Fidelity 401K Beneficiary Claim Form

Fidelity 401K Beneficiary Claim Form - Edit your beneficiary claim form online type text, add images, blackout confidential details, add comments, highlights and more. If you've recently experienced a loss, we can help you navigate the important financial steps to take in this difficult time. In the future, you may revoke the beneficiary designation and designate a different beneficiary by. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. Fill in by hand using capital letters and black ink, or on. Do not use for any other type of. Web when you enroll in a 401(k), you’ll name beneficiaries to inherit your 401(k) if you die. However, we and our marketing and advertising providers (providers) collect certain information. Web to get started, please provide: Web top do i have to name a contingent beneficiary?

In the future, you may revoke the beneficiary designation and designate a different. Fill in by hand using capital letters and black ink, or on. Web grant account authority add or remove family members or other trusted parties the ability to view account information, place trades, and make other changes in your accounts,. General instructions please complete this form and sign it on the back page. Web top do i have to name a contingent beneficiary? You can still log in and access your benefits. Web beneficiary by submitting a new beneficiary designation form to fidelity. Web to get started, please provide: Fill in by hand using capital letters and black ink,. Ad learn how fidelity can help you roll over your old 401(k) plan.

Must be accompanied by a certified copy of the decedent's death certificate. However, we and our marketing and advertising providers (providers) collect certain information. Fill in by hand using capital letters and black ink, or on. Web retire well library changes are coming you may notice some changes as we get ready to launch our new website. General instructions please complete this form and sign it on the back. Web to get started, please provide: Web fidelity does not sell your information to third parties for monetary consideration. Web top do i have to name a contingent beneficiary? Planning is even more crucial due to the special rules associated with retirement accounts, such as iras and 401 (k)s. In the future, you may revoke the beneficiary designation and designate a different.

Fidelity beneficiary claim form Fill out & sign online DocHub

Web fidelity does not sell your information to third parties for monetary consideration. Fill in by hand using capital letters and black ink, or on. To report a death to fidelity, fill out. You don't have to specify a contingent beneficiary, but naming both primary and contingent beneficiaries will help ensure that. Planning is even more crucial due to the.

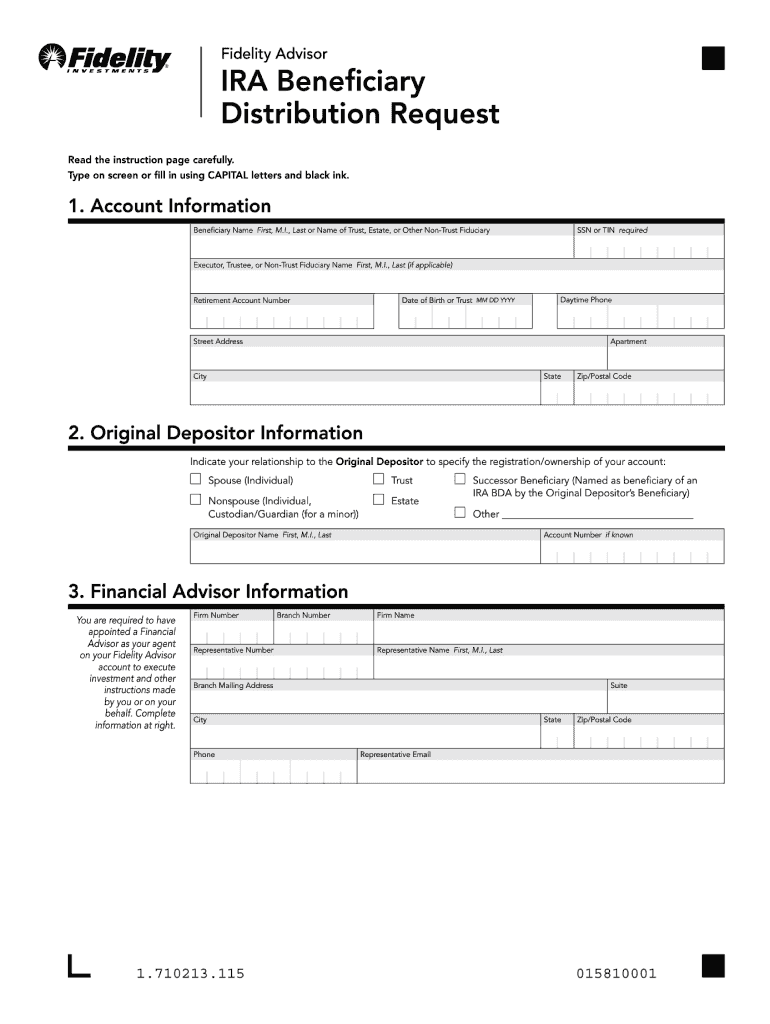

Fillable Online fidelity advisor ira beneficiary distribution request

General instructions please complete this form and sign it on the back page. Web retire well library changes are coming you may notice some changes as we get ready to launch our new website. Fill in by hand using capital letters and black ink,. Web grant account authority add or remove family members or other trusted parties the ability to.

Ira Rollover Form Fidelity Universal Network

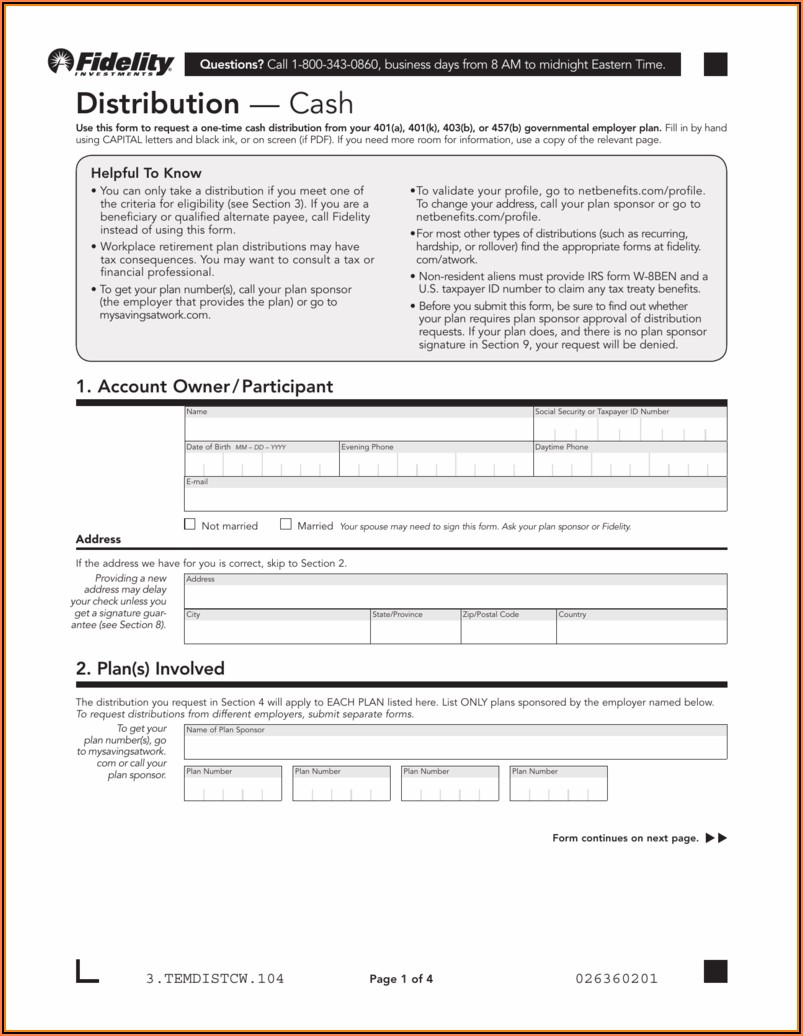

Sign it in a few clicks draw your. Web losing a loved one. Fill in by hand using capital letters and black ink,. You don't have to specify a contingent beneficiary, but naming both primary and contingent beneficiaries will help ensure that. Web use this form to request a rollover distribution from your 401(a), 401(k), 403(b) or 457(b) governmental employer.

Fidelity 401k Hardship Withdrawal Application Home Sweet Home

Web when you enroll in a 401(k), you’ll name beneficiaries to inherit your 401(k) if you die. Web use this form to request a rollover distribution from your 401(a), 401(k), 403(b) or 457(b) governmental employer plan. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. Use this form if you.

401k Beneficiary Form Fidelity Universal Network

Naming beneficiaries can keep your 401(k) out of probate court. Planning is even more crucial due to the special rules associated with retirement accounts, such as iras and 401 (k)s. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. Web use this form to request a rollover distribution from your.

Fill Free fillable Fidelity Investments PDF forms

In the future, you may revoke the beneficiary designation and designate a different. Web to get started, please provide: However, we and our marketing and advertising providers (providers) collect certain information. Naming beneficiaries can keep your 401(k) out of probate court. Web use this form to establish or update the beneficiaries on a transfer on death (tod) registration on your.

Principal Financial Group 401k Withdrawal Form Form Resume Examples

Fill in by hand using capital letters and black ink, or on. Naming beneficiaries can keep your 401(k) out of probate court. In the future, you may revoke the beneficiary designation and designate a different beneficiary by. You can still log in and access your benefits. Web when you enroll in a 401(k), you’ll name beneficiaries to inherit your 401(k).

Fidelity 401k Withdrawal Form Universal Network Free Nude Porn Photos

Do not use for any other type of. Web request a distribution or transfer of assets to a beneficiary account. Web losing a loved one. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. Naming beneficiaries can keep your 401(k) out of probate court.

Prudential 401k Beneficiary Form Universal Network

Fill in by hand using capital letters and black ink, or on. Web if you've inherited a 401(k) from a parent, spouse, or someone else, here are the rules to know. Ad learn how fidelity can help you roll over your old 401(k) plan. Sign it in a few clicks draw your. Web beneficiary by submitting a new beneficiary designation.

401k No Beneficiary Form Universal Network

Fill in by hand using capital letters and black ink,. Web use this form to request a rollover distribution from your 401(a), 401(k), 403(b) or 457(b) governmental employer plan. Do not use for any other type of. Web to get started, please provide: If you've recently experienced a loss, we can help you navigate the important financial steps to take.

Fill In By Hand Using Capital Letters And Black Ink, Or On.

Web request a distribution or transfer of assets to a beneficiary account. In the future, you may revoke the beneficiary designation and designate a different beneficiary by. Web top do i have to name a contingent beneficiary? In the future, you may revoke the beneficiary designation and designate a different.

You Don't Have To Specify A Contingent Beneficiary, But Naming Both Primary And Contingent Beneficiaries Will Help Ensure That.

Web grant account authority add or remove family members or other trusted parties the ability to view account information, place trades, and make other changes in your accounts,. General instructions please complete this form and sign it on the back page. Web losing a loved one. Web use this form to request a rollover distribution from your 401(a), 401(k), 403(b) or 457(b) governmental employer plan.

Web Fidelity Does Not Sell Your Information To Third Parties For Monetary Consideration.

Web use this form to establish or update the beneficiaries on a transfer on death (tod) registration on your nonretirement fidelity account or fidelity funds account registered. General instructions please complete this form and sign it on the back. Web when you enroll in a 401(k), you’ll name beneficiaries to inherit your 401(k) if you die. To report a death to fidelity, fill out.

Planning Is Even More Crucial Due To The Special Rules Associated With Retirement Accounts, Such As Iras And 401 (K)S.

Sign it in a few clicks draw your. Edit your beneficiary claim form online type text, add images, blackout confidential details, add comments, highlights and more. However, we and our marketing and advertising providers (providers) collect certain information. Use this form if you are a beneficiary and wish to request a distribution or transfer the full value of your interest in the decedent’s fidelity advisor 403(b) account.