complete the contribution + earnings = total amount section. Web 457(b) plans 403(b) tax sheltered annuity contracts check your plan’s specific provisions for eligible rollover contributions. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web the adp mobile app.

Help & support page for logging into adp 401k plans. The process for adp can be done either online, by phone, or by mailing a form and a check. Follow the simple instructions below: Get your online template and fill it in using progressive features. Learn more about our 401(k) plan management tools, simple plan setup, time savings, & more. Edit your imm 5401 pay online online type text, add images, blackout confidential details, add comments, highlights and more. Enjoy smart fillable fields and interactivity. Share your form with others send 401k adp enrollment forms via email, link, or fax. • indicate the year your roth 401(k) contributions began. You may download the app from the apple app store® and google play®1 what is a 401(k) plan?

Adp 401k Loan Payoff Form Form Resume Examples AjYdXQwEYl

Help & support page for logging into adp 401k plans. Adp 401k retirement plan login. Web adp 401k retirement plan login. Web make 401(k) retirement plans easy with our solutions. Follow the simple instructions below:

401k Rollover Form Fidelity Investments Form Resume Free Nude Porn Photos

How to complete a rollover follow these steps to complete the roll over process and move your account assets into your current plan. Web the adp mobile app. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Help & support page for logging into adp 401k.

401k Rollover Form 5498 Universal Network

Web 457(b) plans 403(b) tax sheltered annuity contracts check your plan’s specific provisions for eligible rollover contributions. Adp 401k retirement plan login. Get your online template and fill it in using progressive features. Share your form with others send 401k adp enrollment forms via email, link, or fax. Edit your imm 5401 pay online online type text, add images, blackout.

John Hancock 401k Hardship Withdrawal Form Form Resume Examples

Complete the contribution + earnings = total amount section. Web make 401(k) retirement plans easy with our solutions. Web adp 401k retirement plan login. Share your form with others send 401k adp enrollment forms via email, link, or fax. Web the adp mobile app.

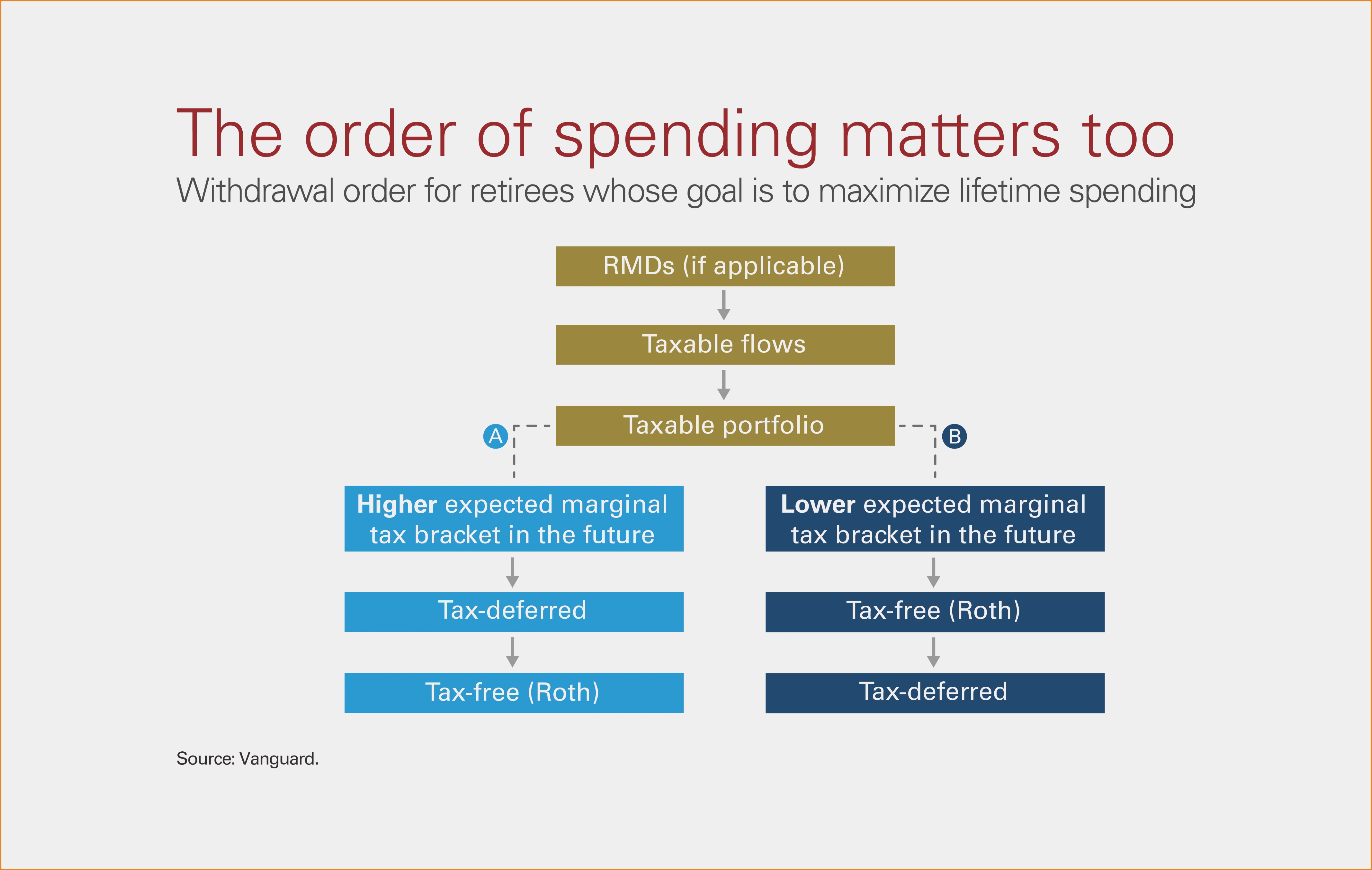

401k Conversion To Roth Ira Tax Form Form Resume Examples dP9l71Dq2R

Web how to fill out and sign adp 401k rollover form online? Web 457(b) plans 403(b) tax sheltered annuity contracts check your plan’s specific provisions for eligible rollover contributions. Complete the contribution + earnings = total amount section. Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.

Principal Financial Group 401k Withdrawal Form Form Resume Examples

Adp 401k retirement plan login. Web adp rollover form process. Complete the contribution + earnings = total amount section. Web make 401(k) retirement plans easy with our solutions. You may download the app from the apple app store® and google play®1 what is a 401(k) plan?

Principal 401k Rollover Form Universal Network

The preparing of lawful documents can. Follow the simple instructions below: Web adp rollover form process. Web 457(b) plans 403(b) tax sheltered annuity contracts check your plan’s specific provisions for eligible rollover contributions. Complete the contribution + earnings = total amount section.

Adp 401K Login Fill Out and Sign Printable PDF Template signNow

Help & support page for logging into adp 401k plans. Web adp rollover form process. Share your form with others send 401k adp enrollment forms via email, link, or fax. • indicate the year your roth 401(k) contributions began. Web if you have a 401(k) retirement plan at adp, inc.

Ascensus 401k Rollover Form Universal Network

The process for adp can be done either online, by phone, or by mailing a form and a check. You may download the app from the apple app store® and google play®1 what is a 401(k) plan? Web 457(b) plans 403(b) tax sheltered annuity contracts check your plan’s specific provisions for eligible rollover contributions. Please refer to the distribution statement.

401k Rollover Form Fidelity Universal Network

Web whether you have questions about what a 401(k) plan is or are looking for ways to enhance your saving strategies, the adp 401(k) resource library can provide you with the information and resources to keep you on the road to retirement readiness. The preparing of lawful documents can. Please refer to the distribution statement provided by prior 401(k) provider.

Please Refer To The Distribution Statement Provided By Prior 401(K) Provider For This Information.

Complete the contribution + earnings = total amount section. Web make 401(k) retirement plans easy with our solutions. Web how to fill out and sign adp 401k rollover form online? From a former employer, there are a few options for you to consider when doing a rollover.

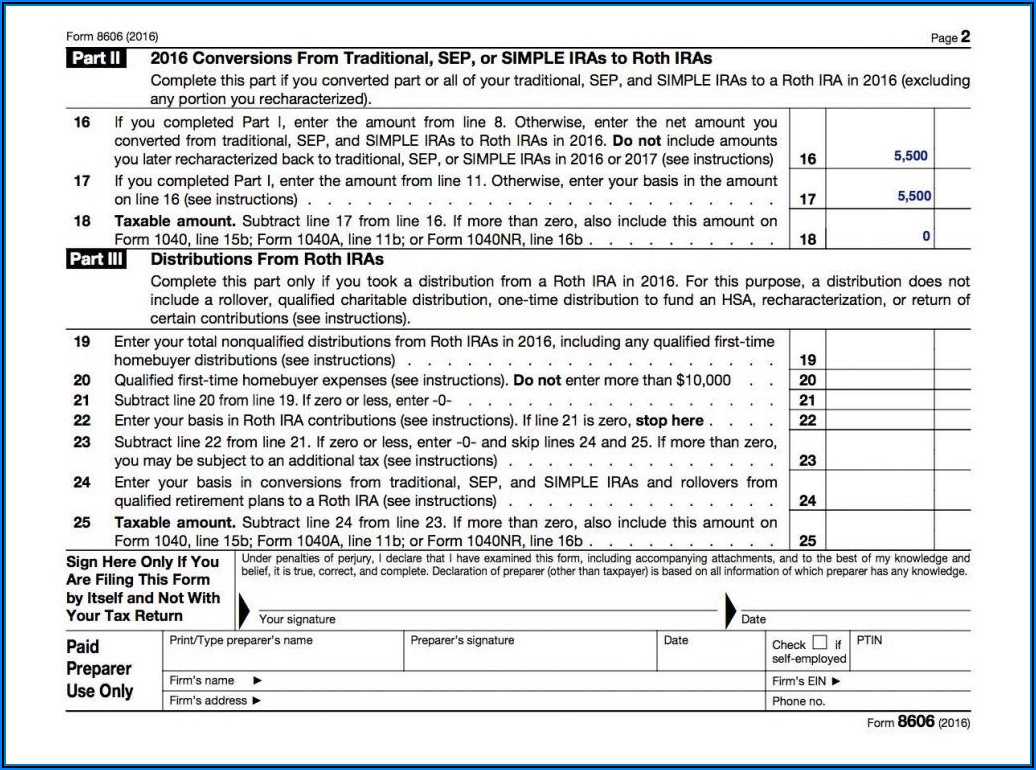

Web • For Roth 401(K) Rollover Amounts:

I recently started a new job, and received a check from fidelity, my old 401k provider, in order to start the rollover process. Get your online template and fill it in using progressive features. Learn more about our 401(k) plan management tools, simple plan setup, time savings, & more. The preparing of lawful documents can.

Follow The Simple Instructions Below:

I sent it that form along with the quarterly statement and fidelity' check, which was made out to the new rollover. • indicate the year your roth 401(k) contributions began. Enjoy smart fillable fields and interactivity. Web if you have a 401(k) retirement plan at adp, inc.

Web 457(B) Plans 403(B) Tax Sheltered Annuity Contracts Check Your Plan’s Specific Provisions For Eligible Rollover Contributions.

Web the adp mobile app. Help & support page for logging into adp 401k plans. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. This year allows adp to track your contribution for taxation purposes.