Erc Form 7200

Erc Form 7200 - Web form 7200 is a detailed form if you have retained employees for at least one year, you can claim an employee retention credit on your federal tax return. If you’re still eligible to file. In this video update, we discuss the ending of irs form 7200, what the form was originally used for, why it. The erc is available to both small and mid sized companies. Web requesting an advanced refund of employee retention credit (form 7200), and/or; Form 7200 remains on irs.gov only as a historical item at Web employers were able to request advance payments of the erc by filing a form 7200. Web last day to file form 7200. Web the erc under the cares act gives employers a payroll tax credit for certain wages and health plan expenses. Claim the employee retention credit to get up to $26k per employee.

If you’re still eligible to file. Ting form 7200, advance payment of employer. Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits due to. Web erc form 7200. Web employers were able to request advance payments of the erc by filing a form 7200. Web all advances requested via the irs form 7200 must be reconciled with the erc and any other credits for which the employer is eligible on the irs form 941,. Form 7200 remains on irs.gov only as a historical item at. Web irs notices and revenue procedures related to the erc. Web in a december 4 statement posted on its website, the irs said that employers will experience a delay in receiving advance payments of credits claimed on. And, new businesses formed after.

Web employers were able to request advance payments of the erc by filing a form 7200. In this video update, we discuss the ending of irs form 7200, what the form was originally used for, why it. Web what happened to form 7200? And, new businesses formed after. Web all advances requested via the irs form 7200 must be reconciled with the erc and any other credits for which the employer is eligible on the irs form 941,. Form 7200 remains on irs.gov only as a historical item at. The erc is available to both small and mid sized companies. Web find out how employers can use form 7200 to claim advance payment on employee retention credits, qualified sick and family leave wages, and cobra subsidy. Claim the employee retention credit to get up to $26k per employee. Ting form 7200, advance payment of employer.

ERTC Form 7200 Alternative ERC Advance Instructions Late Deadline

Web if a reduction in the employer’s employment tax deposits is not sufficient to cover the credit, certain employers may receive an advance payment from the irs by. Claim the employee retention credit to get up to $26k per employee. Department of the treasury internal revenue service. Web employers were able to request advance payments of the erc by filing.

77a. Who Can Sign A Form 7200? Should A Taxpayer Submit Additional

Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits due to. The erc is available to both small and mid sized companies. If you’re still eligible to file. Web what happened to form 7200? The january 2021 revision of form 7200 should be used to request an advance of.

How to Find out if You Qualify for the ERC Expense To Profit

Web the erc under the cares act gives employers a payroll tax credit for certain wages and health plan expenses. Web find out how employers can use form 7200 to claim advance payment on employee retention credits, qualified sick and family leave wages, and cobra subsidy. Employers that received advance payments of the erc for wages paid. Web if a.

When Should The Name And EIN Of A ThirdParty Payer Be Included On Form

Web all advances requested via the irs form 7200 must be reconciled with the erc and any other credits for which the employer is eligible on the irs form 941,. Web form 7200 is a detailed form if you have retained employees for at least one year, you can claim an employee retention credit on your federal tax return. Ting.

Erc Form Fill Online, Printable, Fillable, Blank pdfFiller

It is based upon qualified earnings and also medical care paid to staff. Web what happened to form 7200? Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits due to. Web erc form 7200. And an alternative for ertc advances:

What Documentation Do I Need to Apply for the ERC? Revenued

Form 7200 remains on irs.gov only as a historical item at And an alternative for ertc advances: Department of the treasury internal revenue service. Web in a december 4 statement posted on its website, the irs said that employers will experience a delay in receiving advance payments of credits claimed on. Web find out how employers can use form 7200.

ERTC Qualifications and Guidelines 2022 and 2023 Does your business

Requesting a refund on a timely filed payroll tax return (941). In this video update, we discuss the ending of irs form 7200, what the form was originally used for, why it. Web all advances requested via the irs form 7200 must be reconciled with the erc and any other credits for which the employer is eligible on the irs.

