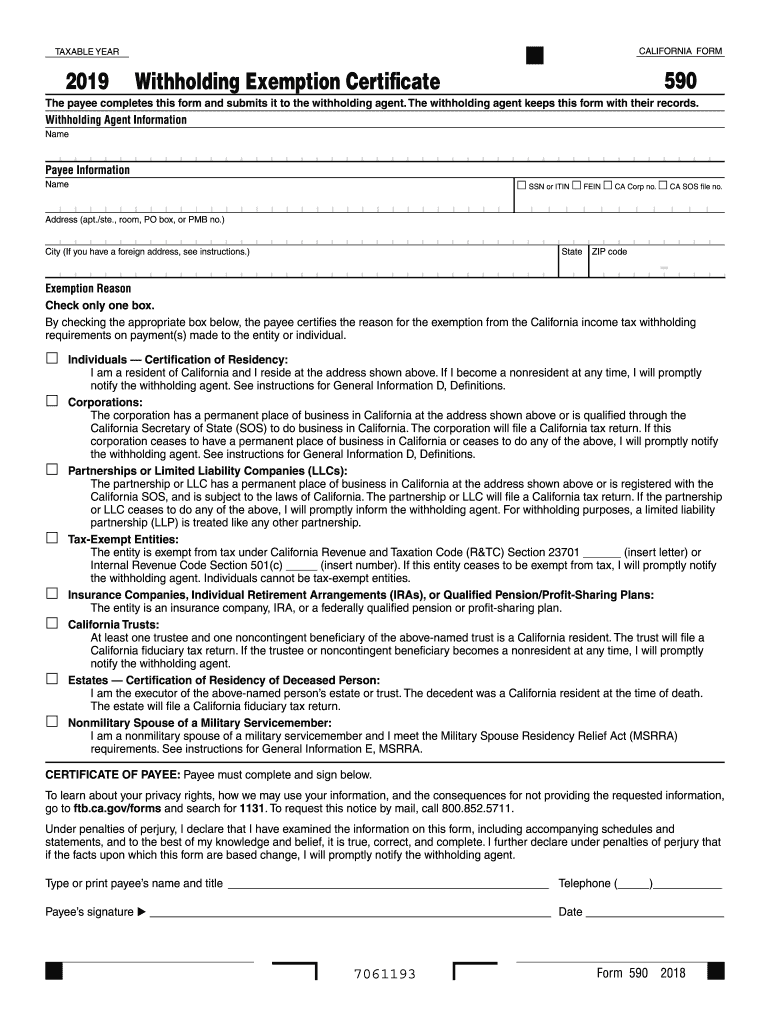

Ca 590 Form 2022 Instructions

Ca 590 Form 2022 Instructions - Web form 590 does not apply to payments for wages to employees. Web purpose use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The withholding agent keeps this form with. Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the california revenue and taxation code. Web form 590 instructions 2022 the payee must notify the withholding agent if any of the following situations occur: Web withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Form 590 does not apply to payments of backup withholding. The payment is to an estate and the decedent was a california resident. Fill in all the info required in ca ftb 590, utilizing fillable fields. Crescent city, ca 95531 cua coordinator (707).

Web form 590 does not apply to payments for wages to employees. General information purpose use form 590 to. Fill in all the info required in ca ftb 590, utilizing fillable fields. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web form 50 201 taxable year 2020 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Form 590 does not apply to payments of backup withholding. The payment is to an estate and the decedent was a california resident. Web we last updated california form 590 in february 2023 from the california franchise tax board. Web form 590 instructions 2022 the payee must notify the withholding agent if any of the following situations occur: Web open the file using our powerful pdf editor.

Web form 50 201 taxable year 2020 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web we last updated california form 590 in february 2023 from the california franchise tax board. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Form 590 does not apply to payments of backup withholding. Wage withholding is administered by the california employment development department (edd). Web withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Items of income that are subject to. General information purpose use form 590 to. The withholding agent keeps this form with their.

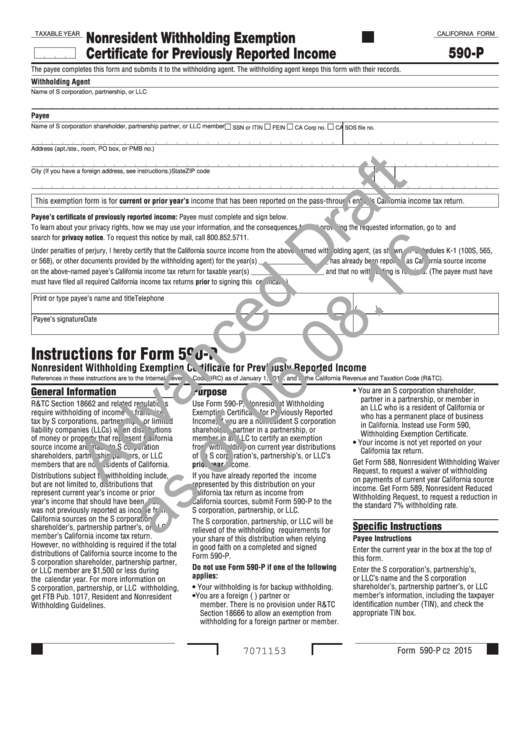

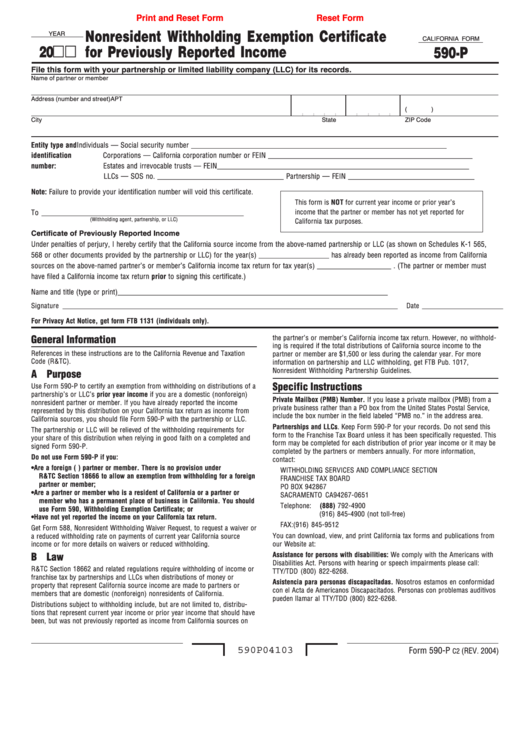

California Form 590P Draft Nonresident Withholding Exemption

General information purpose use form 590 to. Items of income that are subject to. The withholding agent keeps this form with. This form is for income earned in tax year 2022, with tax returns due in april. Crescent city, ca 95531 cua coordinator (707).

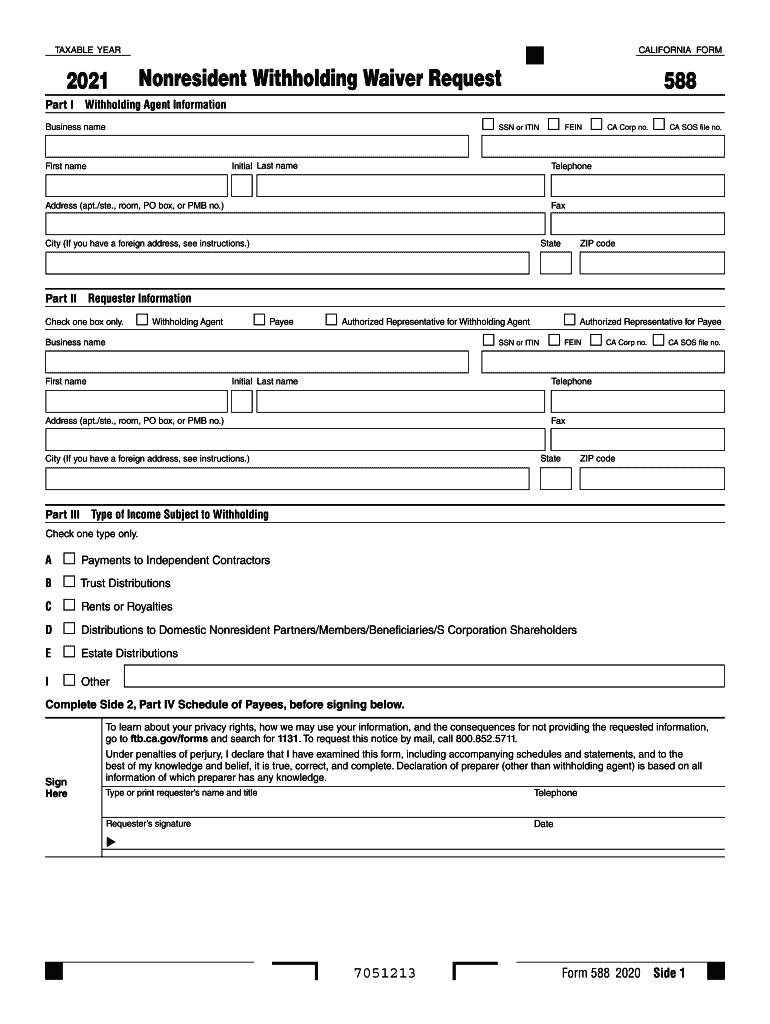

CA FTB 588 20212022 Fill out Tax Template Online US Legal Forms

You can download or print current. Include images, crosses, check and text boxes, if required. The withholding agent keeps this form with. Web we last updated california form 590 in february 2023 from the california franchise tax board. Form 590 does not apply to payments of backup withholding.

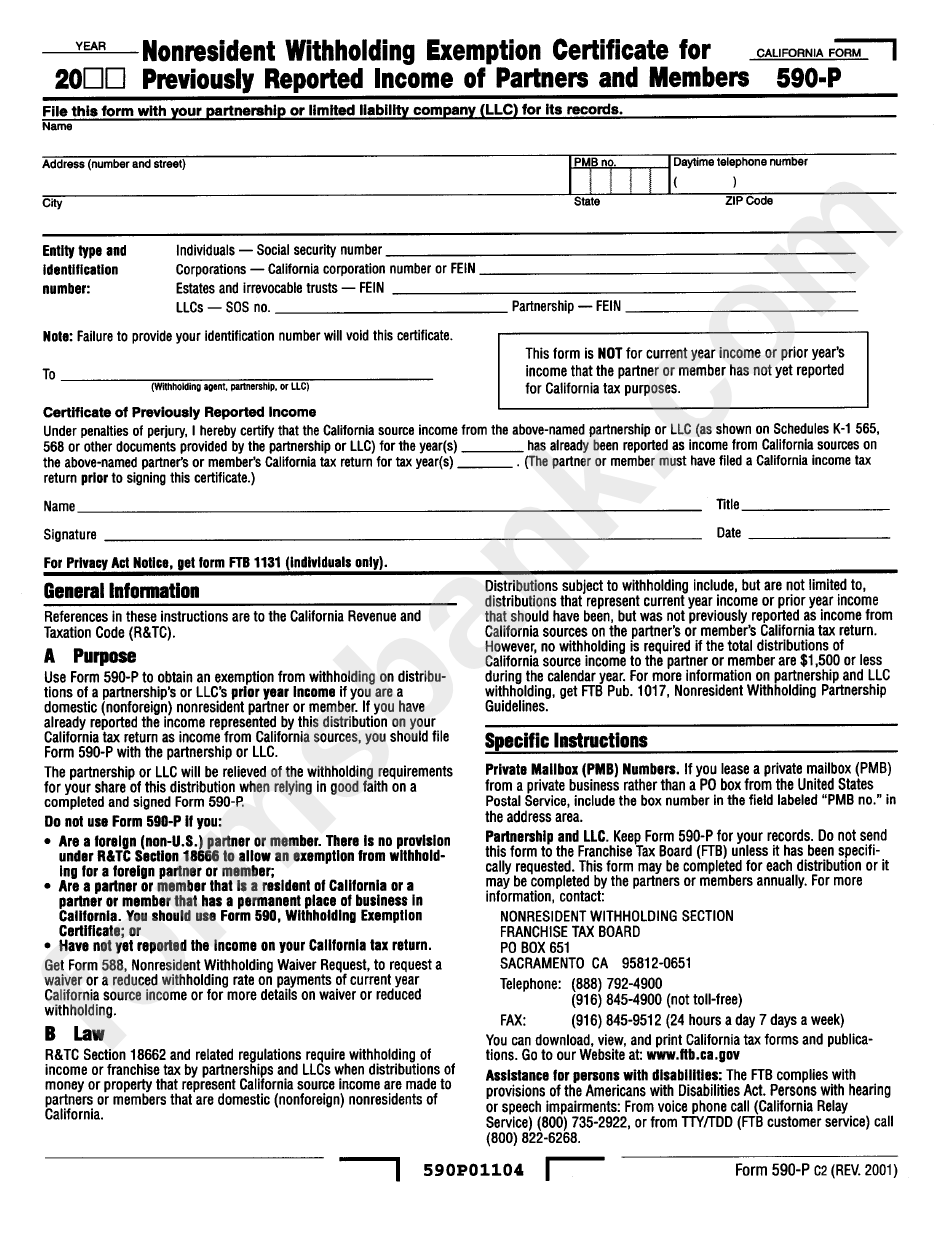

Form 590P Nonresident Withholding Exemption Certificate For

The withholding agent keeps this form with their. Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the california revenue and taxation code. Fill in all the info required in ca ftb 590, utilizing fillable fields. Wage withholding is administered by the california employment development department (edd). Crescent city, ca 95531.

Uscis Form I 590 Printable and Blank PDF Sample to Download

The withholding agent keeps this form with their. Wage withholding is administered by the california employment development department (edd). You can download or print current. The withholding agent keeps this form with. Crescent city, ca 95531 cua coordinator (707).

ads/responsive.txt Ca 590 form 2018 Awesome California Franchise Tax

Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with their. Web form 50 201 taxable year 2020 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. You can download or print current. •.

Form 590 Withholding Exemption Certificate City Of Fill Out and Sign

Web purpose use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Include images, crosses, check and text boxes, if required. The withholding agent keeps this form with their records. Web form 590 does not apply to.

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

Fill in all the info required in ca ftb 590, utilizing fillable fields. The payee completes this form and submits it to the withholding agent. The payment is to an estate and the decedent was a california resident. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web notice.

Ira Deduction Worksheet 2018 —

Web purpose use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Fill in all the info required in ca ftb 590, utilizing fillable fields. Form 590 does not apply to payments of backup withholding. Web we last updated california form 590 in february 2023 from the california franchise tax board. The payment is to an estate.

California Form 590 Draft Withholding Exemption Certificate With

Web form 590 instructions 2022 the payee must notify the withholding agent if any of the following situations occur: The withholding agent keeps this form with. The withholding agent keeps this form with their records. This form is for income earned in tax year 2022, with tax returns due in april. Crescent city, ca 95531 cua coordinator (707).

Fillable California Form 590P Nonresident Withholding Exemption

Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the california revenue and taxation code. Web form 590 does not apply to payments for wages to employees. This form is for income earned in tax year 2022, with tax returns due in april. Web open the file using our powerful pdf.

Web Notice From The Ca Franchise Tax Board That A Withholding Waiver Was Authorized (You Must First File Ca Form 588, Nonresident Withholding Waiver Request) For Your Convenience,.

The payment is to an estate and the decedent was a california resident. • the individual payee becomes a nonresident. Web 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web open the file using our powerful pdf editor.

Items Of Income That Are Subject To.

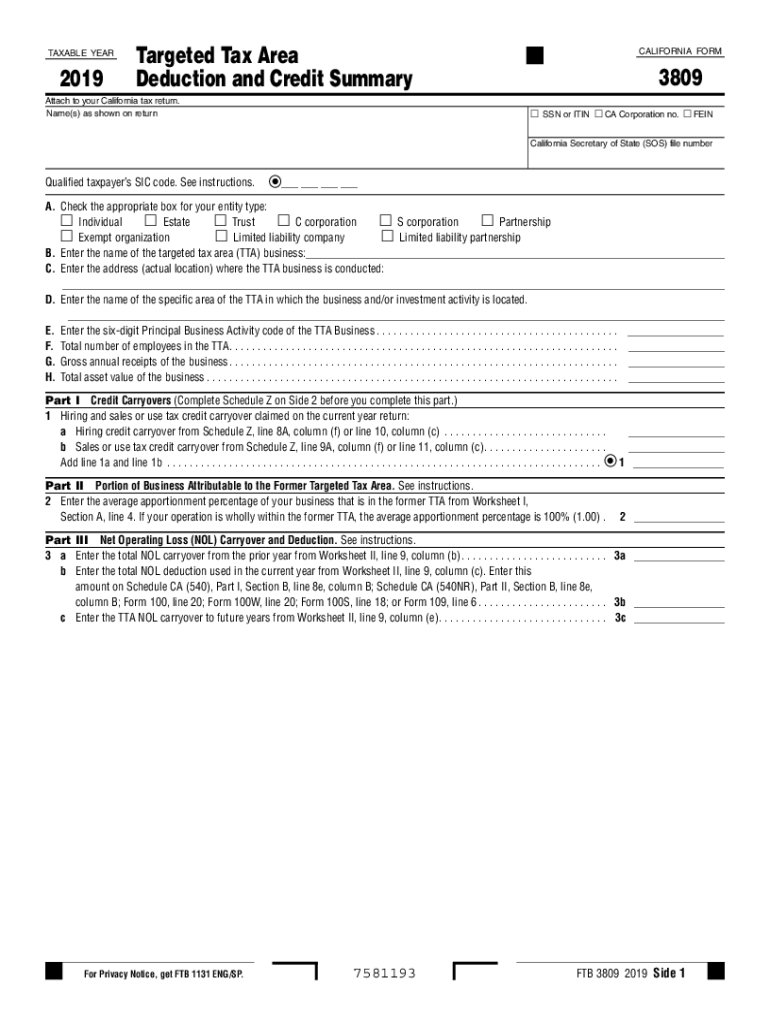

Web withholding exemption certificate references in these instructions are to the california revenue and taxation code (r&tc). Web taxable year 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. This form is for income earned in tax year 2022, with tax returns due in april. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664.

The Payee Completes This Form And Submits It To The Withholding Agent.

Web form 590 does not apply to payments for wages to employees. Web form 590 instructions 2022 the payee must notify the withholding agent if any of the following situations occur: Web purpose use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The withholding agent keeps this form with.

General Information Purpose Use Form 590 To.

Web instructions for form 590 instructions for form 590 withholding exemption certificate references in these instructions are to the california revenue and taxation code. Include images, crosses, check and text boxes, if required. Fill in all the info required in ca ftb 590, utilizing fillable fields. Crescent city, ca 95531 cua coordinator (707).