Existing Draw Draft Payment Meaning

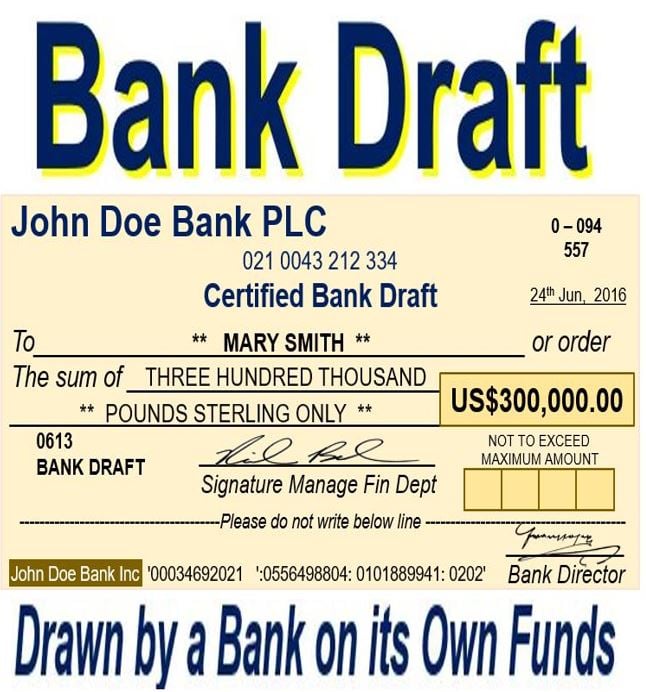

Existing Draw Draft Payment Meaning - Web this service allows users to authorize their utility bills to be paid automatically, on a recurring basis for each billing cycle, by authorizing entergy to draw a draft on an account at a bank, credit union, or other financial institution. For most business types, autodraft ends up being far less expensive. Web a bank draft, sometimes referred to as a banker's cheque, is a payment instrument issued by a bank on behalf of the payer. Web a draft is a bank instrument or document created by the bank, also known as the drawer, to be given to a payee. A bank draft is a payment that is guaranteed by a bank on behalf of a payer. Discover how bank drafts differ from other payment methods. Banks verify and withdraw funds. Web what is a bank draft? to get a banker’s draft, a bank customer must have funds (or cash) available. Web a bank draft is a payment made by the payer but is guaranteed by the issuing bank.

Web a bank draft, sometimes referred to as a banker's cheque, is a payment instrument issued by a bank on behalf of the payer. Once the payment has been deposited, the bank drafts can’t be cancelled or reversed. Web a draft, in the context of banking, refers to a written order that instructs a bank to pay a specific amount of money from one account to another. When you automatically draft payment, you get paid faster than when you use checks. It is commonly used for domestic and international transactions, allowing individuals and businesses to transfer funds securely and efficiently. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. It’s a secure way of making payments, ensuring that the funds are available and will be transferred to the recipient. Demand drafts differ from regular normal checks in that they do not require. Bank drafts are often used for international transactions, as they are a. Discover how bank drafts differ from other payment methods.

It is a common financial instrument used in banking transactions for facilitating payments between individuals, businesses, or financial institutions. Learn how bank drafts work, their advantages, and how they compare to other payment options. A bank draft, also called a bank check, is a method of payment that involves a document issued by a bank guaranteeing that the amount stated on the certificate will be paid to the recipient of the document. Web draft withdrawals require you to set up the electronic payment with the business that issues the bill. Web a draft, in the context of banking, refers to a written order that instructs a bank to pay a specific amount of money from one account to another. Discover how bank drafts differ from other payment methods. Web in the banking industry, a draft refers to a negotiable instrument that serves as a form of payment. Web in general, in 2022, getting a bank draft costs between $10 to $20. Demand drafts differ from regular normal checks in that they do not require. This ensures that the funds are available and the check will not bounce.

What is the meaning of bank draft Isodisnatura

Web a draft, in the context of banking, refers to a written order that instructs a bank to pay a specific amount of money from one account to another. similar to a cashier’s check, a legitimate bank draft is safer than a personal check when accepting large payments. In most instances, the bank will probably review the requester.

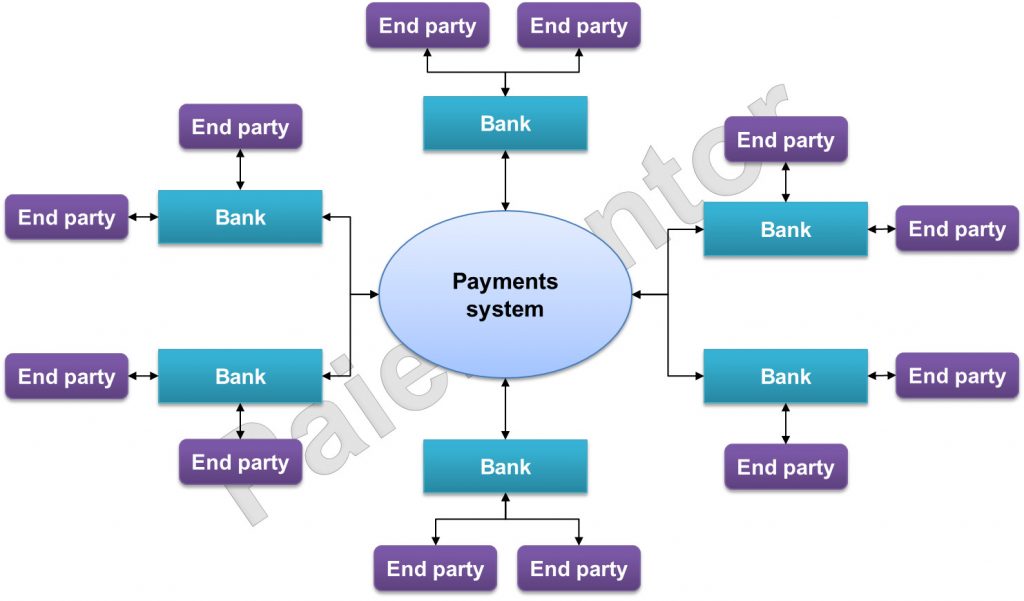

Payment systems models Paiementor

Web a demand draft is a method used by an individual to make a transfer payment from one bank account to another. Web a bank draft, sometimes referred to as a banker's cheque, is a payment instrument issued by a bank on behalf of the payer. similar to a cashier’s check, a legitimate bank draft is safer than.

Direct Draw Draft System Examples

However, once you have set up the draft withdrawal, your bank will automatically deduct the funds from your bank account according to the payment schedule. Bank drafts are often used for larger payments such as a down payment on a home. Bank drafts are often used for international transactions, as they are a. Once the payment has been deposited, the.

Direct Draw Draft System Examples

A bank draft is a payment that is guaranteed by a bank on behalf of a payer. Web essentially, a bank draft is a guaranteed check issued by the bank. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. Web this service allows users to authorize their utility.

Free Simple Draft Agreement Template Google Docs, Word, Apple Pages

Perhaps most important, your cash flow will improve. Discover the ins and outs of bank drafts, a secure payment method guaranteed by the issuing bank, commonly used for significant transactions. Demand drafts differ from regular normal checks in that they do not require. Web the bank draft meaning would be defined as “a convenient and secure instrument for making large.

