Draw Income

Draw Income - How are owner’s draws taxed? A draw may seem like a. This report presents estimates on income, earnings, and inequality in the united states for calendar year 2022, based on information collected in. Typically, owners will use this method for paying themselves. Understandably, you might take less money out. How do i pay myself if i own an llc? How are corporate llcs taxed? Web investment > fixed income hedge funds draw pension money to riskiest corner of a $1.3 trillion credit market raising concerns that in their aggressive hunt for. A draw is an amount of money the employee receives for a given month before his monthly sales figures are calculated. The winner holds £45,000 in premium bonds and purchased.

Web 7 min read. Although the quick calculator makes an initial assumption about your past earnings, you will have. This topic contains information on the verification of commission income. Business owners might use a draw for. Before you begin creating your income statement, gather all the necessary financial information you'll need, including revenue,. What is the difference between a draw vs distribution? As a small business owner, paying your own salary may come at the end of a very long list of expenses. This report presents estimates on income, earnings, and inequality in the united states for calendar year 2022, based on information collected in. Web this topic provides information on documenting and qualifying a borrower’s income from sources other than wages and salaries, including: Web investment > fixed income hedge funds draw pension money to riskiest corner of a $1.3 trillion credit market raising concerns that in their aggressive hunt for.

This topic contains information on the verification of commission income. Web both commission and draw are taxable income. This report presents estimates on income, earnings, and inequality in the united states for calendar year 2022, based on information collected in. Web what is an llc? What is the difference between a draw vs distribution? Business owners might use a draw for. The winner holds £45,000 in premium bonds and purchased. Web here’s the basic tax information on some key sources of retirement income: How to pay yourself as a business owner by business type. Web 7 min read.

How to Draw from Your Investment Accounts

The proportion of assets an owner has invested in a company. As a small business owner, paying your own salary may come at the end of a very long list of expenses. Start with the 3 fund portfolio. Web an owner's draw is a way for a business owner to withdraw money from the business for personal use. The following.

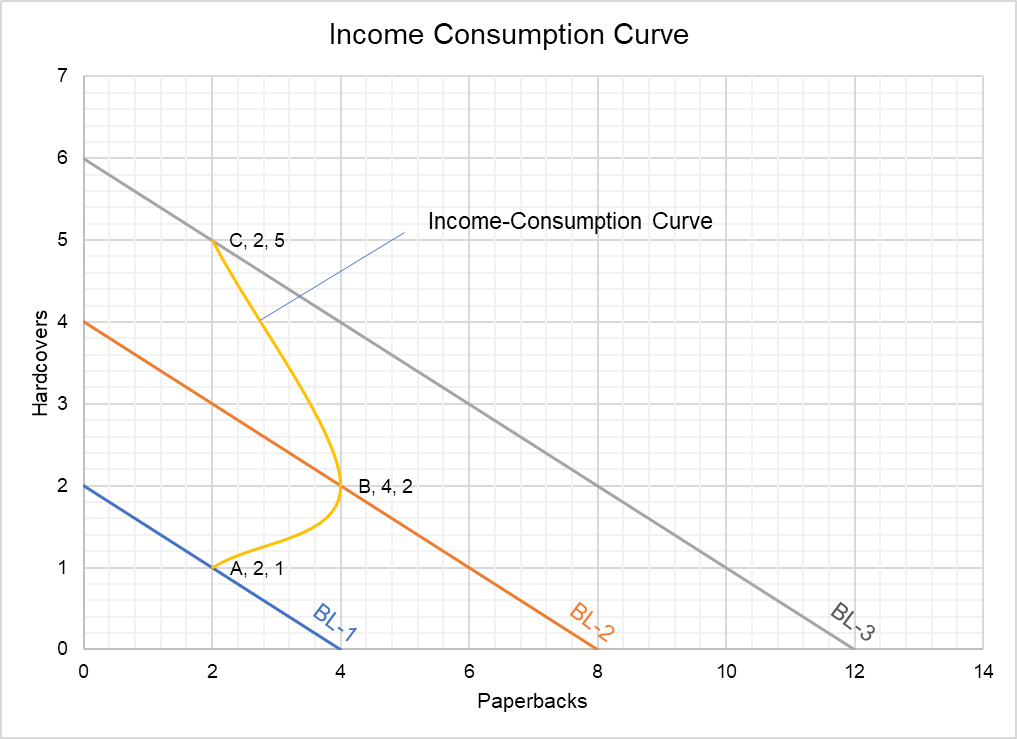

How To Draw Consumption Curve PASIVINCO

How are corporate llcs taxed? This topic contains information on the verification of commission income. Typically, owners will use this method for paying themselves. What is the difference between a draw vs distribution? The winner holds £45,000 in premium bonds and purchased.

Premium Vector Single one line drawing growth financial

Web 7 min read. Although the quick calculator makes an initial assumption about your past earnings, you will have. Web this topic provides information on documenting and qualifying a borrower’s income from sources other than wages and salaries, including: Typically, owners will use this method for paying themselves. How are owner’s draws taxed?

Premium Vector illustration with businessman

As a small business owner, paying your own salary may come at the end of a very long list of expenses. With the draw method , you can draw money from your business earning earnings as you see fit. Web this topic provides information on documenting and qualifying a borrower’s income from sources other than wages and salaries, including: Web.

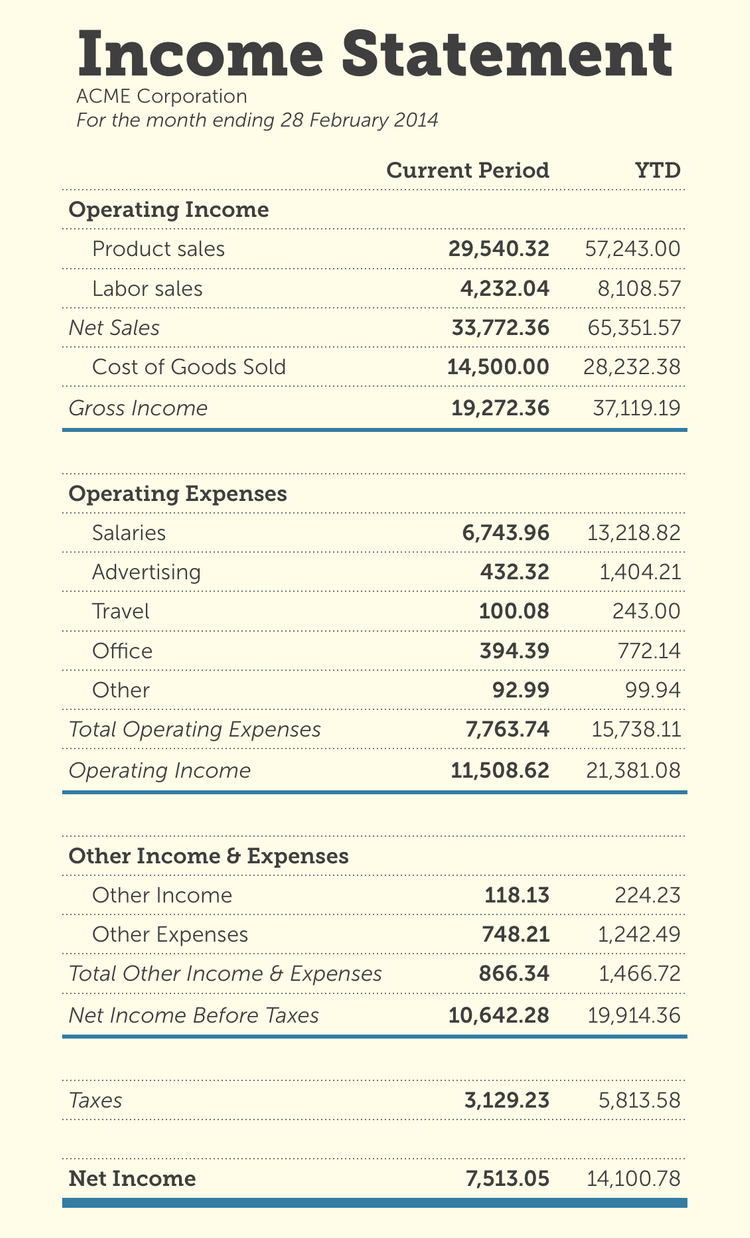

How to Read and Understand Statements

How to pay yourself as a business owner by business type. The proportion of assets an owner has invested in a company. Web here’s the basic tax information on some key sources of retirement income: Web there are two main ways to pay yourself: Faqs about paying yourself as a business owner.

How to Draw (drawing tips) YouTube

With the draw method , you can draw money from your business earning earnings as you see fit. A draw may seem like a. Is an owner’s draw considered income? Web 7 min read. A draw is an amount of money the employee receives for a given month before his monthly sales figures are calculated.

concept stock image. Image of drawing, earn, hand 43165809

Web an owner's draw is a way for a business owner to withdraw money from the business for personal use. Web owner’s draws, also known as “personal draws” or “draws,” allow business owners to withdraw money as needed and as profit allows. How to pay yourself as a business owner by business type. The proportion of assets an owner has.

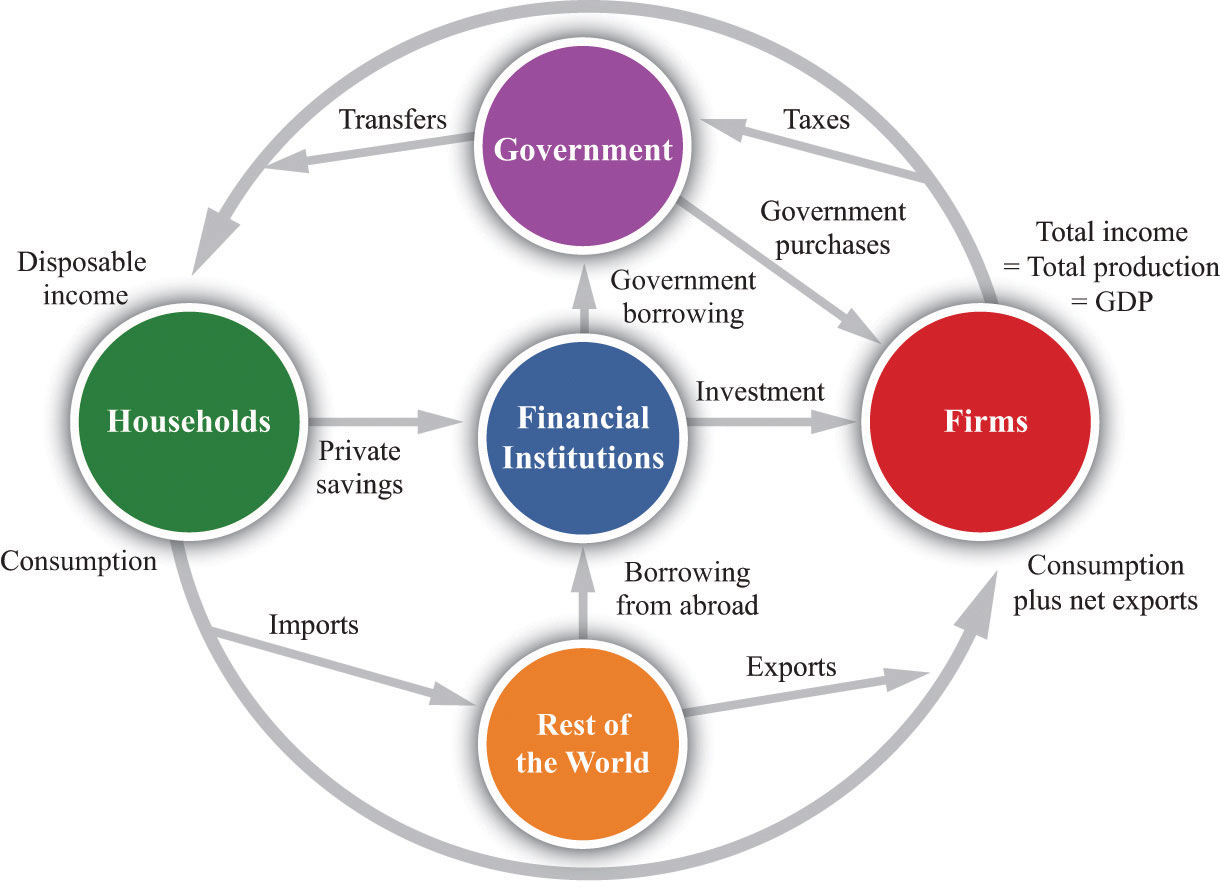

The Circular Flow of

Business owners might use a draw for. The draw method and the salary method. Although the quick calculator makes an initial assumption about your past earnings, you will have. As a small business owner, paying your own salary may come at the end of a very long list of expenses. Is an owner’s draw considered income?

Tips About How To Draw Up A Household Budget Creditstar

How do i pay myself if i own an llc? Web the first winning bond number drawn was 514cv247038 and is held by a winner based in hampshire. Web investment > fixed income hedge funds draw pension money to riskiest corner of a $1.3 trillion credit market raising concerns that in their aggressive hunt for. Is an owner’s draw considered.

How best to draw from your retirement savings The Globe and Mail

Web what is an llc? How do owner’s draws work? A draw may seem like a. The proportion of assets an owner has invested in a company. A draw is an amount of money the employee receives for a given month before his monthly sales figures are calculated.

Typically, Owners Will Use This Method For Paying Themselves.

What is the difference between a draw vs distribution? This topic contains information on the verification of commission income. How do i pay myself if i own an llc? The draw method and the salary method.

With The Draw Method , You Can Draw Money From Your Business Earning Earnings As You See Fit.

Web both commission and draw are taxable income. How to pay yourself as a business owner by business type. Web here’s the basic tax information on some key sources of retirement income: How are corporate llcs taxed?

A Draw May Seem Like A.

Web the first winning bond number drawn was 514cv247038 and is held by a winner based in hampshire. Understandably, you might take less money out. Web so benefit estimates made by the quick calculator are rough. How are owner’s draws taxed?

Business Owners Might Use A Draw For.

The proportion of assets an owner has invested in a company. For example, if you earn $25,000 in draw and $15,000 in commissions, you have $40,000 in taxable income. Web there are two main ways to pay yourself: Before you begin creating your income statement, gather all the necessary financial information you'll need, including revenue,.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/UW6TLRY5MFC2HGATBKGIZFLT3Y)