Ar State Tax Form

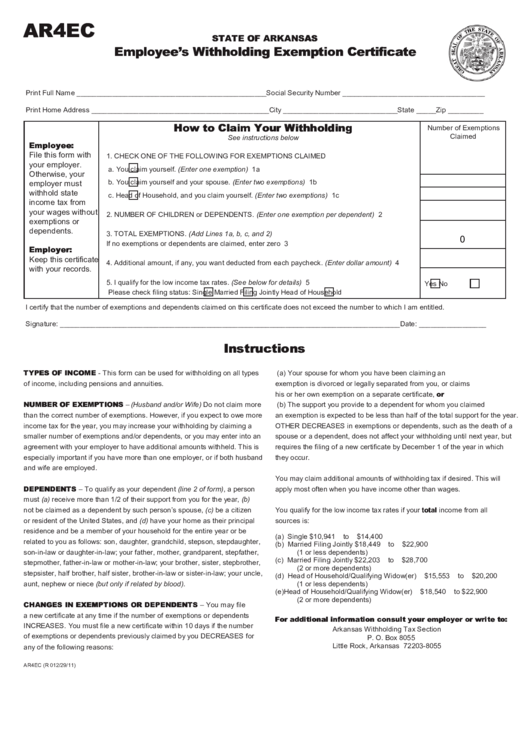

Ar State Tax Form - Ar1000es individual estimated tax vouchers for 2021. Ar4ec employee's withholding exemption certificate: Web 2021 tax year forms. Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Dfa instructions and forms have been updated to reflect the unemployment tax. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Taxformfinder provides printable pdf copies of 40 current arkansas income tax forms. Filing and pay due date extended to may 17, 2021, 03/23/2021. Ar4ecsp employee's special withholding exemption certificate: Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov.

Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Web arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. Filing and pay due date extended to may 17, 2021, 03/23/2021. Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Unemployment is not taxable for 2020. This line is used to report your allowable contribution to an individual retirement account (ira). Dfa instructions and forms have been updated to reflect the unemployment tax. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Taxformfinder provides printable pdf copies of 40 current arkansas income tax forms. Web ar1099pt report of income tax withheld or paid on behalf of nonresident member:

Web ar1099pt report of income tax withheld or paid on behalf of nonresident member: Dfa instructions and forms have been updated to reflect the unemployment tax. Ar4ecsp employee's special withholding exemption certificate: Filing and pay due date extended to may 17, 2021, 03/23/2021. Web fiduciary and estate income tax forms; Ar4ext application for automatic extension of time: Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Taxformfinder provides printable pdf copies of 40 current arkansas income tax forms. This line is used to report your allowable contribution to an individual retirement account (ira). Unemployment is not taxable for 2020.

