Az Form 352

Az Form 352 - For the calendar year 2020 or fiscal year. Then subtract your tax credits from your tax liability to reduce your arizona. After completing arizona form 352, taxpayers will summarize all the. For the calendar year 2022 or fiscal year. Get up to $1,000 for married couples and $500 for single filers. Web arizona form 352 include with your return. Web arizona form 352 credit for contributions to qualifying foster care charitable organizations2021 page 1 of 3 part 1 current year’s credit a. Credit for contributions to qualifying foster care charitable. (a) contribution date mm/dd/2021 (b) qualifying foster care charity code (c) name of qualifying foster care charity. Credit for contributions to qualifying foster care charitable organizations2018 for the calendar year 2018 or fiscal year beginning.

Web arizona form 352 credit for contributions to qualifying foster care charitable organizations2021 page 1 of 3 part 1 current year’s credit a. Web arizona form 352 include with your return. The maximum qfco credit donation amount for 2022: Web the instructions in arizona form 321 and arizona form 352 have two phone numbers for any questions about the credits for donations to qualifying charitable. Click here for form 352 and instructions. Web to claim the credit, taxpayers must complete arizona form 352. Have you been trying to find a fast and practical tool to fill in arizona form 352. Web ad 11294 16 a form 352 (2016) pae 2 o 2 your ame as son on ae 1 your oial eurity umber part 2 available credit carryover if you have a carryover amount available from a prior. Web calculate your individual tax returns (e.g. A nonrefundable individual tax credit for voluntary cash contributions to a qualifying foster.

You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 352. Web ad 11294 16 a form 352 (2016) pae 2 o 2 your ame as son on ae 1 your oial eurity umber part 2 available credit carryover if you have a carryover amount available from a prior. Arizona form 140, 140nr, 140py, or 140x). Get up to $1,000 for married couples and $500 for single filers. Web the tax credit is claimed on form 352. Web general instructions note: Web follow the simple instructions below: Web credit for contributions to qualifying foster care charitable organizations. Then subtract your tax credits from your tax liability to reduce your arizona. The maximum qfco credit donation amount for 2022:

2015 AZ Form 5000A Fill Online, Printable, Fillable, Blank pdfFiller

Web specifically, arizona form 321 is used for donations to qualifying charitable organizations and the arizona form 352 is used for gifts to qualifying foster care charitable. Web arizona form credit for contributions 352to qualifying foster care charitable organizations include with your return. Web ad 11294 16 a form 352 (2016) pae 2 o 2 your ame as son on.

azdor.gov Forms .. ADOR Forms AZ140V_f

Web arizona form 352 credit for contributions to qualifying foster care charitable organizations2021 page 1 of 3 part 1 current year’s credit a. Arizona form 140, 140nr, 140py, or 140x). You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 352. Web the instructions in arizona form 321 and arizona form 352.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Web specifically, arizona form 321 is used for donations to qualifying charitable organizations and the arizona form 352 is used for gifts to qualifying foster care charitable. Get up to $1,000 for married couples and $500 for single filers. Web to get to the right area of turbotax for arizona form 352, please follow the instructions below:. Web arizona form.

