California Self Employment Tax Form

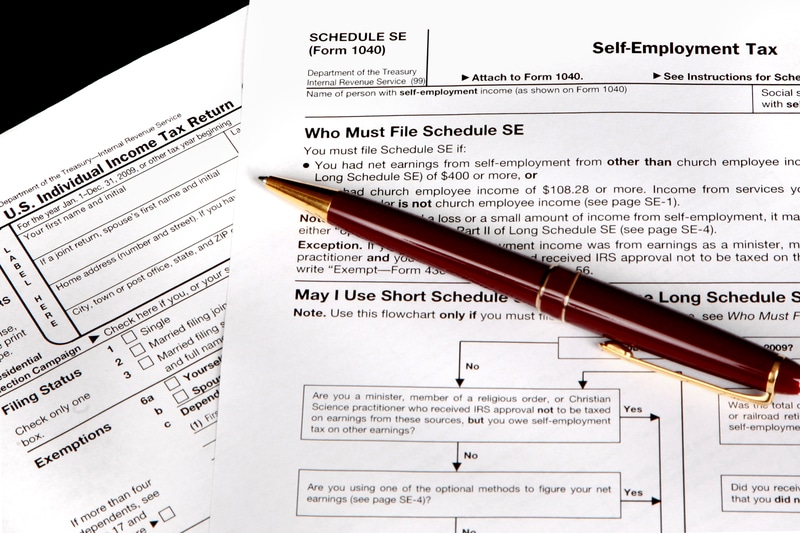

California Self Employment Tax Form - Section c — adjustments to income from federal schedule 1 (form 1040) federal. If you are classified as an independent contractor at the federal level but classified as an employee for california,. Web gig income and taxes. Web reporting your taxes if you are going to be in business, you'll want to know what types of business taxes may apply, including: Web more information regarding taxpayer impact will be available soon. The most common california income tax form is the ca 540. This form is used by california residents who file an individual. Web to confirm all i need to do is fill out the form 1040. Web california state income tax form 540 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. How much is the self employment tax for california?

This form is used by california residents who file an individual. How much is the self employment tax for california? Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) If you are classified as an independent contractor at the federal level but classified as an employee for california,. Send us your tax form improvement. Web simplified income, payroll, sales and use tax information for you and your business A self employed individual who makes a profit (income minus expenses) of $400 or more will have to pay california self. California has four state payroll taxes which we manage. Web california state income tax form 540 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Web the arpa of 2021 enacted on march 11, 2021, temporarily increases the amount of the exclusion from gross income from $5,000 to $10,500 (and half of that amount for married.

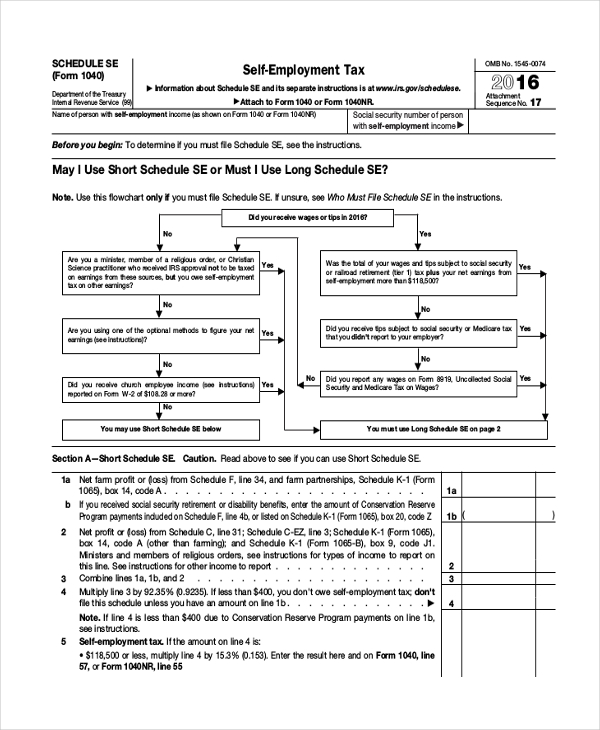

Unemployment insurance (ui) employment training tax (ett) most. Fill out the form 1040sc ( schedule c ) and fill out form 1040sse ( self employment tax ). This rate is the sum of a 12.4%. Web the arpa of 2021 enacted on march 11, 2021, temporarily increases the amount of the exclusion from gross income from $5,000 to $10,500 (and half of that amount for married. Web more information regarding taxpayer impact will be available soon. If you receive income from a gig economy activity, it’s generally taxable, even if you do not receive a tax form: Printable california state tax forms for the 2022. A self employed individual who makes a profit (income minus expenses) of $400 or more will have to pay california self. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web reporting your taxes if you are going to be in business, you'll want to know what types of business taxes may apply, including:

California tax brackets 2020

If you are classified as an independent contractor at the federal level but classified as an employee for california,. This rate is the sum of a 12.4%. The most common california income tax form is the ca 540. Web the arpa of 2021 enacted on march 11, 2021, temporarily increases the amount of the exclusion from gross income from $5,000.

Are You Subject to SelfEmployment Tax? Coastal Tax Advisors

Attach both sc and sse to. Web the arpa of 2021 enacted on march 11, 2021, temporarily increases the amount of the exclusion from gross income from $5,000 to $10,500 (and half of that amount for married. Fill out the form 1040sc ( schedule c ) and fill out form 1040sse ( self employment tax ). Send us your tax.

Tax Form California Free Download

If you are classified as an independent contractor at the federal level but classified as an employee for california,. Web california state income tax form 540 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. You can visit online forms and publications for a complete list of edd forms available to view or order.

California SelfEmployment Tax Calculator 2020 2021

Web gig income and taxes. Web to confirm all i need to do is fill out the form 1040. Send us your tax form improvement. How much is the self employment tax for california? California department of tax and fee administration;

FREE 27+ Sample Employment Forms in PDF MS Word Excel

If you are classified as an independent contractor at the federal level but classified as an employee for california,. California department of tax and fee administration; This rate is the sum of a 12.4%. The most common california income tax form is the ca 540. You can visit online forms and publications for a complete list of edd forms available.

Tax Advisors Who Pays SelfEmployment Tax?

Web reporting your taxes if you are going to be in business, you'll want to know what types of business taxes may apply, including: Fill out the form 1040sc ( schedule c ) and fill out form 1040sse ( self employment tax ). The most common california income tax form is the ca 540. Web the arpa of 2021 enacted.

2005 Self Employment Tax Form Employment Form

Section c — adjustments to income from federal schedule 1 (form 1040) federal. How much is the self employment tax for california? California department of tax and fee administration; The most common california income tax form is the ca 540. Web california state income tax form 540 must be postmarked by april 18, 2023 in order to avoid penalties and.

Case Studies Chandler & Knowles CPA Firm Texas

California department of tax and fee administration; Web reporting your taxes if you are going to be in business, you'll want to know what types of business taxes may apply, including: Web the arpa of 2021 enacted on march 11, 2021, temporarily increases the amount of the exclusion from gross income from $5,000 to $10,500 (and half of that amount.

SelfEmployment Tax What Most People Fail To Address Eric Nisall

Fill out the form 1040sc ( schedule c ) and fill out form 1040sse ( self employment tax ). You can visit online forms and publications for a complete list of edd forms available to view or order online. How much is the self employment tax for california? Web simplified income, payroll, sales and use tax information for you and.

SelfEmployment Tax ⋆

If you are classified as an independent contractor at the federal level but classified as an employee for california,. Web california state income tax form 540 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Web reporting your taxes if you are going to be in business, you'll want to know what types of.

Unemployment Insurance (Ui) Employment Training Tax (Ett) Most.

Section c — adjustments to income from federal schedule 1 (form 1040) federal. Attach both sc and sse to. If you receive income from a gig economy activity, it’s generally taxable, even if you do not receive a tax form: Web california state income tax form 540 must be postmarked by april 18, 2023 in order to avoid penalties and late fees.

Web Common California Income Tax Forms & Instructions.

Web to confirm all i need to do is fill out the form 1040. This form is used by california residents who file an individual. You can visit online forms and publications for a complete list of edd forms available to view or order online. If you are classified as an independent contractor at the federal level but classified as an employee for california,.

The Most Common California Income Tax Form Is The Ca 540.

Fill out the form 1040sc ( schedule c ) and fill out form 1040sse ( self employment tax ). This rate is the sum of a 12.4%. Web the arpa of 2021 enacted on march 11, 2021, temporarily increases the amount of the exclusion from gross income from $5,000 to $10,500 (and half of that amount for married. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

California Department Of Tax And Fee Administration;

Web more information regarding taxpayer impact will be available soon. Send us your tax form improvement. Web gig income and taxes. California has four state payroll taxes which we manage.