Ag990-Il Form

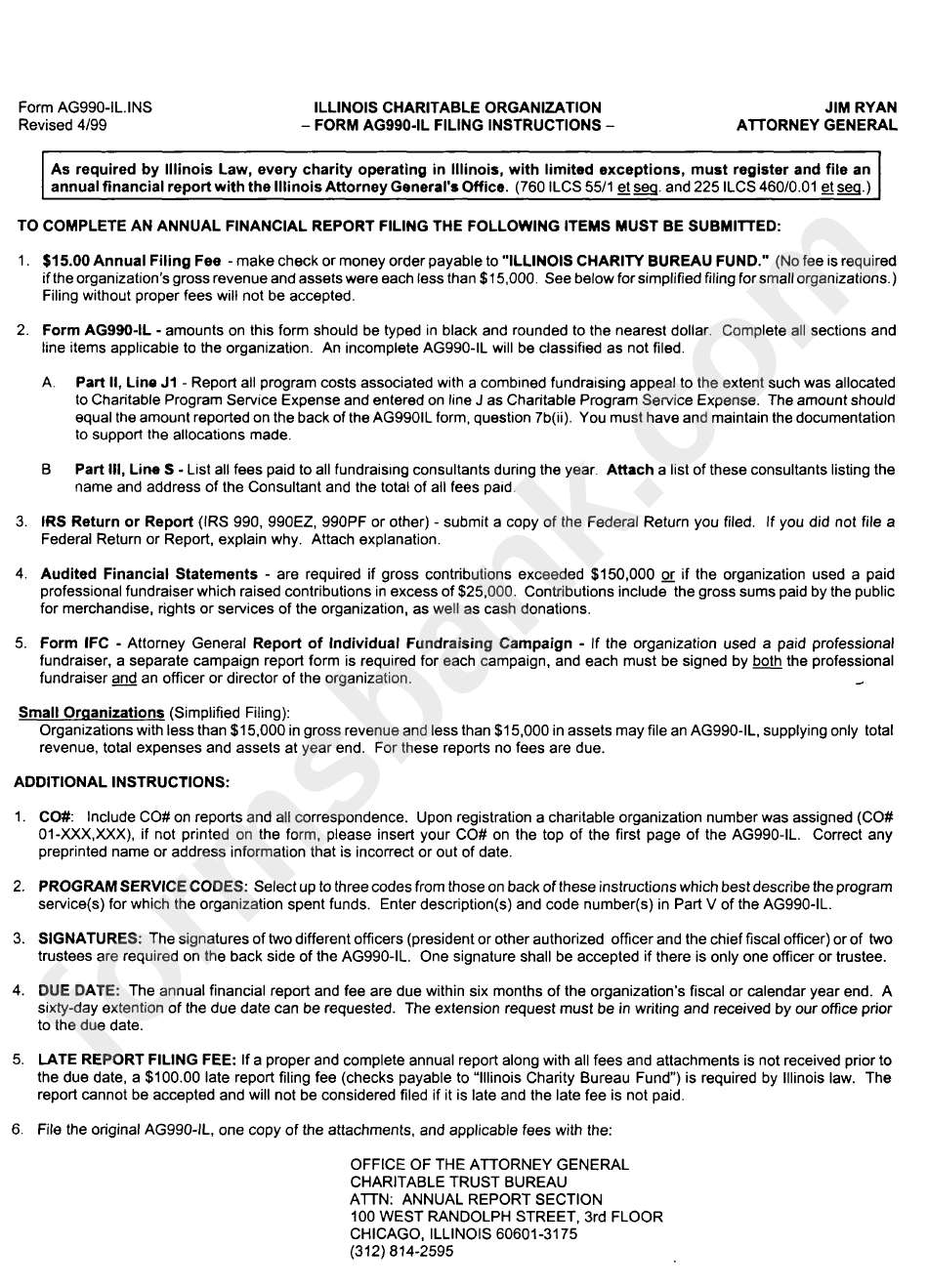

Ag990-Il Form - Use fill to complete blank online others pdf forms for free. Reports should also include audited financial statements if the charity’s annual gross contributions exceed $300,000 or it used a paid professional fundraiser that raised contributions in excess of $25,000. Summary of all revenue items during the year: One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by the charity (p. See 6 below for simplified filing option for small organizations. And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: Forms for lake land college browse lake land college forms Once completed you can sign your fillable form or send for signing. Web summary of all paid fundraiser and consultant activities:

Use fill to complete blank online others pdf forms for free. And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Forms for lake land college browse lake land college forms See 6 below for simplified filing option for small organizations. Web summary of all paid fundraiser and consultant activities: Once completed you can sign your fillable form or send for signing. Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Summary of all revenue items during the year: All forms are printable and downloadable. Illinois charitable organization annual report form.

