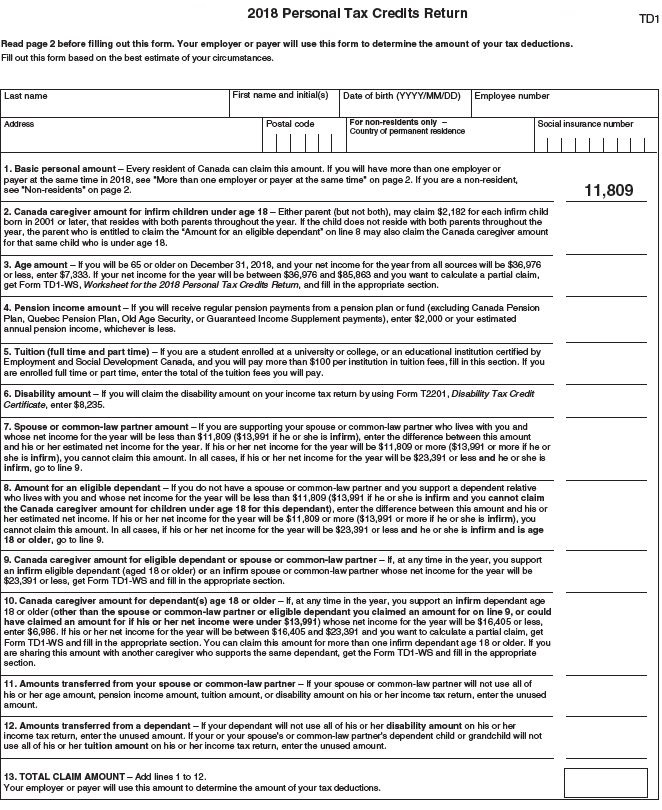

Canada Td1 Form

Canada Td1 Form - January 6, 2023 tax credits! To know how much tax to deduct, each. Web if your net income from all sources for the year will be $150,473 or less, enter$13,229. However, if your net income from all sources will be greater. Web the td1 form, or td1 personal tax credits return, is a set of federal and provincial/territorial documents that helps employers calculate how much income tax they. Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as. The td1 personal tax credits return is used to calculate the amount of income tax that will be deducted or withheld from your. Web td1 is a form provided by the cra that determines the amount of tax to be deducted from employee income. Here is everything you need to know about the td1 form. Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions.

Web a td1 federal form, officially the personal tax credits form, is used to determine the amount of tax to deduct from your income. Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as. Web what is a td1 form? Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best. Web what is a td1 tax form? Web the use of td1 forms enables the canada revenue agency to collect the appropriate amount of tax every time an employee is paid, rather than as a lump sum at the end of. Web the td1 personal tax credit return is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension. To know how much tax to deduct, each. Web td1 forms determine your tax withholdings canada revenue agency provides employers with td1 personal tax credits return forms, both federal and provincial. Web td1 is a form provided by the cra that determines the amount of tax to be deducted from employee income.

Web simply put, the td1 form gives the cra a means to accurately estimate how much a person will owe the government in taxes each fiscal year and make the required. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best. However, if your net income from all sources will be greater. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online. Web the use of td1 forms enables the canada revenue agency to collect the appropriate amount of tax every time an employee is paid, rather than as a lump sum at the end of. Learn about td1 forms on cra’s website. Simply put, a td1, personal tax credits return, is a form that is necessary for. January 6, 2023 tax credits! Web what is a td1 form? Web td1 is a form provided by the cra that determines the amount of tax to be deducted from employee income.

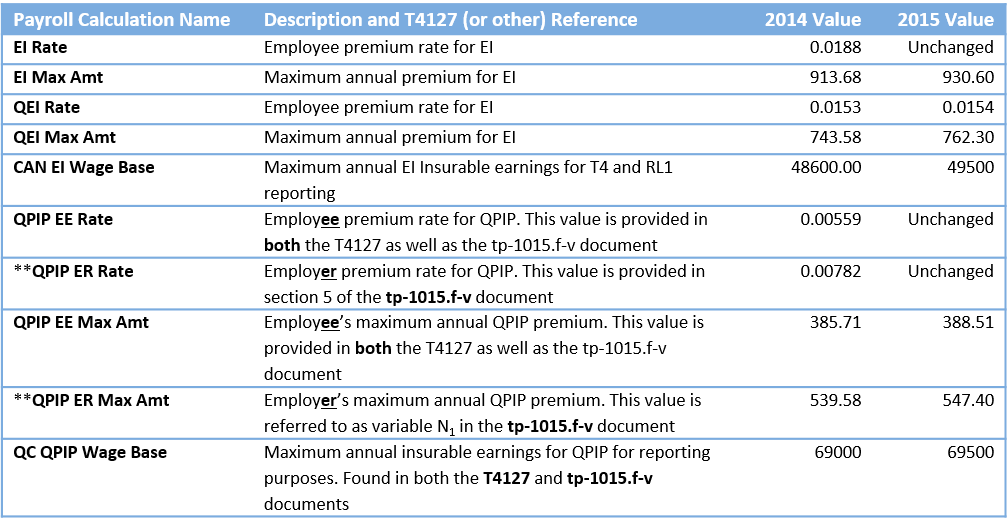

2015 Canadian Statutory Deduction Changes LOKI Systems

Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Web what is a td1 form? If your net income will be between $150,473 and $214,368 and you want to calculate a partial. Web create federal and provincial or territorial forms td1, following the instructions at.

If you work in Canada, you should know this. Form TD1 (Part 1) YouTube

Learn about td1 forms on cra’s website. Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as. Web get the completed td1 forms. Here is everything you need to know about the td1 form. Web the td1 form, or td1 personal tax.

Important Forms & Documents »

Web td1 is a form provided by the cra that determines the amount of tax to be deducted from employee income. Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as. Here is everything you need to know about the td1 form..

What is a TD1 Form & Why Do You Need It?

Web get the completed td1 forms. Web td1 forms determine your tax withholdings canada revenue agency provides employers with td1 personal tax credits return forms, both federal and provincial. Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Web what is a td1 form? Web.

