Casualty Loss Form

Casualty Loss Form - The form has a separate column for each item lost. Web only losses pertaining to personal property can be declared on form 4684. Web generating form 4684 casualty or theft loss for an individual return in lacerte this article will show you how to generate form 4684, casualties and thefts,. Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form 1040x. In taxation, loss due to damage which qualifies for a casualty loss tax deduction. To determine the amount of your casualty loss, you. Web casualty or theft gain or loss (use a separate part l for each casualty or theft.) 19 description of properties (show type, location, and date acquired for each property). However, the rules for determining the amount of deductible loss and where the loss is. Web casualty loss have a casualty loss on a home you own as tenants by the entirety half of the loss, subject to the deduction limits. Then, they have to file form 1040.

If more than four assets are lost in the casualty or theft, add additional units of screen 4684 for the fifth and additional. To report the casualty loss on your tax return, you would typically use form 4684, casualties and thefts, and transfer the deductible loss amount to schedule a. Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form 1040x. First, the taxpayer has to report their losses on form 4684. Then, they have to file form 1040. Web overview use this screen to complete form 4684, page 2. Web how to claim a casualty loss on taxes? However, the rules for determining the amount of deductible loss and where the loss is. They are subject to a 10% adjusted gross income (agi). Web generating form 4684 casualty or theft loss for an individual return in lacerte this article will show you how to generate form 4684, casualties and thefts,.

Claiming the deduction requires you to complete irs form 4684. Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form 1040x. However, if the casualty loss is not the result of a federally. Web how to claim a casualty loss on taxes? Web new loss cost multiplier, deviation or oterwise h modifying it’s currently approved workers' compensation rates or rating procedures must use reference filing adoption form. The amount of each separate casualty or theft loss is more than $100, and; Neither spouse may report the. If more than four assets are lost in the casualty or theft, add additional units of screen 4684 for the fifth and additional. Web casualty and theft losses are reported under the casualty loss section on schedule a of form 1040. First, the taxpayer has to report their losses on form 4684.

Guide to completing Form 4684 to Claim a Casualty Loss

It must be caused by a sudden, unexpected or unusual occurrence such as a. Claiming the deduction requires you to complete irs form 4684. Web overview use this screen to complete form 4684, page 2. To determine the amount of your casualty loss, you. However, if the casualty loss is not the result of a federally.

Form 4684 Theft and Casualty Loss Deduction H&R Block

However, the rules for determining the amount of deductible loss and where the loss is. Web generating form 4684 casualty or theft loss for an individual return in lacerte this article will show you how to generate form 4684, casualties and thefts,. Business losses are deducted elsewhere. It must be caused by a sudden, unexpected or unusual occurrence such as.

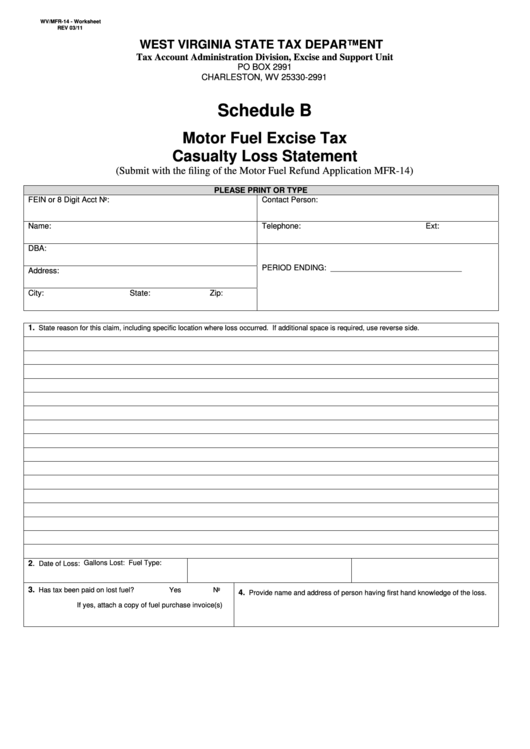

Form Wv/mfr14 Worksheet Schedule B Motor Fuel Exise Tax Casualty

In taxation, loss due to damage which qualifies for a casualty loss tax deduction. Web up to 10% cash back you must complete form 4684 for all casualty losses. First, the taxpayer has to report their losses on form 4684. Web casualty and theft losses are reported under the casualty loss section on schedule a of form 1040. Casualty and.

Home basis, not market value, key amount in calculating disaster loss

Claiming the deduction requires you to complete irs form 4684. Web casualty loss have a casualty loss on a home you own as tenants by the entirety half of the loss, subject to the deduction limits. The form has a separate column for each item lost. Web if you have already filed your return for the preceding year, you may.

Taxes From A To Z (2014) L Is For Lost Property

Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form 1040x. First, the taxpayer has to report their losses on form 4684. Web new loss cost multiplier, deviation or oterwise h modifying it’s currently approved workers' compensation rates or rating procedures must use reference filing adoption form..

Personal casualty losses from natural disasters

Web you can deduct personal casualty or theft losses only to the extent that: In taxation, loss due to damage which qualifies for a casualty loss tax deduction. Web if you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax year, and to deduct the.

casualty loss deduction example Fill Online, Printable, Fillable

However, the rules for determining the amount of deductible loss and where the loss is. Business losses are deducted elsewhere. Claiming the deduction requires you to complete irs form 4684. The amount of each separate casualty or theft loss is more than $100, and; However, if the casualty loss is not the result of a federally.

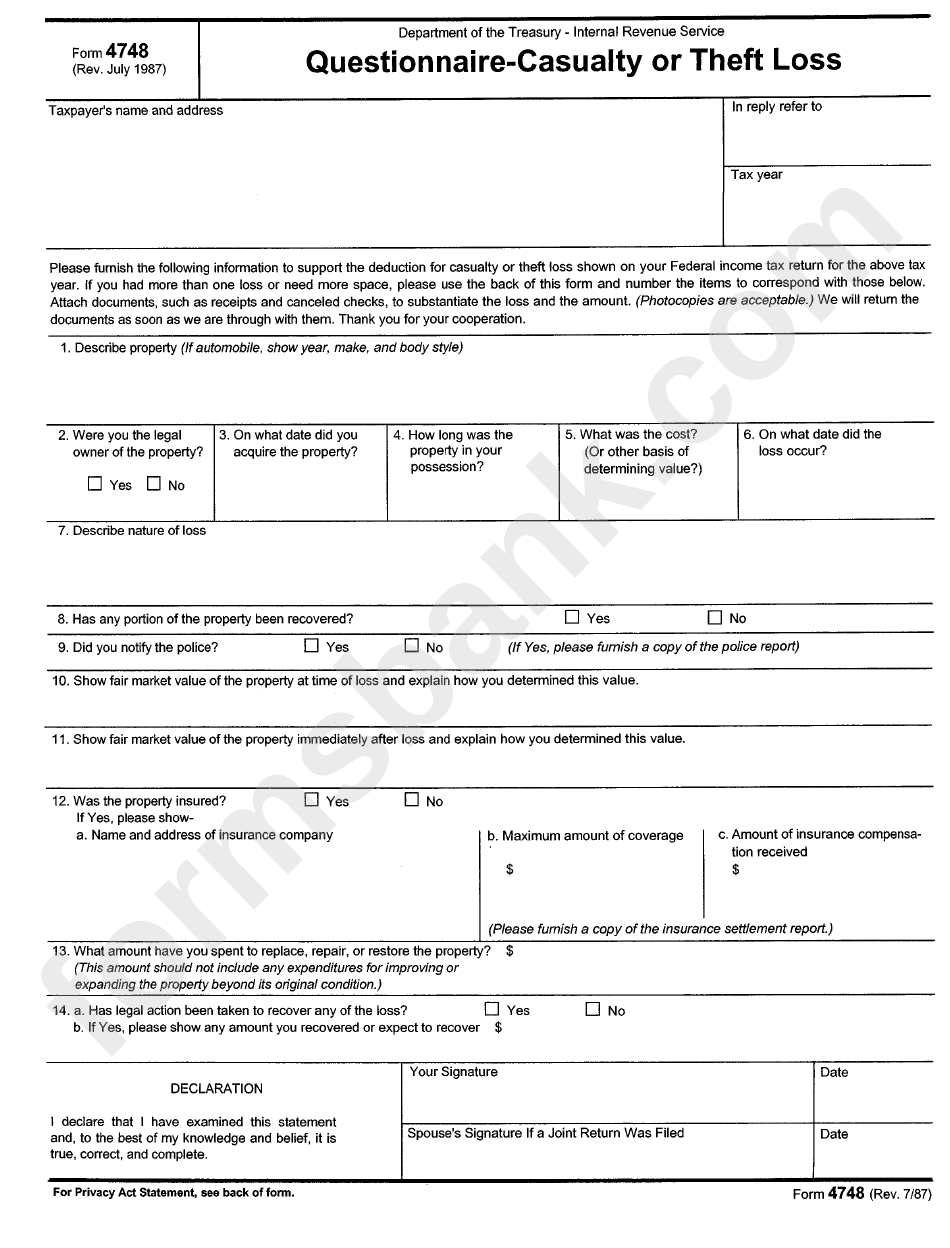

Form 4748 QuestionnaireCasualty Or Theft Loss printable pdf download

The form has a separate column for each item lost. Claiming the deduction requires you to complete irs form 4684. Web only losses pertaining to personal property can be declared on form 4684. Web reporting your casualty deduction. Web overview use this screen to complete form 4684, page 2.

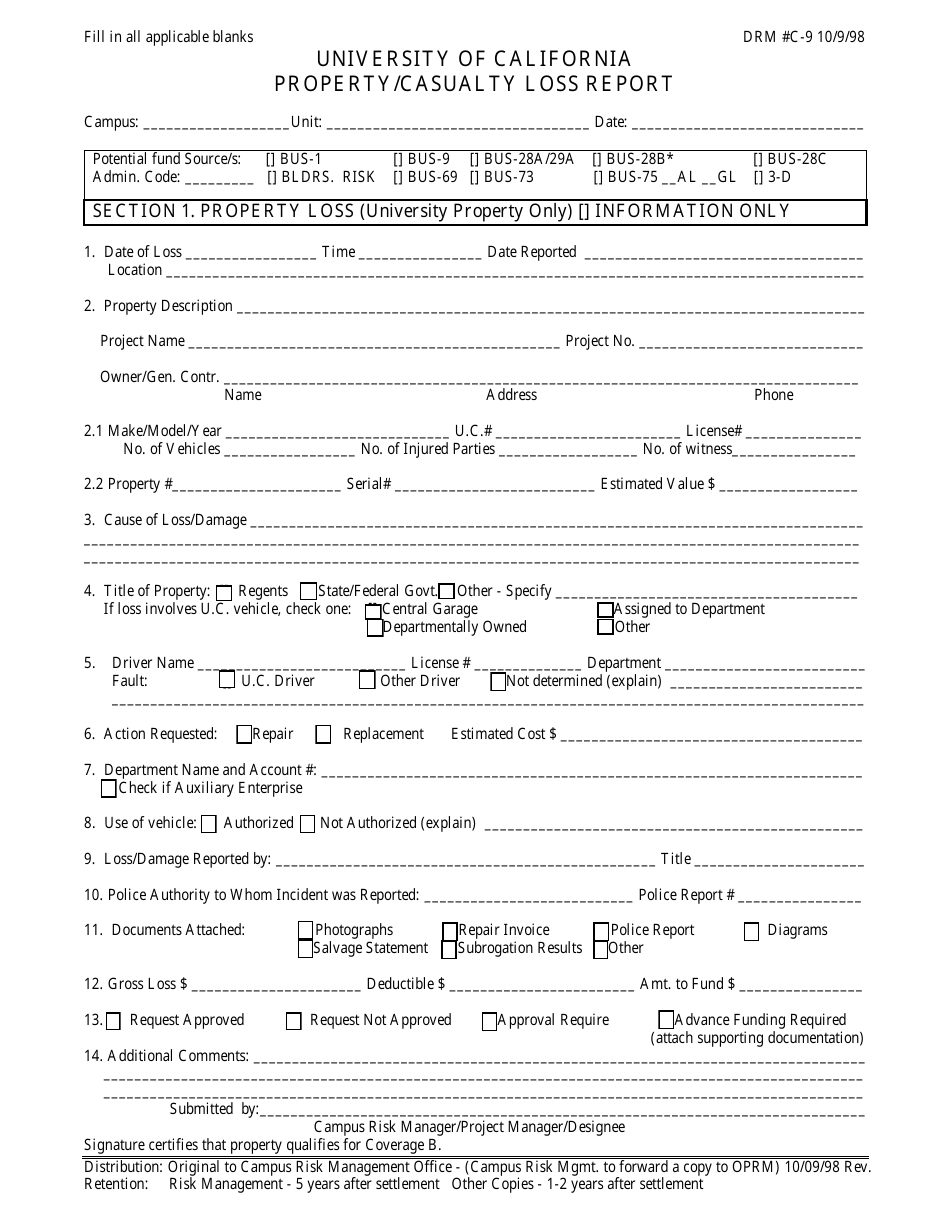

Property/Casualty Loss Report Form University of California Download

Web up to 10% cash back you must complete form 4684 for all casualty losses. The amount of each separate casualty or theft loss is more than $100, and; Web casualty or theft gain or loss (use a separate part l for each casualty or theft.) 19 description of properties (show type, location, and date acquired for each property). Web.

Personal casualty losses from natural disasters

Web reporting your casualty deduction. Neither spouse may report the. The amount of each separate casualty or theft loss is more than $100, and; Claiming the deduction requires you to complete irs form 4684. To report the casualty loss on your tax return, you would typically use form 4684, casualties and thefts, and transfer the deductible loss amount to schedule.

However, If The Casualty Loss Is Not The Result Of A Federally.

To determine the amount of your casualty loss, you. First, the taxpayer has to report their losses on form 4684. Claiming the deduction requires you to complete irs form 4684. Web casualty loss have a casualty loss on a home you own as tenants by the entirety half of the loss, subject to the deduction limits.

Web How To Claim A Casualty Loss On Taxes?

Web if you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax year, and to deduct the loss without. Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form 1040x. Web generating form 4684 casualty or theft loss for an individual return in lacerte this article will show you how to generate form 4684, casualties and thefts,. Web casualty and theft losses are reported under the casualty loss section on schedule a of form 1040.

Web Up To 10% Cash Back You Must Complete Form 4684 For All Casualty Losses.

Web only losses pertaining to personal property can be declared on form 4684. However, the rules for determining the amount of deductible loss and where the loss is. Neither spouse may report the. They are subject to a 10% adjusted gross income (agi).

The Amount Of Each Separate Casualty Or Theft Loss Is More Than $100, And;

Web casualty or theft gain or loss (use a separate part l for each casualty or theft.) 19 description of properties (show type, location, and date acquired for each property). The total amount of all. Web overview use this screen to complete form 4684, page 2. Web reporting your casualty deduction.