File Form 1096 Electronically

File Form 1096 Electronically - According to the irs, individuals filing 1099s electronically do not need to submit an accompanying 1096. Another thing to keep in mind? The due dates for these forms to be sent can be found below. If you’re a small business owner, chances are you’ll mainly be using form 1096 to submit some version of form 1099. Web any entity that needs to file information returns can file electronically via the fire system. 1099 dollar amounts, due dates the dollar amount or maximum earnings to issue a 1099 vary based on the type of form. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. More information can be found at: There’s a limit to how many paper information returns you can file. We encourage filers who have less than 250 information returns to file electronically as well.

Note if you have 250 or more of any type of information return, you must submit that type of return electronically, so you don't need a 1096 form in this case. Web if you are filing your information returns electronically, you do not need to use form 1096. The due dates for these forms to be sent can be found below. You cannot file form 1096 or copy a of forms 1099 or 3921 that you print from the irs website. Web you cannot download form 1096 from the irs website. Another thing to keep in mind? Web keep in mind irs form 1096 is only necessary for the mail transmittal of u.s. If you’re a small business owner, chances are you’ll mainly be using form 1096 to submit some version of form 1099. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format. The mailing address is on the last page of the form 1096 instructions.

Web can i file form 1096 electronically? There’s a limit to how many paper information returns you can file. You cannot file form 1096 or copy a of forms 1099 or 3921 that you print from the irs website. The mailing address is on the last page of the form 1096 instructions. We encourage filers who have less than 250 information returns to file electronically as well. Web form 1096 summarizes all of your 1099 forms and is filed with the irs. 1099 dollar amounts, due dates the dollar amount or maximum earnings to issue a 1099 vary based on the type of form. Web if you file these information forms electronically, either through the irs fire system or a tax preparation software, you do not need to complete irs form 1096. Also, see part f in the 2023 general instructions for certain information returns. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format.

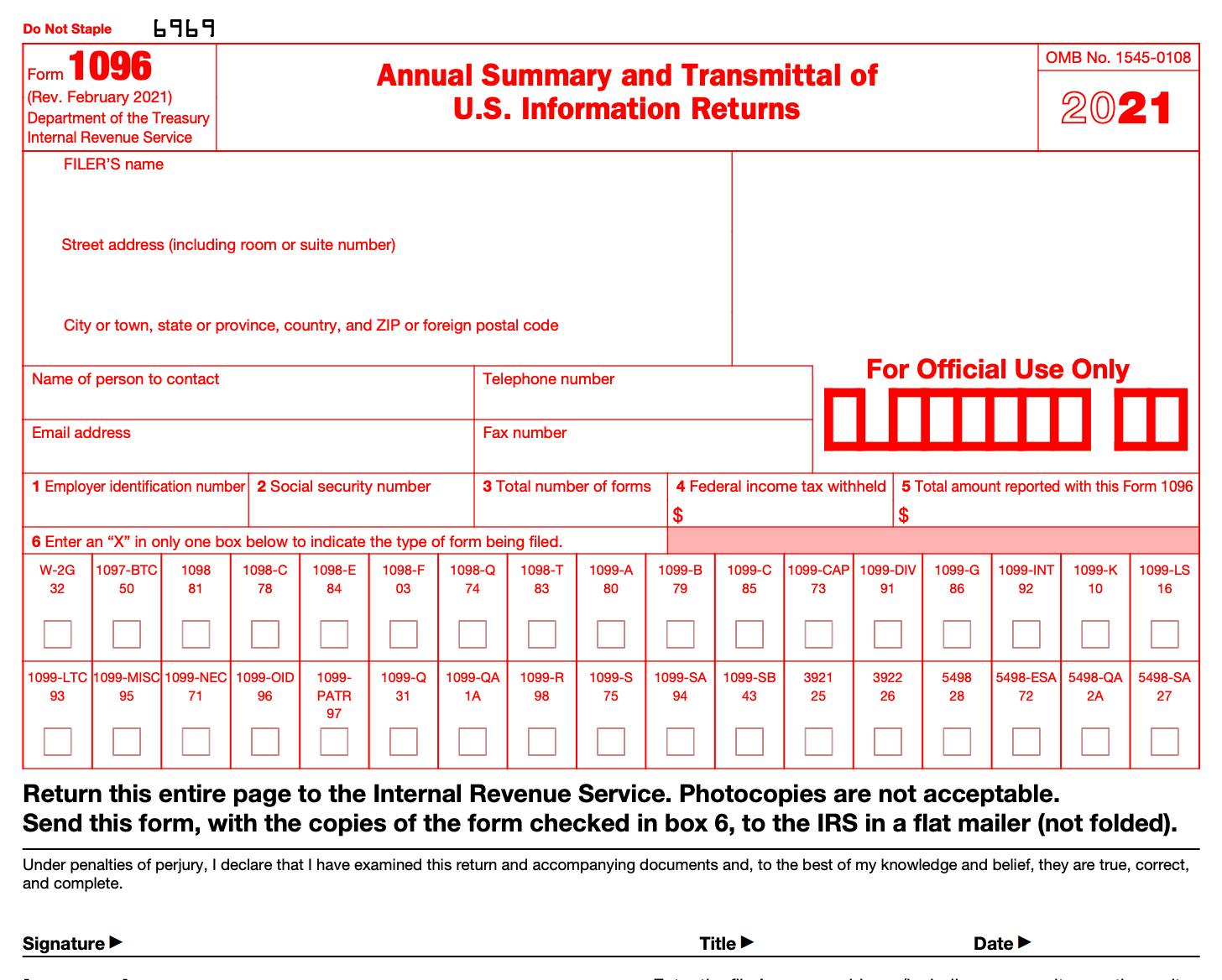

Printable Form 1096 / 1096 Tax Form Due Date Universal Network

Web keep in mind irs form 1096 is only necessary for the mail transmittal of u.s. We encourage filers who have less than 250 information returns to file electronically as well. More information can be found at: Web if you file these information forms electronically, either through the irs fire system or a tax preparation software, you do not need.

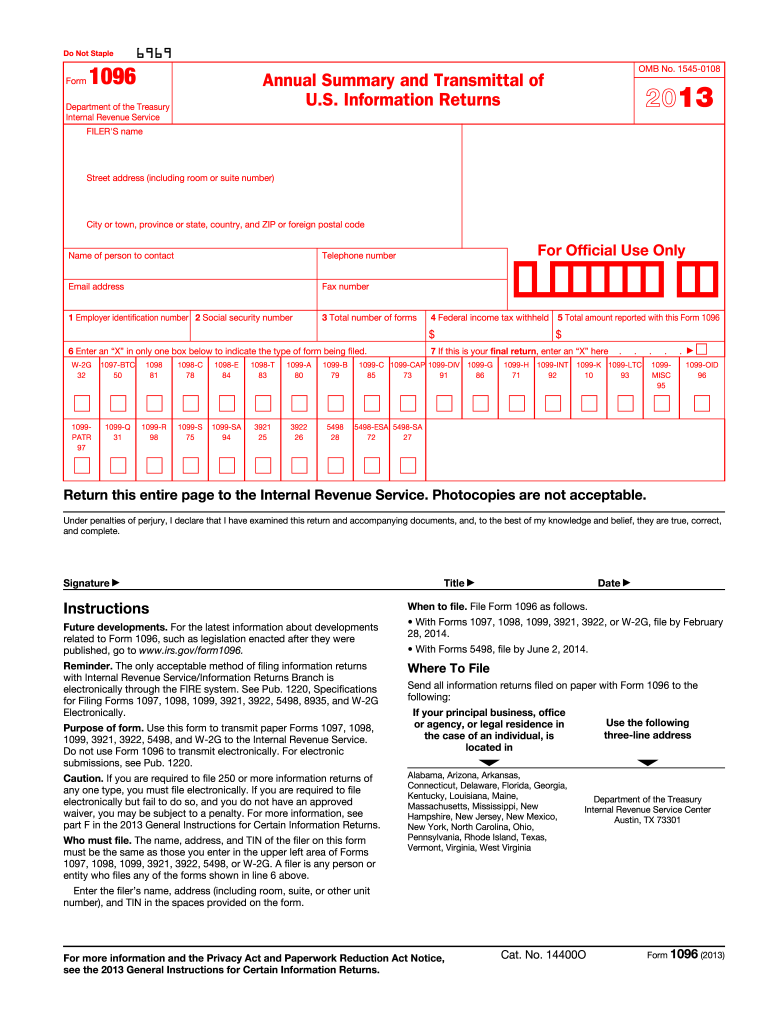

2013 Form IRS 1096 Fill Online, Printable, Fillable, Blank pdfFiller

More information can be found at: The mailing address is on the last page of the form 1096 instructions. Web you cannot download form 1096 from the irs website. Note if you have 250 or more of any type of information return, you must submit that type of return electronically, so you don't need a 1096 form in this case..

1096 Form Editable Online Blank in PDF

Web can i file form 1096 electronically? Web keep in mind irs form 1096 is only necessary for the mail transmittal of u.s. Any corporation, partnership, employer, estate or trust that files 250 or more information returns for any calendar year must file electronically. According to the irs, individuals filing 1099s electronically do not need to submit an accompanying 1096..

Form 1096 Annual Summary and Transmittal of U.S. Information Returns

The due dates for these forms to be sent can be found below. More information can be found at: Also, see part f in the 2023 general instructions for certain information returns. Web can i file form 1096 electronically? If you’re a small business owner, chances are you’ll mainly be using form 1096 to submit some version of form 1099.

Irs Form 1096 What Is It

There’s a limit to how many paper information returns you can file. The mailing address is on the last page of the form 1096 instructions. Web can i file form 1096 electronically? Web form 1096 summarizes all of your 1099 forms and is filed with the irs. Any corporation, partnership, employer, estate or trust that files 250 or more information.

Printable Form 1096 1096 Tax Form Due Date Universal Network What

Web form 1096 summarizes all of your 1099 forms and is filed with the irs. Note if you have 250 or more of any type of information return, you must submit that type of return electronically, so you don't need a 1096 form in this case. The mailing address is on the last page of the form 1096 instructions. Web.

What is a 1096 Form? A Guide for US Employers Remote

The official printed version of form 1096 is scannable and read by a machine (optical character recognition equipment). 1099 dollar amounts, due dates the dollar amount or maximum earnings to issue a 1099 vary based on the type of form. Any corporation, partnership, employer, estate or trust that files 250 or more information returns for any calendar year must file.

IRS Form 1096 Instructions How and When to File It NerdWallet

Web if you file these information forms electronically, either through the irs fire system or a tax preparation software, you do not need to complete irs form 1096. Another thing to keep in mind? There’s a limit to how many paper information returns you can file. If you’re a small business owner, chances are you’ll mainly be using form 1096.

What You Need to Know About 1096 Forms Blue Summit Supplies

You cannot file form 1096 or copy a of forms 1099 or 3921 that you print from the irs website. The due dates for these forms to be sent can be found below. The mailing address is on the last page of the form 1096 instructions. There’s a limit to how many paper information returns you can file. The official.

1096 Form 2021

The official printed version of form 1096 is scannable and read by a machine (optical character recognition equipment). Web you cannot download form 1096 from the irs website. Irs filing information returns electronically (fire) system (visit irs affordable care act information returns (air) program (visit www.irs.gov/fire), or www.irs.gov/air). Web form 1096 summarizes all of your 1099 forms and is filed.

The Mailing Address Is On The Last Page Of The Form 1096 Instructions.

If you’re a small business owner, chances are you’ll mainly be using form 1096 to submit some version of form 1099. Another thing to keep in mind? Web keep in mind irs form 1096 is only necessary for the mail transmittal of u.s. Also, see part f in the 2023 general instructions for certain information returns.

There’s A Limit To How Many Paper Information Returns You Can File.

We encourage filers who have less than 250 information returns to file electronically as well. Web any entity that needs to file information returns can file electronically via the fire system. According to the irs, individuals filing 1099s electronically do not need to submit an accompanying 1096. Any corporation, partnership, employer, estate or trust that files 250 or more information returns for any calendar year must file electronically.

You Cannot File Form 1096 Or Copy A Of Forms 1099 Or 3921 That You Print From The Irs Website.

1099 dollar amounts, due dates the dollar amount or maximum earnings to issue a 1099 vary based on the type of form. Note if you have 250 or more of any type of information return, you must submit that type of return electronically, so you don't need a 1096 form in this case. Web you cannot download form 1096 from the irs website. Web to file electronically, you must have software, or a service provider, that will create the file in the proper format.

Web If You Are Filing Your Information Returns Electronically, You Do Not Need To Use Form 1096.

Web can i file form 1096 electronically? More information can be found at: Web if you file these information forms electronically, either through the irs fire system or a tax preparation software, you do not need to complete irs form 1096. The official printed version of form 1096 is scannable and read by a machine (optical character recognition equipment).

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)