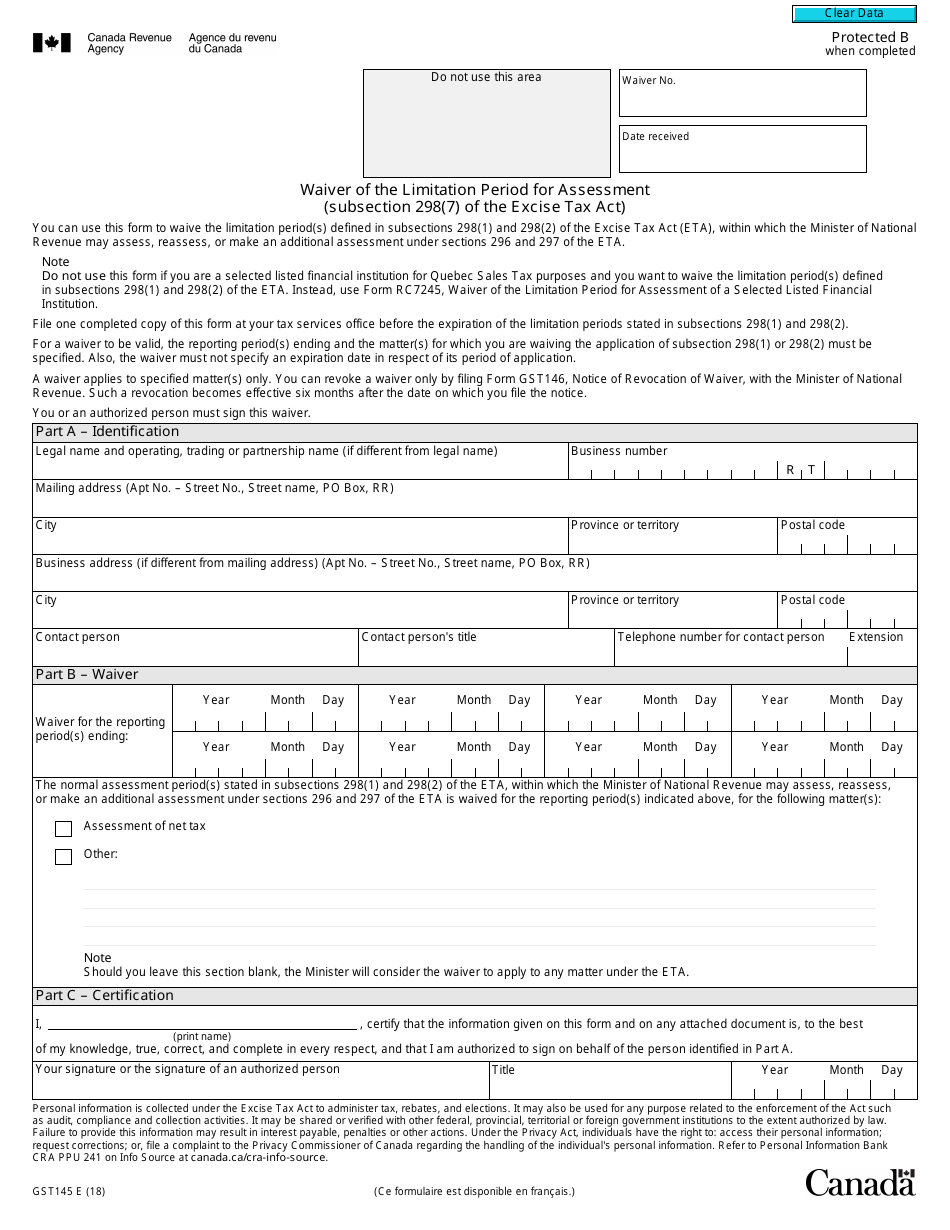

Form GST145 Download Fillable PDF or Fill Online Waiver of the

Unfortunately, they aren’t magically calculated on your employee’s behalf. Web this page contains links to federal and provincial td1 forms (personal tax credits return) for 2021. Simply put, a td1, personal tax credits return, is a form that is necessary for. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your.

How to stop paying the Tax Man too much VazOxlade Toronto Star

Web this page contains links to federal and provincial td1 forms (personal tax credits return) for 2021. If your net income will be between $150,473 and $214,368 and you want to calculate a partial. Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income,.

How to Fill out a TD1 Form (2021)

Web what is a td1 form? Unfortunately, they aren’t magically calculated on your employee’s behalf. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best. Learn about td1 forms on cra’s website. Web create federal and provincial or territorial forms td1, following the.

HOW TO Fill a TD1 Form Canada (2023) YouTube

Web td1 forms determine your tax withholdings canada revenue agency provides employers with td1 personal tax credits return forms, both federal and provincial. The td1 personal tax credits return is used to calculate the amount of income tax that will be deducted or withheld from your. Learn about td1 forms on cra’s website. Web td1 is a form provided by.

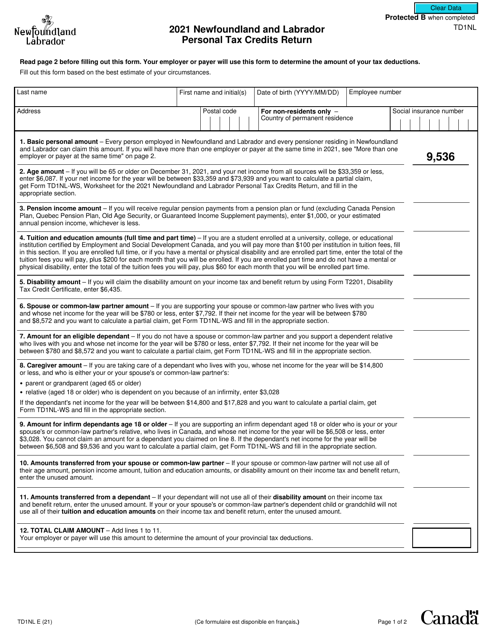

Form TD1NL Download Fillable PDF or Fill Online Newfoundland and

Unfortunately, they aren’t magically calculated on your employee’s behalf. Learn about td1 forms on cra’s website. Web the td1 form, or td1 personal tax credits return, is a set of federal and provincial/territorial documents that helps employers calculate how much income tax they. Web td1 forms determine your tax withholdings canada revenue agency provides employers with td1 personal tax credits.