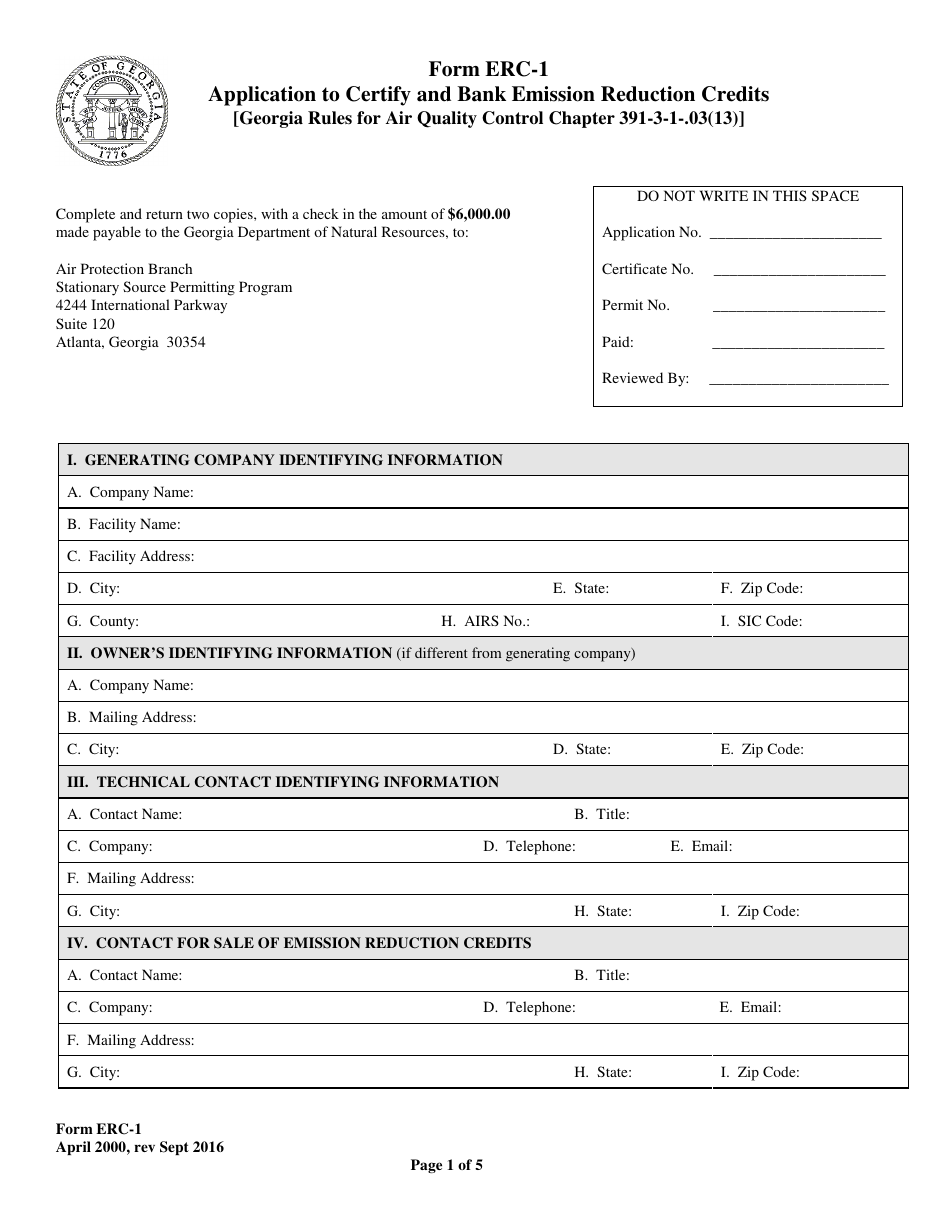

Form ERC1 Download Printable PDF or Fill Online Application to Certify

Web erc form 7200. Ting form 7200, advance payment of employer. Web if a reduction in the employer’s employment tax deposits is not sufficient to cover the credit, certain employers may receive an advance payment from the irs by. It is based upon qualified earnings and also medical care paid to staff. The january 2021 revision of form 7200 should.

IRS Form 7200 Instructions For (ERC) EMPLOYEE RETENTION TAX CREDIT

Ting form 7200, advance payment of employer. Web form 7200 is a detailed form if you have retained employees for at least one year, you can claim an employee retention credit on your federal tax return. Web last day to file form 7200. The january 2021 revision of form 7200 should be used to request an advance of the credits.

Whats Erc What is ERC20? / 32,374 likes · 181

Web last day to file form 7200. Web erc form 7200. Web form 7200 is a detailed form if you have retained employees for at least one year, you can claim an employee retention credit on your federal tax return. Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits.

Web Requesting An Advanced Refund Of Employee Retention Credit (Form 7200), And/Or;

The erc is available to both small and mid sized companies. Web form 7200 is a detailed form if you have retained employees for at least one year, you can claim an employee retention credit on your federal tax return. Web what happened to form 7200? And, new businesses formed after.

Web Irs Notices And Revenue Procedures Related To The Erc.

Web in a december 4 statement posted on its website, the irs said that employers will experience a delay in receiving advance payments of credits claimed on. Claim the employee retention credit to get up to $26k per employee. Web employers were able to request advance payments of the erc by filing a form 7200. The january 2021 revision of form 7200 should be used to request an advance of the credits eligible to be claimed on a 2021 employment tax return.

Web Instructions For Form 7200 (Rev.

Ting form 7200, advance payment of employer. Web according to the irs, form 7200 may be filed to request an advance payment for the erc through august 2, 2021. Form 7200 remains on irs.gov only as a historical item at. Employers that received advance payments of the erc for wages paid.

Web Last Day To File Form 7200.

Web erc form 7200. If you’re still eligible to file. Web if a reduction in the employer’s employment tax deposits is not sufficient to cover the credit, certain employers may receive an advance payment from the irs by. It is based upon qualified earnings and also medical care paid to staff.