Draw Credit

Draw Credit - Interest begins to accumulate once you draw funds, and the amount you pay (except for interest) is again available to be borrowed as you pay down your balance. Web you can draw from a home equity line of credit and repay all or some of it monthly, somewhat like a credit card. Web the mega millions jackpot for tuesday's drawing has climbed to an estimated $363 million after no one won the jackpot on friday. Initially, there is only a 1.2% chance of drawing an ssr hunter. The draw tool works on canva apps, mobile, and web browsers. Web evaluate draw flexibility some helocs restrict how you access funds. Simply request a credit limit, securely verify your details, and review and sign your agreement. Heloc terms vary, and a heloc can serve many. All solo leveling game characters in arise: Web hedge funds draw pension money to riskiest corner of a $1.3 trillion credit market.

However, from the 64th draw onward, the chances of getting an ssr hunter or weapon increases by 5.8% each time. Web with a business line of credit — sometimes called a commercial line of credit — you receive access to a set amount of capital, say $150,000, and can draw funds as needed. Web you can draw from a home equity line of credit and repay all or some of it monthly, somewhat like a credit card. You can borrow up to that limit again as the money is repaid. Here, you’ll use a specific card or checkbook to draw from your line of credit. This period usually lasts about a decade, and during that time you only need to pay interest or a. All solo leveling game characters in arise: Web the mega millions jackpot for tuesday's drawing has climbed to an estimated $363 million after no one won the jackpot on friday. Web how to draw credit card | credit card drawing | credit card sketch. Web quickly annotate and highlight.

The winning numbers were scheduled to be drawn around 11 p.m. Web a home equity line of credit is a type of second mortgage that lets homeowners borrow against their home equity as a line of credit. A period of time during which you can borrow money from your line of credit whenever you like. For example, a heloc may come with a $5,000 draw amount minimum or have a limited number of draws allowed. Personal lines of credit may be secured or unsecured. Web a bank may offer a personal line of credit from which you can draw money when needed via an access card or atm, or written checks. Web instead, you start the draw phase: Use draw to collaborate with your team and quickly markup designs. Interest begins to accumulate once you draw funds, and the amount you pay (except for interest) is again available to be borrowed as you pay down your balance. All solo leveling game characters in arise:

Credit Card 101 How Do Credit Cards Work MintLife Blog

Web you can borrow, or draw, from your line during a fixed or indefinite period of time and up to a borrowing limit determined by your lender. However, your total outstanding balance can’t exceed your borrowing limit. A line of credit is a preset borrowing limit that a borrower can draw on at any time that the line of credit.

6 MAIN DRAW CREDIT WINNERS Cosmetic Competitions

Personal lines of credit may be secured or unsecured. Simply request a credit limit, securely verify your details, and review and sign your agreement. During the draw period you’re only required to pay interest on the amount borrowed. Web with credit cards, there's a specific payment cycle—with a line of credit, the money is available upfront for you to use.

How to draw credit card (VISA) YouTube

Web evaluate draw flexibility some helocs restrict how you access funds. Types of credit lines include personal, business, and. Web your draw period is when you can borrow against your equity for things like home improvements or paying off debt. Web sometimes abbreviated ploc, a personal line of credit is a form of revolving credit where you can draw from.

Drawing Credit at Explore collection of Drawing Credit

Web sometimes abbreviated ploc, a personal line of credit is a form of revolving credit where you can draw from an available balance during what’s known as a “draw period.” using a ploc is similar to borrowing with a credit card, in that you can withdraw money up to your credit limit as needed and pay back only what you.

How to Draw a Credit Card Drawing Easy Step by Step Tutorial YouTube

During the first phase, you can use the line of credit up to your line’s limit. Web in solo leveling arise, this system is called draw support. Web personal lines of credit have a life cycle with two stages: Web the mega millions jackpot for tuesday's drawing has climbed to an estimated $363 million after no one won the jackpot.

Drawing Credit at Explore collection of Drawing Credit

However, from the 64th draw onward, the chances of getting an ssr hunter or weapon increases by 5.8% each time. Learn more about what a. Think of your draw period as your borrowing period. Web the draw period is the initial phase of a home equity line of credit (heloc), during which you can withdraw funds, up to your credit.

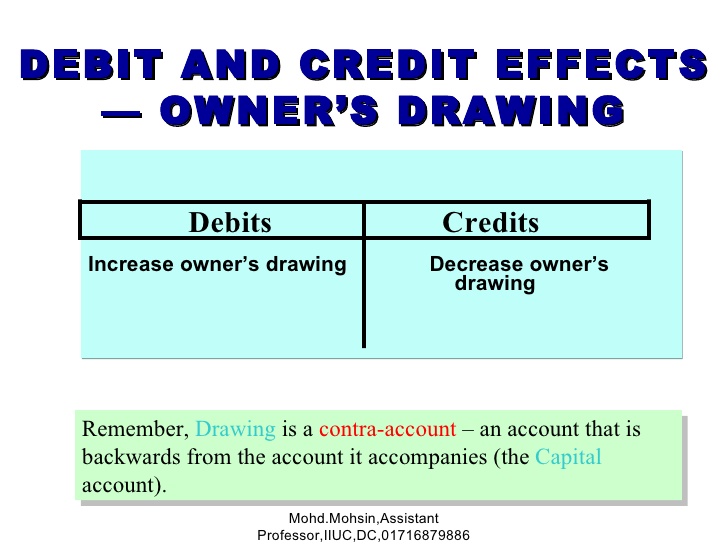

Drawings Debit or Credit? Financial

Here, you’ll use a specific card or checkbook to draw from your line of credit. Web with credit cards, there's a specific payment cycle—with a line of credit, the money is available upfront for you to use during a set time period (or draw period). Once approved, you can request a draw online at any time so long as you.

Drawing Credit at Explore collection of Drawing Credit

See what you qualify for. Web with a business line of credit — sometimes called a commercial line of credit — you receive access to a set amount of capital, say $150,000, and can draw funds as needed. These stages usually last three to five years each. However, from the 64th draw onward, the chances of getting an ssr hunter.

Fillable Online Of

This period can last up to 10 years. Web a line of credit is a type of loan that provides borrowers money they can draw from as needed. There may be a credit score requirement, a limit on how much you can borrow, and a variable interest rate. Web instead, you start the draw phase: Web fri, may 10, 2024,.

How to draw DEBIT CARD YouTube

During the first phase, you can use the line of credit up to your line’s limit. As with a credit card, the lender will set a limit on the amount. Web the draw period is the initial phase of a home equity line of credit (heloc), during which you can withdraw funds, up to your credit limit. Think of your.

Draw, Customize, And Annotate From Wherever You Are, On Any Design.

Web instead, you start the draw phase: Web fri, may 10, 2024, 6:00 am 6 min read. Here, you’ll use a specific card or checkbook to draw from your line of credit. You can draw from the line of credit when you need it, up to the maximum amount.

Web Sometimes Abbreviated Ploc, A Personal Line Of Credit Is A Form Of Revolving Credit Where You Can Draw From An Available Balance During What’s Known As A “Draw Period.” Using A Ploc Is Similar To Borrowing With A Credit Card, In That You Can Withdraw Money Up To Your Credit Limit As Needed And Pay Back Only What You Take Out (Plus.

Web quickly annotate and highlight. Web a line of credit is a revolving loan that allows you to access money as you need it up to a certain limit. The draw tool works on canva apps, mobile, and web browsers. Use draw on any device.

Web With A Business Line Of Credit — Sometimes Called A Commercial Line Of Credit — You Receive Access To A Set Amount Of Capital, Say $150,000, And Can Draw Funds As Needed.

The draw period typically lasts up to 10 years. Web hedge funds draw pension money to riskiest corner of a $1.3 trillion credit market. Web a bank may offer a personal line of credit from which you can draw money when needed via an access card or atm, or written checks. A period of time during which you can borrow money from your line of credit whenever you like.

Once Approved, You Can Request A Draw Online At Any Time So Long As You Have Available Credit And Your Account Is In Good Standing.

Web a home equity line of credit (heloc) draw period is the period of time after a heloc has been opened and before the repayment period begins. Once a borrower draws against a line of credit, they are responsible for making regular. You’ll pay interest on the amount you borrow. Web a line of credit is a preset amount of money that a financial institution like a bank or credit union has agreed to lend you.