And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. See 6 below for simplified filing option for small organizations. Charity annual report extensions these are the instructions for requesting and receiving. Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Web we would like to show you a description here but the site won’t allow us. Illinois charitable organization annual report form. Web summary of all paid fundraiser and consultant activities: One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by the charity (p. Once completed you can sign your fillable form or send for signing. Summary of all revenue items during the year:

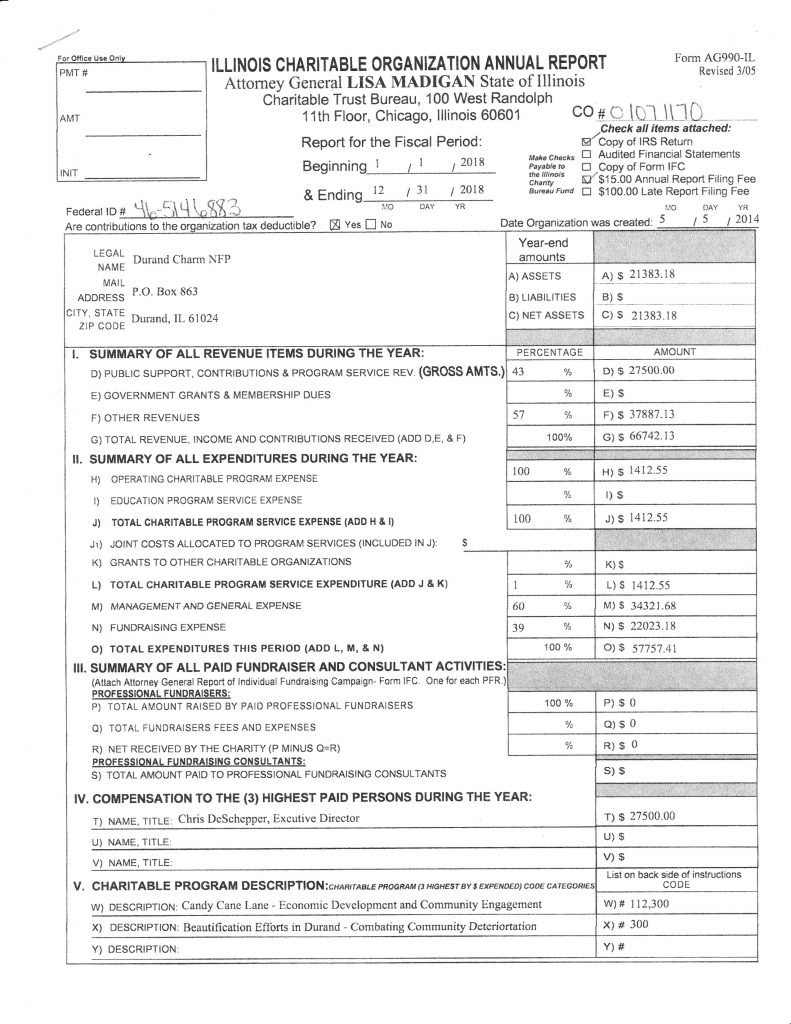

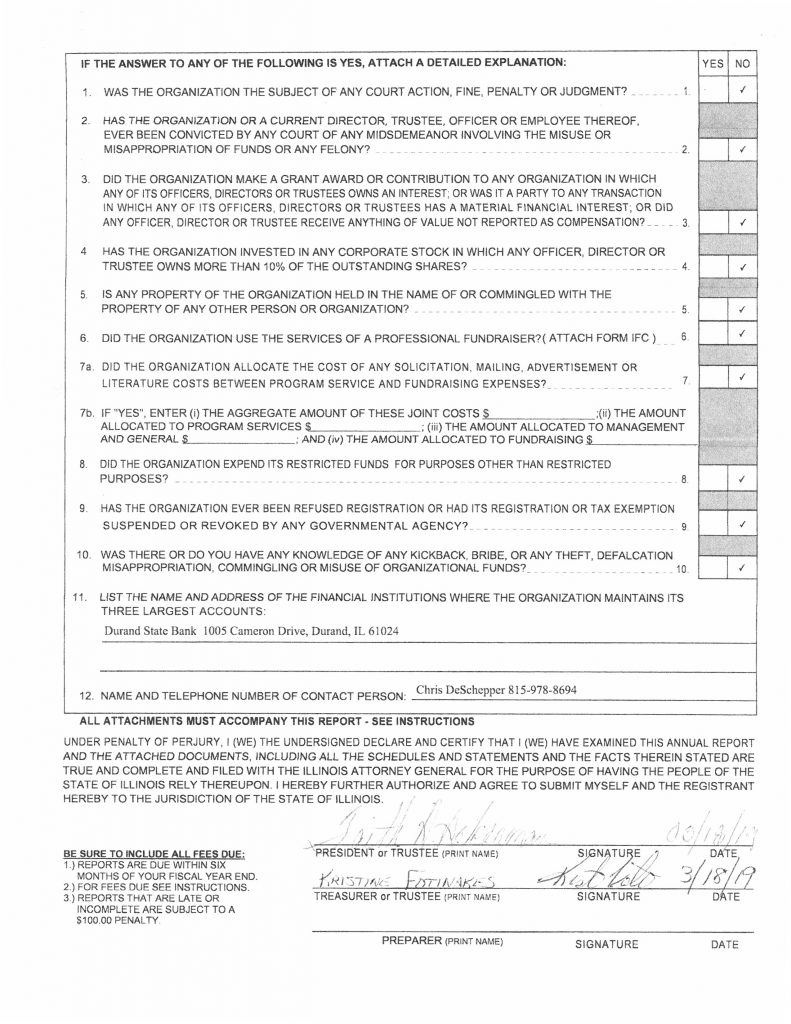

FY 2018 AG990IL Form Durand Charm

Use fill to complete blank online others pdf forms for free. One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by the charity (p. Once completed you can sign your fillable form or send for signing. Illinois charitable organization annual report form. All forms are printable and downloadable.

Form Ag990 Il 2017 Awesome What is Sel

One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by the charity (p. See 6 below for simplified filing option for small organizations. And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns.

Form Ag990Il Illinois Charitable Organization Annual Report 1999

And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Illinois charitable organization annual report form. Web summary of all paid fundraiser and consultant activities: One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses.

Form Ag990 Il 2017 Fresh Home

Forms for lake land college browse lake land college forms Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: Summary of all revenue items during the year: Charity annual report extensions these are the instructions for requesting and receiving. One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers.

Form Ag990Il Annucal Financial Report For Illinois Charitable

Charity annual report extensions these are the instructions for requesting and receiving. Web we would like to show you a description here but the site won’t allow us. Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: All forms are printable and downloadable. Once completed you can sign your fillable form or send for.

ads/responsive.txt Form Ag990 Il 2017 New Bentley Continental Gt

Use fill to complete blank online others pdf forms for free. Charity annual report extensions these are the instructions for requesting and receiving. See 6 below for simplified filing option for small organizations. Web we would like to show you a description here but the site won’t allow us. Summary of all revenue items during the year:

Form Ag990 Il 2017 Lovely Iaa Cv 2018 â £ Iaa 2018

Summary of all revenue items during the year: Web we would like to show you a description here but the site won’t allow us. And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. See 6 below for simplified filing option for small.

Form Ag990 Il 2017 Inspirational Home

Forms for lake land college browse lake land college forms Charity annual report extensions these are the instructions for requesting and receiving. And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. One for each pfr.) p) total amount raised by paid professional.

FY 2018 AG990IL Form Durand Charm

Illinois charitable organization annual report form. Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. See 6 below for simplified filing option for small organizations. All forms.

Form Ag990 Il 2017 Fresh 2017 tour De France

Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. See 6 below for simplified filing option for small organizations. Use fill to complete blank online others pdf forms for free. Web summary of all paid fundraiser and consultant activities: Forms for lake land.

Forms For Lake Land College Browse Lake Land College Forms

Once completed you can sign your fillable form or send for signing. Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: Reports should also include audited financial statements if the charity’s annual gross contributions exceed $300,000 or it used a paid professional fundraiser that raised contributions in excess of $25,000. Summary of all revenue items during the year:

Illinois Charitable Organization Annual Report Form.

Use fill to complete blank online others pdf forms for free. And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Web summary of all paid fundraiser and consultant activities: Web we would like to show you a description here but the site won’t allow us.

Charity Annual Report Extensions These Are The Instructions For Requesting And Receiving.

See 6 below for simplified filing option for small organizations. All forms are printable and downloadable. Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by the charity (p.