Blank 941 Form 2019

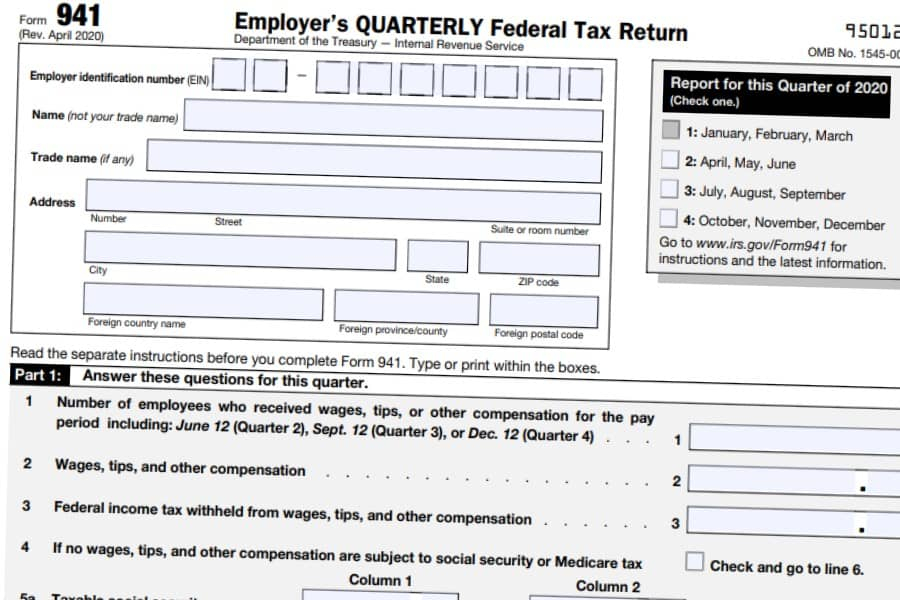

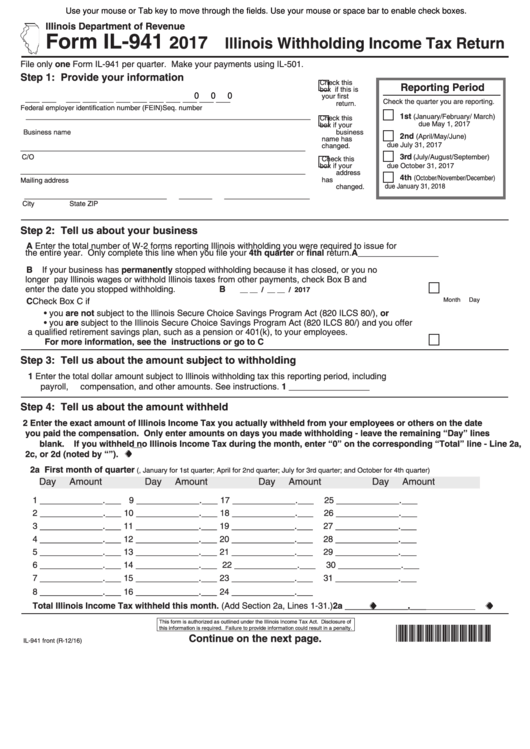

Blank 941 Form 2019 - Web first of all, open a blank 941 form. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Form 941 is used to determine For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web complete irs 941 2019 online with us legal forms. Web form 941 for 2019:(rev. Web form 941 for 2021: Employer’s quarterly federal tax return. Now, the irs has extended it to the second, third, and fourth quarters. Web form 941 for 2023:

January 2019) employer’s quarterly federal tax returndepartment of the treasury — internal revenue service 950117 omb no. All forms are printable and downloadable. Use fill to complete blank online irs pdf forms for free. Web complete irs 941 2019 online with us legal forms. We need it to figure and collect the right amount of tax. Calculate the total wages paid to employees during the quarter, including any tips and taxable fringe. Save or instantly send your ready documents. Employer’s quarterly federal tax return. You'll be able to obtain the blank form from the pdfliner catalog. It should contain the dollar amount of the taxable social security wages.

All forms are printable and downloadable. We need it to figure and collect the right amount of tax. Web the irs form 941, also known as employer's quarterly federal tax return, was scheduled to change in june 2022. Save or instantly send your ready documents. Use fill to complete blank online irs pdf forms for free. Form 941 is used to determine Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web when i create the 2020 q2 941 form, line 5a column 1 is blank. Obtain access to a hipaa and gdpr compliant solution for maximum simpleness. Employer’s quarterly federal tax return.

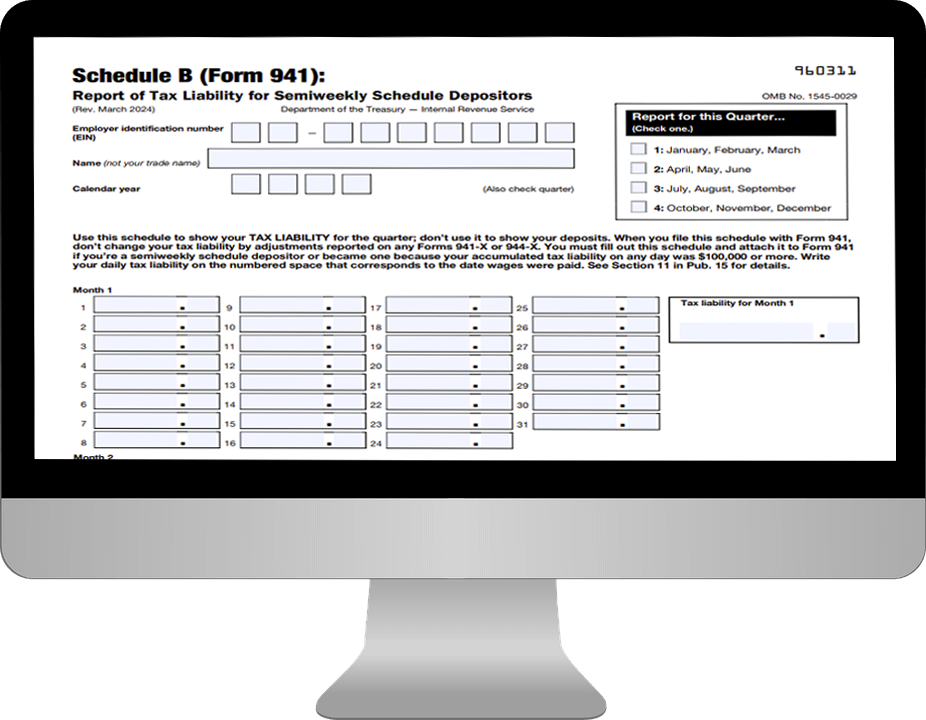

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Previously, form 941 was only updated in march for the first quarter reports. Web form 941 for 2021: Web first of all, open a blank 941 form. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. March 2021) employer’s quarterly federal tax return department of the treasury — internal.

printable 941 form 2019 PrintableTemplates

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Now, the irs has extended it to the second, third, and fourth quarters. American samoa, guam, the commonwealth of the northern mariana islands, and the u.s. All forms are printable and downloadable. Employers use form 941 to:

941 schedule b 2022 Fill Online, Printable, Fillable Blank form971

Web fill online, printable, fillable, blank form 941 employer’s federal tax return form. Employer identification number (ein) — name (not your trade name) trade. We need it to figure and collect the right amount of tax. Form 941 employer’s federal tax return. As the form is submitted each quarter, check the right quartal in.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Once completed you can sign your fillable form or send for signing. Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. Web we know how straining filling out documents can be. You'll be able to obtain the blank form from the pdfliner catalog. Web first of all, open a.

printable 941 form 2019 PrintableTemplates

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web form 941 employer's quarterly federal tax return. Employer identification number.

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

January 2019) employer’s quarterly federal tax returndepartment of the treasury — internal revenue service 950117 omb no. Form 941 is used to determine Previously, form 941 was only updated in march for the first quarter reports. Web how to fill out form 941: Web when i create the 2020 q2 941 form, line 5a column 1 is blank.

Printable 941 Tax Form 2021 Printable Form 2022

All forms are printable and downloadable. Web we know how straining filling out documents can be. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Instructions for form 941 (2021) pdf. American samoa, guam, the commonwealth of the northern mariana islands, and the u.s.

printable 941 form 2019 PrintableTemplates

Save or instantly send your ready documents. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web form 941 for 2021: Web 01 fill and edit template 02 sign it online 03 export or print immediately where to find a blank form 941.

941 form 2020 Fill Online, Printable, Fillable Blank form941

Once completed you can sign your fillable form or send for signing. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Previously, form 941 was only updated in march for the first quarter reports. Web we ask for the information on form 941 to carry out the internal revenue laws of the united.

form 941 instructions Fill Online, Printable, Fillable Blank form

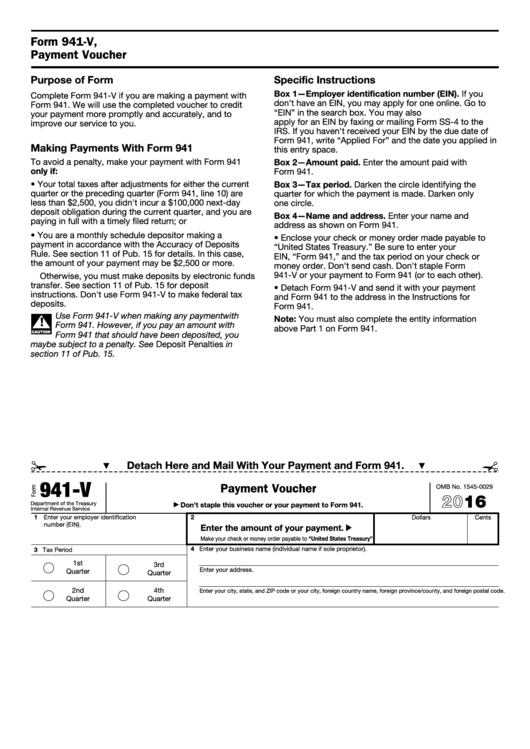

Web complete irs 941 2019 online with us legal forms. Web fill online, printable, fillable, blank form 941 employer’s federal tax return form. Employer identification number (ein) — name (not. Previously, form 941 was only updated in march for the first quarter reports. It has five parts and a payment voucher at the end if you’re submitting the form by.

Web Form 941 For 2021:

Web complete irs 941 2019 online with us legal forms. We need it to figure and collect the right amount of tax. Web about form 941, employer's quarterly federal tax return. Web form 941 for 2023:

April 2023) Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund Department Of The Treasury — Internal Revenue Service Omb No.

Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. All forms are printable and downloadable. Employer’s quarterly federal tax return. Employer identification number (ein) — name (not.

To Start Filling Out The Form, Click The “Fill This Form” Button, Or If You Would Like To Know How To Find It Here Letter, Follow These Steps:

Gather all necessary information, such as employer identification number, business name, and mailing address. Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. As the form is submitted each quarter, check the right quartal in. Web the irs form 941, also known as employer's quarterly federal tax return, was scheduled to change in june 2022.

You'll Be Able To Obtain The Blank Form From The Pdfliner Catalog.

January 2019) department of the treasury — internal revenue service. It should contain the dollar amount of the taxable social security wages. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web form 941 for 2019:(rev.