Arkansas State Tax Form 2023

Arkansas State Tax Form 2023 - Ar1023ct application for income tax exempt status. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web arkansas tax forms mailing addresses efiling information income tax refunds quickfact: Ar1036 employee tuition reimbursement tax credit. Multiply the period gross pay by the number of pay periods per year to arrive at the annual gross pay. Arkansas income tax table learn how marginal tax brackets work 2. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Individual income tax penalty waiver request form. The arkansas income tax rate for tax year 2022 is progressive from a low of.

Ar1100esct corporation estimated tax vouchers. We also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. The average family pays $2,343.00 in arkansas income taxes. Web calendar year 2023 filers must file their declaration of estimated taxon or before april 15th of the income year. Web arkansas tax forms mailing addresses efiling information income tax refunds quickfact: Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Individual income tax penalty waiver request form. Arkansas income tax table learn how marginal tax brackets work 2.

The arkansas state tax tables for 2023 displayed on this page are provided in support of the 2023 us tax calculator and the dedicated 2023 arkansas state tax calculator. Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Web calendar year 2023 filers must file their declaration of estimated taxon or before april 15th of the income year. Ar1100esct corporation estimated tax vouchers. The average family pays $2,343.00 in arkansas income taxes. We also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state. Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. The arkansas income tax rate for tax year 2022 is progressive from a low of. Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022.

Maryland Estimated Tax Form 2020

Arkansas income tax table learn how marginal tax brackets work 2. Ar1023ct application for income tax exempt status. Printable arkansas state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Ar1036 employee tuition reimbursement tax credit. The arkansas income tax rate for tax year 2022 is progressive from.

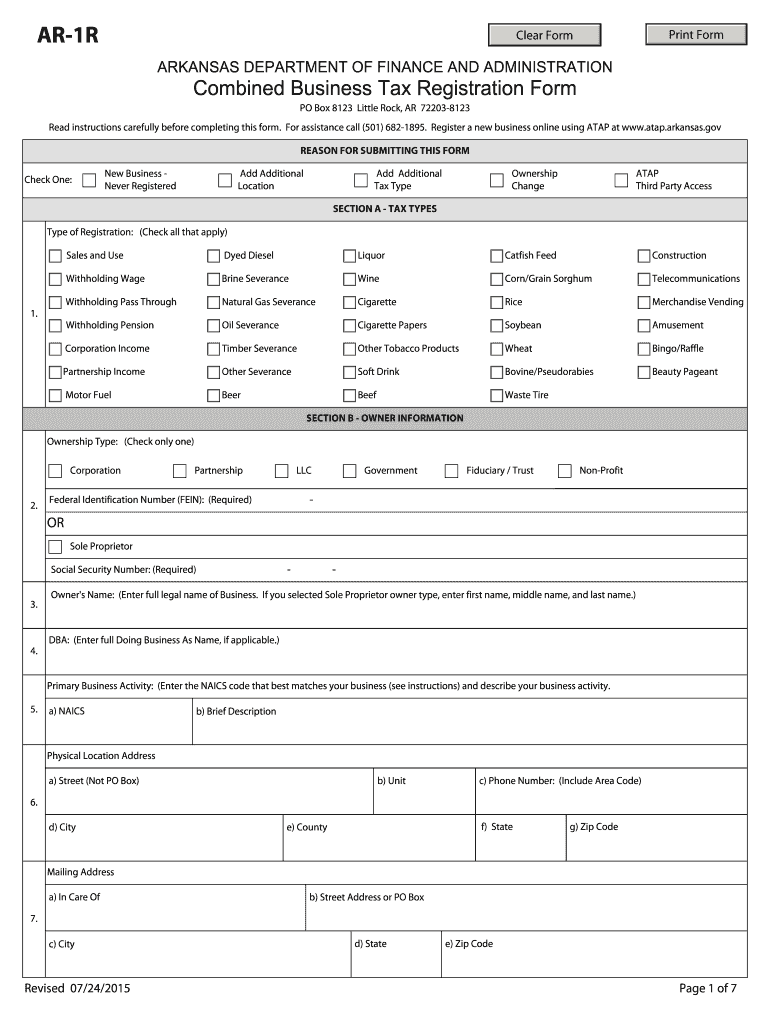

20152022 Form AR DFA AR1R Fill Online, Printable, Fillable, Blank

Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. Fiduciary and estate income tax forms. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Be sure to verify that the form you are downloading is.

