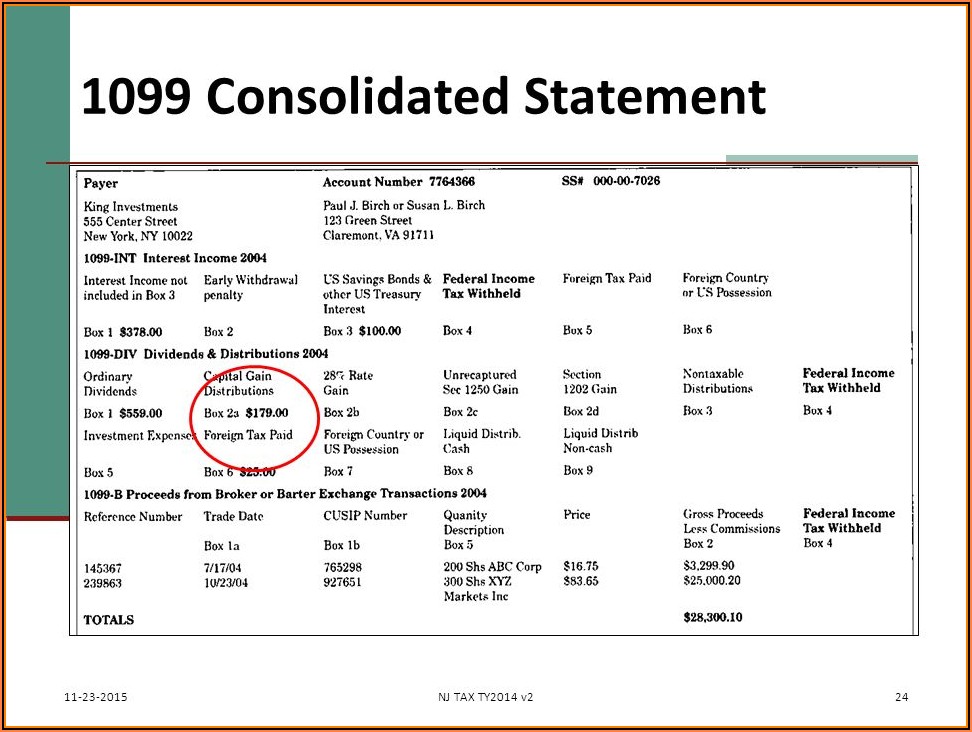

Consolidated Form 1099

Consolidated Form 1099 - Web a broker or barter exchange must file this form for each person: View and download up to seven years of past returns in turbotax online. The following guides take you. Persons with a hearing or speech disability with access to. Web your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. Web the consolidated form 1099 received from your broker may contain several parts, which should be clearly labeled on the form: See the instructions for form. How do i file an irs extension (form 4868) in. Web learn 8 key things to look for on your consolidated 1099 tax statement. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.

