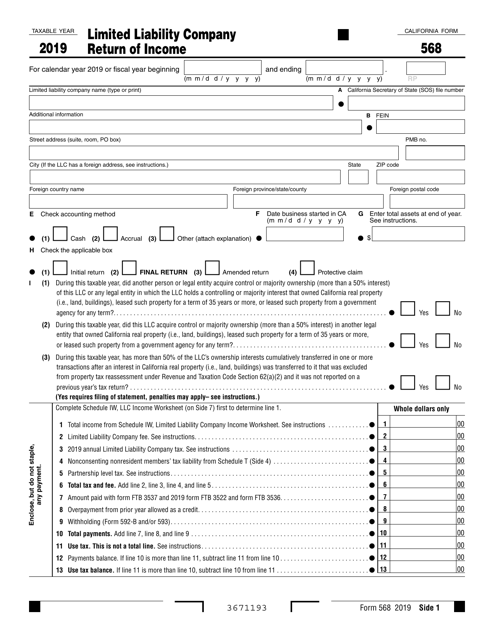

Ca Form 568 2022

Ca Form 568 2022 - References in these instructions are to the internal revenue code (irc) as of. For example, the 2023 tax needs to be paid by the. For llcs classified as a. Web important dates for income tax when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Web limited liability companies are automatically assessed an $800 tax. 8331223 schedule eo (568) 2022 Web 3671213 form 568 2021 side 1 taxable year 2021 limited liability company return of income california form 568 i (1) during this taxable year, did another person or. Web mail form 568 with payment to: Please use the link below. Web california form 568 for limited liability company return of income is a separate state formset.

Web file a timely final california return (form 568) with the ftb and pay the $800 annual tax for the taxable year of the final return. The same as any other type of tax return, you’ll. Web you still have to file form 568 if the llc is registered in california. Web california — limited liability company return of income download this form print this form it appears you don't have a pdf plugin for this browser. Web 2022 instructions for form 568, limited liability company return of income. Using black or blue ink, make the check or money. This amount needs to be prepaid and filed with form 3522. 8331223 schedule eo (568) 2022 January 1, 2015, and to. Please use the link below.

It’s no different than an individual state income tax return. The same as any other type of tax return, you’ll. This amount needs to be prepaid and filed with form 3522. Web mail form 568 with payment to: For amounts over $250,000 refer to the ca franchise tax board llc fee. 8331223 schedule eo (568) 2022 Web file a timely final california return (form 568) with the ftb and pay the $800 annual tax for the taxable year of the final return. Web 2022 instructions for form 568, limited liability company return of income. For llcs classified as a. January 1, 2015, and to.

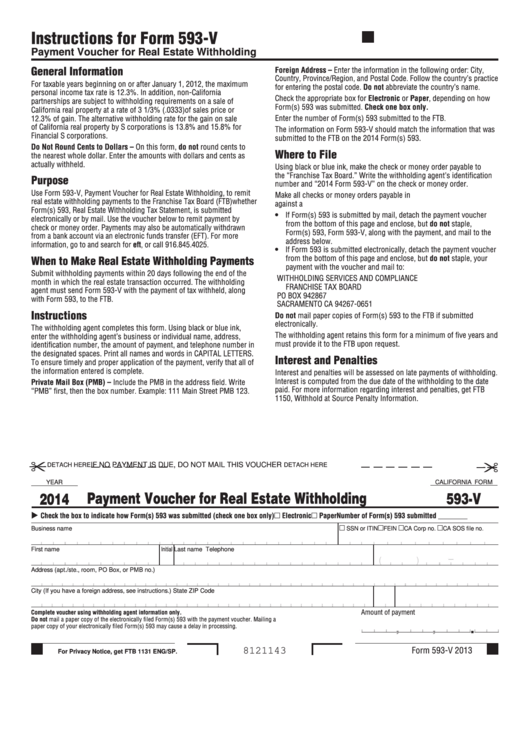

Fillable California Form 593V Payment Voucher For Real Estate

Web form 568 is the tax return of limited liability companies in california. Web 3671213 form 568 2021 side 1 taxable year 2021 limited liability company return of income california form 568 i (1) during this taxable year, did another person or. Please use the link below. Web to complete california form 568 for a partnership, from the main menu.

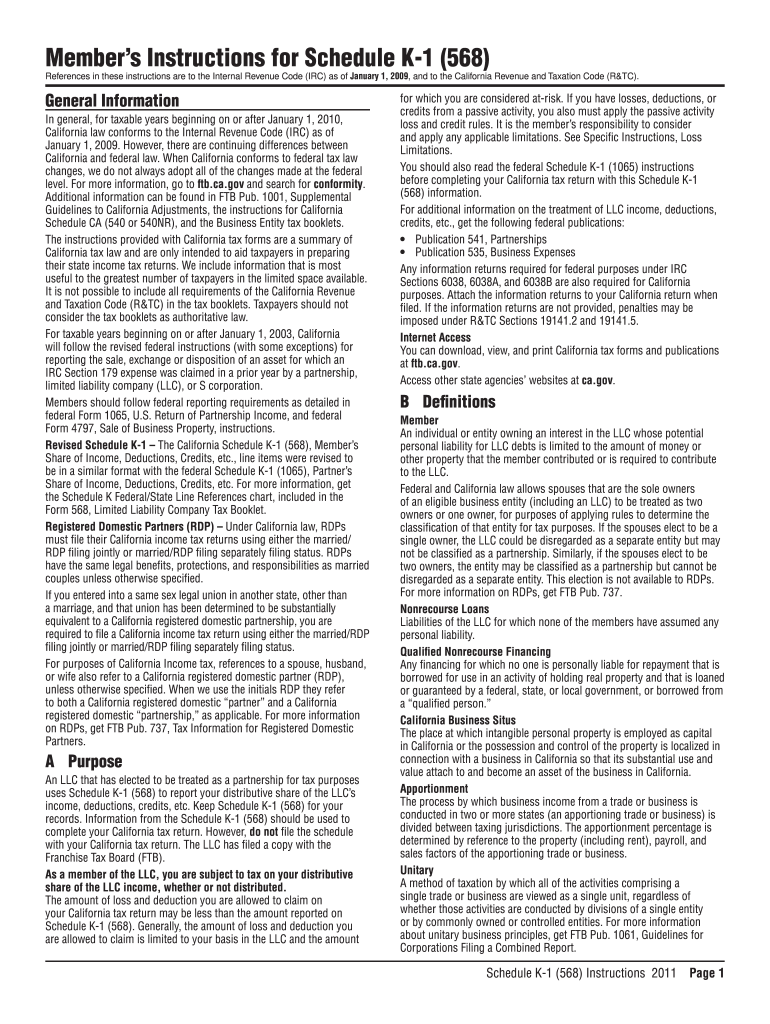

568 Instructions Fill Out and Sign Printable PDF Template signNow

(m m / d d / y y y y) member’s identifying number address address. Web entering the total number of partners (including partners with california addresses) in question j, side 2, of form 568. Web file a timely final california return (form 568) with the ftb and pay the $800 annual tax for the taxable year of the final.

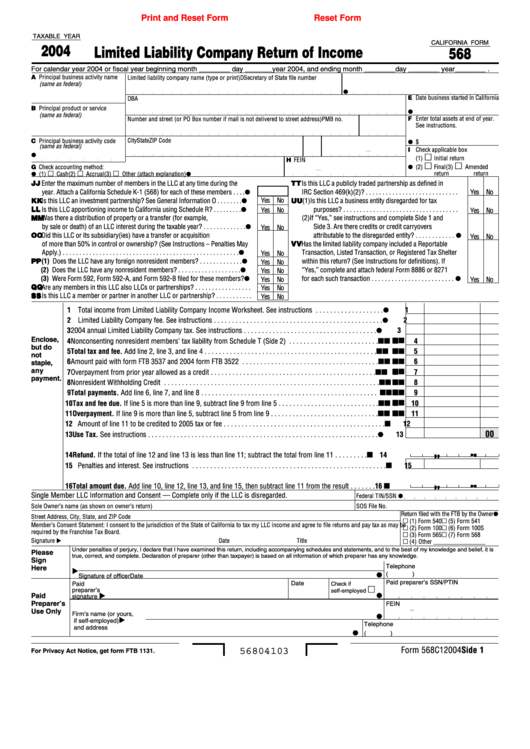

Fillable California Form 568 Limited Liability Company Return Of

Web mail form 568 with payment to: When is form 568 due? California grants an automatic extension of time to file a return;. 8331223 schedule eo (568) 2022 For llcs classified as a.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. When is form 568 due? 8331223 schedule eo (568) 2022 Web file a timely final california return (form 568) with the ftb and pay the $800 annual tax for the taxable year of the final return. Web.

Form 568 Booklet Fill Out and Sign Printable PDF Template signNow

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web form 568 is the tax return of limited liability companies in california. Web if line 2 of form 568 is blank, it’s most likely because line 1 is below $250,000. For amounts over $250,000 refer to.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Web limited liability companies are automatically assessed an $800 tax. Web 3671213 form 568 2021 side 1 taxable year 2021 limited liability company return of income california form 568 i (1) during this taxable year, did another person or. This amount needs to be prepaid and filed with form 3522. For amounts over $250,000 refer to the ca franchise tax.

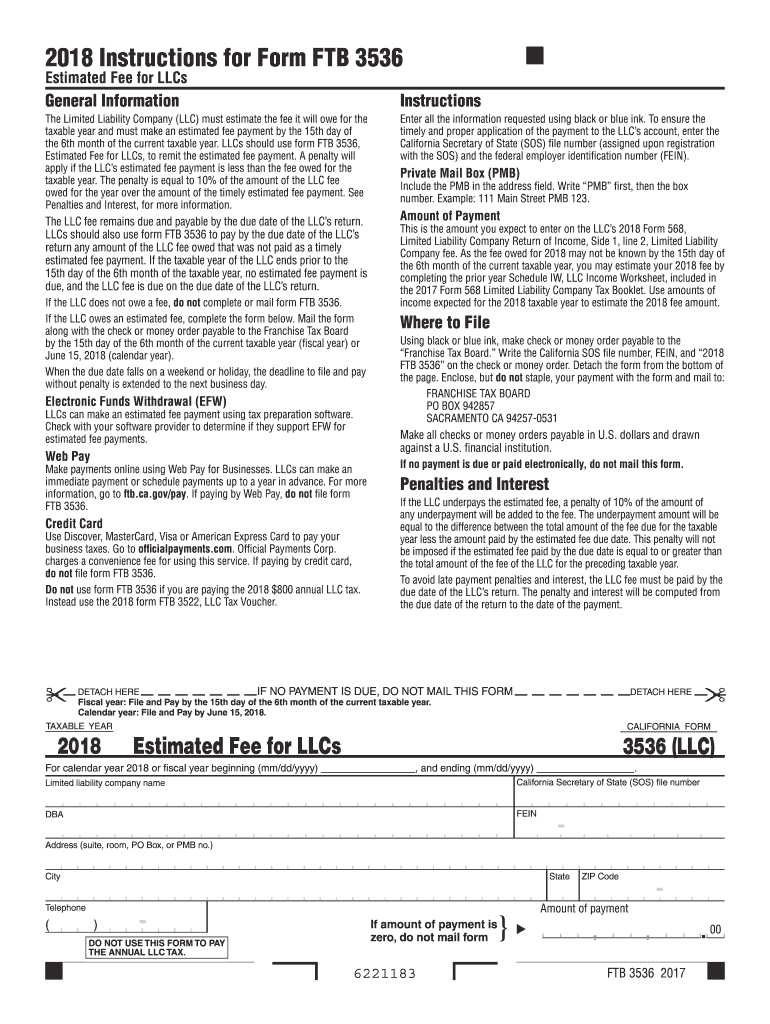

Ca Form 3536 Fill Out and Sign Printable PDF Template signNow

Web if line 2 of form 568 is blank, it’s most likely because line 1 is below $250,000. Web limited liability companies are automatically assessed an $800 tax. Web form 568 is the tax return of limited liability companies in california. For example, the 2023 tax needs to be paid by the. This amount needs to be prepaid and filed.

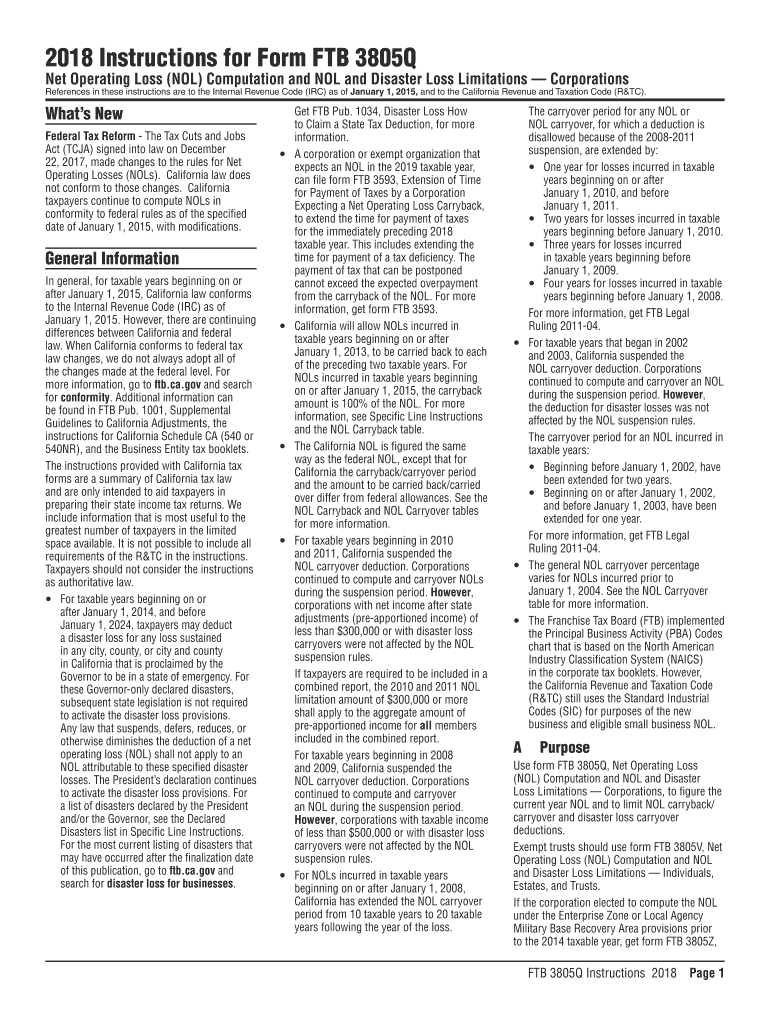

Form 568 Instructions 2022 State And Local Taxes Zrivo

Web you still have to file form 568 if the llc is registered in california. Please use the link below. The same as any other type of tax return, you’ll. Web form 568 is the tax return of limited liability companies in california. Web how it works open form follow the instructions easily sign the form with your finger send.

CA Form 568 Due Dates 2022 State And Local Taxes Zrivo

Web california — limited liability company return of income download this form print this form it appears you don't have a pdf plugin for this browser. References in these instructions are to the internal revenue code (irc) as of. 8331223 schedule eo (568) 2022 Web mail form 568 with payment to: Please use the link below.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Web important dates for income tax when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Web entering the total number of partners (including partners with california addresses) in question j, side 2, of form 568. How to fill in california form 568 if you.

The Same As Any Other Type Of Tax Return, You’ll.

Web california form 568 for limited liability company return of income is a separate state formset. This amount needs to be prepaid and filed with form 3522. It isn't included with the regular ca state partnership formset. Web you still have to file form 568 if the llc is registered in california.

Web To Complete California Form 568 For A Partnership, From The Main Menu Of The California Return, Select:

Web california — limited liability company return of income download this form print this form it appears you don't have a pdf plugin for this browser. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. For example, the 2023 tax needs to be paid by the. Web 2022 instructions for form 568, limited liability company return of income.

Web Yes, You Can Use Turbotax Home & Business For Tax Year 2021 To File Form 568 Along With Your Personal Federal And State Income Tax Returns.

It’s no different than an individual state income tax return. Web limited liability companies are automatically assessed an $800 tax. Web mail form 568 with payment to: When is form 568 due?

8331223 Schedule Eo (568) 2022

Web file a timely final california return (form 568) with the ftb and pay the $800 annual tax for the taxable year of the final return. Using black or blue ink, make the check or money. January 1, 2015, and to. Web important dates for income tax when the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.