Fillable Form 2553

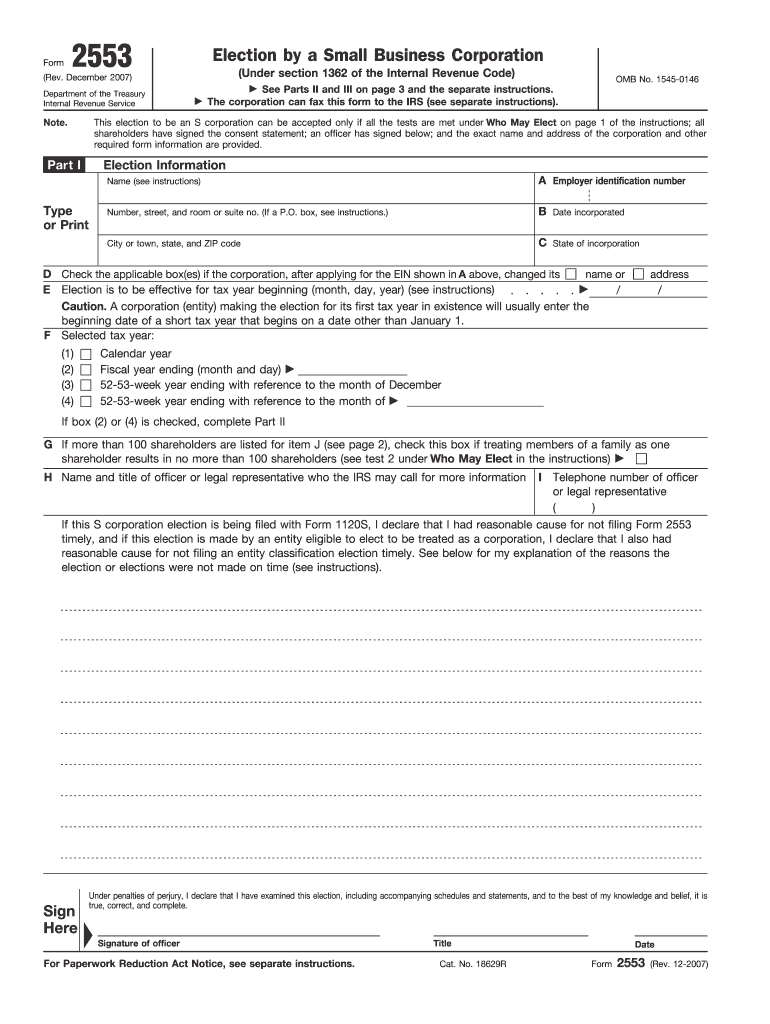

Fillable Form 2553 - A corporation or other entity. Download or email irs 2553 & more fillable forms, register and subscribe now! Web filling out irs 2553. There is no filing fee associated with this. Election by a small business corporation (under section 1362 of the internal revenue. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web like most irs forms, the first fillable page of form 2553 is meant to identify and learn more about your organization. Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. Web requirements for filing form 2553. Web so if you want your business to be taxed as an s corportion (s corp), you’ll have to fill out the internal revenue service’s (irs) form 2553 you can make this.

Form 2553 must be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second. Currently, an online filing option does not exist for this form. Ad fill, sign, email irs 2553 & more fillable forms, try for free now! Ad form 2553, get ready for tax deadlines by filling online any tax form for free. Web what is form 2553? To complete this form, you’ll need the following. Ad access irs tax forms. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web a corporation can file form 2553 to elect “s” corporation (also known as an “s corp” or “subchapter s corporation”) federal tax classification with the irs. Download, print or email irs 2553 tax form on pdffiller for free.

Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. A corporation or other entity. To complete this form, you’ll need the following. Web what is form 2553? Download or email irs 2553 & more fillable forms, register and subscribe now! Ad access irs tax forms. Currently, an online filing option does not exist for this form. Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Web filling out irs 2553. Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation.

Ssurvivor Form 2553 Irs Fax Number

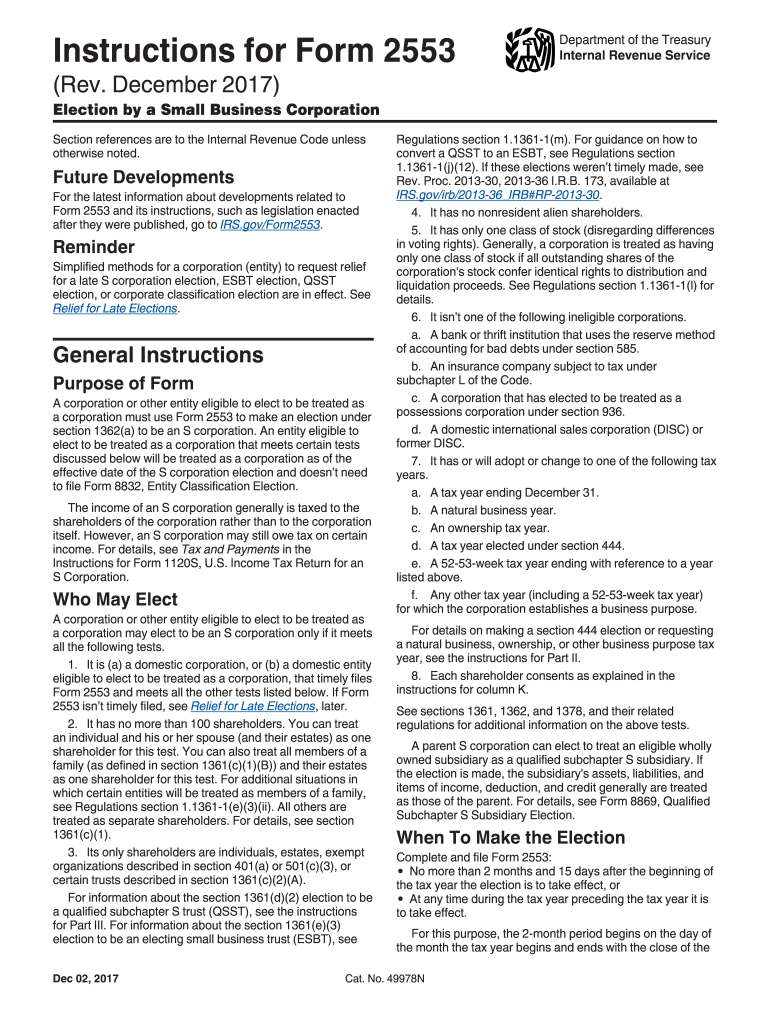

Web by filing form 2553 with the irs (instructions below) you are simply changing the default tax classification of the llc (from either sole proprietorship or. Selection of fiscal tax year;. December 2017) department of the treasury internal revenue service. Ad fill, sign, email irs 2553 & more fillable forms, try for free now! Web the purpose of form 2553.

Free W 9 Form 2021 Printable Pdf Example Calendar Printable

Election information and employer identification number; Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. Ad access irs tax forms. Web filling out irs 2553. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely.

Fillable Form 2553 (2017) Edit, Sign & Download in PDF PDFRun

Complete, edit or print tax forms instantly. Selection of fiscal tax year;. Web a corporation can file form 2553 to elect “s” corporation (also known as an “s corp” or “subchapter s corporation”) federal tax classification with the irs. Web filling out irs 2553. Under election information, fill in the corporation's name and address, along with your ein number and.

20172020 Form IRS Instruction 2553 Fill Online, Printable, Fillable

It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Complete, edit or print tax forms instantly. Download or email irs 2553 & more fillable forms, register and subscribe now! Ad access irs tax forms. Web what is form 2553 used for?

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

A corporation or other entity. Download, print or email irs 2553 tax form on pdffiller for free. Web a corporation can file form 2553 to elect “s” corporation (also known as an “s corp” or “subchapter s corporation”) federal tax classification with the irs. Web form 2553 is an irs form. To complete this form, you’ll need the following.

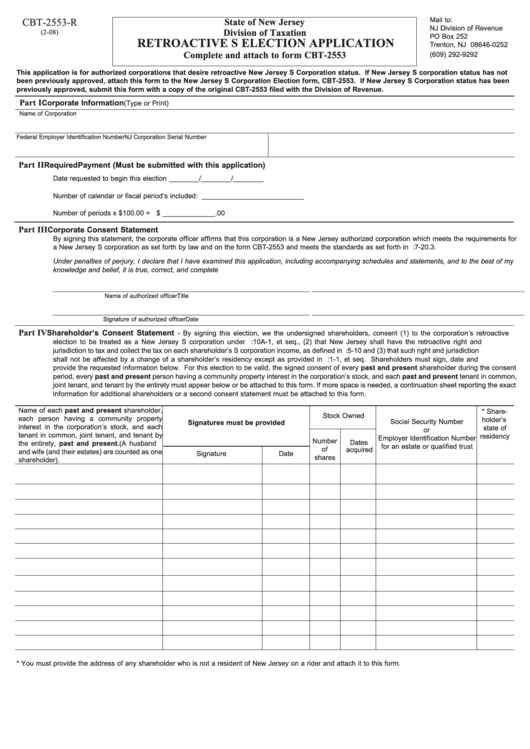

Fillable Form Cbt2553R Retroactive S Election Application printable

Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Ad access irs tax forms. The form consists of several parts requiring the following information: Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Ad form 2553, get ready.

Form 2553 Fill Out and Sign Printable PDF Template signNow

Web like most irs forms, the first fillable page of form 2553 is meant to identify and learn more about your organization. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Instructions to complete form 2553.

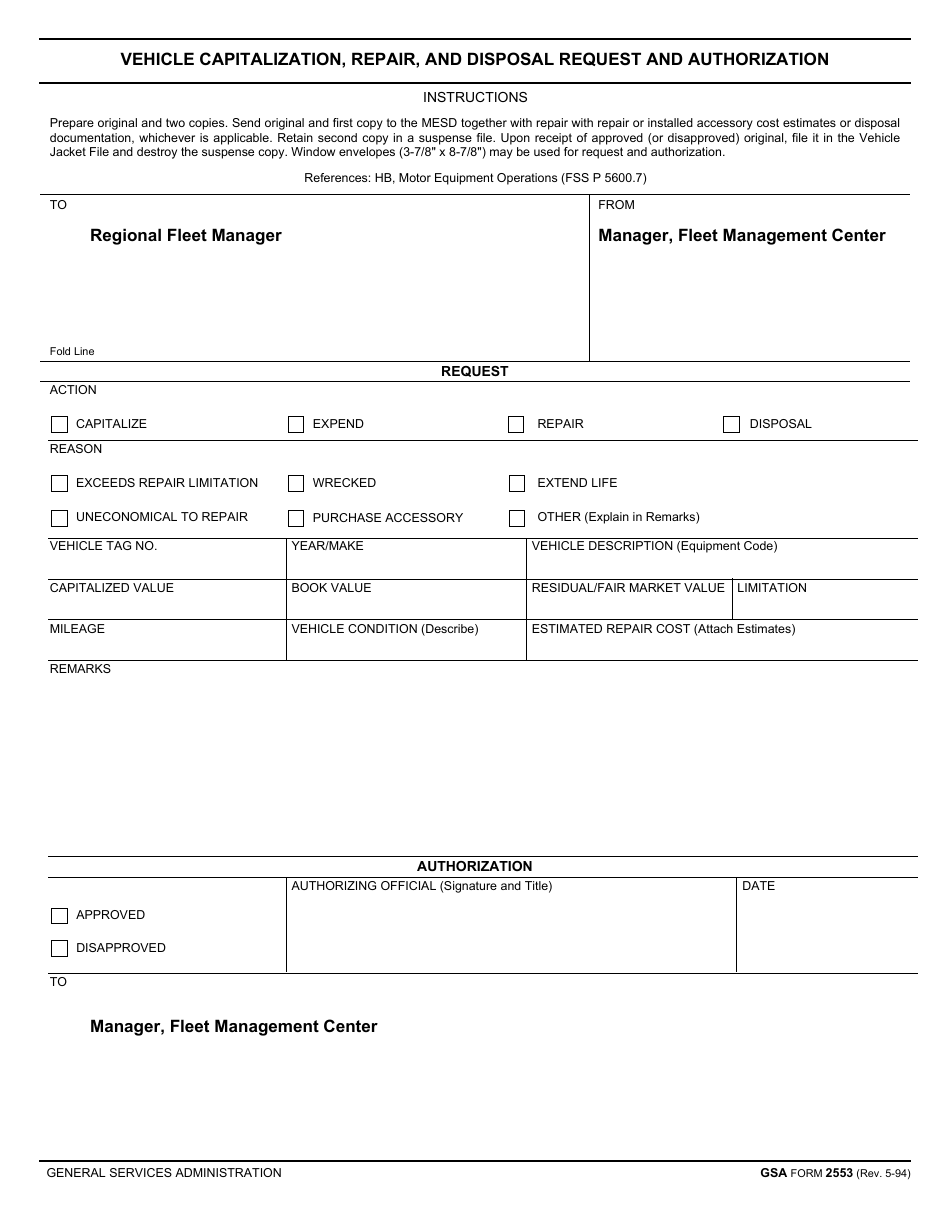

GSA Form 2553 Download Fillable PDF or Fill Online Vehicle

The form consists of several parts requiring the following information: Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Currently, an online filing option does not exist for this form. There is no filing fee associated with this. Web a corporation can file form.

Form 5553 Edit, Fill, Sign Online Handypdf

Ad form 2553, get ready for tax deadlines by filling online any tax form for free. Web requirements for filing form 2553. December 2017) department of the treasury internal revenue service. To complete this form, you’ll need the following. Form 2553 must be filed before the 16th day of the third month of the corporation's tax year, or before the.

Fillable Form 1120S (2019) in 2021 Profit and loss statement,

To complete this form, you’ll need the following. The form consists of several parts requiring the following information: Web filling out irs 2553. There is no filing fee associated with this. Ad form 2553, get ready for tax deadlines by filling online any tax form for free.

Web Filling Out Irs 2553.

Instructions to complete form 2553 filling out your form 2553 frequently asked questions the united states tax system affords. Form 2553 must be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Web form 2553 is an irs form.

Web What Is Form 2553?

Web by filing form 2553 with the irs (instructions below) you are simply changing the default tax classification of the llc (from either sole proprietorship or. There is no filing fee associated with this. Election by a small business corporation (under section 1362 of the internal revenue. Ad access irs tax forms.

Web So If You Want Your Business To Be Taxed As An S Corportion (S Corp), You’ll Have To Fill Out The Internal Revenue Service’s (Irs) Form 2553 You Can Make This.

To complete this form, you’ll need the following. Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. Download or email irs 2553 & more fillable forms, register and subscribe now! The form consists of several parts requiring the following information:

Ad Fill, Sign, Email Irs 2553 & More Fillable Forms, Try For Free Now!

A corporation or other entity. Web requirements for filing form 2553. Download, print or email irs 2553 tax form on pdffiller for free. Web a corporation can file form 2553 to elect “s” corporation (also known as an “s corp” or “subchapter s corporation”) federal tax classification with the irs.