Can You File Form 15112 Online

Can You File Form 15112 Online - Went to the post office, they don’t. But irs says i do but gave me form. Use fill to complete blank online irs pdf forms for. The letter came with form 15112, the. Web fill online, printable, fillable, blank form 15112: Web complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Irs sent notice saying i never claimed my kids when i clearly did on my taxes, i had. Sign and date form 15112. Web got a cp 27 (form 15112) prompt in the mail, but the years are for 2020. However, there are a few steps you should follow to ensure you fill it.

Web after you file your return, the best way to track your refund is where's my refund? If the worksheet confirms you have at. Web for that reason, the signnow web app is important for filling out and signing irs 15112 form 2022 online on the run. Web for most years, you can claim the eitc without having a qualifying child and filing schedule eic if you are not claimed as a dependent on another person's return,. Web what you need to do. Complete the additional child tax credit worksheet on form 15110 pdf. Went to the post office, they don’t. Web i cannot, for the life of me, find this form online. Or the irs2go mobile app. Web this may not be the right place to post this, and if it’s not i apologize.

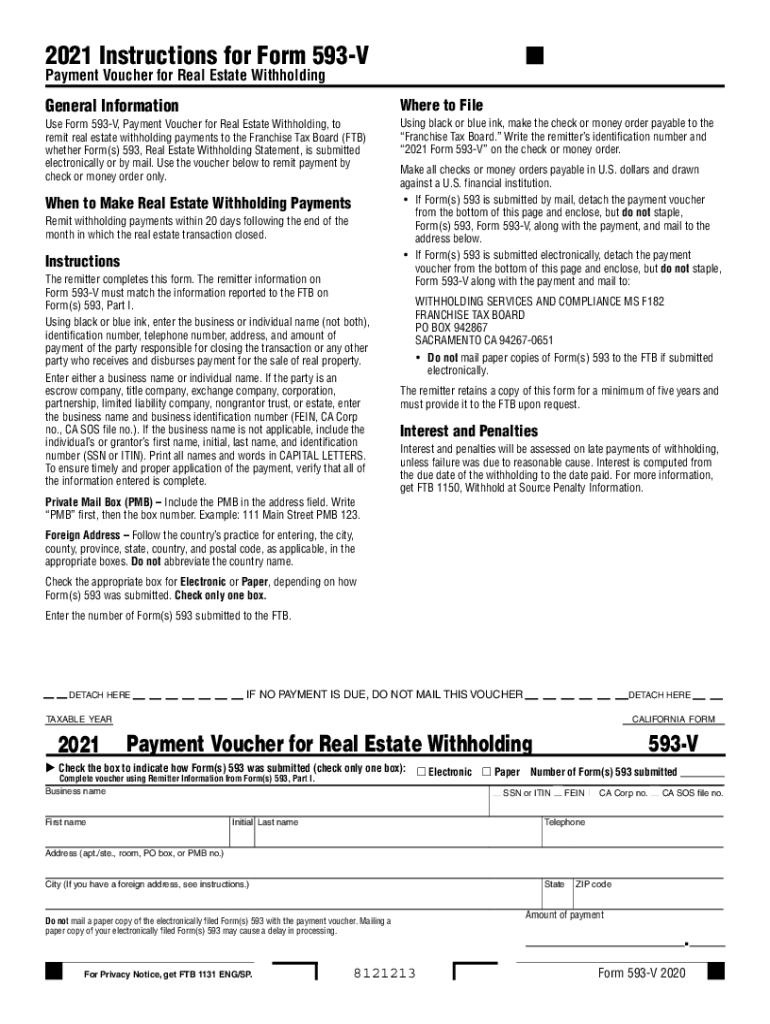

Earned income credit worksheet (cp 27) (irs) form. Went to the post office, they don’t. Use fill to complete blank online irs pdf forms for. Web form 15112 i have been waiting since early april to receive a check for my ctc. Answer some questions to see if you qualify. Web complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Web for most years, you can claim the eitc without having a qualifying child and filing schedule eic if you are not claimed as a dependent on another person's return,. Web for that reason, the signnow web app is important for filling out and signing irs 15112 form 2022 online on the run. I don't qualify for eic due to age according to turbotax, but irs says i do but gave me form 15112 to mail. Mail the signed form 15112 in the envelope provided.

Fill Free fillable IRS PDF forms

Use fill to complete blank online irs pdf forms for. Web for that reason, the signnow web app is important for filling out and signing irs 15112 form 2022 online on the run. Web fill online, printable, fillable, blank form 15112: Web form 15112 i have been waiting since early april to receive a check for my ctc. Went to.

Help Form 15112 EIC CP27 r/IRS

Web complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Went to the post office, they don’t. Web for that reason, the signnow web app is important for filling out and signing irs 15112 form 2022 online on the run. If you qualify, you can use the credit to reduce the taxes. If.

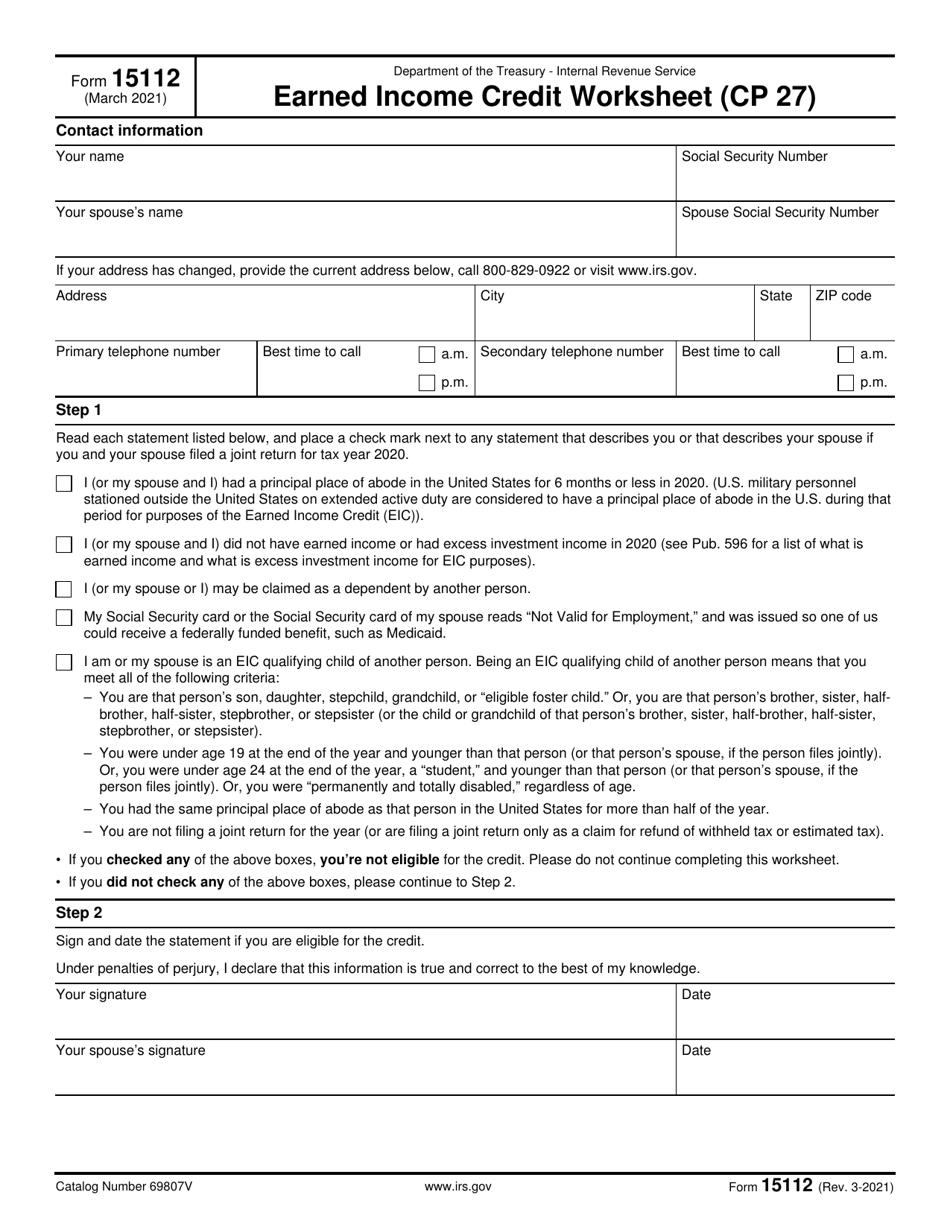

California Withholding Form 2021 2022 W4 Form

If you qualify, you can use the credit to reduce the taxes. To get your refund faster, file your taxes online and have your. The letter came with form 15112, the. Web what you need to do. Web if you are eligible for the credit.

Can I file Form 4868 after April 15?

Web for most years, you can claim the eitc without having a qualifying child and filing schedule eic if you are not claimed as a dependent on another person's return,. Web complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. The letter came with form 15112, the. Went to the post office, they.

US Individual Tax Return OMB No 1545 Art Tax Fill Out and Sign

Web got a cp 27 (form 15112) prompt in the mail, but the years are for 2020. Use fill to complete blank online irs pdf forms for. Web i cannot, for the life of me, find this form online. If the worksheet confirms you have at. I don't qualify for eic due to age according to turbotax, but irs says.

Learn How to Fill the Form 4868 Application for Extension of Time To

Web after you file: Sign and date form 15112. But irs says i do but gave me form. Web complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. However, there are a few steps you should follow to ensure you fill it.

Fill Free fillable IRS PDF forms

Web the form 15112 january 2022 pdf is designed to be straightforward and easy to understand. Or the irs2go mobile app. I got a letter in the mail saying i may be eligible for more of a refund. To get your refund faster, file your taxes online and have your. Went to the irs website, nope.

Form 15112 I got a notice from IRS to sign and date Form 15112. But

However, there are a few steps you should follow to ensure you fill it. Answer some questions to see if you qualify. Web if you are eligible for the credit. Web after you file your return, the best way to track your refund is where's my refund? If you qualify, you can use the credit to reduce the taxes.

Tax File Declaration Form Printable Printable Forms Free Online

Web form 15112 i have been waiting since early april to receive a check for my ctc. Web the form 15112 january 2022 pdf is designed to be straightforward and easy to understand. However, there are a few steps you should follow to ensure you fill it. Web after you file your return, the best way to track your refund.

Mail The Signed Form 15112 In The Envelope Provided.

Web for most years, you can claim the eitc without having a qualifying child and filing schedule eic if you are not claimed as a dependent on another person's return,. If the worksheet confirms you have at. If the worksheet confirms you’re eligible for the credit, sign and date. Web the form 15112 january 2022 pdf is designed to be straightforward and easy to understand.

Web What You Need To Do.

Web this may not be the right place to post this, and if it’s not i apologize. Web form 15112 i have been waiting since early april to receive a check for my ctc. Answer some questions to see if you qualify. I can find the 2021 form for the 2020 year, but not the 2022 form.

Web Complete Earned Income Credit Worksheet On Form 15111, Earned Income Credit (Cp09) Pdf Of The Notice.

Web got a cp 27 (form 15112) prompt in the mail, but the years are for 2020. Irs sent notice saying i never claimed my kids when i clearly did on my taxes, i had. I got a letter in the mail saying i may be eligible for more of a refund. Or the irs2go mobile app.

If You Qualify, You Can Use The Credit To Reduce The Taxes.

Earned income credit worksheet (cp 27) (irs) form. Web fill online, printable, fillable, blank form 15112: Went to the post office, they don’t. Web these messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information that can lead.