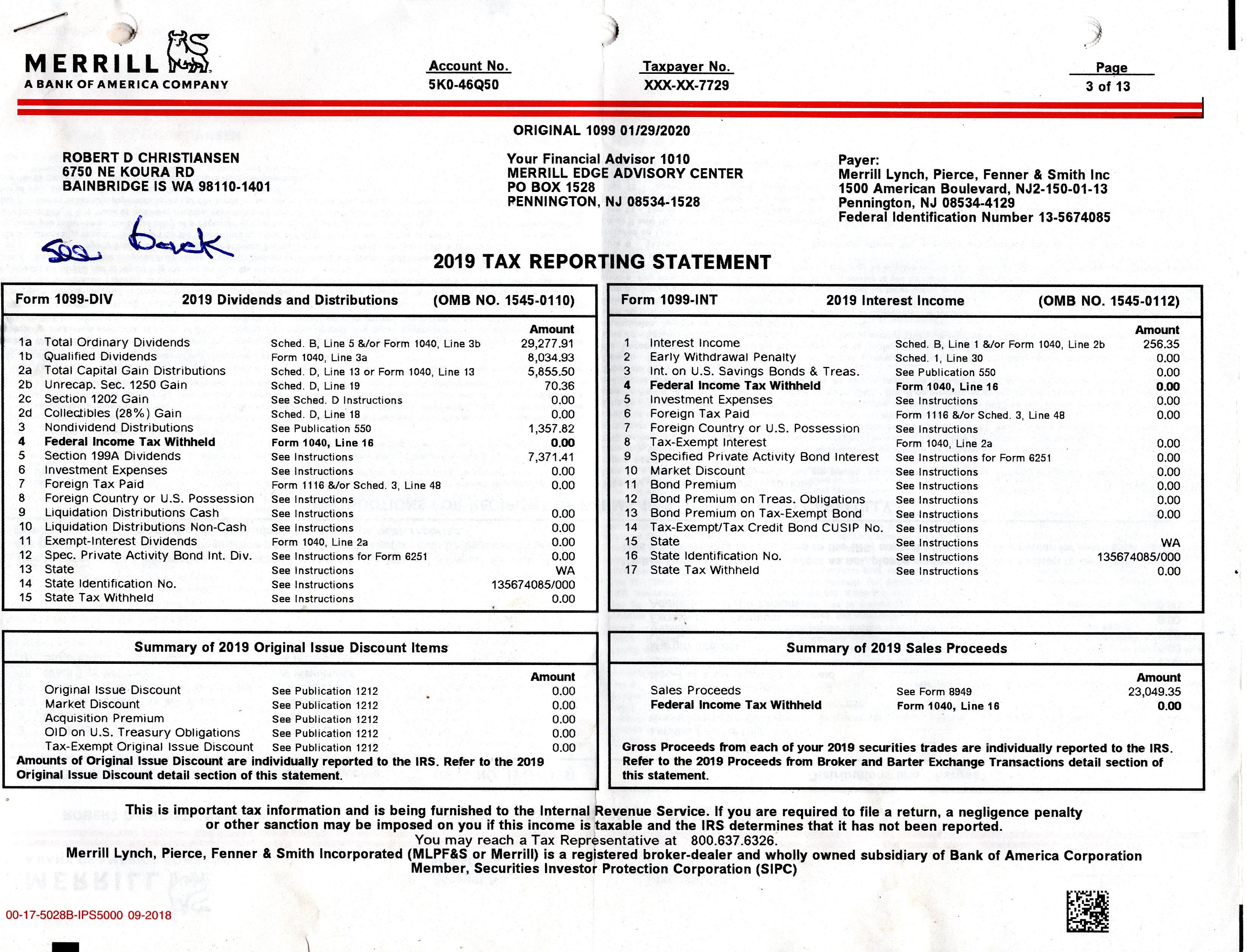

In some cases, exempt recipients. Learn more about how to simplify your businesses 1099 reporting. For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts,. Persons with a hearing or speech disability with access to. See the instructions for form. You may also have a filing requirement. This is important tax information and is being furnished to the. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

How do i file an irs extension (form 4868) in. In some cases, exempt recipients. You may also have a filing requirement. See the instructions for form. Web the consolidated form 1099 received from your broker may contain several parts, which should be clearly labeled on the form: Web your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts,. This is important tax information and is being furnished to the. It reflects information that is reported to the irs and is designed to assist you. Web learn 8 key things to look for on your consolidated 1099 tax statement.

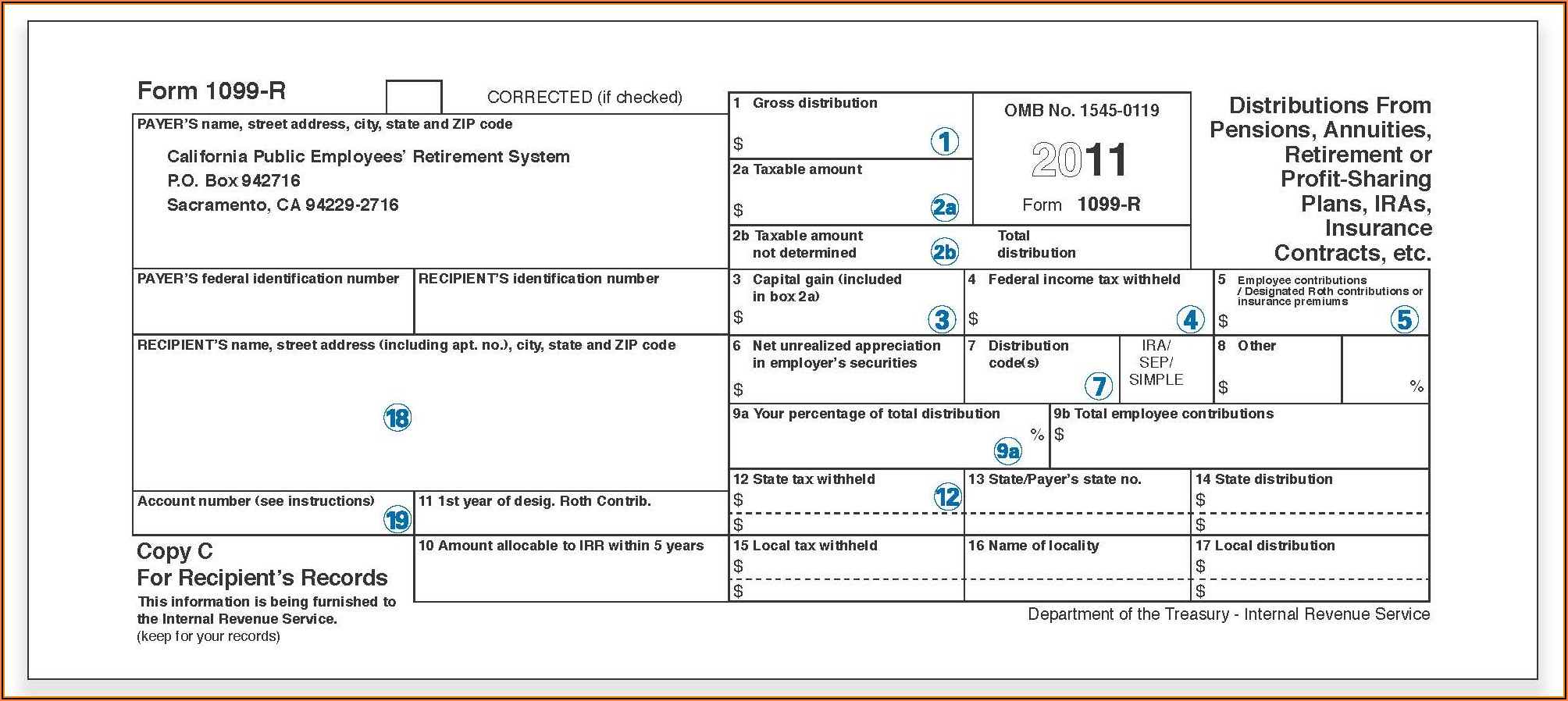

What Is A Consolidated 1099 Tax Form Form Resume Examples Wk9yMaO93D

Web your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. Due to internal revenue service (irs) regulatory changes that have been phased in. How do i file an irs extension (form 4868) in. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web a broker.

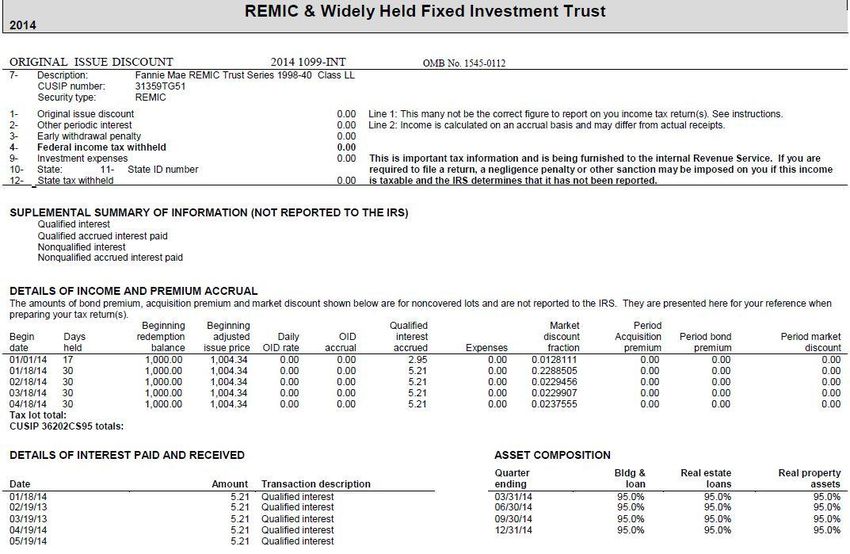

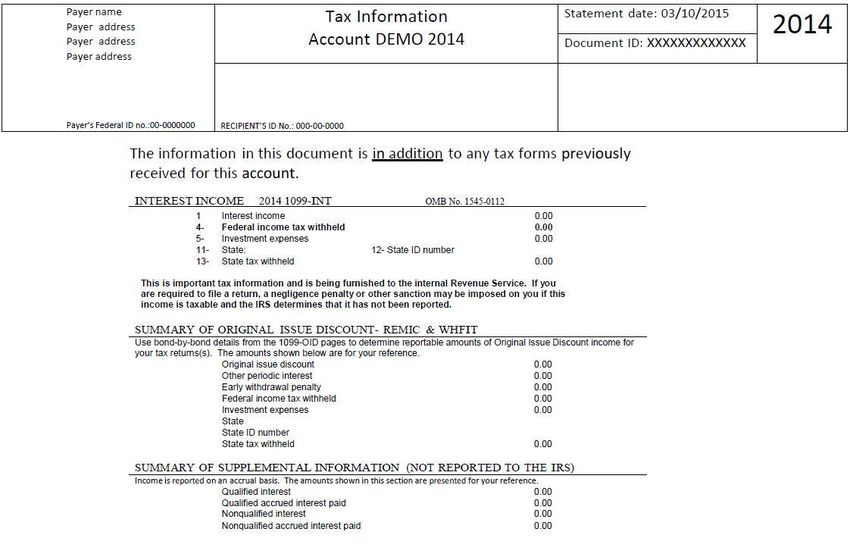

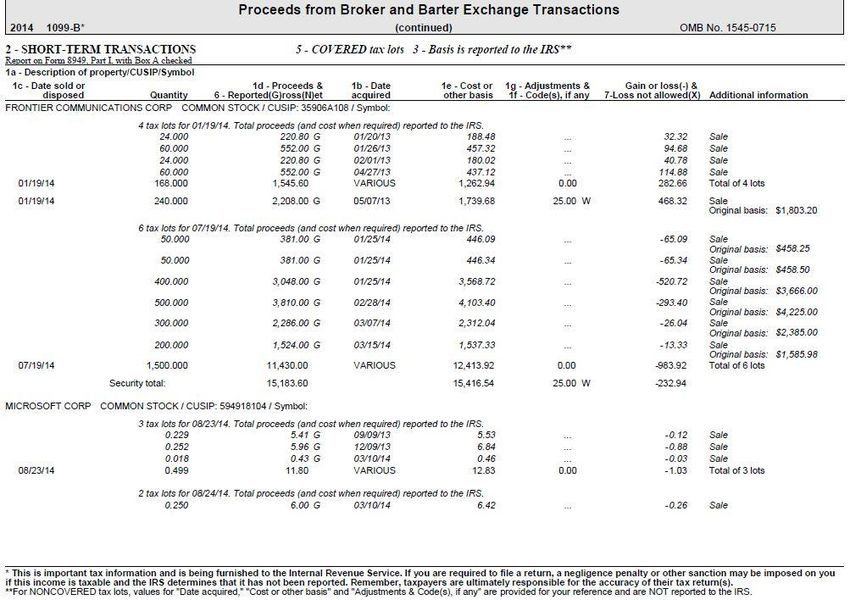

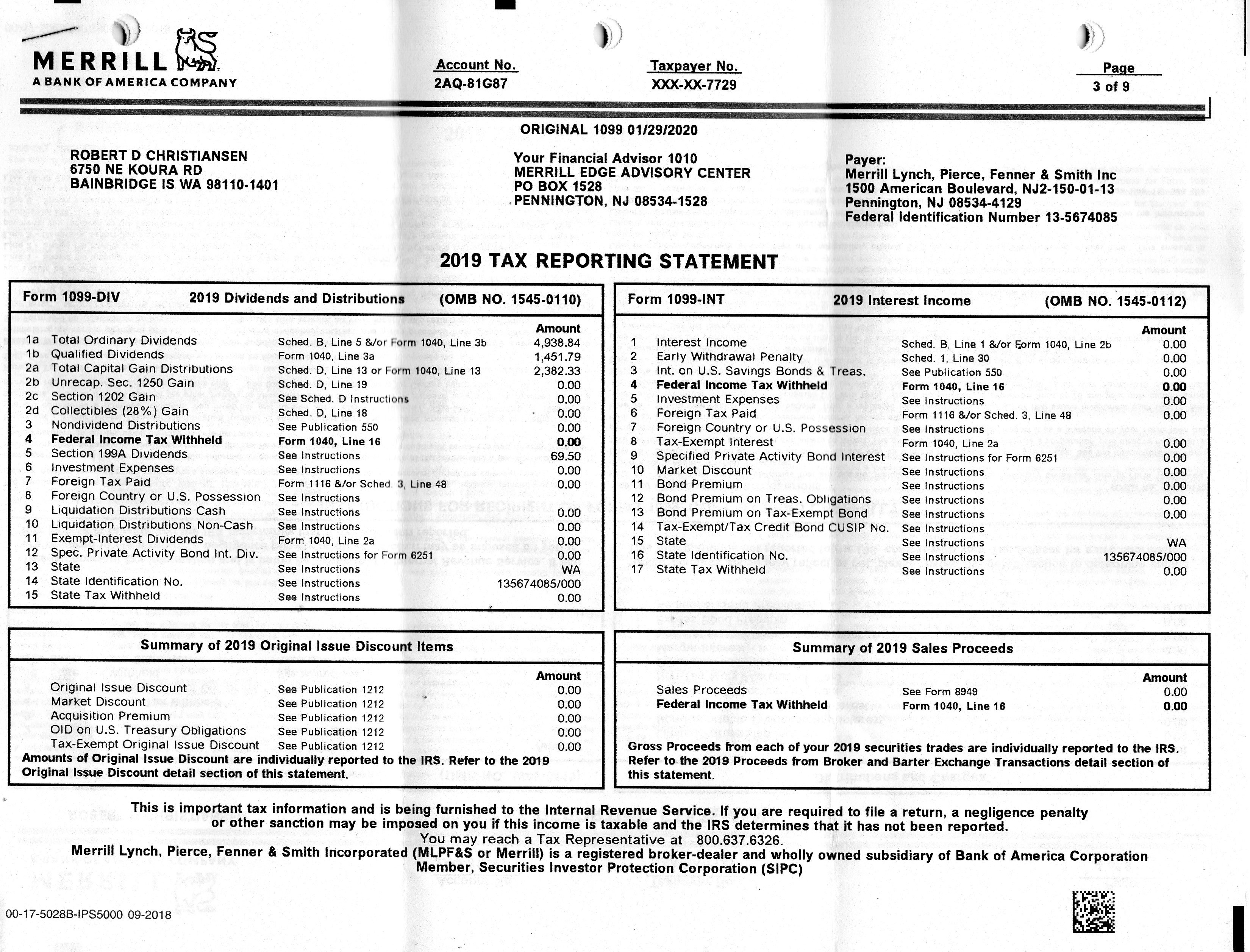

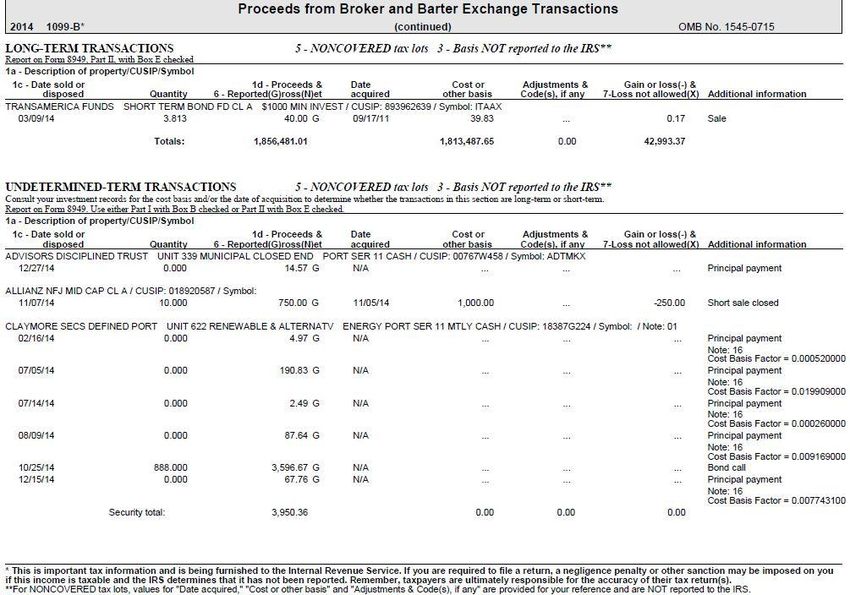

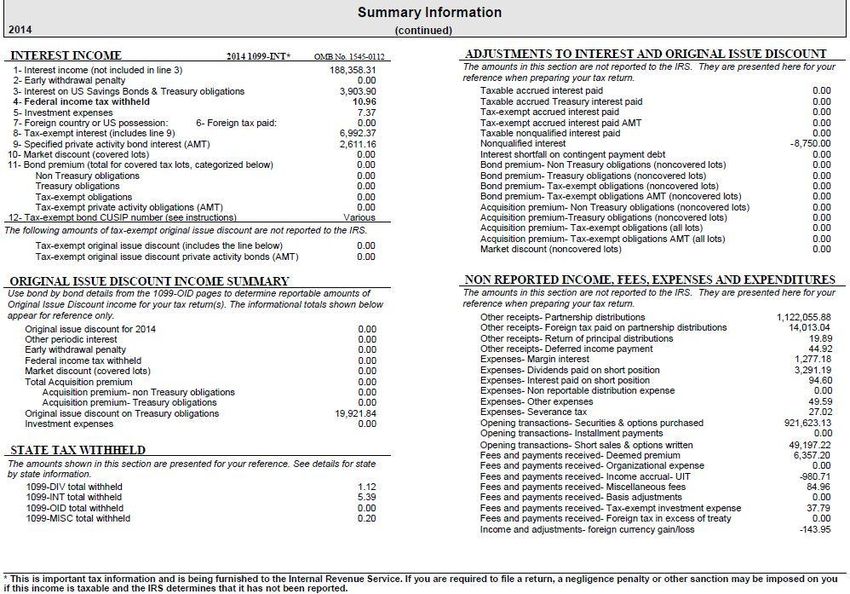

A guide to your 2014 Consolidated IRS Form 1099

Web your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. Web your consolidated form 1099 is the authoritative document for tax reporting purposes. The following guides take you. How do i file an irs extension (form 4868) in. Web learn 8 key things to look for on your consolidated 1099 tax statement.

A guide to your 2014 Consolidated IRS Form 1099

You may also have a filing requirement. This is important tax information and is being furnished to the. Web a broker or barter exchange must file this form for each person: Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. How do i file an irs extension (form 4868) in.

A guide to your 2014 Consolidated IRS Form 1099

Web all individuals receive a consolidated 1099 if they are united states citizens or legal residents and have had reportable tax activity. Web your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. It could include some or all of the following five forms: Web a corrected consolidated form 1099 may be required.

1099 Form Tax Id Form Resume Examples kLYrPX726a

Learn more about how to simplify your businesses 1099 reporting. In some cases, exempt recipients. This is important tax information and is being furnished to the. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs.

Forms 1099 The Basics You Should Know Kelly CPA

You may also have a filing requirement. Persons with a hearing or speech disability with access to. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. Web learn 8 key things to look for on your consolidated 1099 tax statement. Due to internal revenue service (irs) regulatory changes that have been phased.

tax 2019

Web a corrected consolidated form 1099 may be required under these circumstances: Web the consolidated form 1099 received from your broker may contain several parts, which should be clearly labeled on the form: Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Persons with a hearing or speech disability with.

A guide to your 2014 Consolidated IRS Form 1099

Web your consolidated form 1099 is the authoritative document for tax reporting purposes. In some cases, exempt recipients. You may also have a filing requirement. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Learn more about how to simplify your businesses 1099 reporting.

A guide to your 2014 Consolidated IRS Form 1099

Web learn 8 key things to look for on your consolidated 1099 tax statement. This is important tax information and is being furnished to the. Web a corrected consolidated form 1099 may be required under these circumstances: Web the consolidated form 1099 received from your broker may contain several parts, which should be clearly labeled on the form: It reflects.

tax 2019

How do i file an irs extension (form 4868) in. For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts,. It reflects information that is reported to the irs and is designed to assist you. Web your consolidated 1099 tax form will show all your reportable income and transactions for the tax year. Web the consolidated.

Web On This Form 1099 To Satisfy Its Account Reporting Requirement Under Chapter 4 Of The Internal Revenue Code.

How do i file an irs extension (form 4868) in. Due to internal revenue service (irs) regulatory changes that have been phased in. Web all individuals receive a consolidated 1099 if they are united states citizens or legal residents and have had reportable tax activity. This is important tax information and is being furnished to the.

You May Also Have A Filing Requirement.

Web your consolidated form 1099 is the authoritative document for tax reporting purposes. Web the consolidated form 1099 is the collection of all applicable forms 1099 merged into one document. Persons with a hearing or speech disability with access to. It could include some or all of the following five forms:

View And Download Up To Seven Years Of Past Returns In Turbotax Online.

The following guides take you. For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts,. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. See the instructions for form.

Web Learn 8 Key Things To Look For On Your Consolidated 1099 Tax Statement.

Web a corrected consolidated form 1099 may be required under these circumstances: Learn more about how to simplify your businesses 1099 reporting. In some cases, exempt recipients. Web a broker or barter exchange must file this form for each person: