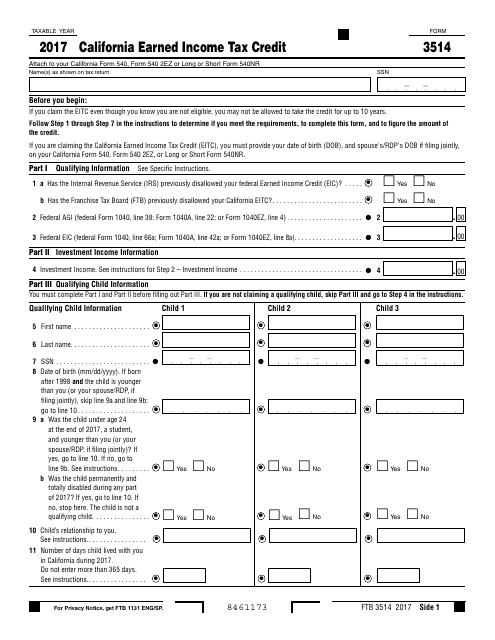

Ca Form 3514

Ca Form 3514 - Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no. This form is for income earned in tax year 2022, with tax returns due in april. California earned income tax credit. You can download or print. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. You do not need a child to qualify, but must file a california income tax return. Web 2021 form 3514 california earned income tax credit. California earned income tax credit.

Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. You do not need a child to qualify, but must file a california income tax return to. Ftb 3514 2021 side 1. You do not need a child to qualify, but must file a california. For taxable years beginning on or after january 1, 2020, california expanded earned income tax credit (eitc) and. You do not need a child to qualify, but must file a california income tax return. Web 2021 form 3514 california earned income tax credit. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. California earned income tax credit.

Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. California earned income tax credit. You do not need a child to qualify, but must file a california income tax return. Web 2021 form 3514 california earned income tax credit. You do not need a child to qualify, but must file a california income tax return to. Web 2017 instructions for form ftb 3514. This form is for income earned in tax year 2022, with tax returns due in april. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Web the california eitc reduces your california tax obligation, or allows a refund if no california tax is due. You can download or print.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. For taxable years beginning on or after january 1, 2020, california expanded earned income tax credit (eitc) and. After reviewing this, lacerte currently does not have a way to force form 3514.

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

Schedule s, other state tax credit. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. California earned income tax credit. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Web most taxpayers are required to.

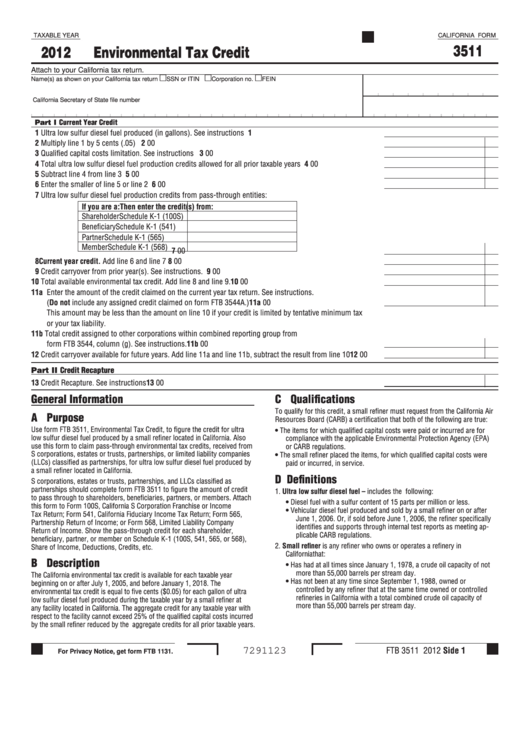

Fillable California Form 3511 Environmental Tax Credit 2012

California earned income tax credit. Web 2021 form 3514 california earned income tax credit. Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information.

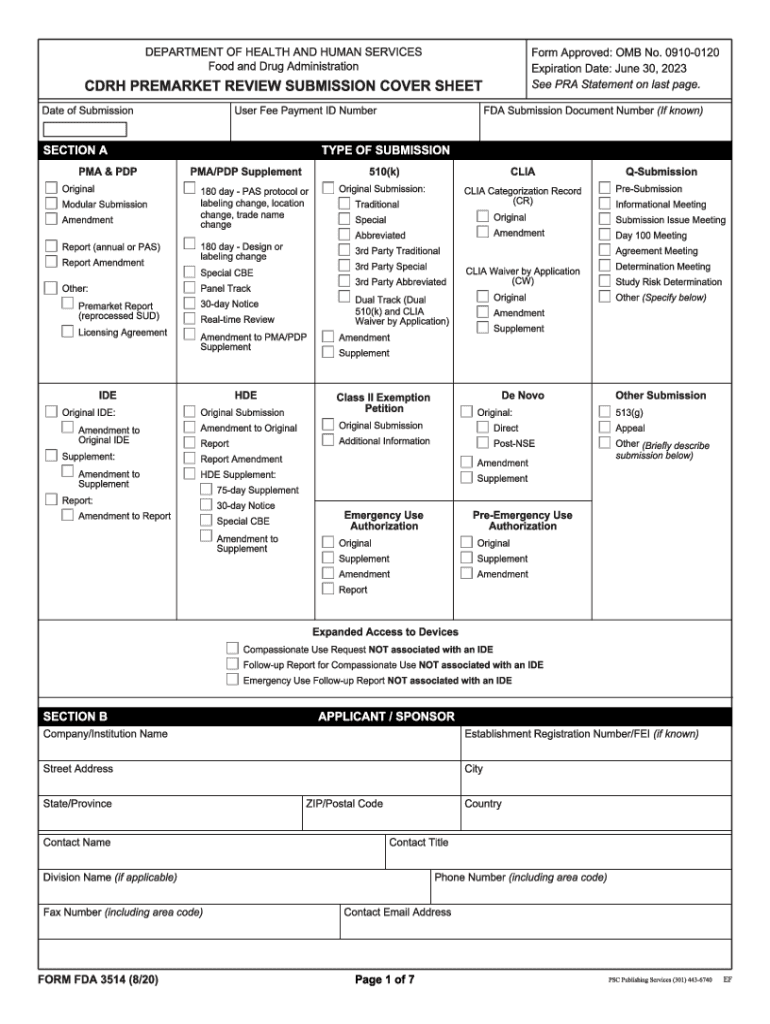

FDA 3514 20202022 Fill and Sign Printable Template Online US Legal

Web the california eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no. Web california form 3514 (california earned income tax credit. Web use form ftb 3514 to determine whether you qualify to claim the credit, provide.

CA Form 2 Download Printable PDF or Fill Online Car 145 Approval

Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be. Web the california eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic..

California Tax Table 540 2ez Review Home Decor

Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Web california form 3514 (california earned income tax credit. References in these instructions are to the internal revenue code (irc) as of january 1,. Web use form.

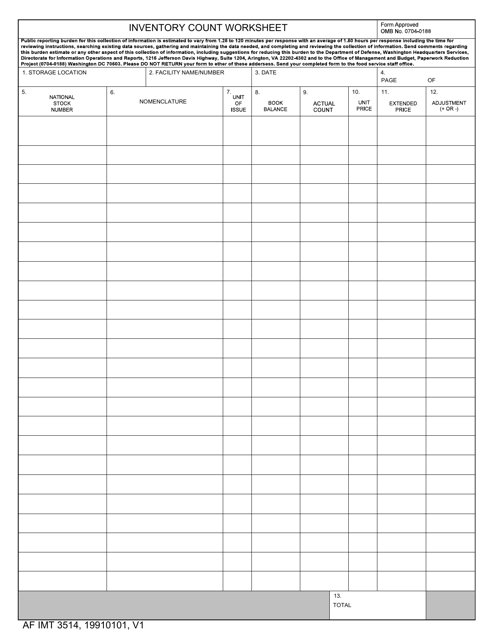

AF IMT Form 3514 Download Fillable PDF or Fill Online Inventory Count

Attach to your california form. Web 2021 form 3514 california earned income tax credit. You do not need a child to qualify, but must file a california income tax return to. Web the california eitc reduces your california tax obligation, or allows a refund if no california tax is due. Ftb 3514 2021 side 1.

78th field artillery hires stock photography and images Alamy

Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Web eitc reduces your california tax obligation, or allows a refund if no california.

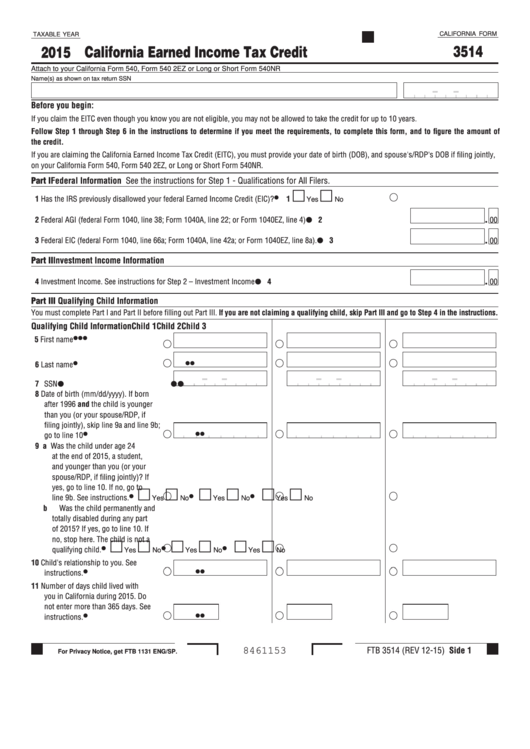

Form 3514 California Earned Tax Credit 2015 printable pdf

Web form 3514, is ca earned income tax credit. This form is for income earned in tax year 2022, with tax returns due in april. You do not need a child to qualify, but must file a california income tax return to. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

Web we last updated california form 3514 in january 2023 from the california franchise tax board. Web 2021 form 3514 california earned income tax credit. California earned income tax credit. Web california form 3514 (california earned income tax credit. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and.

References In These Instructions Are To The Internal Revenue Code (Irc) As Of January 1,.

Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. Web the california eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due.

Web 2017 Instructions For Form Ftb 3514.

Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Web california form 3514 (california earned income tax credit. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Ftb 3514 2021 side 1.

Web We Last Updated California Form 3514 Ins In May 2021 From The California Franchise Tax Board.

This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year 2022, with tax returns due in april. You do not need a child to qualify, but must file a california income tax return. You do not need a child to qualify, but must file a california income tax return to.

California Earned Income Tax Credit.

After reviewing this, lacerte currently does not have a way to force form 3514 for ca when the taxpayer does not qualify for eic. California earned income tax credit. Schedule s, other state tax credit. Attach to your california form.