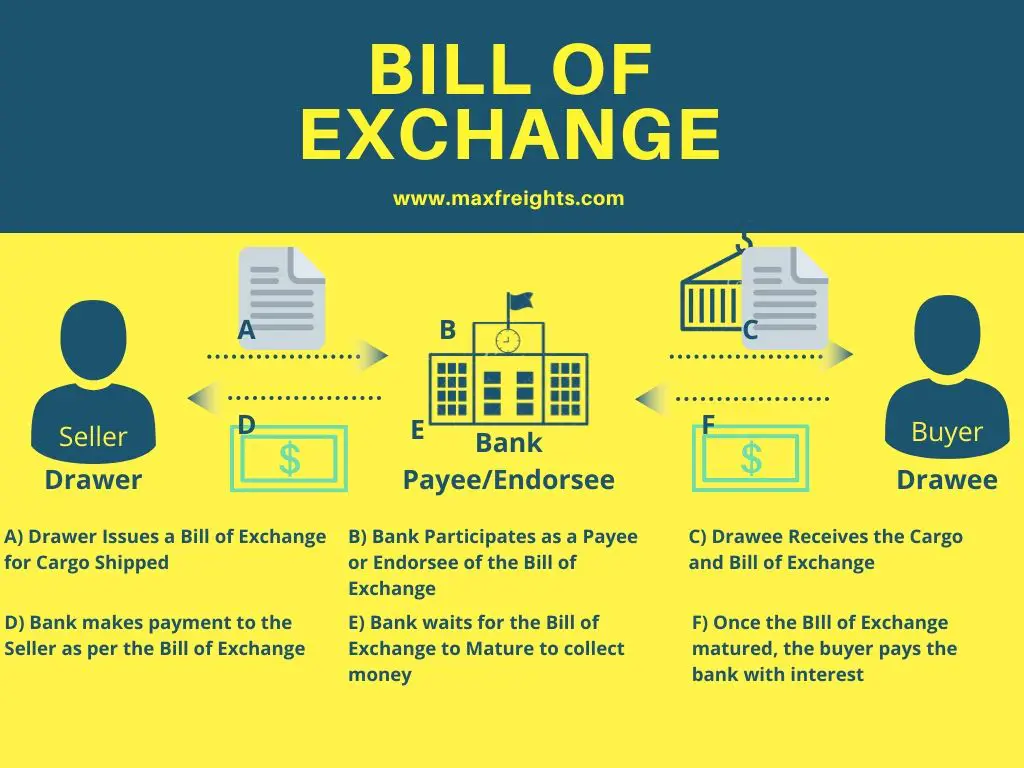

Explain the Difference Between a Drawer and a Drawee IsiahhasIbarra

Learn how to make and accept this secure form of payment. Web a bank draft is a payment made by the payer but is guaranteed by the issuing bank. Perhaps most important, your cash flow will improve. In most instances, the bank will probably review the requester of the draft to establish whether he or she has enough funds for.

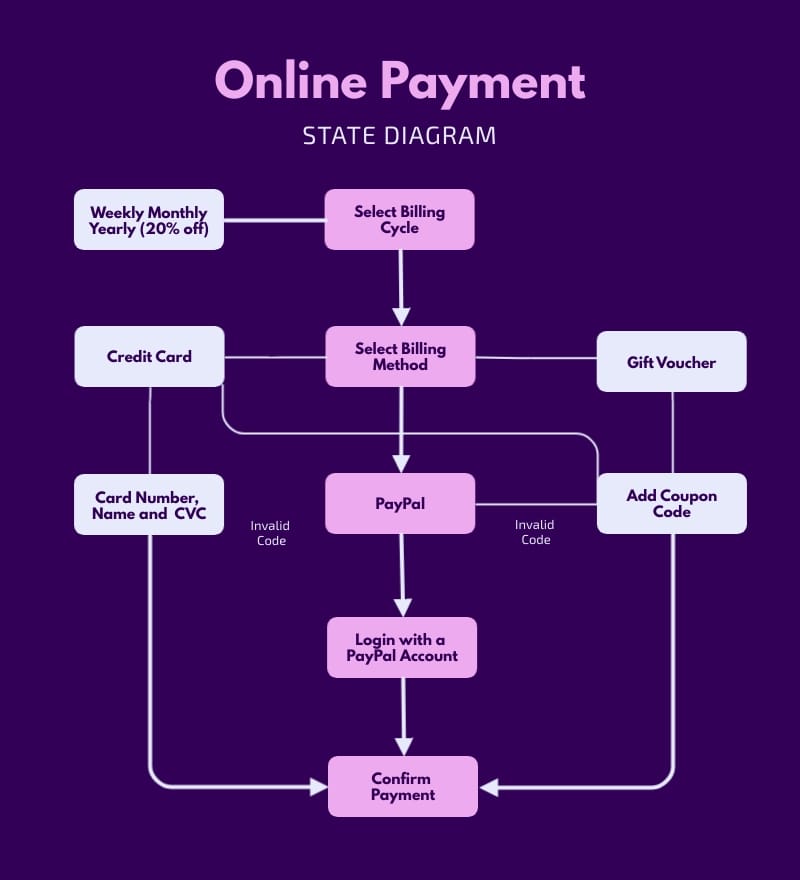

Online Payment State Diagram Template Visme

Banks verify and withdraw funds. Once the payment has been deposited, the bank drafts can’t be cancelled or reversed. Web essentially, a bank draft is a guaranteed check issued by the bank. Web a bank draft, also known as a banker’s draft or a cashier’s check, is a secure and widely accepted form of payment issued by a bank on.

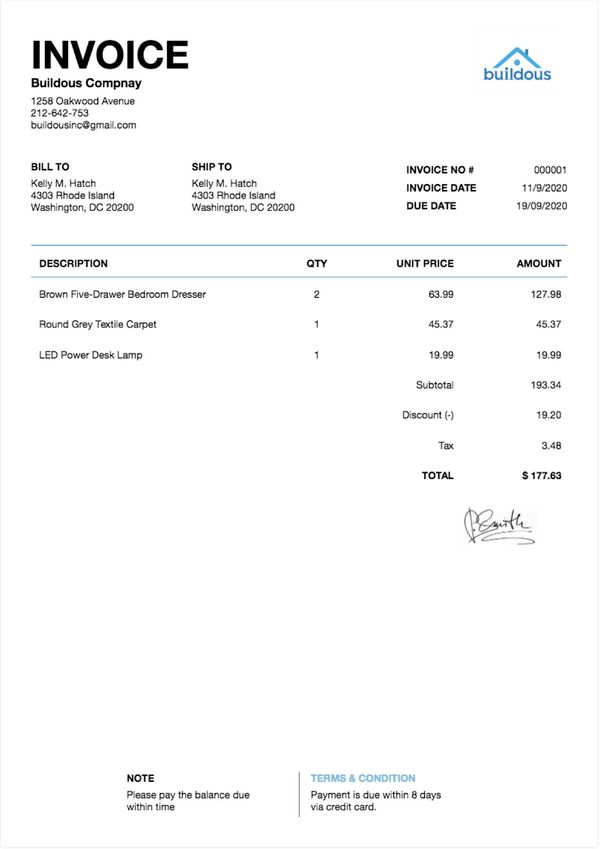

How to Make An Invoice & Get Paid Faster (10+ Invoice Templates)

Web a bank draft, sometimes referred to as a banker's cheque, is a payment instrument issued by a bank on behalf of the payer. Web a bank draft, also known as a banker’s draft or a cashier’s check, is a secure and widely accepted form of payment issued by a bank on behalf of an account holder. Web in the.

Direct Draw Draft System Examples

Web this service allows users to authorize their utility bills to be paid automatically, on a recurring basis for each billing cycle, by authorizing entergy to draw a draft on an account at a bank, credit union, or other financial institution. For most business types, autodraft ends up being far less expensive. When you automatically draft payment, you get paid.

Direct Draw Draft System Examples

These instruments draw money from the account of the issuing corporation and. When you automatically draft payment, you get paid faster than when you use checks. A bank draft, also called a bank check, is a method of payment that involves a document issued by a bank guaranteeing that the amount stated on the certificate will be paid to the.

It Is Commonly Used For Domestic And International Transactions, Allowing Individuals And Businesses To Transfer Funds Securely And Efficiently.

When you automatically draft payment, you get paid faster than when you use checks. Web a bank draft, also known as a banker’s draft or a cashier’s check, is a secure and widely accepted form of payment issued by a bank on behalf of an account holder. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. to get a banker’s draft, a bank customer must have funds (or cash) available.

Web This Service Allows Users To Authorize Their Utility Bills To Be Paid Automatically, On A Recurring Basis For Each Billing Cycle, By Authorizing Entergy To Draw A Draft On An Account At A Bank, Credit Union, Or Other Financial Institution.

Web in general, in 2022, getting a bank draft costs between $10 to $20. Once the payment has been deposited, the bank drafts can’t be cancelled or reversed. Demand drafts differ from regular normal checks in that they do not require. Bank drafts are often used for international transactions, as they are a.

Similar To A Cashier’s Check, A Legitimate Bank Draft Is Safer Than A Personal Check When Accepting Large Payments.

Web a draft, in the context of banking, refers to a written order that instructs a bank to pay a specific amount of money from one account to another. Unlike regular checks, which can bounce if the payer's account has insufficient funds, bank drafts are pre. This ensures that the funds are available and the check will not bounce. Bank drafts are often used for larger payments such as a down payment on a home.

Web A Bank Draft Is A Check That Is Drawn On A Bank’s Funds And Guaranteed By The Bank That Issues It.

Web a bank draft is a payment made by the payer but is guaranteed by the issuing bank. It’s used for large purchases or to provide security during a transaction. Where can i go to get a bank draft? Web in the banking industry, a draft refers to a negotiable instrument that serves as a form of payment.