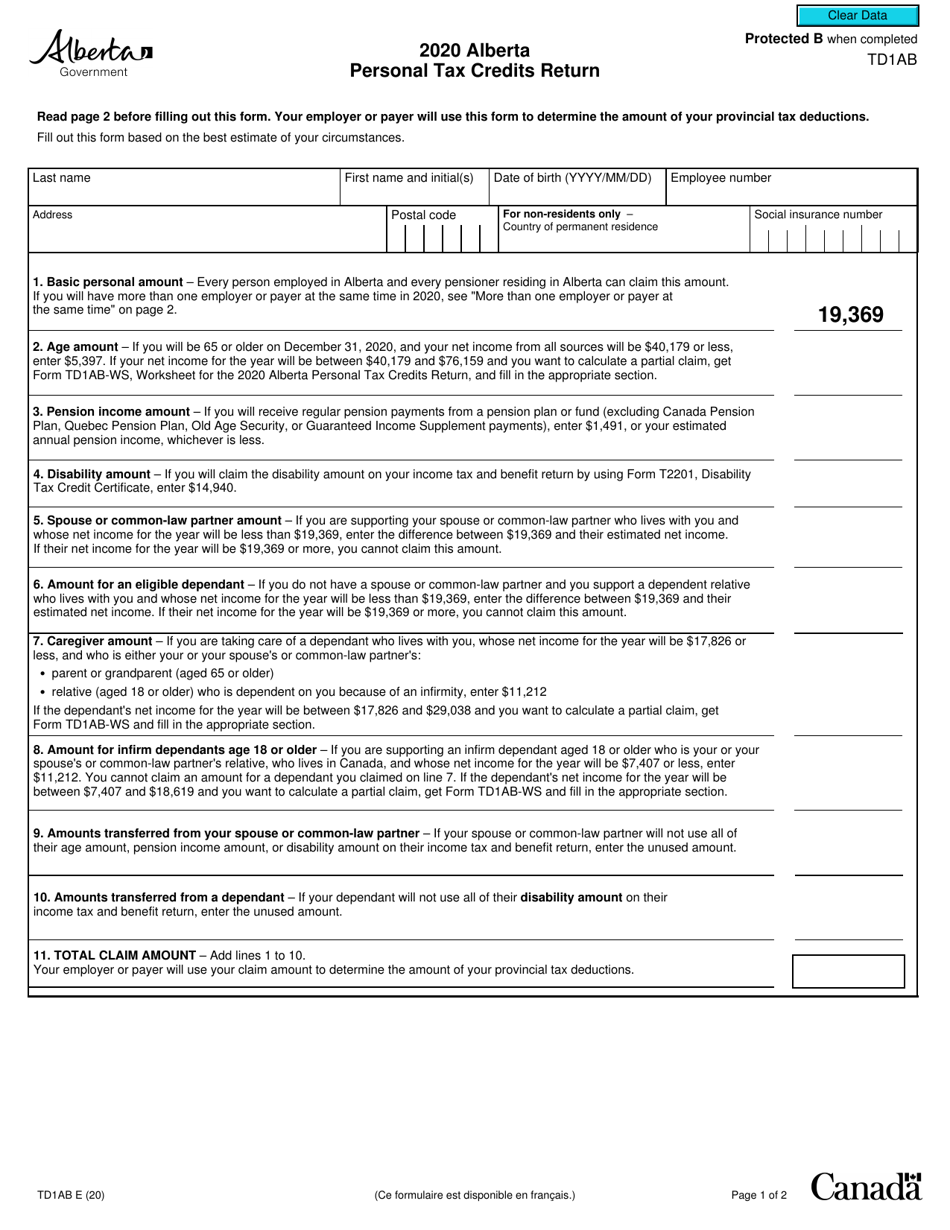

Form TD1AB Download Fillable PDF or Fill Online Personal Tax Credits

Web what is a td1 tax form? Web the td1 form, or td1 personal tax credits return, is a set of federal and provincial/territorial documents that helps employers calculate how much income tax they. Learn about td1 forms on cra’s website. Here is everything you need to know about the td1 form. To know how much tax to deduct, each.

Web The Use Of Td1 Forms Enables The Canada Revenue Agency To Collect The Appropriate Amount Of Tax Every Time An Employee Is Paid, Rather Than As A Lump Sum At The End Of.

There are td1 federal forms. To know how much tax to deduct, each. Web if your net income from all sources for the year will be $150,473 or less, enter$13,229. Web the td1 personal tax credit return is a form used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension.

January 6, 2023 Tax Credits!

If your net income will be between $150,473 and $214,368 and you want to calculate a partial. Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Web this page contains links to federal and provincial td1 forms (personal tax credits return) for 2021. Web td1 is a form provided by the cra that determines the amount of tax to be deducted from employee income.

Web A Td1 Federal Form, Officially The Personal Tax Credits Form, Is Used To Determine The Amount Of Tax To Deduct From Your Income.

Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online. Here is everything you need to know about the td1 form. The td1 personal tax credits return is used to calculate the amount of income tax that will be deducted or withheld from your. Web form td1, personal tax credits return, is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as.

Web What Is A Td1 Form?

Web the td1 form, or td1 personal tax credits return, is a set of federal and provincial/territorial documents that helps employers calculate how much income tax they. Unfortunately, they aren’t magically calculated on your employee’s behalf. Web get the completed td1 forms. Web create federal and provincial or territorial forms td1, following the instructions at electronic form td1, and have your employees send them to you online for best.