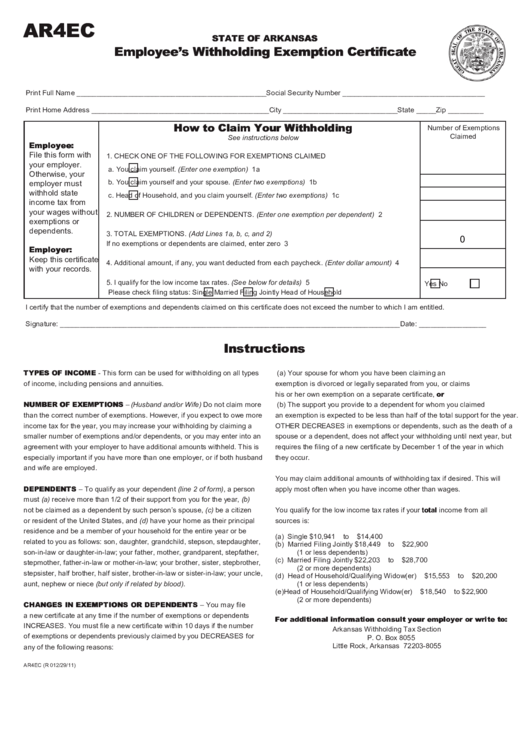

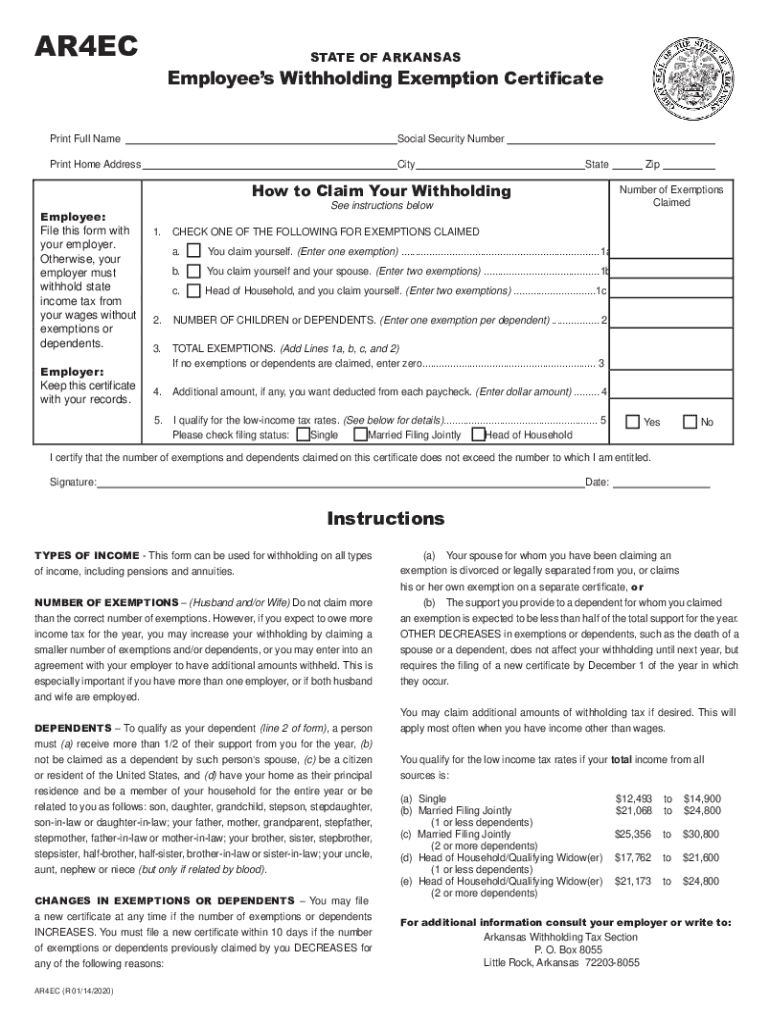

Fillable State Of Arkansas Employee's Withholding Exemption Certificate

Individual income tax name and address change form. Web arkansas tax forms mailing addresses efiling information income tax refunds quickfact: Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. The arkansas state tax tables for.