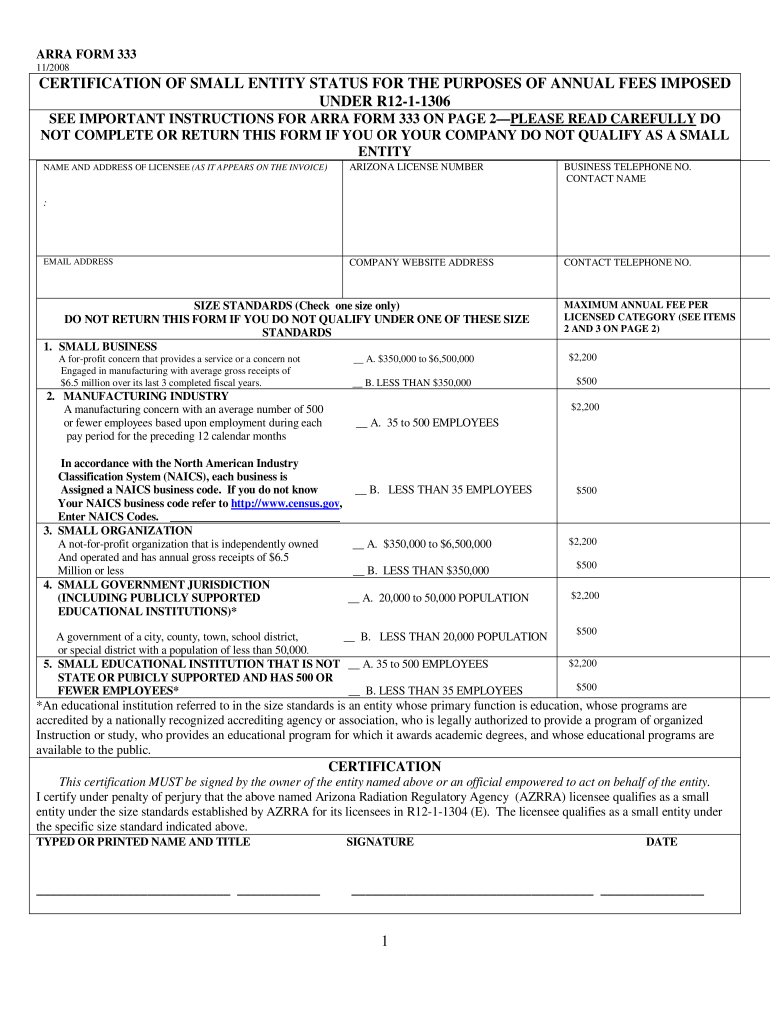

Az Form 333 Fill Online, Printable, Fillable, Blank pdfFiller

Get up to $1,000 for married couples and $500 for single filers. Credit for contributions to qualifying foster care charitable organizations2018 for the calendar year 2018 or fiscal year beginning. Web general instructions note:you must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 352 with your tax. Web arizona form 352 include.

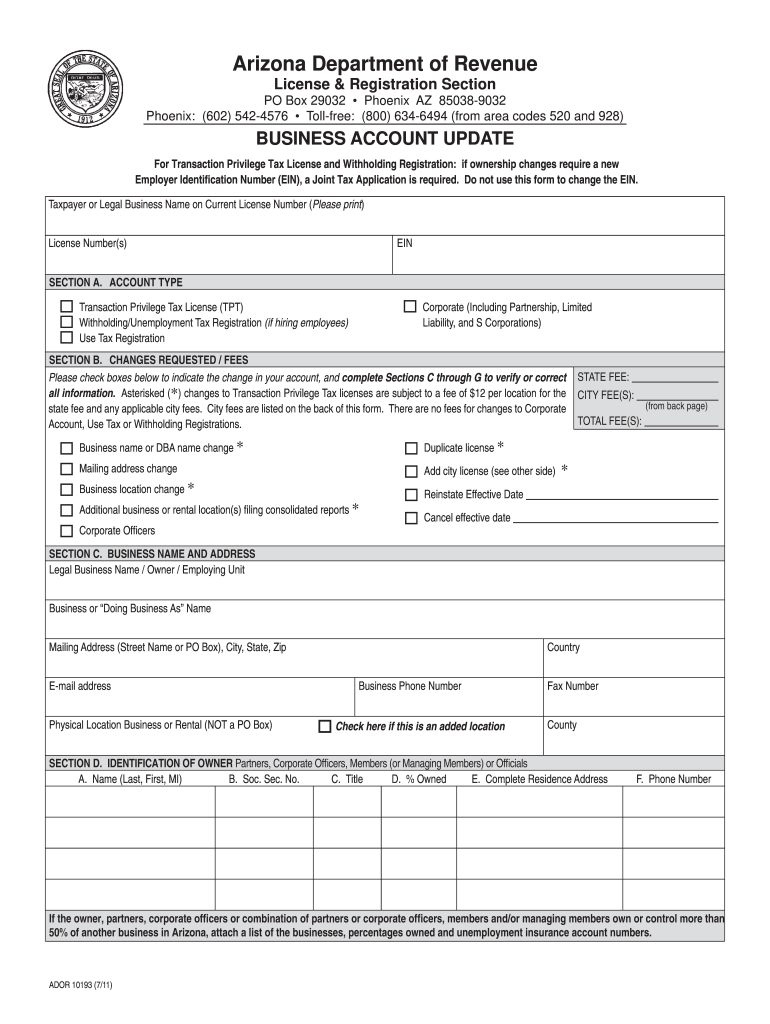

Az Form 10193 Fill Online, Printable, Fillable, Blank PDFfiller

$500 single, married filing separate or head of household; Web the tax credit is claimed on form 352. Credit for contributions to qualifying foster care charitable organizations2018 for the calendar year 2018 or fiscal year beginning. Click here for form 352 and instructions. Web general instructions note:you must also complete arizona form 301, nonrefundable individual tax credits and recapture, and.

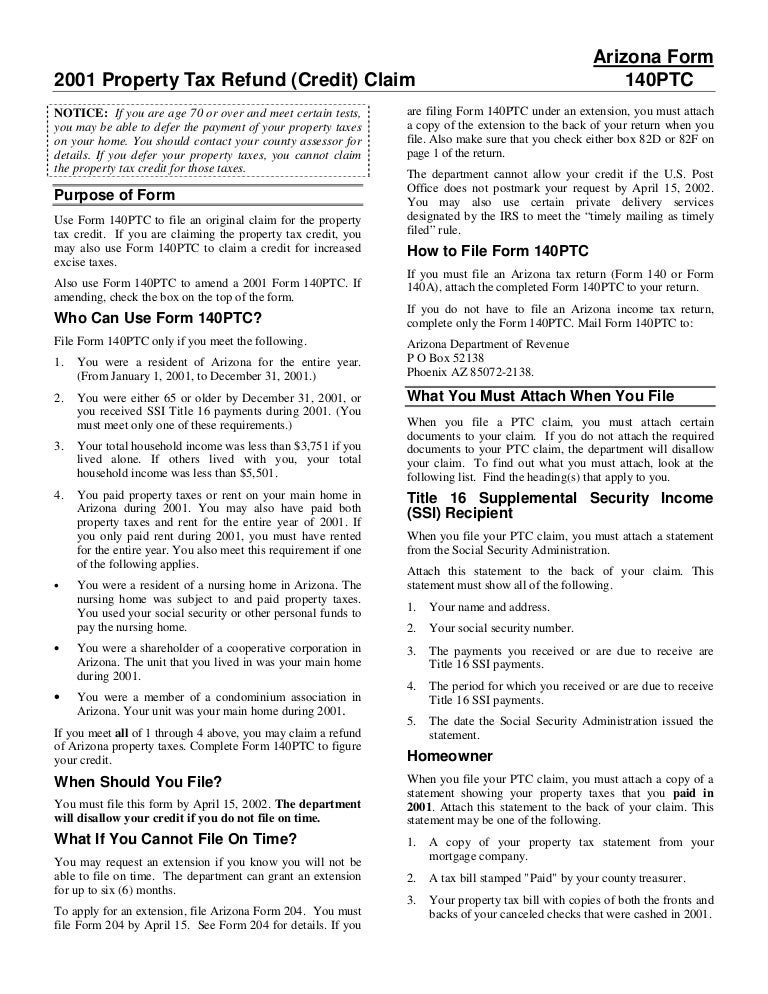

azdor.gov Forms 140PTCi

Web arizona form credit for contributions 352to qualifying foster care charitable organizations include with your return. Web general instructions note: Web specifically, arizona form 321 is used for donations to qualifying charitable organizations and the arizona form 352 is used for gifts to qualifying foster care charitable. You must also complete arizona form 301, nonrefundable individual tax credits and recapture,and.

AZ Form 301, Nonrefundable Individual Tax Credits and Recapture

Then subtract your tax credits from your tax liability to reduce your arizona. Web to claim the credit, taxpayers must complete arizona form 352. Web arizona form credit for contributions 352to qualifying foster care charitable organizations include with your return. Have you been trying to find a fast and practical tool to fill in arizona form 352. Web arizona form.

Annual Property Operating Data Sheet (APOD) — RPI Form 352

Get up to $1,000 for married couples and $500 for single filers. Credit for contributions to qualifying foster care charitable organizations2018 for the calendar year 2018 or fiscal year beginning. You must also complete arizona form 301, nonrefundable individual tax credits and recapture,and include forms 301 and 352 with your tax. The maximum qfco credit donation amount for 2022: Web.

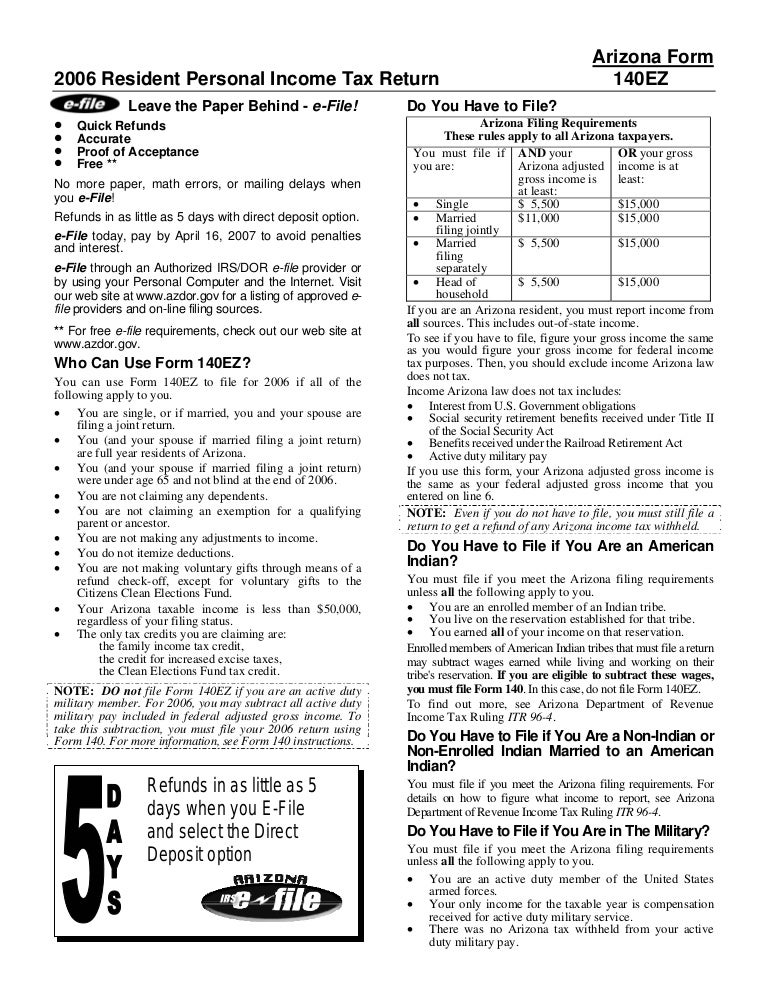

azdor.gov Forms 140EZ20instructions

Web the tax credit is claimed on form 352. The tax credit is claimed on form 352. Web arizona form 352 4aq’s for arizona state taxpayers credit eligible contributions made to a qualifying foster care organization that are made on or before april 15, 2023 may be. Web the instructions in arizona form 321 and arizona form 352 have two.

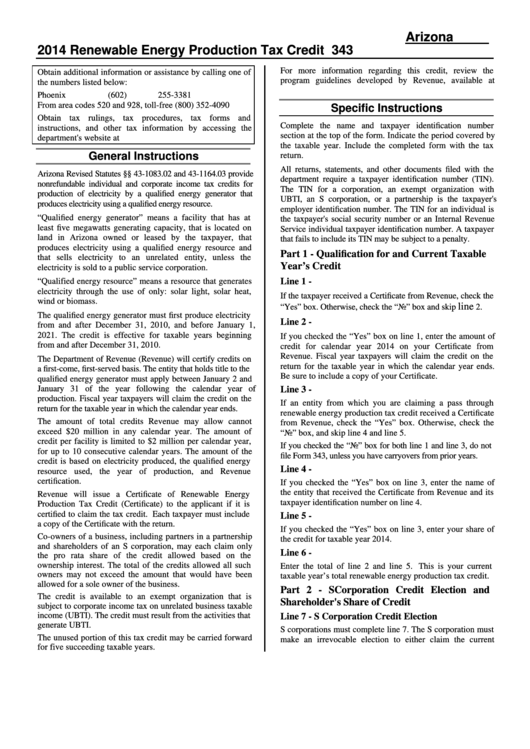

Instructions For Form 343 Arizona Renewable Energy Production Tax

Web arizona form credit for contributions 352to qualifying foster care charitable organizations include with your return. The maximum qfco credit donation amount for 2022: Have you been trying to find a fast and practical tool to fill in arizona form 352. Web the tax credit is claimed on form 352. You must also complete arizona form 301, nonrefundable individual tax.

Web Arizona Form 352 4Aq’s For Arizona State Taxpayers Credit Eligible Contributions Made To A Qualifying Foster Care Organization That Are Made On Or Before April 15, 2023 May Be.

Web arizona form credit for contributions 352to qualifying foster care charitable organizations2020 include with your return. After completing arizona form 352, taxpayers will summarize all the. Credit for contributions to qualifying foster care charitable organizations2018 for the calendar year 2018 or fiscal year beginning. Get up to $1,000 for married couples and $500 for single filers.

Web General Instructions Note:

For the calendar year 2022 or fiscal year. Web follow the simple instructions below: Web ad 11294 16 a form 352 (2016) pae 2 o 2 your ame as son on ae 1 your oial eurity umber part 2 available credit carryover if you have a carryover amount available from a prior. The maximum qfco credit donation amount for 2022:

Click Here For Form 352 And Instructions.

During tax time, complete az form 301 ( form | instructions) and az form 352 ( form | instructions) and include it when you file your state taxes. For the calendar year 2020 or fiscal year. Web the instructions in arizona form 321 and arizona form 352 have two phone numbers for any questions about the credits for donations to qualifying charitable. $500 single, married filing separate or head of household;

Web To Get To The Right Area Of Turbotax For Arizona Form 352, Please Follow The Instructions Below:.

Credit for contributions to qualifying foster care charitable. Web arizona form credit for contributions 352to qualifying foster care charitable organizations include with your return. Then subtract your tax credits from your tax liability to reduce your arizona. Web to claim the credit, taxpayers must complete arizona form 352.