Extension For Form 5500

Extension For Form 5500 - Get ready for tax season deadlines by completing any required tax forms today. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Thus, filing of the 2023 forms generally will not begin until july 2024. A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. Avoid errors when requesting an extension. An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns) on or before the regular form 5500 due date, which is seven months after the end of the plan year. Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series.

A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records. Thus, filing of the 2023 forms generally will not begin until july 2024. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Avoid errors when requesting an extension. An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns) on or before the regular form 5500 due date, which is seven months after the end of the plan year. Get ready for tax season deadlines by completing any required tax forms today. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond.

Complete, edit or print tax forms instantly. Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series. Thus, filing of the 2023 forms generally will not begin until july 2024. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Avoid errors when requesting an extension. A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Get ready for tax season deadlines by completing any required tax forms today. Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan;

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records. Thus, filing of the 2023 forms generally will not begin until july 2024. An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file.

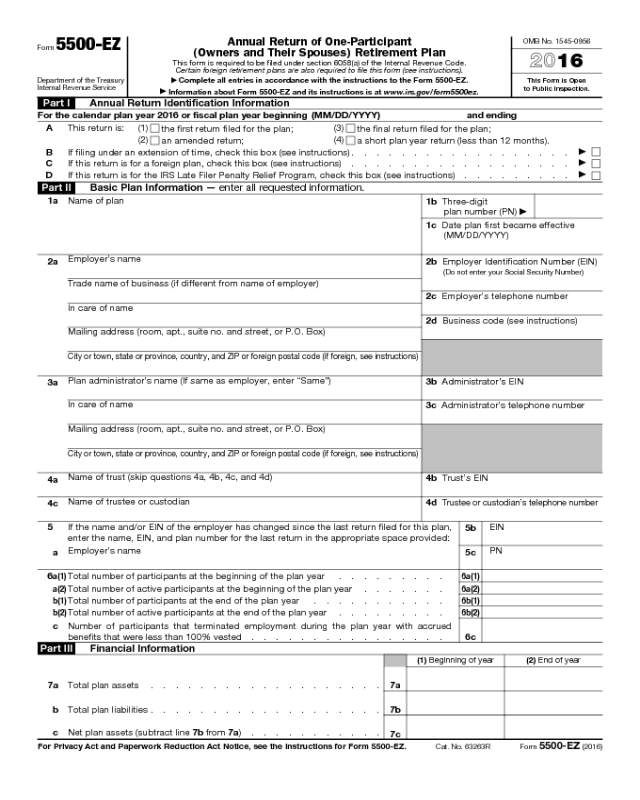

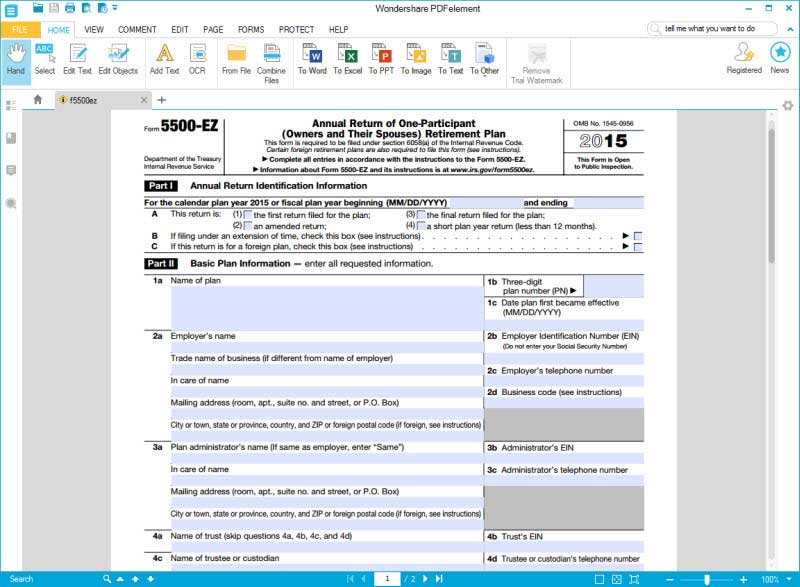

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. Complete, edit or print tax forms instantly. An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns).

Avoid Using the 5500 Extension Wrangle 5500 ERISA Reporting and

See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records. Web if you received a cp notice about filing your form 5500.

Form 5500 Search What You Need To Know Form 5500

Avoid errors when requesting an extension. Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time.

Form 5500EZ Annual Return of One Participant Retirement Plan (2014

Avoid errors when requesting an extension. Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form.

Form 5500EZ Edit, Fill, Sign Online Handypdf

Web the employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for filing the form 5500; Unless specified otherwise, reference to form 5500 series return includes: The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements.

5500 Extension due to COVID19

Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series. Complete, edit or print tax forms instantly. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. Get ready for tax season deadlines by completing.

form 5500 extension due date 2022 Fill Online, Printable, Fillable

Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. A copy of the application for extension of time to file the federal income tax return.

IRS Form 5500EZ Use the Most Efficient Tool to Fill it

Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Avoid errors when requesting an extension. Complete, edit or print tax forms instantly. An extension for filing form 5500 (annual return/report of employee benefit plan) is obtained by filing form 5558 (application for extension of time to file certain employee plan returns).

How to File Form 5500EZ Solo 401k

Complete, edit or print tax forms instantly. A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records. Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series. The quick reference chart of form 5500, schedules and attachments, gives a.

An Extension For Filing Form 5500 (Annual Return/Report Of Employee Benefit Plan) Is Obtained By Filing Form 5558 (Application For Extension Of Time To File Certain Employee Plan Returns) On Or Before The Regular Form 5500 Due Date, Which Is Seven Months After The End Of The Plan Year.

Web use a separate form 5558 for an extension of time to file form 5330 or form 5500 series. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Web an extension of time to file form 5500 series (form 5500, annual return/report of employee benefit plan; Avoid errors when requesting an extension.

Web The Employer Has Been Granted An Extension Of Time To File Its Federal Income Tax Return To A Date Later Than The Normal Due Date For Filing The Form 5500;

A copy of the application for extension of time to file the federal income tax return is maintained with the filer’s records. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and. Get ready for tax season deadlines by completing any required tax forms today. Unless specified otherwise, reference to form 5500 series return includes:

Complete, Edit Or Print Tax Forms Instantly.

The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Thus, filing of the 2023 forms generally will not begin until july 2024.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](https://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-2.png)