De Form 1100 Instructions 2021

De Form 1100 Instructions 2021 - Failure to make a declaration or file and pay the required tentative tax. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022. Web home business tax forms 2020 listen please select the type of business from the list below. Alcoholic beverages business licenses business tax credits. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web the corporation must file form 1100 if it does not meet all three eligibility requirements. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income. Web calendar year 2021 and fiscal year ending 2022. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code.

Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022. Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year. 1101 election to be treated for tax purposes as a “subsidiary corporation” of a delaware chartered banking organization or trust. Failure to make a declaration or file and pay the required tentative tax. Web more about the delaware form 1100 corporate income tax tax return ty 2022. Failure to make a declaration or file and pay the required tentative tax. Electronic filing is fast, convenient, accurate and.

Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year. Electronic filing is fast, convenient, accurate and. Failure to make a declaration or file and pay the required tentative tax. Web the corporation must file form 1100 if it does not meet all three eligibility requirements. Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income tax. We last updated the corporate income. 1101 election to be treated for tax purposes as a “subsidiary corporation” of a delaware chartered banking organization or trust. This is a form for reporting the income of a corporation.

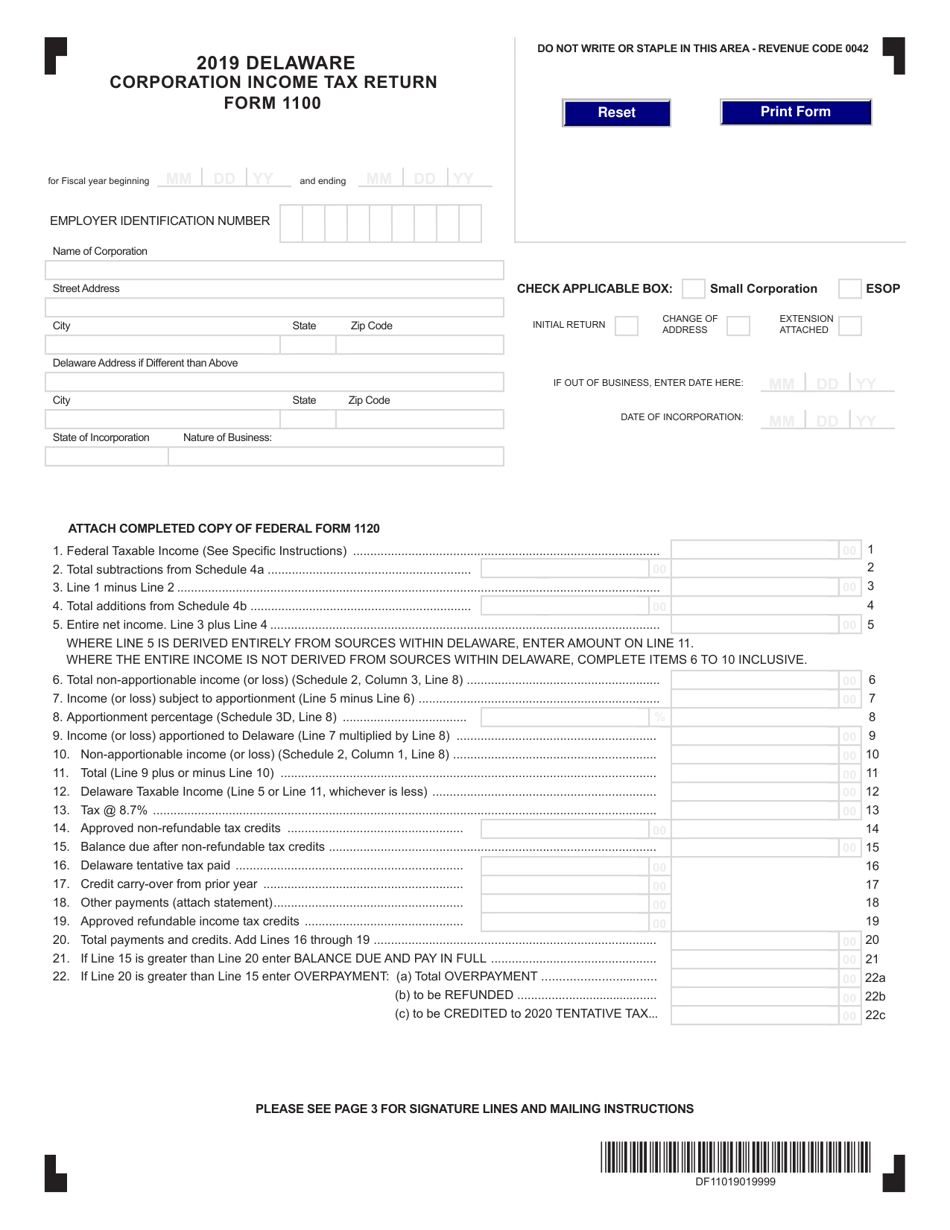

Form 1100 Download Fillable PDF or Fill Online Corporation Tax

Web more about the delaware form 1100 corporate income tax tax return ty 2022. This is a form for reporting the income of a corporation. Web home business tax forms 2020 listen please select the type of business from the list below. Failure to make a declaration or file and pay the required tentative tax. Web instructions instruction highlights calendar.

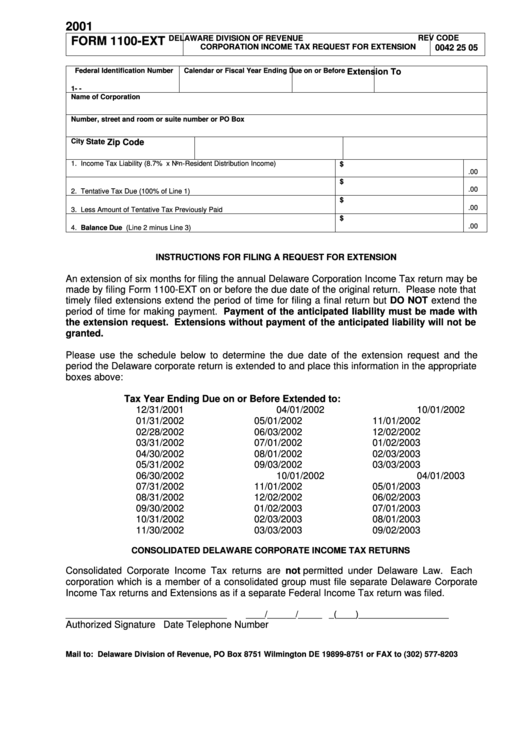

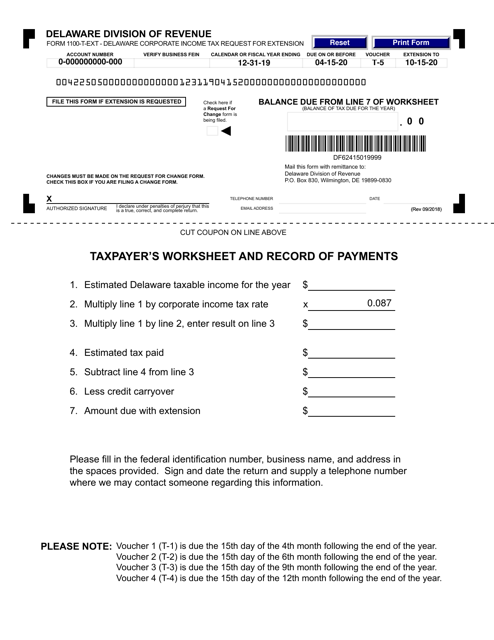

Form 1100Ext Corporation Tax Request For Extension 2001

Electronic filing is fast, convenient, accurate and. Web more about the delaware form 1100 corporate income tax tax return ty 2022. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022. 1101 election to be treated for tax purposes as a.

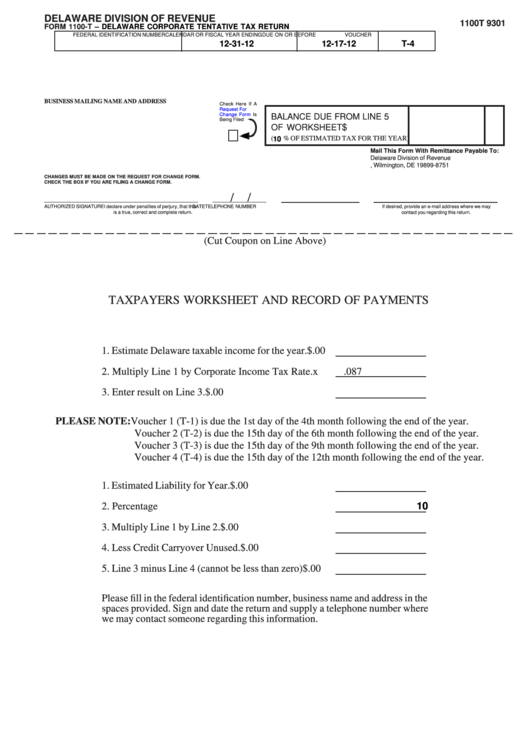

Fillable Form 1100T Delaware Corporate Tentative Tax Return 2012

Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Who is required to file a delaware tax return? Failure to make a.

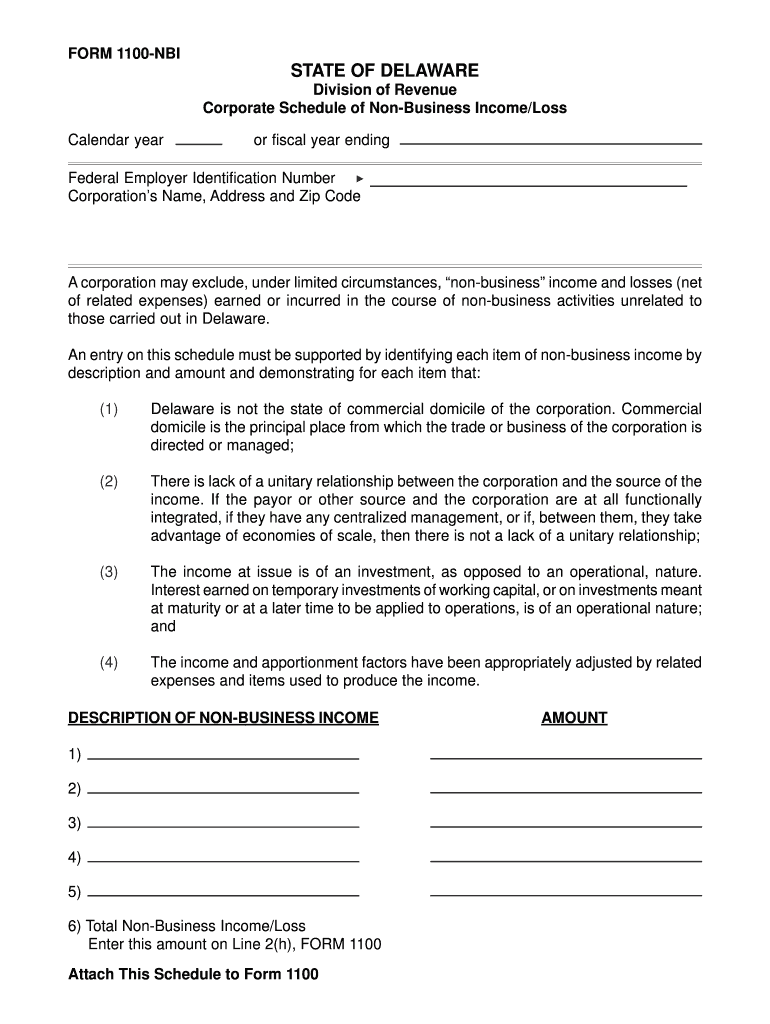

форма 1100 Fill Online, Printable, Fillable, Blank pdfFiller

Electronic filing is fast, convenient, accurate and. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022..

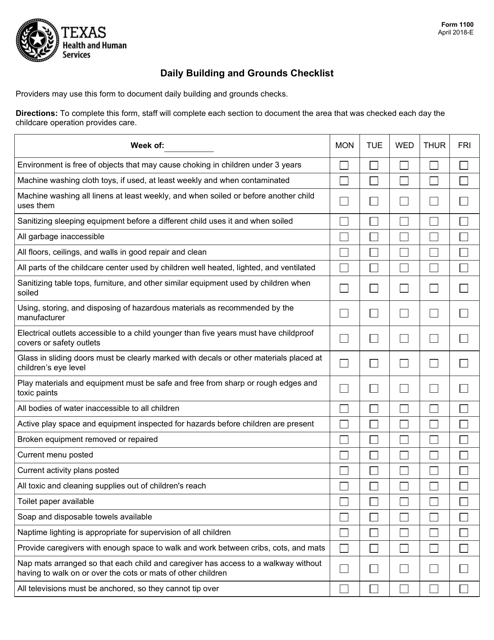

Form 1100 Download Fillable PDF or Fill Online Daily Building and

Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year. 1101 election to be treated for tax purposes as a “subsidiary corporation” of a delaware chartered banking organization or trust. Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021.

Form 1100S Download Printable PDF 2018, S CORPORATION RECONCILIATION

Web the corporation must file form 1100 if it does not meet all three eligibility requirements. Who is required to file a delaware tax return? Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022. Web every domestic or foreign corporation.

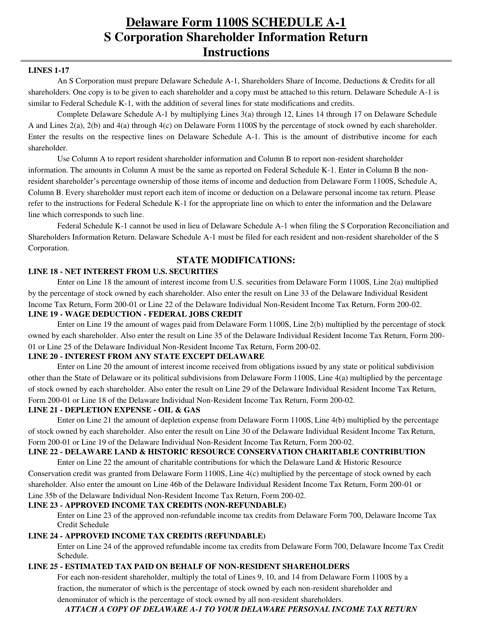

Download Instructions for Form 1100S Schedule A1 S Corporation

Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code. Electronic filing is fast, convenient, accurate and. This is a form for reporting the income of a corporation. Web calendar year 2021 and fiscal year ending 2022. Web we last updated the s corporation reconciliation and shareholders.

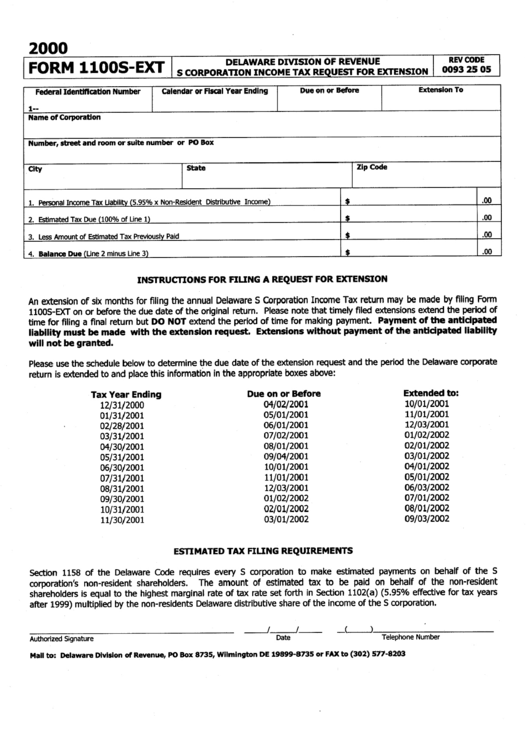

Form 1100sExt S Corporation Tax Request For Extension 2000

This is a form for reporting the income of a corporation. Web we last updated the s corporation reconciliation and shareholders instructions in february 2023, so this is the latest version of form 1100si, fully updated for tax year. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is.

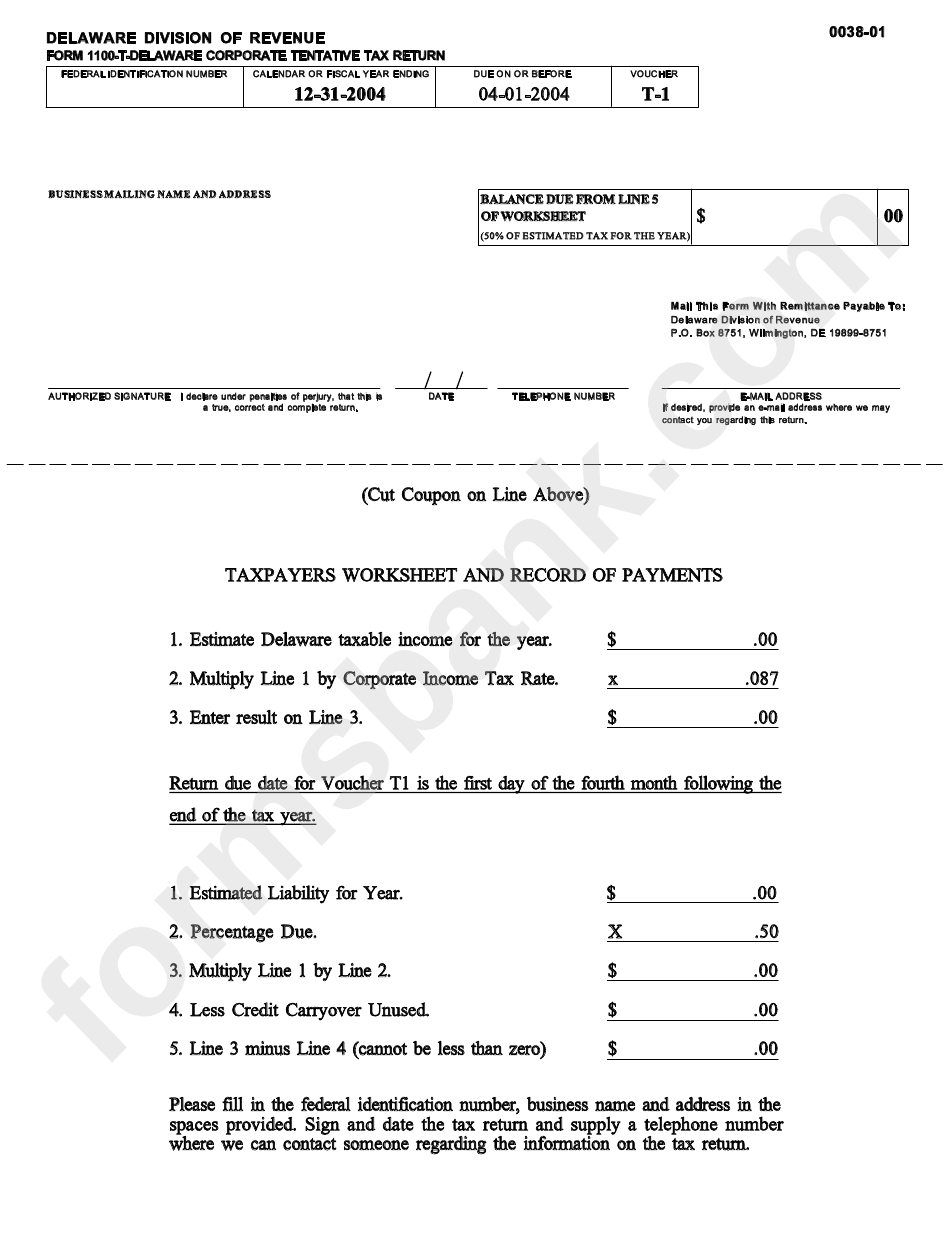

Form 1100T Delaware Corporate Tentative Tax Return 2004 printable

Alcoholic beverages business licenses business tax credits. Web home business tax forms 2020 listen please select the type of business from the list below. Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022. Failure to make a declaration or file.

Form 1100TEXT Download Fillable PDF or Fill Online Delaware Corporate

Web home business tax forms 2020 listen please select the type of business from the list below. Failure to make a declaration or file and pay the required tentative tax. Web the corporation must file form 1100 if it does not meet all three eligibility requirements. This is a form for reporting the income of a corporation. Web more about.

Web We Last Updated The S Corporation Reconciliation And Shareholders Instructions In February 2023, So This Is The Latest Version Of Form 1100Si, Fully Updated For Tax Year.

Web more about the delaware form 1100 corporate income tax tax return ty 2022. Web the corporation must file form 1100 if it does not meet all three eligibility requirements. 1101 election to be treated for tax purposes as a “subsidiary corporation” of a delaware chartered banking organization or trust. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions.

Web Calendar Year 2021 And Fiscal Year Ending 2022.

We last updated the corporate income. This is a form for reporting the income of a corporation. Electronic filing is fast, convenient, accurate and. Failure to make a declaration or file and pay the required tentative tax.

Web Every Domestic Or Foreign Corporation Doing Business In Delaware, Not Specifically Exempt Under Section 1902(B), Title 30, Delaware Code, Is Required To File A Corporate Income Tax.

Web instructions instruction highlights calendar year 2020 and fiscal year ending 2021 tax year section 1158(a) of title 30 of the delaware code. Alcoholic beverages business licenses business tax credits. Failure to make a declaration or file and pay the required tentative tax. Who is required to file a delaware tax return?

Web Home Business Tax Forms 2020 Listen Please Select The Type Of Business From The List Below.

Web we last updated the s corporation reconciliation and shareholders return in january 2023, so this is the latest version of form 1100s, fully updated for tax year 2022. Web every domestic or foreign corporation doing business in delaware, not specifically exempt under section 1902(b), title 30, delaware code, is required to file a corporate income.