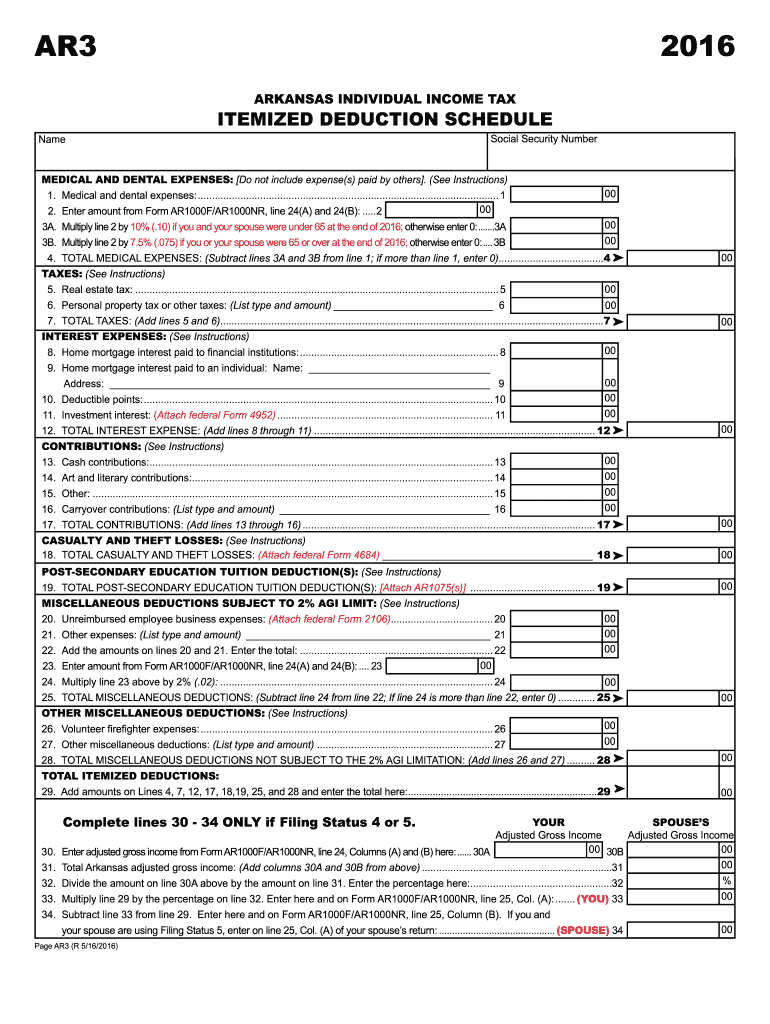

AR AR3 2016 Fill out Tax Template Online US Legal Forms

Ar1000es individual estimated tax vouchers for 2021. Taxformfinder provides printable pdf copies of 40 current arkansas income tax forms. Web arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. Ar4ext application for automatic extension of time: The current tax year is 2022, and most states will release updated.

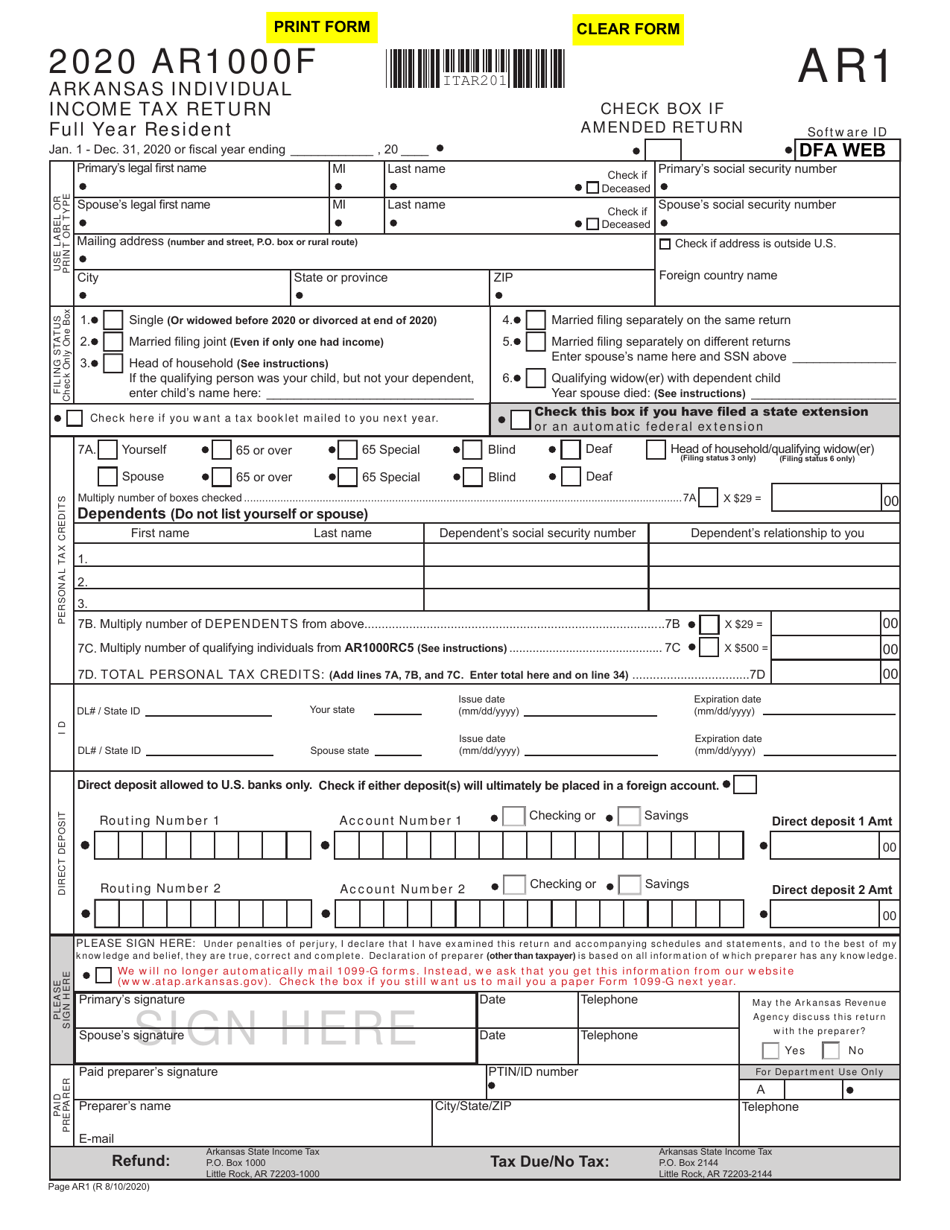

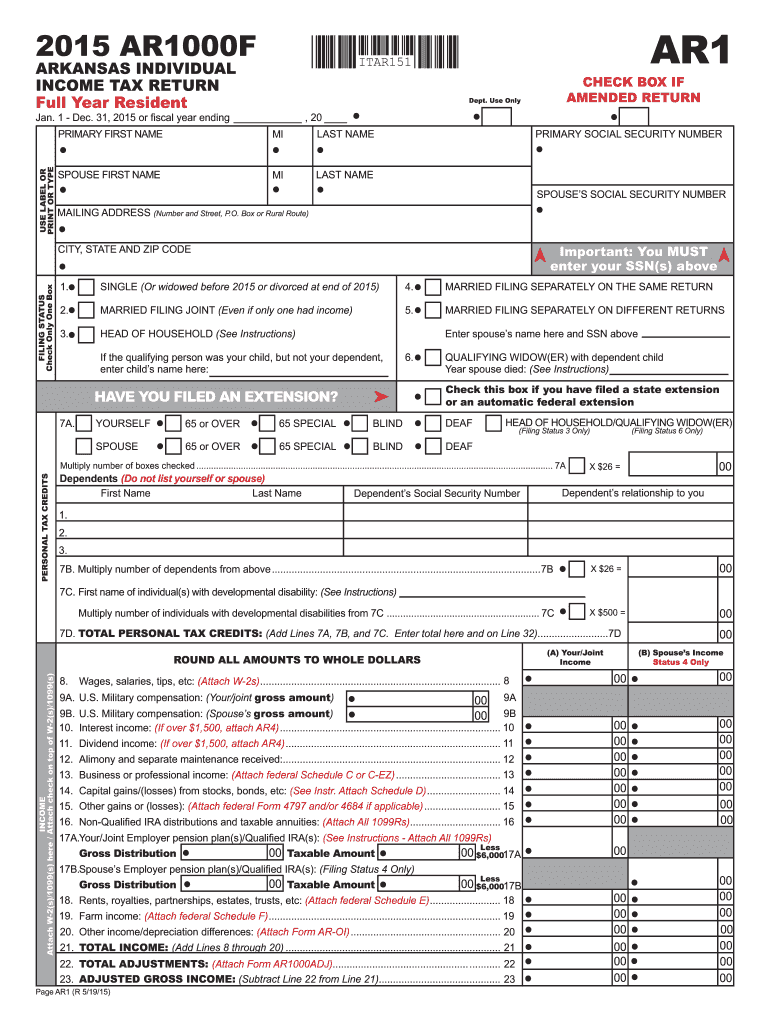

Form AR1000F Download Fillable PDF or Fill Online Arkansas Full Year

Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Unemployment is not taxable for 2020. Ar4ext application for automatic extension of time: Ar1000es individual estimated tax vouchers for 2021. Web arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue.

Bupa Tax Exemption Form / Edd De 1446 Fill Online, Printable

Web 2021 tax year forms. Web fiduciary and estate income tax forms; Web fiduciary and estate income tax forms; Filing and pay due date extended to may 17, 2021, 03/23/2021. Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and late fees.

Arkansas Excise Tax Return Et 1 Form 20202022 Fill and Sign

Dfa instructions and forms have been updated to reflect the unemployment tax. Web 2021 tax year forms. Ar4ec employee's withholding exemption certificate: Web fiduciary and estate income tax forms; Ar1000es individual estimated tax vouchers for 2021.

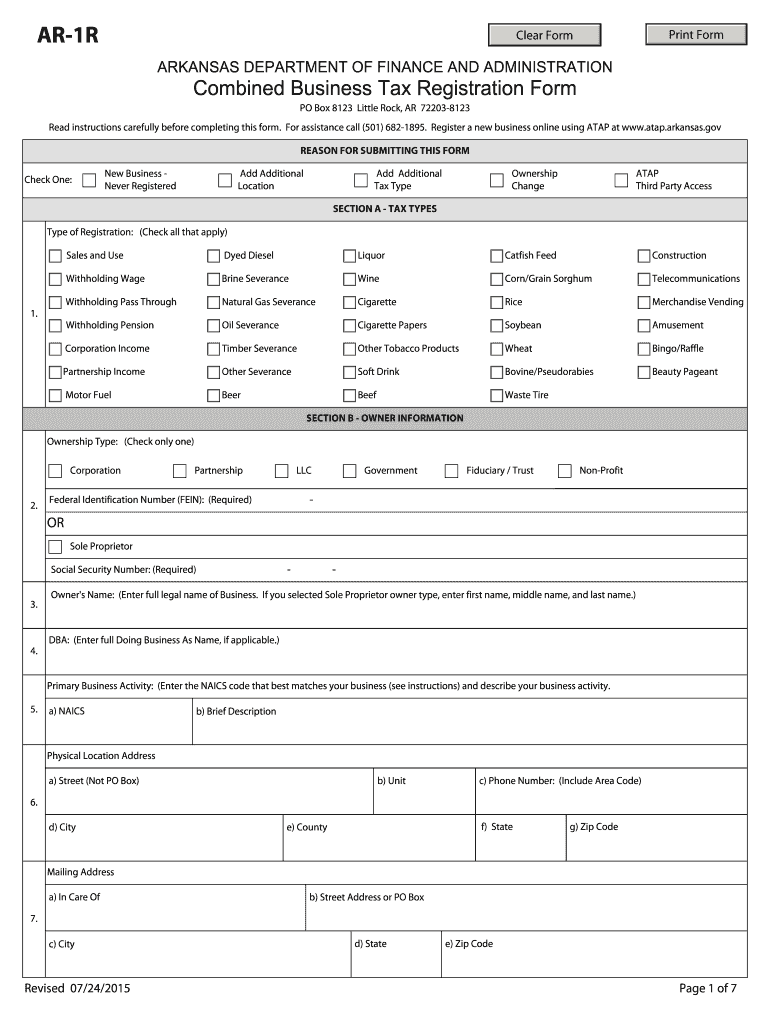

AR DFA AR1R 2015 Fill out Tax Template Online US Legal Forms

Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Taxformfinder provides printable pdf copies of 40 current arkansas income tax forms. Ar4ecsp employee's special withholding exemption certificate: Ar4ext application for automatic extension of time: Filing and pay due date extended to may 17, 2021, 03/23/2021.

AR DFA AR1000F 2015 Fill out Tax Template Online US Legal Forms

Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Ar1000es individual estimated tax vouchers for 2021. Taxformfinder provides printable pdf copies of 40 current arkansas income tax forms. Ar4ec employee's withholding exemption certificate: Printable arkansas state tax forms for the 2022 tax year will be based on.

Individual Tax Return Arkansas Free Download

Web fiduciary and estate income tax forms; Web ar1099pt report of income tax withheld or paid on behalf of nonresident member: Ar4ecsp employee's special withholding exemption certificate: Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Filing and pay due date extended to may 17, 2021, 03/23/2021.

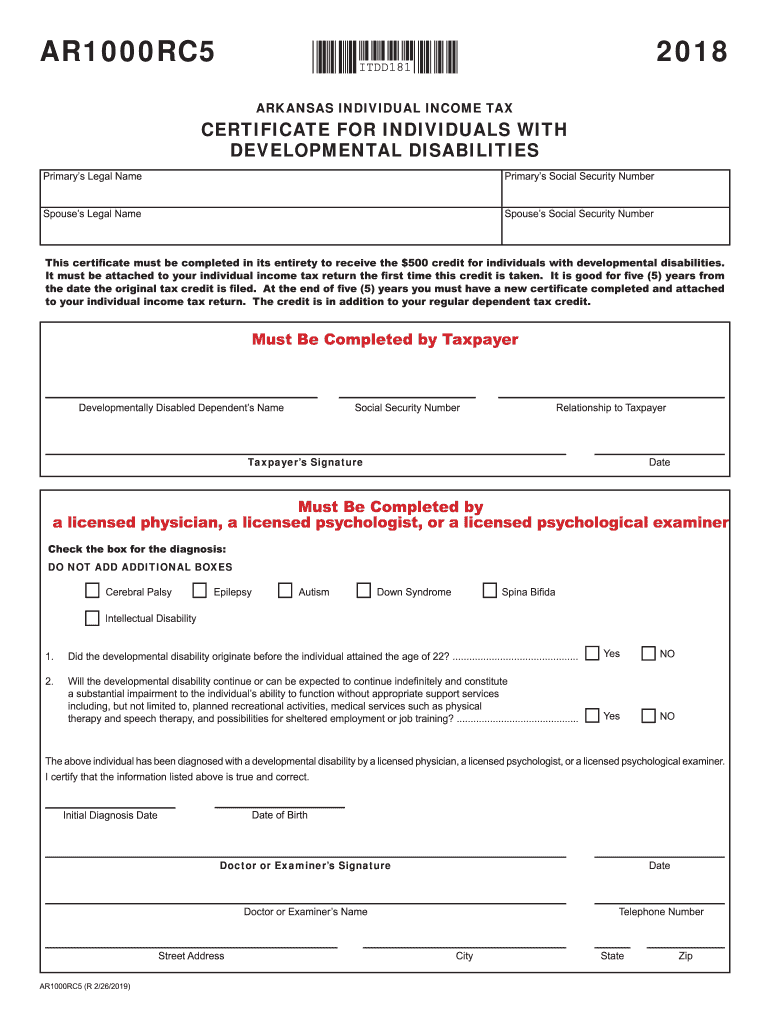

AR AR1000RC5 2018 Fill out Tax Template Online US Legal Forms

Web fiduciary and estate income tax forms; Unemployment is not taxable for 2020. Web fiduciary and estate income tax forms; Ar4ext application for automatic extension of time: Web arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue.

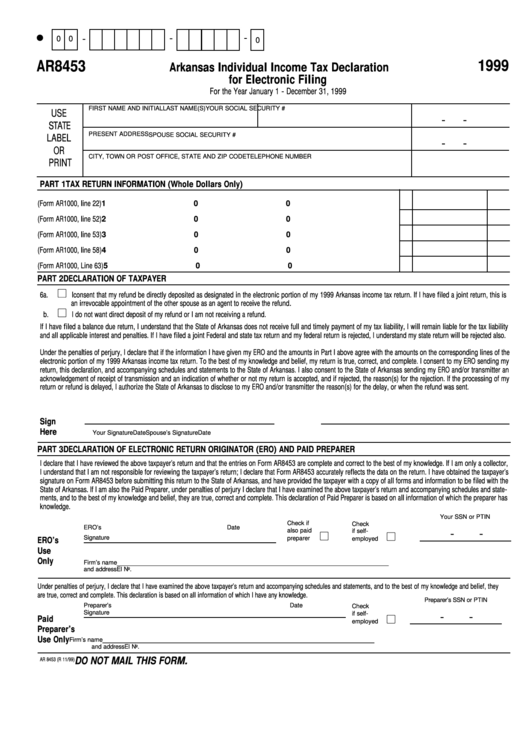

Form Ar8453 Arkansas Individual Tax Declaration 1999

Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,. Web arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Web fiduciary.

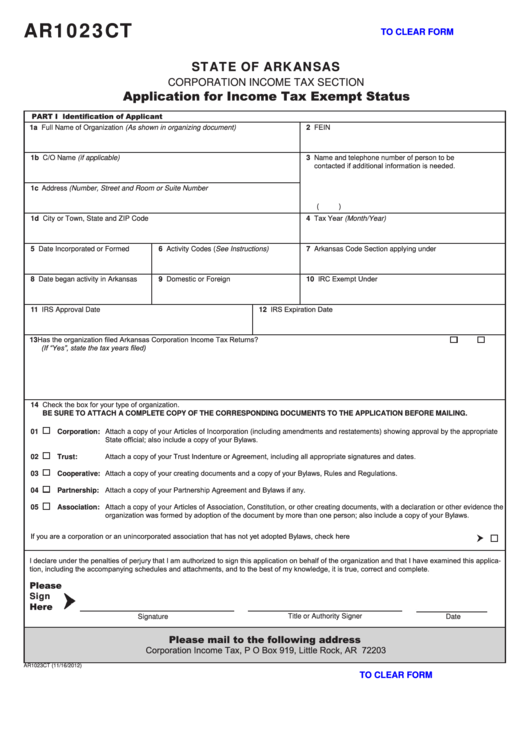

Fillable Form Ar1023ct Arkansas Application For Tax Exempt

Unemployment is not taxable for 2020. Filing and pay due date extended to may 17, 2021, 03/23/2021. Web 2021 tax year forms. Ar4ec employee's withholding exemption certificate: Web arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue.

The Current Tax Year Is 2022, And Most States Will Release Updated Tax Forms Between January And April Of 2023.

Ar4ecsp employee's special withholding exemption certificate: Web ar1099pt report of income tax withheld or paid on behalf of nonresident member: Taxformfinder provides printable pdf copies of 40 current arkansas income tax forms. Filing and pay due date extended to may 17, 2021, 03/23/2021.

Ar1000Es Individual Estimated Tax Vouchers For 2021.

Web 2021 tax year forms. Web tax help and forms internet you can access the department of finance and administration’s website atwww.dfa.arkansas.gov. Web arkansas has a state income tax that ranges between 2% and 6.6%, which is administered by the arkansas department of revenue. Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and late fees.

Web Fiduciary And Estate Income Tax Forms;

Ar4ext application for automatic extension of time: Web fiduciary and estate income tax forms; Ar4ec employee's withholding exemption certificate: Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1,.

This Line Is Used To Report Your Allowable Contribution To An Individual Retirement Account (Ira).

Unemployment is not taxable for 2020. Dfa instructions and forms have been updated to reflect the unemployment tax.