Arkansas State Withholding Form 2019 Fill Out And Sign Online Dochub

Web 2023 arkansas state tax tables. Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. Ar1023ct application for income tax exempt status. The arkansas state.

Arkansas Resale Certificate PDF Form Fill Out and Sign Printable PDF

Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. 7th out of 51 download arkansas tax information sheet launch arkansas income tax calculator 1. Individual income tax name and address change form. Withholding tax tables.

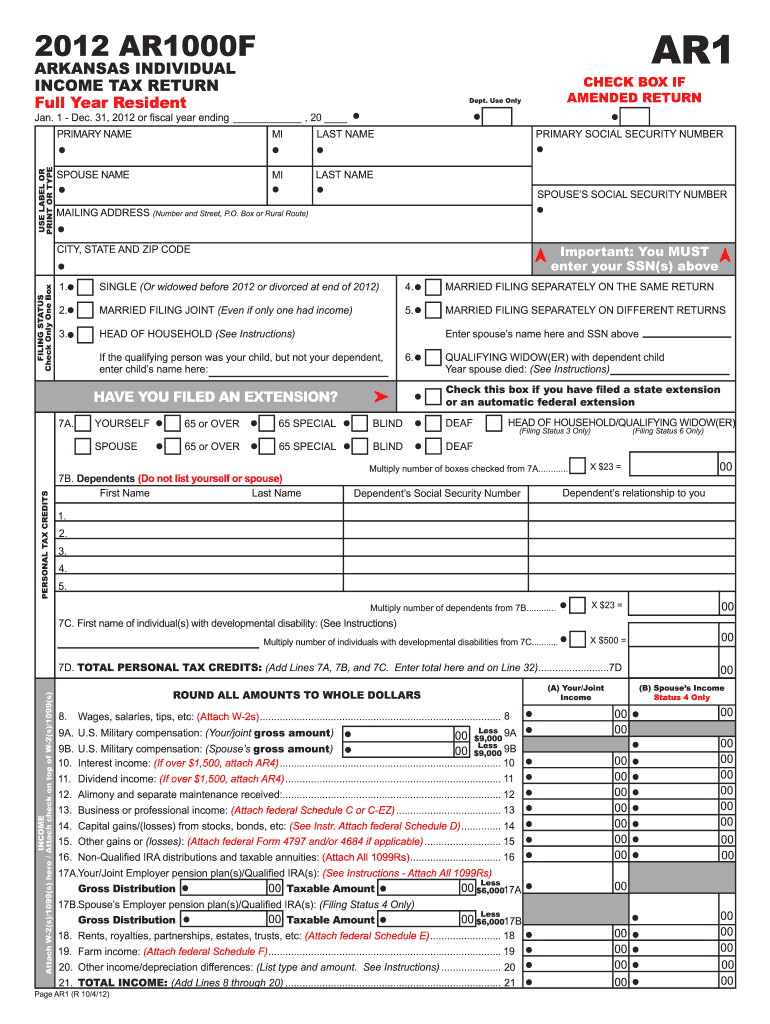

AR DFA AR1000F 2012 Fill out Tax Template Online US Legal Forms

Web 2023 arkansas state tax tables. Ar1036 employee tuition reimbursement tax credit. The arkansas state tax tables for 2023 displayed on this page are provided in support of the 2023 us tax calculator and the dedicated 2023 arkansas state tax calculator. Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023.

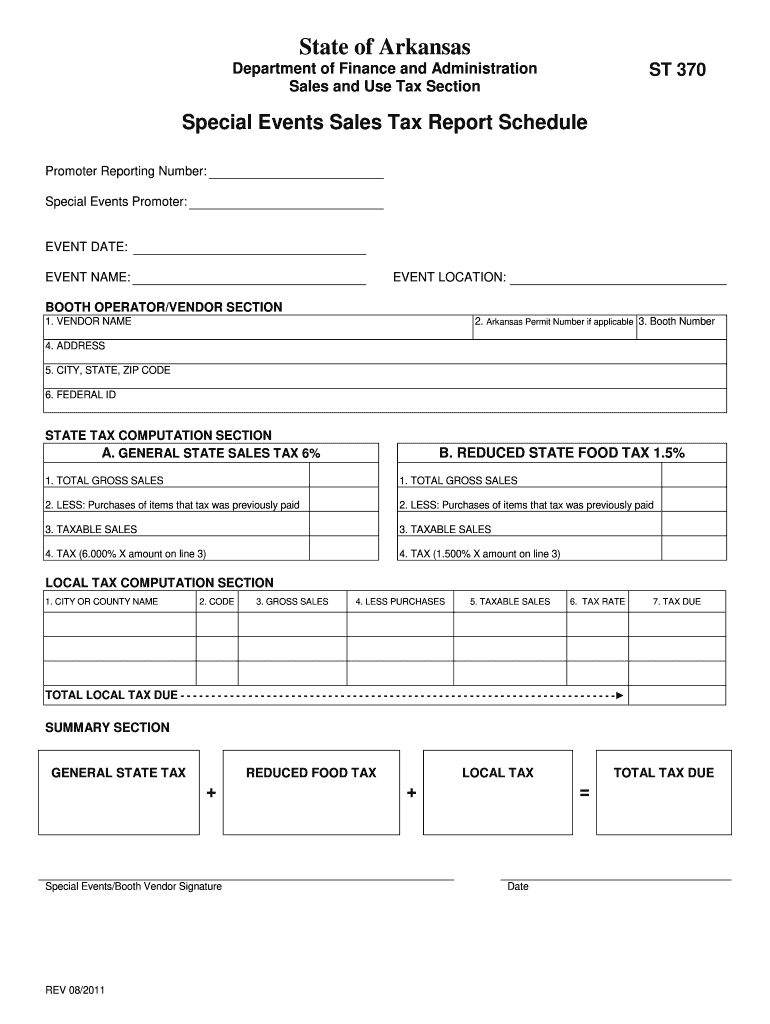

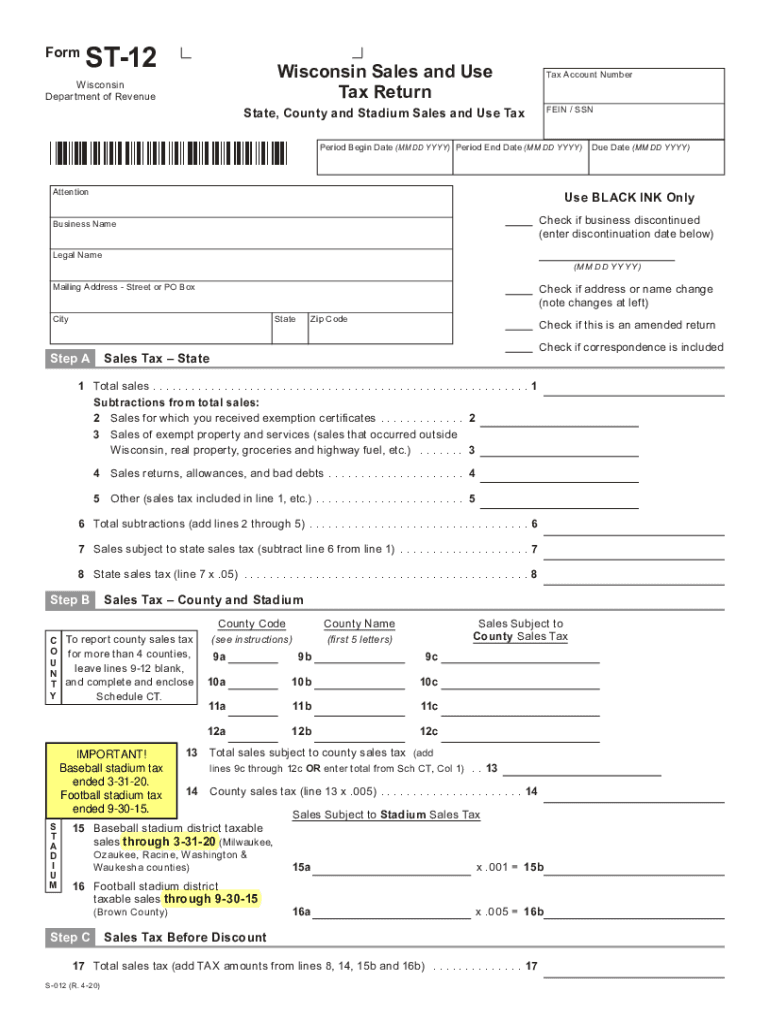

20202022 Form WI DoR ST12 Fill Online, Printable, Fillable, Blank

7th out of 51 download arkansas tax information sheet launch arkansas income tax calculator 1. Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. We also provide state tax tables for each us state with.

Arkansas State Tax Return Phone Number TAXP

Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Web calendar year 2023 filers must file their declaration of estimated taxon or before april 15th of the income year. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Ar1036 employee tuition reimbursement tax credit. Individual income tax penalty waiver request form.

Arkansas state tax forms Fill out & sign online DocHub

Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. 7th out of 51 download arkansas tax information sheet launch arkansas income tax calculator 1. Individual income tax penalty waiver request form. The arkansas income tax rate for tax year 2022 is progressive from a low of. Keep in mind that some states will not update their tax forms for 2023 until.

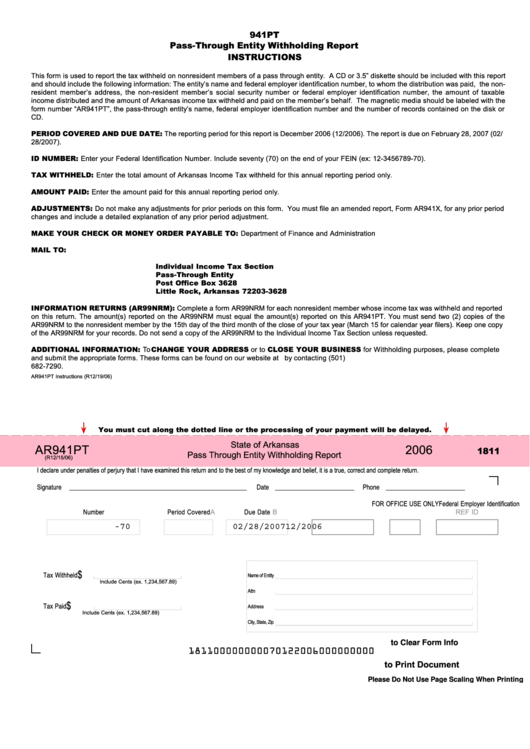

Fillable Form Ar941pt State Of Arkansas Pass Through Entity

Multiply the period gross pay by the number of pay periods per year to arrive at the annual gross pay. Web arkansas state income tax form ar1000f must be postmarked by april 18, 2023 in order to avoid penalties and late fees. The arkansas income tax rate for tax year 2022 is progressive from a low of. Printable arkansas state.

Ar1036 Employee Tuition Reimbursement Tax Credit.

Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Arkansas income tax table learn how marginal tax brackets work 2. Individual income tax penalty waiver request form. Web name/address change, penalty waiver request, and request for copies of tax return (s) title.

Ar1100Esct Corporation Estimated Tax Vouchers.

Web 2023 arkansas state tax tables. The arkansas state tax tables for 2023 displayed on this page are provided in support of the 2023 us tax calculator and the dedicated 2023 arkansas state tax calculator. Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of withholding rather than use the withholding tables. Be sure to verify that the form you are downloading is for the correct year.

Withholding Tax Tables For Employers (Effective 06/01/2023) 06/05/2023.

Multiply the period gross pay by the number of pay periods per year to arrive at the annual gross pay. Individual income tax name and address change form. 7th out of 51 download arkansas tax information sheet launch arkansas income tax calculator 1. The average family pays $2,343.00 in arkansas income taxes.

Withholding Tax Tables For Low Income (Effective 06/01/2023) 06/05/2023.

Keep in mind that some states will not update their tax forms for 2023 until january 2024. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Fiduciary and estate income tax forms. Web arkansas tax forms mailing addresses efiling information income tax refunds quickfact: