Dol 4N Fillable Form

Dol 4N Fillable Form - You can complete some forms online, while you can download and print all. Web to view the full contents of this document, you need a later version of the pdf viewer. Utilize the sign tool to create and add your electronic signature to signnow the georgia dol4n instructions form. Go digital and save time with signnow, the best solution for. Select the appropriate filing quarter. They are likewise a simple method to get information from. Complete the necessary fields that are. Web home forms forms these are the most frequently requested u.s. Web go to employees or on the fly > state tax & wage forms. Web double check all the fillable fields to ensure full precision.

Web handy tips for filling out ga dol 4 form pdf online printing and scanning is no longer the best way to manage documents. 01 begin by entering your personal information, such as your name, address, and contact details. Sign it in a few clicks draw your signature, type it,. Web up to $40 cash back to fill out dol 4n, follow these steps: Sign it in a few clicks draw your signature, type it,. Complete the necessary fields that are. They are likewise a simple method to get information from. You can complete some forms online, while you can download and print all. Web the form is designed to: Edit your dol4n online type text, add images, blackout confidential details, add comments, highlights and more.

Save or instantly send your ready documents. Sign it in a few clicks draw your signature, type it,. Edit your dol4n online type text, add images, blackout confidential details, add comments, highlights and more. Web up to $40 cash back to fill out dol 4n, follow these steps: On the ecomp site you can register for an account, initiate a claim,. Edit your dol 4n online type text, add images, blackout confidential details, add comments, highlights and more. Web double check all the fillable fields to ensure full precision. Web to view the full contents of this document, you need a later version of the pdf viewer. Web submit forms online through the employees' compensation operations and management portal (ecomp). Web go to employees or on the fly > state tax & wage forms.

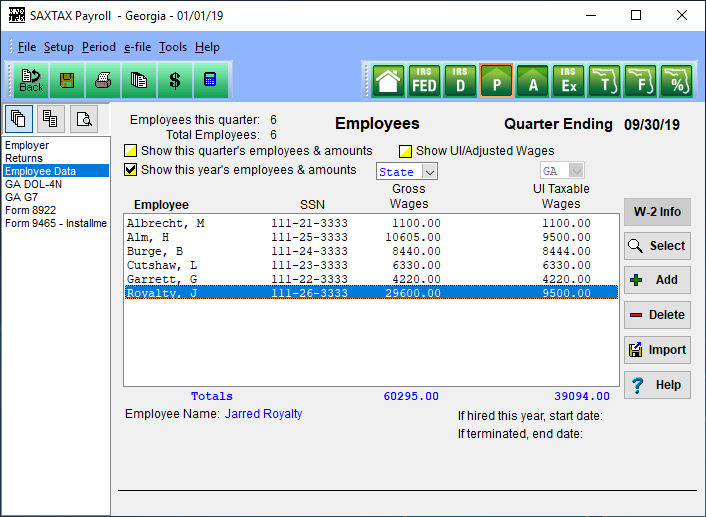

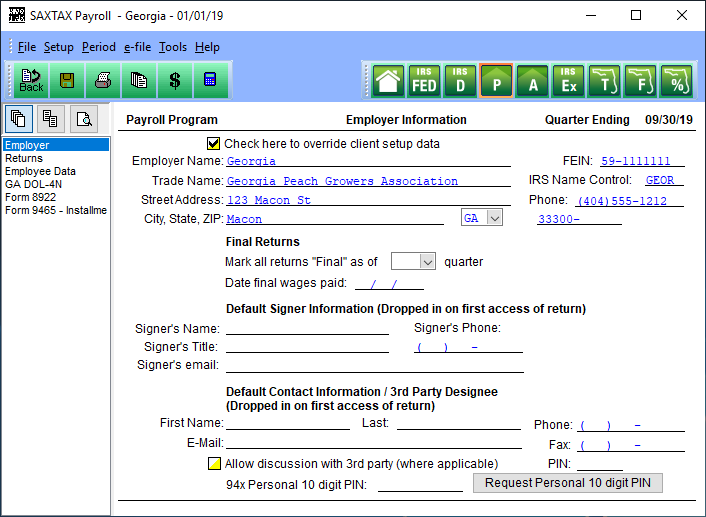

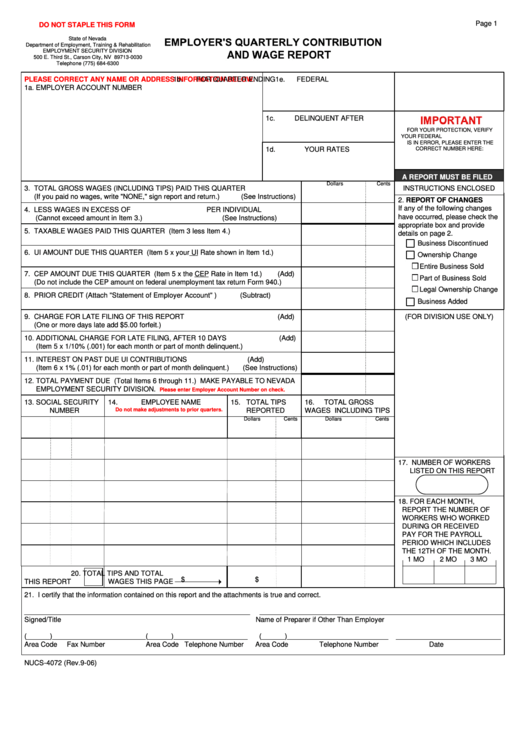

DOL4N Employer’s Tax and Wage Report SAXTAX

Web submit forms online through the employees' compensation operations and management portal (ecomp). 01 begin by entering your personal information, such as your name, address, and contact details. Web home forms forms these are the most frequently requested u.s. Sign it in a few clicks draw your signature, type it,. You can upgrade to the latest version of adobe reader.

DOL4N Employer’s Tax and Wage Report SAXTAX

Edit your dol 4n online type text, add images, blackout confidential details, add comments, highlights and more. 01 begin by entering your personal information, such as your name, address, and contact details. Web handy tips for filling out ga dol 4 form pdf online printing and scanning is no longer the best way to manage documents. You can complete some.

How to save pdf form with data Australia examples Cognitive Guide

Web home forms forms these are the most frequently requested u.s. Web handy tips for filling out ga dol 4 form pdf online printing and scanning is no longer the best way to manage documents. You can complete some forms online, while you can download and print all. They are likewise a simple method to get information from. Web submit.

Form DOL4N Download Fillable PDF or Fill Online Employer's Quarterly

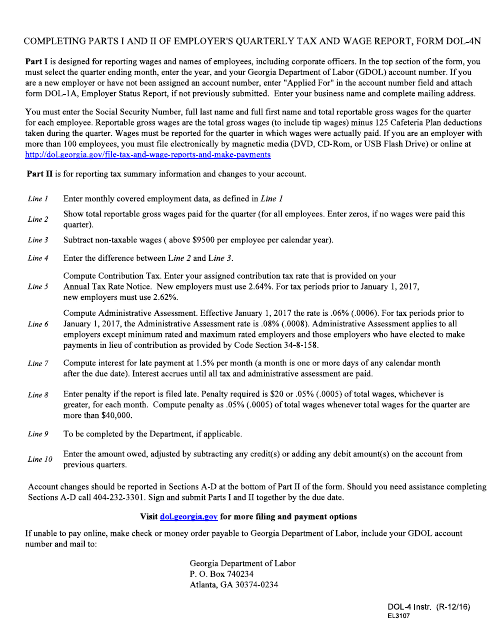

Right justify and zero fill. Web handy tips for filling out ga dol 4 form pdf online printing and scanning is no longer the best way to manage documents. Web up to $40 cash back to fill out dol 4n, follow these steps: (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original.

2005 Form GA DOL3C Fill Online, Printable, Fillable, Blank pdfFiller

Web to view the full contents of this document, you need a later version of the pdf viewer. Go digital and save time with signnow, the best solution for. Easily fill out pdf blank, edit, and sign them. Complete the necessary fields that are. Web double check all the fillable fields to ensure full precision.

DOL4N Employer’s Tax and Wage Report SAXTAX

Right justify and zero fill. Utilize the sign tool to create and add your electronic signature to signnow the georgia dol4n instructions form. (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. Sign it in a few clicks draw your signature, type it,. Select the appropriate filing.

2001 Form GA DOL1a Fill Online, Printable, Fillable, Blank pdfFiller

You can complete some forms online, while you can download and print all. Web home forms forms these are the most frequently requested u.s. Right justify and zero fill. Sign it in a few clicks draw your signature, type it,. Go digital and save time with signnow, the best solution for.

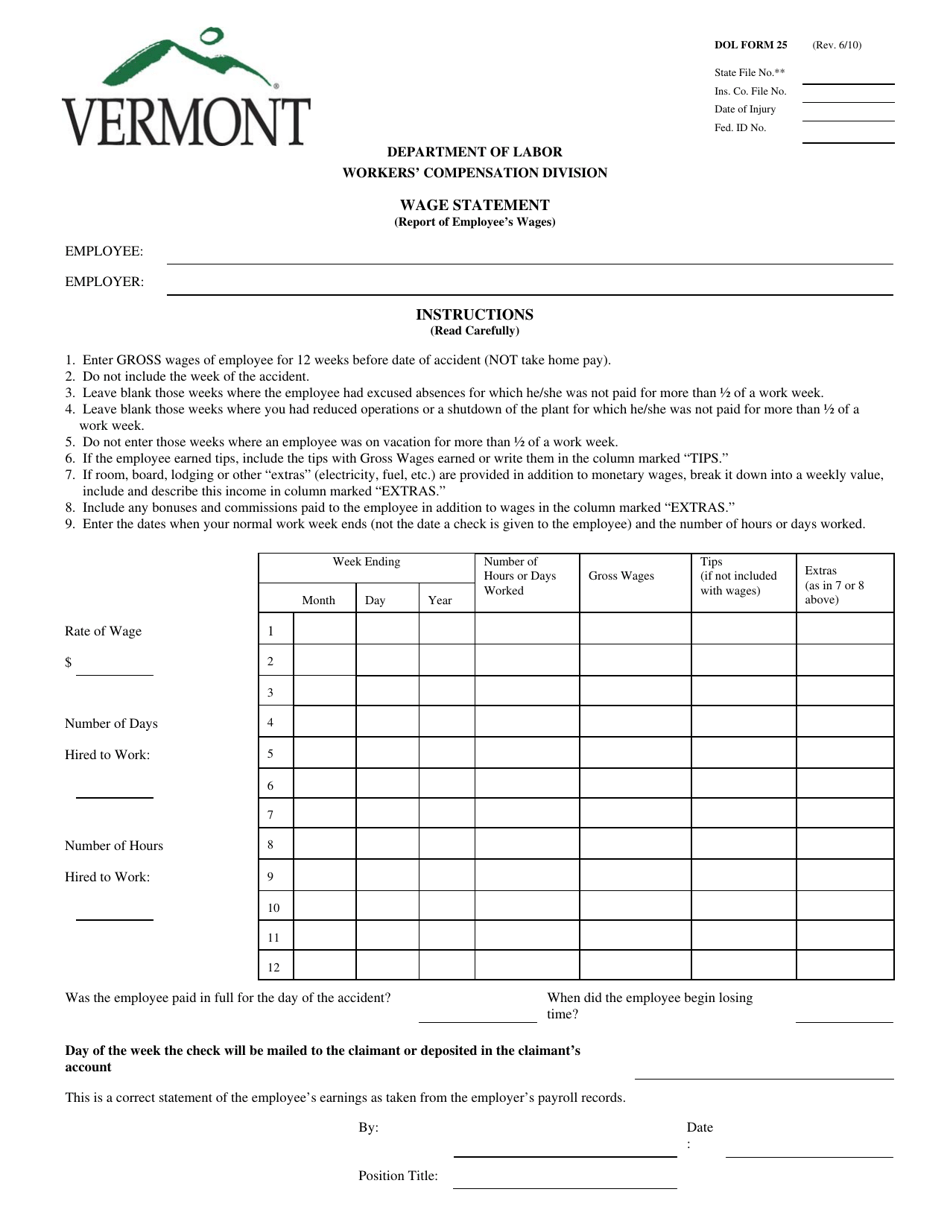

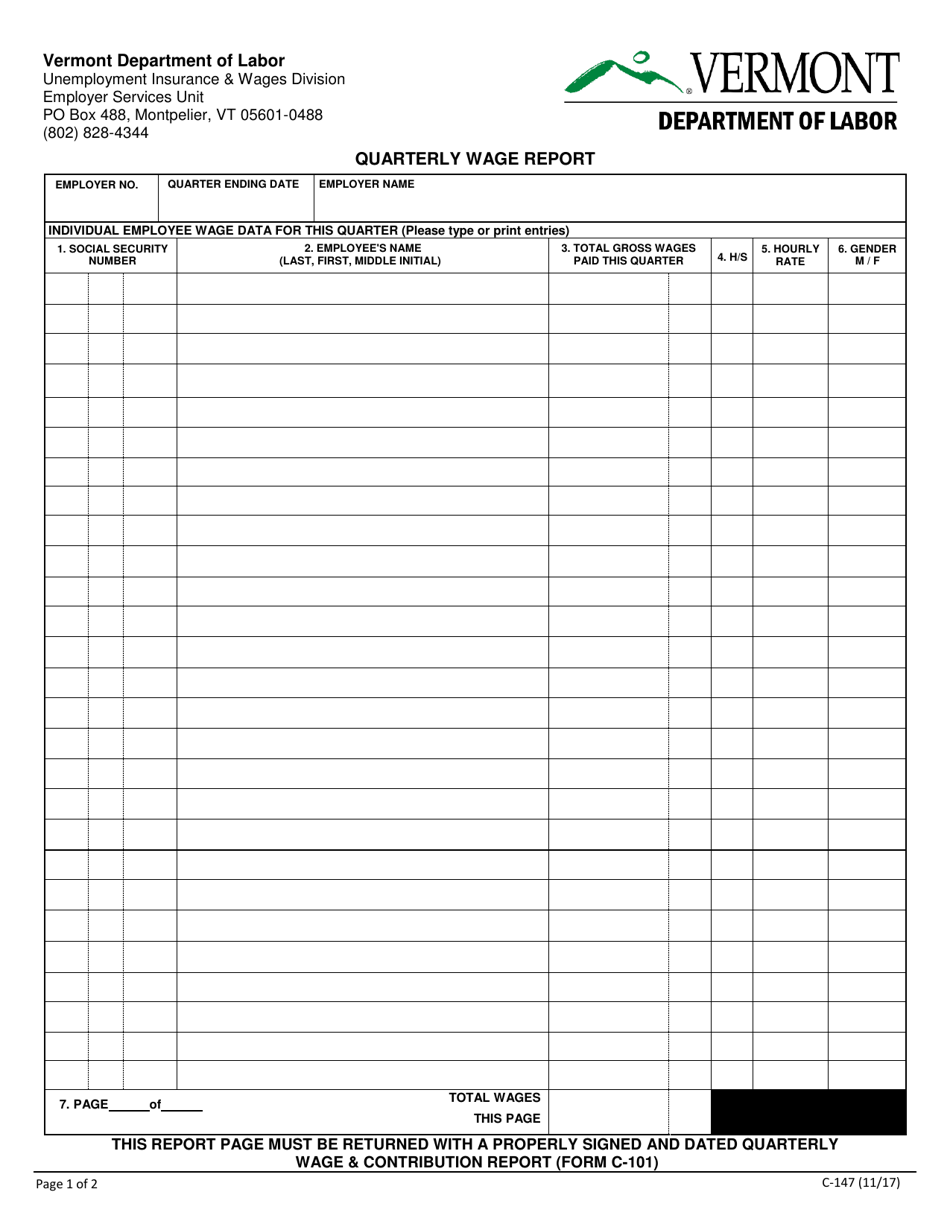

DOL Form 25 Download Fillable PDF or Fill Online Wage Statement Vermont

Web the form is designed to: Edit your dol 4n online type text, add images, blackout confidential details, add comments, highlights and more. 01 begin by entering your personal information, such as your name, address, and contact details. Easily fill out pdf blank, edit, and sign them. Select the appropriate filing quarter.

Fillable Form Nucs4073 Emploewr'S Quarterly Contribution And Wage

Select the appropriate filing quarter. Sign it in a few clicks draw your signature, type it,. Web go to employees or on the fly > state tax & wage forms. Web handy tips for filling out ga dol 4 form pdf online printing and scanning is no longer the best way to manage documents. Go digital and save time with.

DOL Form C147 Download Fillable PDF or Fill Online Quarterly Wage

(1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. Utilize the sign tool to create and add your electronic signature to signnow the georgia dol4n instructions form. Web the form is designed to: You can upgrade to the latest version of adobe reader from www.adobe.com. Web up.

Go Digital And Save Time With Signnow, The Best Solution For.

Easily fill out pdf blank, edit, and sign them. Sign it in a few clicks draw your signature, type it,. Web go to employees or on the fly > state tax & wage forms. Web the form is designed to:

Web Submit Forms Online Through The Employees' Compensation Operations And Management Portal (Ecomp).

Save or instantly send your ready documents. Web to view the full contents of this document, you need a later version of the pdf viewer. Web home forms forms these are the most frequently requested u.s. Make sure to provide accurate.

You Can Complete Some Forms Online, While You Can Download And Print All.

Complete the necessary fields that are. On the ecomp site you can register for an account, initiate a claim,. Right justify and zero fill. Web up to $40 cash back to fill out dol 4n, follow these steps:

Edit Your Dol4N Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Utilize the sign tool to create and add your electronic signature to signnow the georgia dol4n instructions form. Web double check all the fillable fields to ensure full precision. Edit your dol 4n online type text, add images, blackout confidential details, add comments, highlights and more. (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage.