Audit Reconsideration Form 4549

Audit Reconsideration Form 4549 - (2) this section contains general information on procedures and administrative matters relative to the central reconsideration unit. Web if you’ve received irs form 4549, you’re already going through an audit. This taxpayer guide to form 4549 explains what to expect if you receive this form and how to respond. Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. It will include information, including: Web the irs form 4549 is the income tax examination changes letter. Now, you’re finding out what the irs thinks after digging around in your taxes. The form also includes requesting an audit reconsideration using form 12661 ( disputed issued verification ). Copies of the new documentation that supports your. Enter name control, first three numbers of tin and tax period e.g.

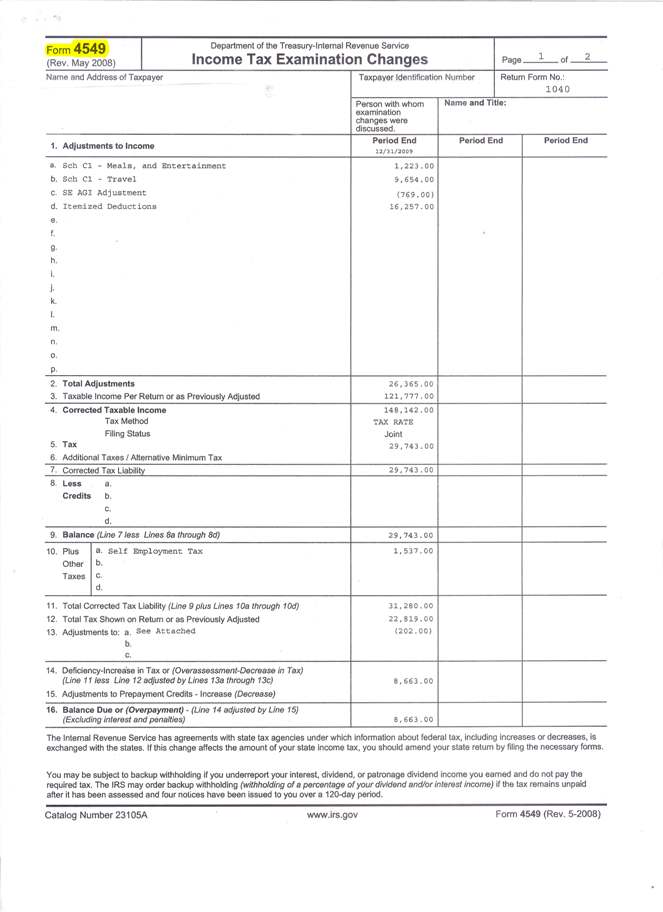

Include a schedule with the applicable form 4549 to show the tax computations. Web the irs form 4549 is the income tax examination changes letter. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Web attach audit reconsideration form 4549 irs form 4549, also known as the income tax examination changes letter, provides a summary of the changes proposed by the department for your tax return in addition to any penalties and interest determined as a result of the audit. Once you have form 4549, you’ll have to decide what to do next,. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. How long do i have to file for audit reconsideration? Be clear about which changes you want the irs to consider. A copy of your audit report (irs form 4549, income tax examination changes), if available. The form also includes requesting an audit reconsideration using form 12661 ( disputed issued verification ).

Once you have form 4549, you’ll have to decide what to do next,. Enter name control, first three numbers of tin and tax period e.g. It will include information, including: Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. The form also includes requesting an audit reconsideration using form 12661 ( disputed issued verification ). A copy of your audit report (irs form 4549, income tax examination changes), if available. Web if you’ve received irs form 4549, you’re already going through an audit. Copies of the new documentation that supports your. B) attempt to secure a copy of the examination report, form 4549, income tax examination changes, from the taxpayer.

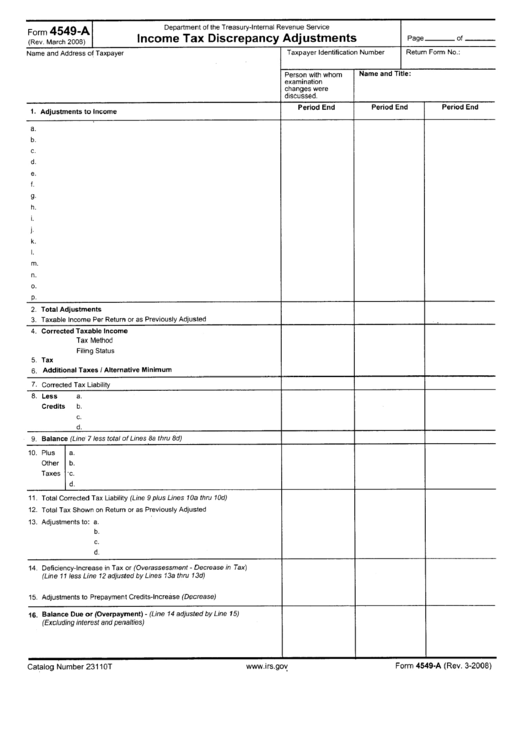

Form 4549A Tax Discrepancy Adjustments printable pdf download

Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. An audit reconsideration request can be made anytime after an examination assessment has been made on your account and the tax remains unpaid. (2) this section contains general information on procedures and administrative matters relative to.

Form 4549 IRS Audit Reconsideration The Full Guide Silver Tax Group

B) attempt to secure a copy of the examination report, form 4549, income tax examination changes, from the taxpayer. Web attach audit reconsideration form 4549 irs form 4549, also known as the income tax examination changes letter, provides a summary of the changes proposed by the department for your tax return in addition to any penalties and interest determined as.

IRS Audit Reconsideration If You Owe Back Taxes Wiztax

Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Now, you’re finding out what the irs thinks after digging around in your taxes. (2) this section contains general information on procedures and.

Audit Form 4549 Tax Lawyer Response to IRS Determination

How long do i have to file for audit reconsideration? Web attach audit reconsideration form 4549 irs form 4549, also known as the income tax examination changes letter, provides a summary of the changes proposed by the department for your tax return in addition to any penalties and interest determined as a result of the audit. Web form 4549 details.

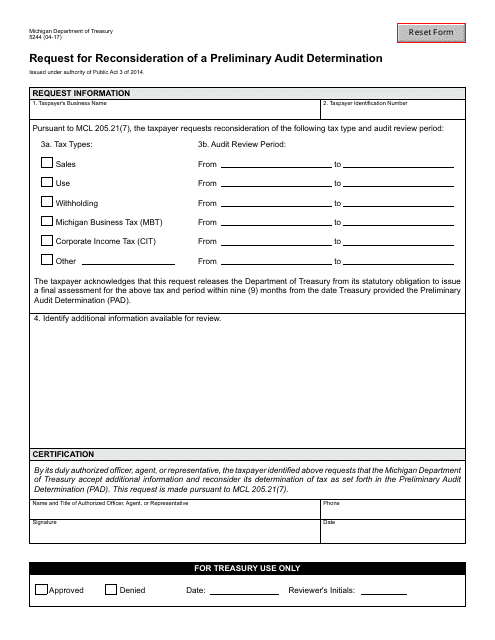

Form 5244 Download Fillable PDF or Fill Online Request for

Be clear about which changes you want the irs to consider. Include a schedule with the applicable form 4549 to show the tax computations. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. B) attempt to secure a copy of the examination report, form.

The Tax Times RA's Report Was Initial Determination For Penalty

Once you have form 4549, you’ll have to decide what to do next,. This taxpayer guide to form 4549 explains what to expect if you receive this form and how to respond. How long do i have to file for audit reconsideration? Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. Be clear about which changes.

Form 4549 IRS Audit Reconsideration The Full Guide Silver Tax Group

Now, you’re finding out what the irs thinks after digging around in your taxes. Enter name control, first three numbers of tin and tax period e.g. B) attempt to secure a copy of the examination report, form 4549, income tax examination changes, from the taxpayer. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments.

IRS Audit Letter 692 Sample 1

Enter name control, first three numbers of tin and tax period e.g. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Web attach audit reconsideration form 4549 irs form 4549, also known as the income tax examination changes letter, provides a summary of the changes.

Audit Reconsideration Tax Defense Group

Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. This taxpayer guide to form 4549 explains what to expect if you receive this form and how to respond. Now, you’re finding out what the irs thinks after digging around in your taxes. The form.

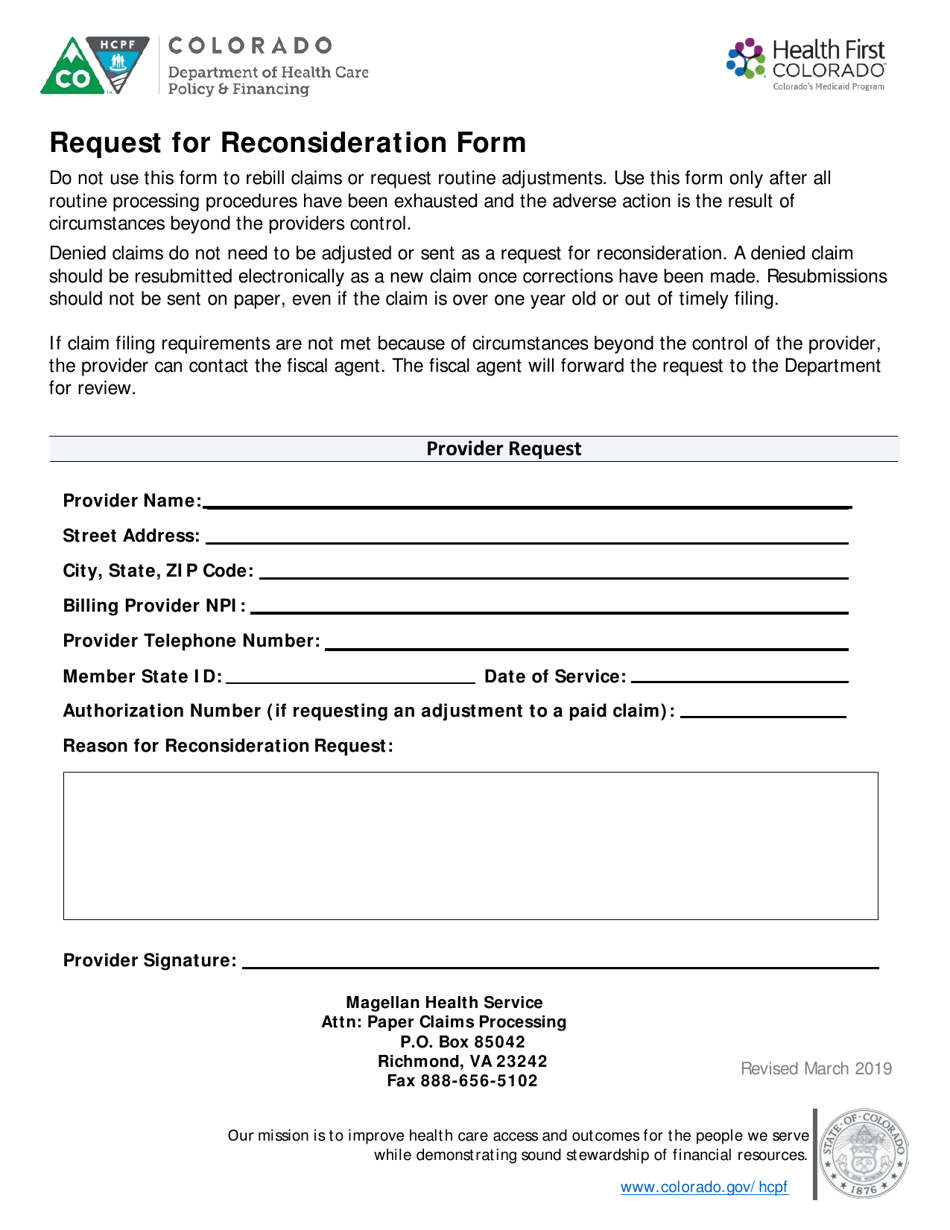

Colorado Request for Reconsideration Form Download Printable PDF

It will include information, including: An audit reconsideration request can be made anytime after an examination assessment has been made on your account and the tax remains unpaid. Web attach audit reconsideration form 4549 irs form 4549, also known as the income tax examination changes letter, provides a summary of the changes proposed by the department for your tax return.

Include A Schedule With The Applicable Form 4549 To Show The Tax Computations.

Web the irs form 4549 is the income tax examination changes letter. How long do i have to file for audit reconsideration? An audit reconsideration request can be made anytime after an examination assessment has been made on your account and the tax remains unpaid. It will include information, including:

Once You Have Form 4549, You’ll Have To Decide What To Do Next,.

Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Be clear about which changes you want the irs to consider. Now, you’re finding out what the irs thinks after digging around in your taxes.

The Form Will Include A Summary Of The Proposed Changes To The Tax Return, Penalties, And Interest Determined As An Outcome Of The Audit.

Copies of the new documentation that supports your. Enter name control, first three numbers of tin and tax period e.g. Web form 4549 details the irs's proposed changes to your return and shows your updated tax liability. This taxpayer guide to form 4549 explains what to expect if you receive this form and how to respond.

(2) This Section Contains General Information On Procedures And Administrative Matters Relative To The Central Reconsideration Unit.

A copy of your audit report (irs form 4549, income tax examination changes), if available. Web if you’ve received irs form 4549, you’re already going through an audit. B) attempt to secure a copy of the examination report, form 4549, income tax examination changes, from the taxpayer. Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit.