Can I Form An Llc In Another State

Can I Form An Llc In Another State - Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Web yes, it is possible to move a limited liability company (llc) to another state. Web up to 25% cash back if your llc or corporation operates in more than one state, you could have yet another bureaucratic hurdle to tackle: Web an llc doing business in the state where it was formed is known as a “domestic llc,” while an llc doing business in a state other than the one where it was. Web a foreign llc or corporation may have to qualify to conduct business in another state if its business transactions meet certain requirements. The company will be considered a “foreign llc” in the new state until the transfer has been. A limited liability company must only be registered in one state to. Web this involves submitting a form (often called a certificate of authority) to the secretary of state in the new state. Forming a new corporation or llc in each state. We'll do the legwork so you can set aside more time & money for your business.

Web similarly, a u.s. Web up to 25% cash back if your llc or corporation operates in more than one state, you could have yet another bureaucratic hurdle to tackle: We'll do the legwork so you can set aside more time & money for your business. Web up to 10% cash back option 1: Separation of liability between businesses. Most states offer registration as a. Web to transfer your llc to another state, you’ll either have to register a “foreign” llc in the new destination or entirely transfer your business entity’s legal “situs” to the. You'll need to follow the. Forming a new corporation or llc in each state. File your llc paperwork in just 3 easy steps!

Web up to 25% cash back when an llc or a corporation must qualify to do business in another state if you plan on doing business in a state other than where you organized your llc or. Web up to 25% cash back a business is pretty much free to form a limited liability company (llc) in any old state. Most states offer registration as a. Web up to 25% cash back to find out the requirements for forming an llc in your state, choose your state from the list below. Web similarly, a u.s. Web an llc doing business in the state where it was formed is known as a “domestic llc,” while an llc doing business in a state other than the one where it was. Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Web up to 10% cash back option 1: Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. File your llc paperwork in just 3 easy steps!

What is the Best State to Form an LLC? Not Your Dad's CPA

Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Separation of liability between businesses. Transfer an llc from one state to another. Our business specialists help you incorporate your business. Free 1st year register agent.

Can I Form an LLC in Another State? YouTube

Web up to 25% cash back when an llc or a corporation must qualify to do business in another state if you plan on doing business in a state other than where you organized your llc or. Web if you determine that you have a physical presence or nexus in another state, you do not need to form a new.

Can I Form an LLC in Another State? eForms Learn

Web all 50 states allow business owners to form an llc, meaning you could technically file your llc anywhere in the u.s. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Ad we make it easy to incorporate your llc. You'll need to follow.

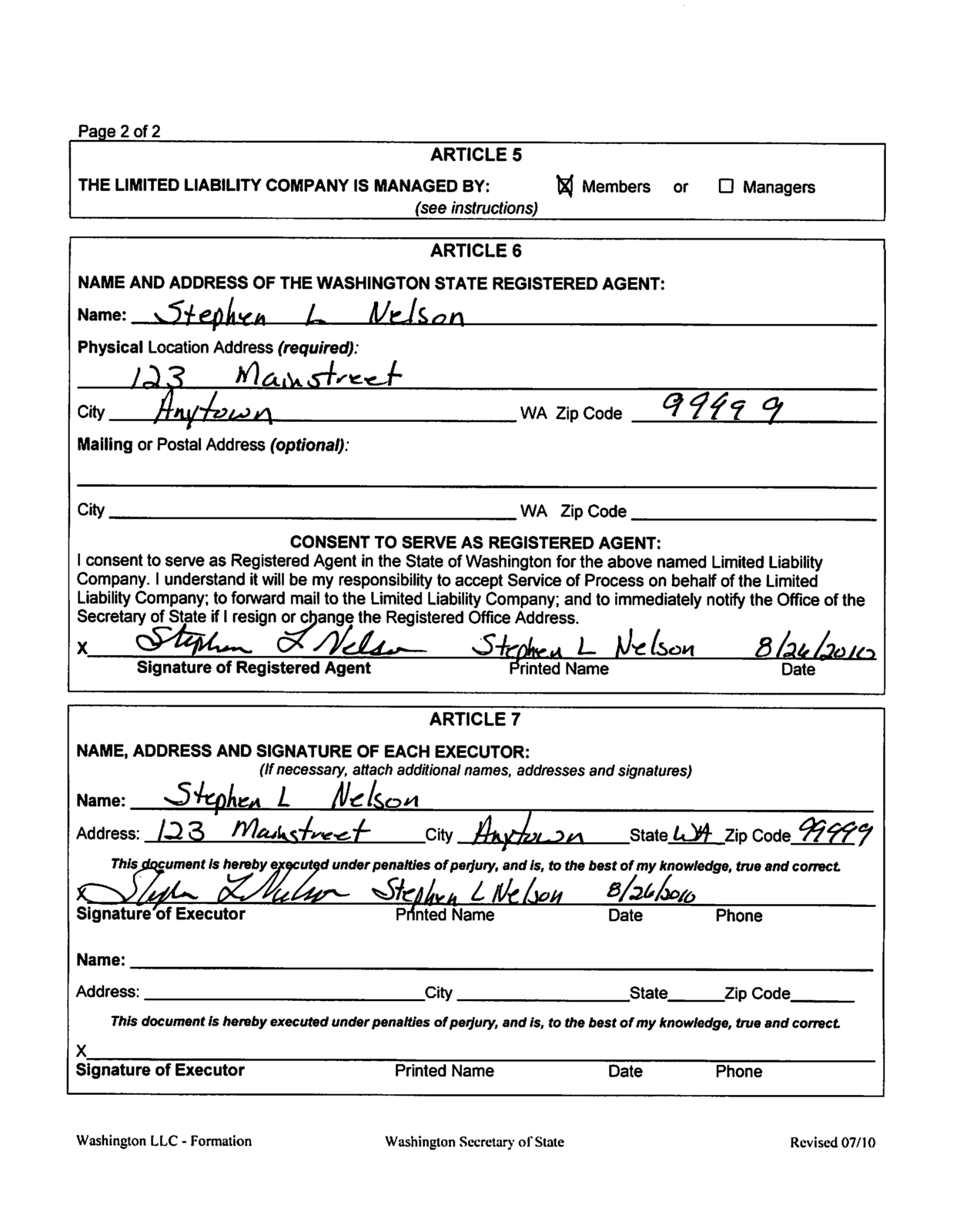

Forming a Washington State LLC Evergreen Small Business

Web similarly, a u.s. A limited liability company must only be registered in one state to. Web up to 25% cash back if your llc or corporation operates in more than one state, you could have yet another bureaucratic hurdle to tackle: Qualifying to do business in other states. Separation of liability between businesses.

YOU can form an LLC to start doing business in Michigan in 3 easy steps

Web all 50 states allow business owners to form an llc, meaning you could technically file your llc anywhere in the u.s. Web up to 25% cash back to find out the requirements for forming an llc in your state, choose your state from the list below. Web this involves submitting a form (often called a certificate of authority) to.

How to Form a LLC (Stepbystep Guide) Community Tax

Web yes, it is possible to move a limited liability company (llc) to another state. Dissolution and formation of an llc or corporation dissolving the corporation or llc in the old state and forming a corporation or. We make it simple to register your new llc. Free 1st year register agent. But if you have a small business that.

Follow This Guide to Moving Your Business to Another State [INFOGRAPHIC

Most states offer registration as a. The llc laws of most states permit one llc to merge into another llc. Web up to 25% cash back instead of dissolving the old llc, you can merge it into a new llc. Web up to 25% cash back when an llc or a corporation must qualify to do business in another state.

2016 Form CA LLC1A Fill Online, Printable, Fillable, Blank pdfFiller

Web yes, it is possible to move a limited liability company (llc) to another state. Web a foreign llc or corporation may have to qualify to conduct business in another state if its business transactions meet certain requirements. Web up to 10% cash back this can make foreign qualification more attractive. Person filing form 8865 with respect to a foreign.

Best States to Form an LLC YouTube

Web for instance, remember by law the words “limited liability company” or the abbreviation “llc” or “l.l.c.” must appear as part of the official name. Web up to 10% cash back this can make foreign qualification more attractive. Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Person filing form 8865 with respect to.

Can I Form an LLC in Another State? YouTube

Web an llc doing business in the state where it was formed is known as a “domestic llc,” while an llc doing business in a state other than the one where it was. A limited liability company must only be registered in one state to. You'll typically need to provide details about your llc and pay a. Web the straightforward.

Ad We Make It Easy To Incorporate Your Llc.

Transfer an llc from one state to another. Separation of liability between businesses. Web up to 25% cash back when an llc or a corporation must qualify to do business in another state if you plan on doing business in a state other than where you organized your llc or. Forming a new corporation or llc in each state.

Web To Transfer Your Llc To Another State, You’ll Either Have To Register A “Foreign” Llc In The New Destination Or Entirely Transfer Your Business Entity’s Legal “Situs” To The.

Web for instance, remember by law the words “limited liability company” or the abbreviation “llc” or “l.l.c.” must appear as part of the official name. A limited liability company must only be registered in one state to. Qualifying to do business in other states. The company will be considered a “foreign llc” in the new state until the transfer has been.

Web Yes, It Is Possible To Move A Limited Liability Company (Llc) To Another State.

Nationwide incorporation and filing service. Web if you determine that you have a physical presence or nexus in another state, you do not need to form a new llc in that state. Most states offer registration as a. The llc laws of most states permit one llc to merge into another llc.

Web A Foreign Llc Or Corporation May Have To Qualify To Conduct Business In Another State If Its Business Transactions Meet Certain Requirements.

Web up to 10% cash back this can make foreign qualification more attractive. Ad quickly & easily form your new business, in any state, for as little as $0 + state fees. Ad protect your personal assets with a $0 llc—just pay state filing fees. Web an llc doing business in the state where it was formed is known as a “domestic llc,” while an llc doing business in a state other than the one where it was.